COVID concerns spook Indian stock market, wipe out Rs 4.4 trillion in wealth: Report

One of the main reasons for uncertainty among investors was the rise in India Volatility Index (VIX) by 12.9 percent, highest in six months, to 15.56 per cent

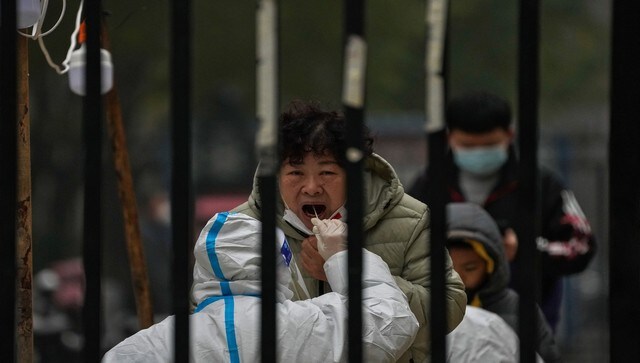

Representational Image. News18

The COVID-19 scare in China has ignited concern all over the world. The Indian government also issued an advisory, regarding the potential resurgence of coronavirus cases. This, coupled with factors like China’s increasing COVID caseload and the Bank of Japan altering its yield curve control (YCC) strategy, has caused Rs 4.4 trillion of investors’ wealth to be wiped off the Indian stock market, as per a Mint report. After initial gains, both Sensex and Nifty continued to trade about 0.5 percent lower today, 22 December. Nifty 50 was trading at 18,110.20 at 12:31 pm, while Sensex slid over 316 points to 60,750.33.

Foreign institutional investors offloaded shares amounting to Rs 1,119.11 crore. On the other hand, domestic institutional investors bought a provisional Rs 1,757 crore worth of equities. The markets are also being impacted by the release of the latest Monetary Policy Committee (MPC) meeting minutes. In the minutes of the meeting, Reserve Bank of India (RBI) Governor Shaktikanta Das had said that “a premature pause in monetary policy action would be a costly policy error at this juncture.”

The Centre’s advisory for setting up genome sequencing to identify fresh COVID strains coming from China spooked Dalal Street. One of the main reasons for uncertainty among investors was the rise in India Volatility Index (VIX) by 12.9 percent, highest in six months, to 15.56 percent. The financial, media, and metal stocks were the worst impacted. Pharma, Fast-moving consumer goods (FMCG) and Information Technology (IT) shares jumped over renewed concerns of the pandemic’s resurgence.

Bajaj Financial Services, Tata Steel and Tata Motors were among the top losers, falling between 2 and 3 percent. Bharti Airtel, Sun Pharma, Kotak Bank and Infosys were the only gainers.

In a recent development, three cases of Omicron BF.7 strain have been detected in India so far. This is the strain behind the present wave of coronavirus infections in China. The first case of this strain was identified in Gujarat earlier in October. Now, the number of Omicron BF.7 cases in India stands at 3, with 2 in Gujarat and 1 in Odisha.

Read all the Latest News, Trending News, Cricket News, Bollywood News,

India News and Entertainment News here. Follow us on Facebook, Twitter and Instagram.

also read

Covid after relaxation of ‘Zero Covid’ overwhelms China as hospitals burst at seams, medicine short

Beijing authorities said more than 22,000 patients had visited hospitals across the city in the previous day — 16 times the number a week ago

China to shut down Covid tracking app as virus rules ease

The ‘Communications Itinerary Card’, first launched in 2020, will go offline at 12 am on Tuesday according to an official WeChat post

As China gives up ‘Zero Covid’ policy, deaths predicted to top 2 million in ‘winter wave’ of infections

China is rapidly abandoning the mass testing, lockdowns and centralized quarantine that defined the stringent, three-year-old policy