Stock Market Today:

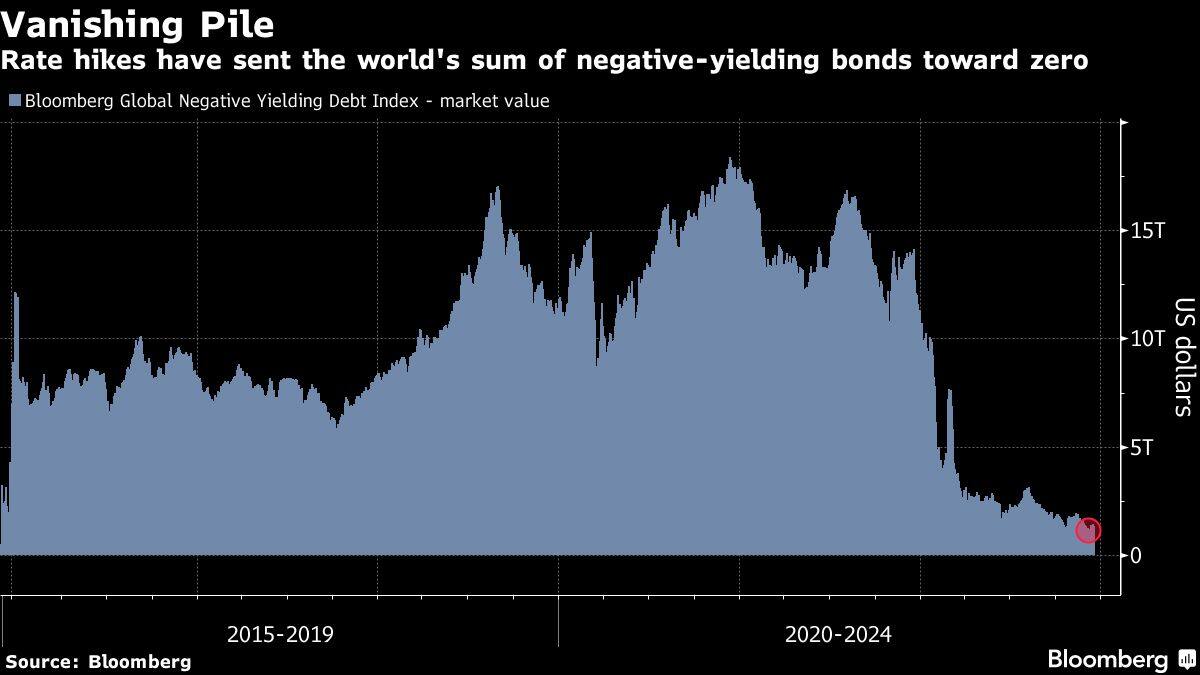

Japan’s two-year yield rose above zero for the first time since 2015, bringing the global era of negative yields closer to an end.

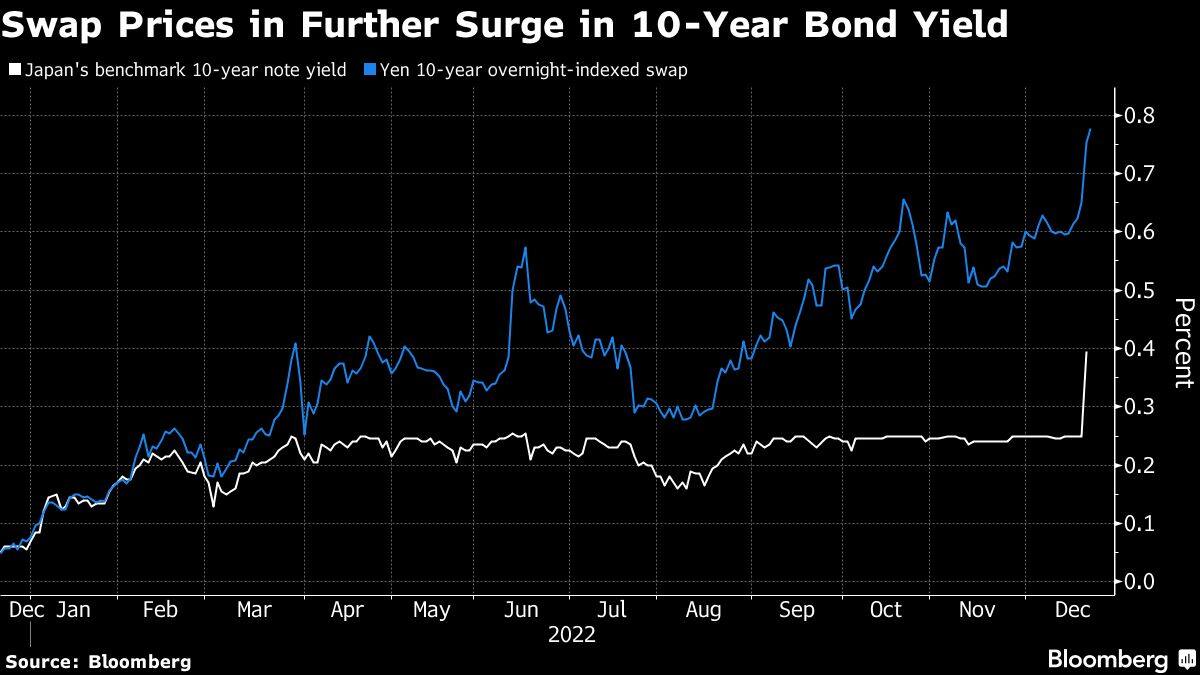

The rate added as much as two basis points to 0.01% on Wednesday, according to Japan Bond Trading Co. data, as the country’s debt extended declines after the central bank doubled its cap on 10-year yields on Tuesday. All other benchmark tenors have yields above zero and Bloomberg’s gauge of global negative-yielding debt only contains short-term Japanese bonds.

The pool of global debt with sub-zero yields shrank Tuesday to $686 billion, from more than $11 trillion at the end of 2021, as this year’s wave of global policy tightening sent bonds into the first bear market in a generation. The Bank of Japan’s surprise decision to widen the trading band for 10-year yields sent bonds tumbling worldwide as investors decided the last major central bank to stick with the ultra-loose settings in vogue for much of the past decade or more was finally giving into the tightening trend.

“What we are looking at is a reexamination of the efficacy of ultra loose monetary policy, and the BOJ is the last skittle to fall in all of this,” said Stephen Miller, a former head of fixed income at BlackRock Inc. in Australia who’s now at GSFM Pty. “I hope this is the end for negative rates because it might mean we’re going to stop relying on central banks to do everything. We now know that negative rates don’t work, full stop.”

Japan’s inflation hit its fastest clip in 40 years in October, adding to doubts over the need for continued stimulus, especially after the yen’s collapse to the weakest in more than 30 years stirred discontent across the nation.

“The BOJ is already allowing yields to fluctuate by 100 basis points in total and any further widening would undermine the rationale for a 10-year yield target of 0%,” Goldman Sachs Group Inc. analysts including Naohiko Baba wrote in a note on Tuesday. “We therefore believe that the next policy decision the BOJ takes will likely be a major one—such as changing long-/short-term policy rate targets or terminating yield curve control altogether.”

For now, the BOJ is defending its yield curve control policy. The central bank announced unscheduled purchases of ¥200 billion ($1.5 billion) yen three-to-10 year debt after the 10-year yield rose toward its 0.5% ceiling. That’s on top of the daily offer to buy an unlimited amount of 10-year notes at a fixed yield of 0.50%.