The market nosedived for the second straight day with the Nifty50 closing below the crucial support of 18,300 mark on December 16, tracking correction in global counterparts amid growing recession fears.

The BSE Sensex fell 461 points to 61,338, while the Nifty50 plunged 146 points to 18,269 and formed a bearish candle with a long upper shadow.

"Technically this market action indicates sell on rise and downward continuation pattern. This is a negative signal and more weakness could be in store. The negative chart pattern like the lower top has been confirmed at 18,696 (December 14) and further weakness from here could signal a formation of the new lower bottom of the sequence on the daily chart," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

The Nifty on the weekly chart also formed a similar pattern to that of the daily chart (small negative candle with long upper shadow), which indicates the presence of key resistance around 18,700 levels.

Having moved below the crucial immediate support of 18,500 levels, as per the weekly chart, the Nifty could slide down to the next important support of 18,100-18,000 levels in the coming week, the market expert said. "Immediate resistance is at 18,450-18,500 levels."

The selling pressure was also seen in broader markets as the Nifty Midcap 100 and Smallcap 100 indices fell 1.6 percent and 0.6 percent respectively, while the volatility index India VIX increased quite sharply by 23 percent in the last few sessions from a weekly low, indicating the possibility of some kind of uncertainty, though on a weekly basis it rose just 4.4 percent to 14.07 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 18,251, followed by 18,207 & 18,136. If the index moves up, the key resistance levels to watch out for are 18,393 followed by 18,436 and 18,507.

The Nifty Bank also extended its southward journey for yet another session, falling 279 points to 43,219 and forming a Doji kind of pattern on the daily charts, indicating indecisiveness among buyers and sellers about future market trends.

The important pivot level, which will act as crucial support for the index, is placed at 43,102, followed by 42,980 and 42,782 levels. On the upside, key resistance levels are placed at 43,497 followed by 43,619 & 43,817 levels.

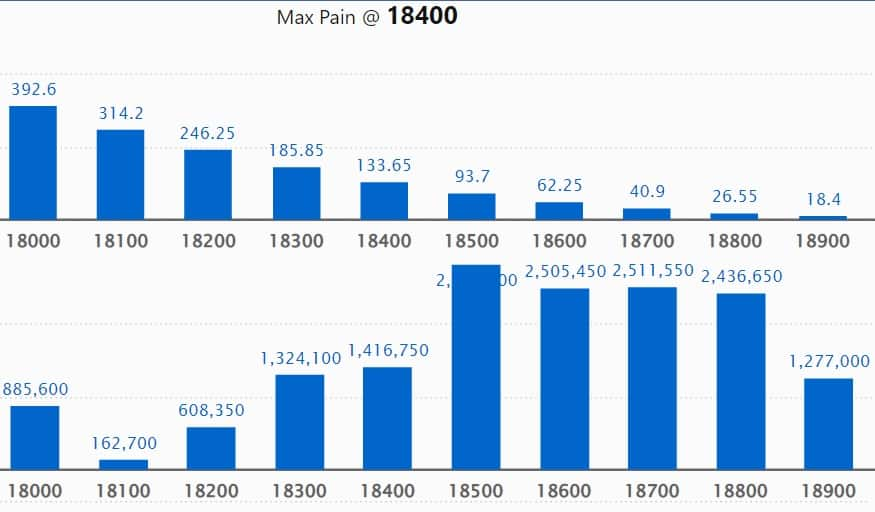

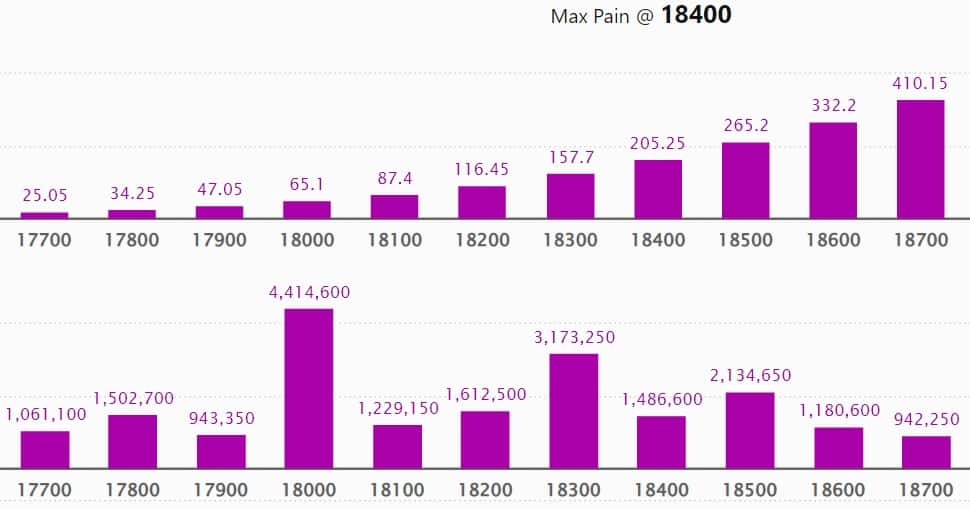

We have seen the maximum Call open interest at 19,000 strike, with 37.72 lakh contracts, which can act as a crucial resistance level in the December series.

This is followed by 18,500 strike, which holds 28.23 lakh contracts, and 18,700 strike, which have more than 25.11 lakh contracts.

Call writing was seen at 18,300 strike, which added 7.83 lakh contracts, followed by 18,400 strike, which added 5.81 lakh contracts, and 18,200 strike which added 81,600 contracts.

Call unwinding was seen at 18,800 strike, which shed 6.77 lakh contracts, followed by 19,000 strike which shed 1.92 lakh contracts and 19,600 strike which shed 1.3 lakh contracts.

We have seen a maximum Put open interest at 18,000 strike, with 44.14 lakh contracts which can act as a crucial support level in the December series.

This is followed by 18,300 strike, which holds 31.73 lakh contracts, and 17,500 strike, which has accumulated 31.24 lakh contracts.

Put writing was seen at 18,300 strike, which added 6.63 lakh contracts, followed by 18,000 strike, which added 6.44 lakh contracts and 17,700 strike which added 3.66 lakh contracts.

Put unwinding was seen at 18,500 strike, which shed 5.69 lakh contracts, followed by 18,600 strike which shed 4.17 lakh contracts, and 18,700 strike which shed 3.66 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in Power Grid Corporation of India, Tata Consultancy Services, HDFC Bank, Sun Pharma, and Mphasis, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, we have seen a long build-up in six stocks on Friday, including Balrampur Chini Mills, Tata Motors, MCX India, PI Industries, and Chambal Fertilisers.

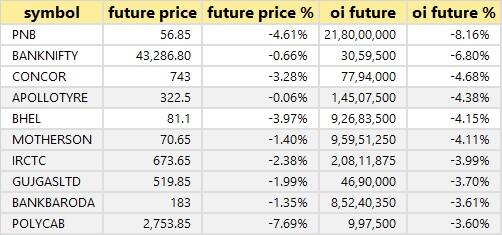

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, 100 stocks have seen long unwinding on Friday including Punjab National Bank, Bank Nifty, Container Corporation, Apollo Tyres, and BHEL.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, we have seen a short build-up in 81 stocks on Friday including Dr Reddy's Laboratories, Nifty Financial, Mphasis, HDFC AMC, and Bharat Electronics.

8 stocks witnessed short-covering

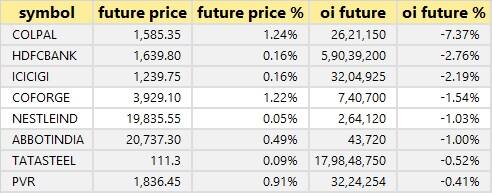

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, we have eight stocks on the short-covering list on Friday including Colgate Palmolive, HDFC Bank, ICICI Lombard General Insurance, Coforge, and Nestle India.

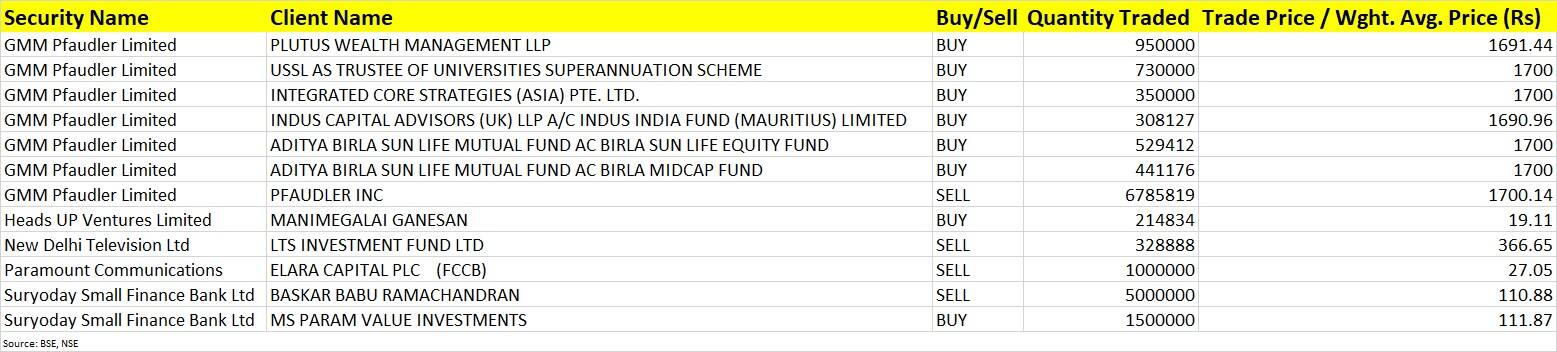

GMM Pfaudler: Promoter Pfaudler Inc has sold 67.85 lakh shares or a 15 percent stake in the company via open market transactions at an average price of Rs 1,700.14 per share. The stake sale was worth Rs 1,153.68 crore. The total promoter shareholding in the company was 56.06 percent as of September 2022 including Pfaudler Inc's 31.88 percent. However, five investors -- Plutus Wealth Management LLP, USSL as Trustee of Universities Superannuation Scheme, Integrated Core Strategies (Asia) Pte Ltd, Indus Capital Advisors (UK) LLP A/C Indus India Fund (Mauritius), and Aditya Birla Sun Life Mutual Fund were buyers for some of those shares, buying 33.08 lakh shares or 7.35 percent stake in the company.

Suryoday Small Finance Bank: Promoter Baskar Babu Ramachandran has offloaded 50 lakh shares in the small finance bank via open market transactions, at an average price of Rs 110.88 per share, which was worth Rs 55.44 crore. Ramachandran sold shares to repay the loan availed by him for exercising warrants in order to maintain the promoter's stake at a minimum of 26 percent for the first five years as per the RBI regulations. Post this transaction, the total promoter group holding will stand at 23.30 percent and Ramachandran’s individual holding will stand at 5.94 percent. However, MS Param Value Investments bought 15 lakh shares in the company at an average price of Rs 111.87 per share.

(For more bulk deals, click here)

Investors Meetings on December 19

Eicher Motors: Officials of the company will interact with Millenium Partners.

Praj Industries: Officials of the company will interact with Sundaram Mutual Fund and Sundaram Alternates.

Alkem Laboratories: Officials of the company will interact with SBI Life.

Jindal Stainless: Company will be attending analyst/investor meeting(s) in Mumbai.

Hindware Home Innovation: The management of the company will meet Avener Capital.

Stocks in News

Tata Motors: Bengaluru Metropolitan Transport Corporation has signed a definitive agreement with the company's fully owned subsidiary, TML Smart City Mobility Solutions, for the operation of 921 electric buses in Bengaluru. As part of the agreement, TML Smart City Mobility Solutions will supply, operate and maintain 921 electric buses for a period of 12 years.

IT stocks in focus: Accenture has delivered a 15 percent year-on-year growth in revenue at $15.75 billion in constant currency terms (better than its own forecast of 11-14 percent), and 5 percent growth in dollar terms. Operating margin at 16.5 percent expanded 20 bps YoY, but new bookings at $16.2 billion declined 3 percent YoY and were down 12 percent QoQ. The IT company has retained its FY23 revenue growth guidance at 8-11 percent in constant currency terms and also margin forecast at 15.3-15.5 percent, while it sees Q2 revenue growth at 6-10 percent YoY in constant currency terms.

GMR Airports Infrastructure: Step-down subsidiary GMR Airports International BV received Rs 1,389.90 crore against the sale of shares in GMR Megawide Cebu Airport Corporation (a joint venture between GMR Airports International BV, and Megawide Construction Corporation) and the issuance of exchangeable notes to Aboitiz InfraCapital Inc (AIC).

Tilaknagar Industries: Tilaknagar Industries has received board approval for the allotment of 1.05 crore shares at a price of Rs 95 per share to foreign portfolio investor Think India Opportunities Master Fund LP on a preferential basis. Think India will invest nearly Rs 100 crore.

Phoenix Mills: The company completed the acquisition of 7.22 acres of land in Surat, Gujarat, for Rs 510 crore. The land was acquired through the subsidiary Thoth Mall and Commercial Real Estate. Thoth will develop a premium retail destination with a gross leasable area of approximately 1 million square feet and currently expects to complete the retail development by FY27.

Tech Mahindra: The company has approved the sale of a 100 percent stake in wholly owned subsidiary Dynacommerce Holdings BV, to step-down subsidiary Comviva Netherlands BV. The transaction cost is 6.6 million euro and the expected date for transaction completion is the first week of January 2023.

Dilip Buildcon: The company has received a letter of acceptance for a new HAM project '4-Laning of Karimnagar Warangal section of NH-563' in Telangana, from the National Highways Authority of India. The order is worth Rs 1,647 crore.

Sun Pharmaceutical Industries: The company has received a warning letter from USFDA for the Halol facility. The warning letter mentions violations with respect to current good manufacturing practice (cGMP) regulations. The Halol facility was placed under import alert by USFDA.

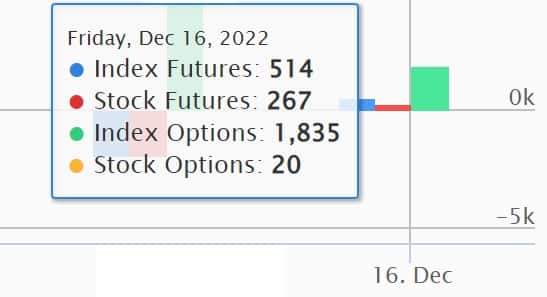

Fund Flow

Foreign institutional investors (FIIs) have net-sold shares worth Rs 1,975.44 crore, while domestic institutional investors (DIIs) net-purchased shares worth Rs 1,542.50 crore on December 16, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added Balrampur Chini Mills, and retained IRCTC, Punjab National Bank, Indiabulls Housing Finance, BHEL, Delta Corp, and GNFC under its F&O ban list for December 19. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.