The losing streak kept roiling the benchmark indices with both the Sensex and the Nifty shedding over 1 percent each in a volatile week ended December 16 amid rate hikes by some major economies, continued selling by foreign investors, and lower inflation print in India.

The BSE Sensex lost 843.86 points or 1.35 percent to end at 61,337.81 and the Nifty50 declined 227.6 points or 1.23 percent to end at 18,269 levels. The two indices lost nearly 3 percent each so far in December.

Among sectors, Nifty Media index fell 2.2 percent, Nifty FMCG index 1.8 percent, Nifty Realty 1.7 percent and Nifty Information Technologies index was down 1.6 percent. Nifty PSU Bank index, however, climbed 0.8 percent.

During this week, the BSE Small-cap index ended on flat note, while Large-cap and Mid-cap indices lost over a percent each.

"Volatility in the market this week was dictated by the release of favourable inflation numbers, which were offset by major global central banks' aggressive decisions. The US CPI inflation eased to 7.1 percent in November, while India’s retail inflation eased sharply to 5.88 percent, which was within the RBI’s tolerance band. However, the Fed startled the market by maintaining its hawkish tone, as investors were expecting a softer approach after the release of better-than-expected inflation numbers," said Vinod Nair, Head of Research at Geojit Financial services.

After the US Federal Reserve, the Bank of England (BOE) and the European Central Bank (ECB) raised their interest rate by 50bps while maintaining their hawkish stance in combating inflation.

"Selloffs were broad-based, IT stocks dragged in the domestic market as recession fears boomed in the global economies. Lack of major triggers will push the domestic market to follow its global peers, in the coming week," Nair said.

Foreign institutional investors (FIIs) offloaded equities worth Rs 1,832.91 crore of equities, while domestic institutional investors (DIIs) bought equities worth of Rs 3,462.22 crore in the week under review. In December so far, FIIs sold equities worth Rs 7,490.05 crore and DIIs bought equities worth Rs 10,551.62 crore.

"Global equity markets witnessed a spike in volatility as global central banks reiterated their intent to keep policy rates high for an extended period to quell elevated inflation in their respective economies," said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities.

The domestic markets, according to him, may be dominated by global news flows and steps taken by various governments to tackle their economies. On the economy front, November CPI inflation dropped sharply to 5.88 percent from 6.77 percent in October, led by a steep sequential fall in food prices, while the core inflation remained steady at 6.3 percent. October IIP contracted sharply by 4 percent as against a growth of 3.5 percent in September.

The Federal Reserve raised the US benchmark interest rate by 50 basis points to a target range of 4.25 percent to 4.5 percent — the highest in 15 years. It said it would continue hiking the rates through 2023 to 5.1 percent, a larger figure than previously expected. There was announcement by the ECB and comments by its president Christine Lagarde as she stressed that “significant” further rate rises at a “steady pace” were still to come," he said.

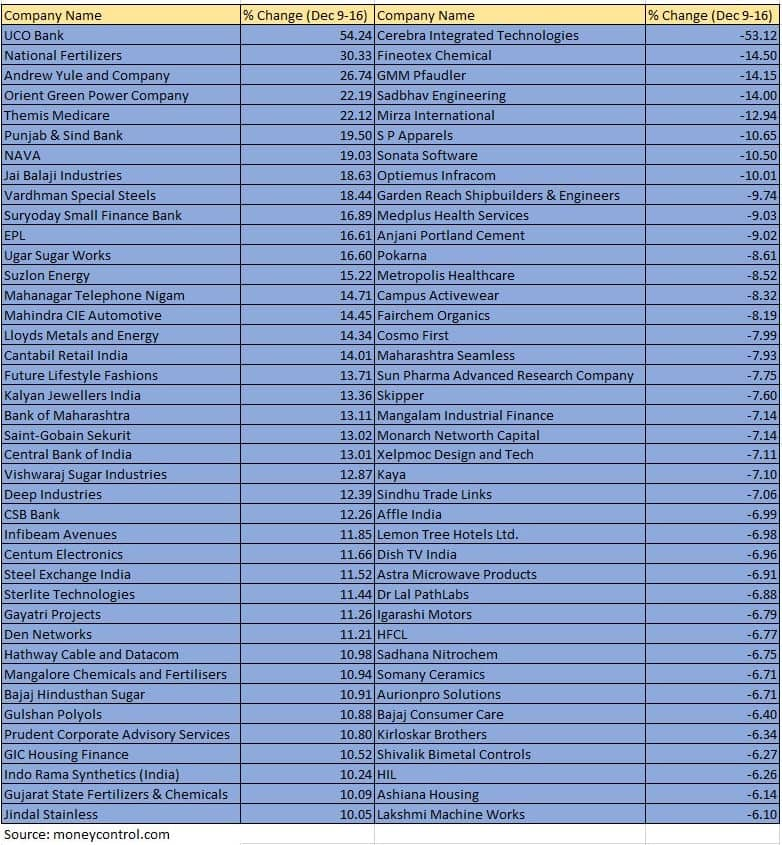

The BSE Small-cap index ended on flat note. UCO Bank, National Fertilizers, Andrew Yule and Company, Orient Green Power Company, Themis Medicare, Punjab & Sind Bank, NAVA, Jai Balaji Industries, Vardhman Special Steels, Suryoday Small Finance Bank, EPL, Ugar Sugar Works and Suzlon Energy added 15-54 percent.

However, Cerebra Integrated Technologies, Fineotex Chemical, GMM Pfaudler, Sadbhav Engineering, Mirza International, S P Apparels, Sonata Software and Optiemus Infracom lost 10-53 percent.

Where is Nifty50 headed?

Apurva Sheth, Head of Market Perspectives, Samco Securities.

Previous week on the weekly chart Nifty50 formed bearish dark cloud cover candle stick pattern at all-time high levels and index continued to drift lower post that. India VIX, witnessed a bounce of more than 20 percent in a week indicating some uncertainty creeping at higher levels.

On the technical ground, the support for the Index is placed near 18,100 and any move below the same will extend the fall till 17,900 levels. Similarly on the higher side 18,500 will be the immediate resistance and followed by 18,650 levels.

Amol Athawale, Deputy Vice President - Technical Research at Kotak Securities

The Nifty not only broke the important support level of 18,400 but closed below the same. The next support level for the index would be 50 day SMA or 18,100-18,000 levels.

On the flip side, 18,400 could act as an immediate resistance zone for the index, and above the same the index could retest the 20-day SMA or 18,550. In case of further upside, the index could move up to 18,700.

Ajit Mishra, VP - Technical Research, Religare Broking

Weak global cues are weighing on the sentiment and indications are in the favour of further decline. Nifty has breached crucial support at 18,300 and now the next support comes at the 18,000 zone.

In absence of any major event, global cues will continue to dictate the trend. Meanwhile, traders should align their positions as per the market trend and avoid making aggressive bets.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.