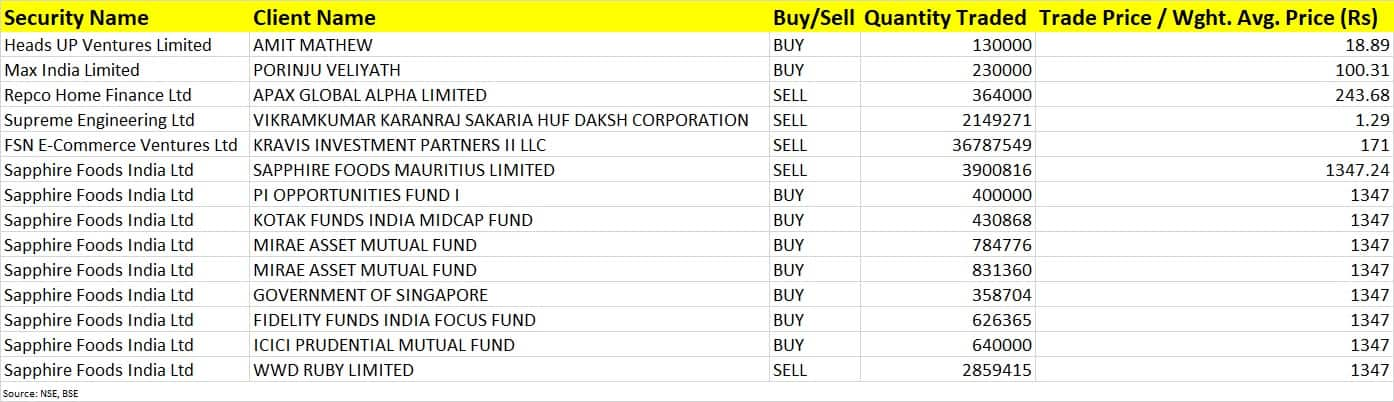

Foreign investor Kravis Investment Partners offloaded Rs 629 crore worth of shares in FSN E-Commerce Ventures, the Nykaa Fashion operator, via open market transactions on December 15.

Kravis Investment Partners II LLC has sold a total of 3.67 crore shares in FSN, at an average price of Rs 171 apiece. The stock corrected 1 percent to close at Rs 170.80.

Among other deals, promoter entity Sapphire Foods Mauritius has offloaded 39 lakh shares in Sapphire Foods India, one of the largest franchisees of Yum! Brands Inc in the subcontinent.

These shares were sold at an average price of Rs 1,347.24 apiece, and the stake sale was worth Rs 525 crore.

Investor WWD Ruby also sold 28.59 lakh shares in Sapphire Foods at an average price of Rs 1,347 per share.

However, investors PI Opportunities Fund I, Kotak Funds India Midcap Fund, Mirae Asset Mutual Fund, Government of Singapore, Fidelity Funds India Focus Fund, and ICICI Prudential Mutual Fund were buyers for some of those shares, acquiring 40.72 lakh shares in the company at an average price of Rs 1,347 per share. The stock closed with nearly 3 percent gains at Rs 1,397.50.

Ace investor Porinju Veliyath bought 2.3 lakh shares in Max India on Thursday. These shares were purchased at an average price of Rs 100.31 per share. Shares of Max India rose nearly 7 percent to close at Rs 101.75.

Apax Global Alpha sold 3.64 lakh shares in Repco Home Finance at an average price of Rs 243.68 per share. The stock was down 1.4 percent at Rs 239.80.

Apax Global Alpha held a 2.12 percent stake or 13.29 lakh shares in Repco Home Finance as of September 2022.