The market gained momentum and moved closer to 18,700 on the Nifty50 on December 14, tracking positive global cues and a further decline in US inflation numbers. Technology, metal, and select bank, auto, and pharma stocks aided an uptrend.

The BSE Sensex rose 145 points to 62,678, while the Nifty50 climbed 52 points to 18,660 and formed a Doji kind of pattern on the daily charts, indicating indecisiveness among bulls and bears, and also caution about future market trends.

"On the daily charts, the Nifty formed a Doji candle pattern near the important resistance zone of 18670 levels indicating some caution for the short term," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

But the momentum indicator RSI (relative strength index) is moving upward and sustained above 60 levels, which indicates the bullish momentum of the index.

As per the overall price structure and evidence provided by indicators, the market expert feels that the Nifty will stay in the range between 18,886 and 18,300 levels.

The broader markets remained in momentum, with the Nifty Midcap 50, Midcap 100 and Smallcap 100 indices gaining in the range of 0.6-0.8 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 18,639, followed by 18,624 & 18,600. If the index moves up, the key resistance levels to watch out for are 18,687 followed by 18,702 and 18,726.

The Nifty Bank sustained a northward journey, ending with 102 points gains at a fresh all-time closing high of 44,049, but formed a Doji kind of pattern on the daily charts, making higher highs higher lows formation. In fact, the index climbed above the 44,000 mark for the first time.

The important pivot level, which will act as crucial support for the index, is placed at 44,000, followed by 43,962 and 43,899 levels. On the upside, key resistance levels are placed at 44,126 followed by 44,164 & 44,227 levels.

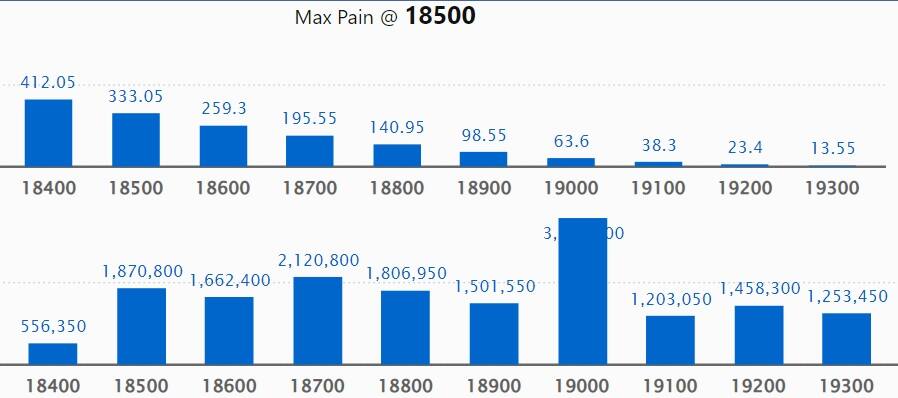

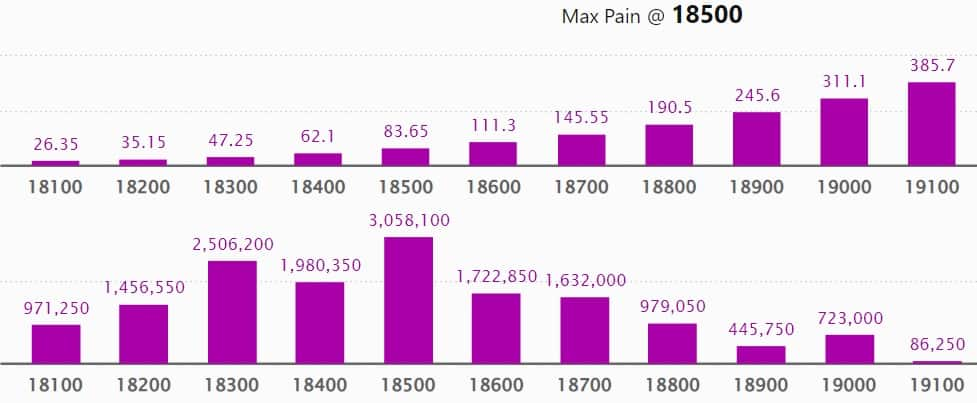

We have seen the maximum Call open interest at 19,000 strike, with 35.6 lakh contracts, which can act as a crucial resistance level in the December series.

This is followed by 20,000 strike, which holds 22.51 lakh contracts, and 18,700 strike, which have more than 21.2 lakh contracts.

Call writing was seen at 19,200 strike, which added 3.44 lakh contracts, followed by 19,100 strike, which added 1.39 lakh contracts, and 18,700 strike which added 1.14 lakh contracts.

Call unwinding was seen at 18,900 strike, which shed 4.67 lakh contracts, followed by 18,500 strike which shed 3.53 lakh contracts and 19,000 strike which shed 1.19 lakh contracts.

We have seen a maximum Put open interest at 18,000 strike, with 37.36 lakh contracts which can act as a crucial support level in the December series.

This is followed by 18,500 strike, which holds 30.58 lakh contracts, and 17,500 strike, which has accumulated 29.18 lakh contracts.

Put writing was seen at 18,700 strike, which added 3.02 lakh contracts, followed by 18,800 strike, which added 1.68 lakh contracts and 17,500 strike which added 1.36 lakh contracts.

Put unwinding was seen at 18,500 strike, which shed 3.76 lakh contracts, followed by 17,800 strike which shed 2.16 lakh contracts, and 18,300 & 17,600 strikes which shed 1.24 lakh contracts each.

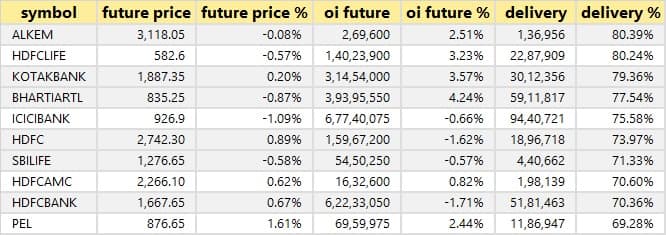

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in Alkem Laboratories, HDFC Life Insurance Company, Kotak Mahindra Bank, Bharti Airtel, and ICICI Bank, among others.

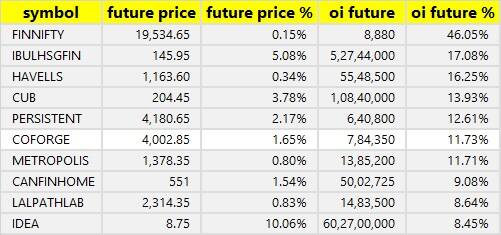

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, we have seen a long build-up in 69 stocks on Wednesday, including Nifty Financial, Indiabulls Housing Finance, Havells India, City Union Bank, and Persistent Systems.

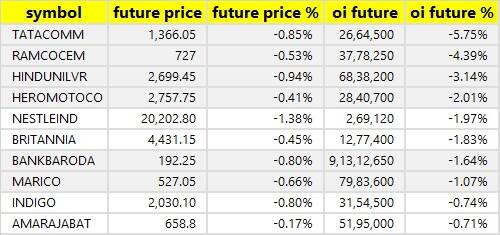

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, 19 stocks have seen a long unwinding on Wednesday including Tata Communications, Ramco Cements, Hindustan Unilever, Hero MotoCorp, and Nestle India.

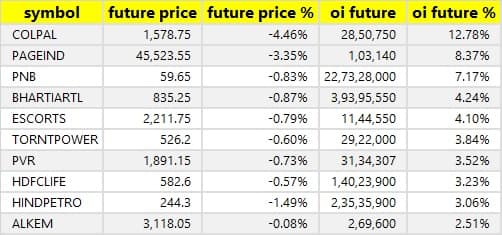

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, we have seen a short build-up in 28 stocks on Wednesday including Colgate Palmolive, Page Industries, Punjab National Bank, Bharti Airtel, and Escorts.

77 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, we have a total of 77 stocks on the short-covering list on Wednesday including Dalmia Bharat, Astral, Indian Hotels, Eicher Motors, and Max Financial Services.

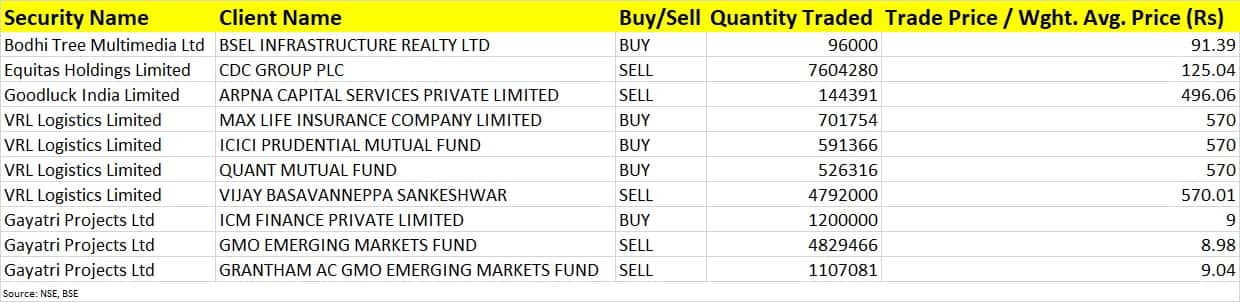

Equitas Holdings: CDC Group Plc sold 76.04 lakh equity shares or a 2.22 percent stake in the company via open market transactions, at an average price of Rs 125.04 per share. CDC Group held a 2.72 percent stake in the company as of September 2022.

VRL Logistics: Promoter Vijay Basavanneppa Sankeshwar sold 47.92 lakh equity shares in the company (5.4 percent stake) at an average price of Rs 570.01 per share. However, Max Life Insurance Company, ICICI Prudential Mutual Fund, and Quant Mutual Fund bought 18.19 lakh shares in the company at an average price of Rs 570 per share.

Gayatri Projects: GMO Emerging Markets Fund sold 48.29 lakh shares in the company at an average price of Rs 8.98 per share, and Grantham AC GMO Emerging Markets Fund offloaded 11.07 lakh shares at an average price of Rs 9.04 per share. However, ICM Finance bought 12 lakh shares at an average price of Rs 9 per share.

(For more bulk deals, click here)

Investors meetings on December 15

Eicher Motors: Officials of the company will interact with Janus Henderson.

Blue Star: Officials of the company will interact with Sundaram Mutual Fund.

Tata Motors: Officials of the company will interact with Millennium Management, SG.

Titan Company: Officials of the company will interact with ASK Investment Managers.

Nuvoco Vistas Corporation: Officials of the company will interact with IIFL Securities.

Maruti Suzuki India: Officials of the company will participate in an investor meeting.

Nazara Technologies: Officials of the company will interact with Nippon Mutual Fund.

Dixon Technologies: Officials of the company will interact with BNP Paribas.

Stocks in News

Kamat Hotels: The company will be issuing up to 58.96 lakh warrants, each convertible into one equity share within the period of eighteen months at a price of Rs. 97 each aggregating up to Rs 57.19 crore on a preferential basis to the promoters and members of the promoter group.

Wipro: Wipro announced the launch of new financial services advisory company, Capco in the Middle East. Capco will offer strategic management and technology consulting capabilities to financial services firms in the Middle East to enable their transformation, digitisation, and business consolidation initiatives.

Dunseri Tea & Industries: The company has entered into an MOU to sell the Khagorijan tea estate for an amount of Rs 15 crore subject to adjustment of current assets and current liabilities to Sahdev Singh Kushwah, Sanwar Mal More and Nikhil Agarwalla. The tea estate contributed Rs 23.34 crore (11.11 percent) to the total turnover.

State Bank of India: SBI board has approved raising capital by way of issuance of Basel III compliant debt instrument in INR and/or any other convertible currency, up to FY24 up to an amount of Rs 10,000 crore. This is subject to concurrence from the Government of India.

JB Chemicals and Pharma: JB Chemicals to acquire the entire Razel (Rousvastatin) franchise from Glenmark Pharmaceuticals for India and Nepal region for Rs 314 crore. The acquisition marks JB Pharma’s entry into the ‘Statin’ segment which is the largest group in cardiac therapy. Razel ranks among the top 10 brands in the Rousvastatin molecule category in the country. The transaction is expected to be closed within the next two weeks.

Dilip Buildcon: Dilip Buildcon has executed a contract agreement through its RBL-DBL JV with Gujarat Metro Rail for Rs 1,061 crore for Surat Metro Rail Project Phase 1 (Package CS 5). The length of the project is 10.6 km and will take 26 months to complete.

Torrent Pharmaceuticals: Torrent Pharmaceuticals Ltd enters into a co-marketing partnership with Boehringer Ingelheim India to co-market Cospiaq (Empagliflozin), Cospiaq MetTM (Empagliflozin+ Metformin) and Xilingio (Empagliflozin+ Linagliptin) in India. Empagliflozin is a novel sodium glucose co-transporter-2 (SGLT-2) inhibitor, which is useful for improving glycaemic control in adults with type-2 diabetes mellitus. Empagliflozin is also indicated to reduce the risk of cardiovascular death, in adults with type 2 diabetes mellitus and established cardiovascular disease.

Poonawalla Fincorp: Poonawalla Fincorp announces the sale of its housing subsidiary to TPG (Perseus SG Pte. Ltd., an entity affiliated with TPG Global, LLC) for Rs 3,900 crore. The company said in a release that the transaction will maximise the shareholders’ value in the long term as Poonawalla Fincorp focuses on building a tech-led and digital-first financial services company, with leadership in consumer and MSME financing.

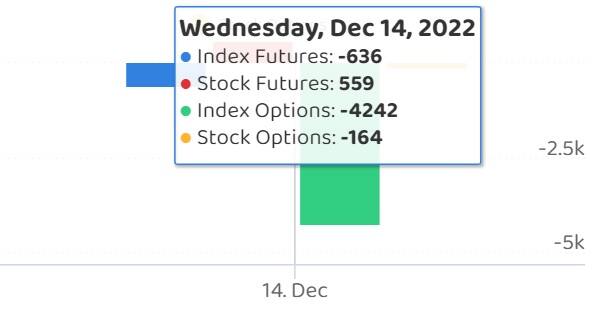

Fund Flow

Foreign institutional investors (FIIs) have net-bought shares worth Rs 372.16 crore, while domestic institutional investors (DIIs) net-purchased shares worth Rs 926.45 crore on December 14, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added Indiabulls Housing Finance, and retained BHEL, Delta Corp, and GNFC under its F&O ban list for December 15. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.