personal-finance

Why short-term debt funds will look attractive again

Dec 09, 05:12

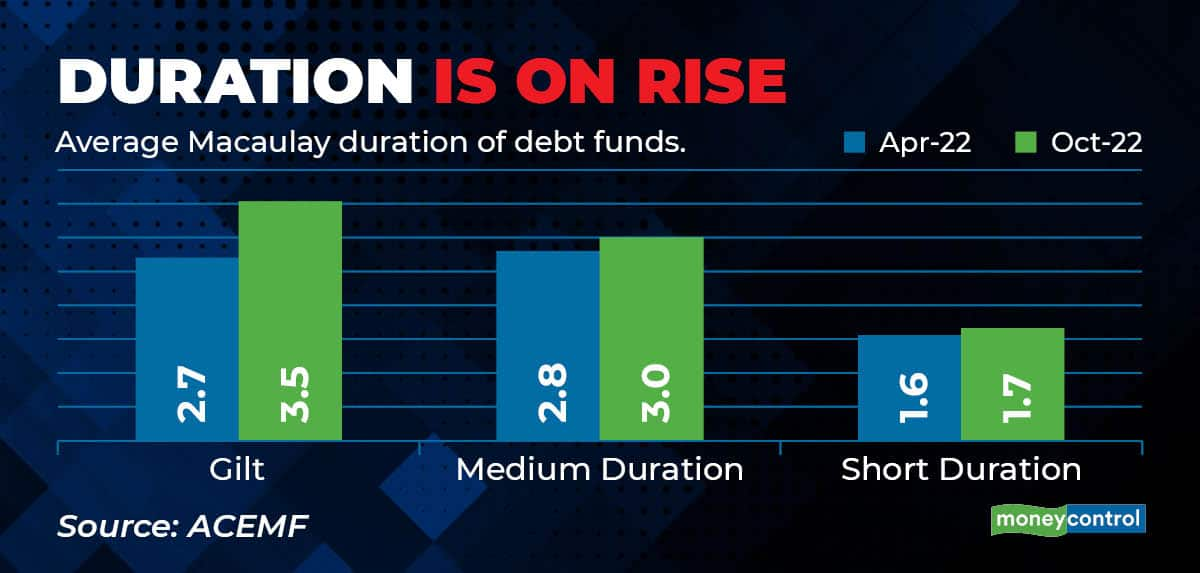

Debt mutual funds were not an attractive asset class in a low interest-rate environment. After the pandemic, central bank had cut policy rates to boost growth, which lowered bond yields. This made it difficult for debt funds to generate returns. With the yields going up due to the recent rate hikes, the overall outlook for fixed income return has improved. Yields of the short term debt securities have now inched up significantly. Debt fund managers are finding it attractive and increasing the average maturity of portfolio that had kept lower so far. Experts believe, this will likely to benefit the short term funds going ahead.