Reserve Bank of India (RBI) Governor Shaktikanta Das has announced a 35 basis-point (bps) hike in the repo rate to 6.25 percent, its highest level since August 2018. The central bank has hiked rates by a cumulative 225 bps since it started the rate tightening cycle in May this year.

The consecutive rate hikes are affecting individual borrowers who have taken – or are looking for floating-rate home, car and consumer durable loans. “All consumer loans have got costlier this year. Borrowers are under the pressure of mounting interest rates and rising equated monthly instalments (EMIs),” says Adhil Shetty, CEO, BankBazaar.com.

Rate hike impact on new and existing home loan borrowers

All floating-rate retail loans sanctioned by banks after October 1, 2019, are linked to an external benchmark, which is the repo rate in most cases. So home loans linked to repo rates would have the quickest transmission of increased policy rates.

Most banks have fully passed on the repo rate increase of 190 bps to the consumers of home loans till date. “This rate hike of 190 bps has resulted in a loan tenor increase of around 13 years for borrowers who had initially opted for 20 years loan period, assuming they had taken a home loan at 6 percent at the time of home purchase,” says Shrikant Shrivastava, Chief Risk Officer, IMGC (India Mortgage Guarantee Corporation). He adds, there is not much room for loan tenor increase beyond the 13 years already done till date, due to 190 bps previous increases. Alternatively, those borrowers who opted for an EMI increase instead of a loan tenor increase have seen their EMI go up by around 20 percent.

“Borrowers who have leveraged themselves to the extent of 70 percent of their post-tax income will have trouble in managing their cash flow to repay EMIs,” says Vipul Patel, Founder, MortgageWorld, a loan consultancy firm. He explains this is because they will be overleveraged with the consecutive rate hikes if they didn’t have an increase in their income.

The interest rates for existing home loan borrowers will go up from the reset dates set by their lenders. Till then, they would continue to repay their home loans at existing interest rates.

“The overall home loan eligibility of the new borrower has gone down by 40 percent with a recent repo rate hike,” says Patel.

However, those planning to avail home loans should never time their home-buying decision based on the trends of policy rate movements. “As home loans are typically long-term loans, a borrower would witness several reversals in the interest rate cycle during his loan tenure,” says Naveen Kukreja, CEO & Co-founder, Paisabazaar.

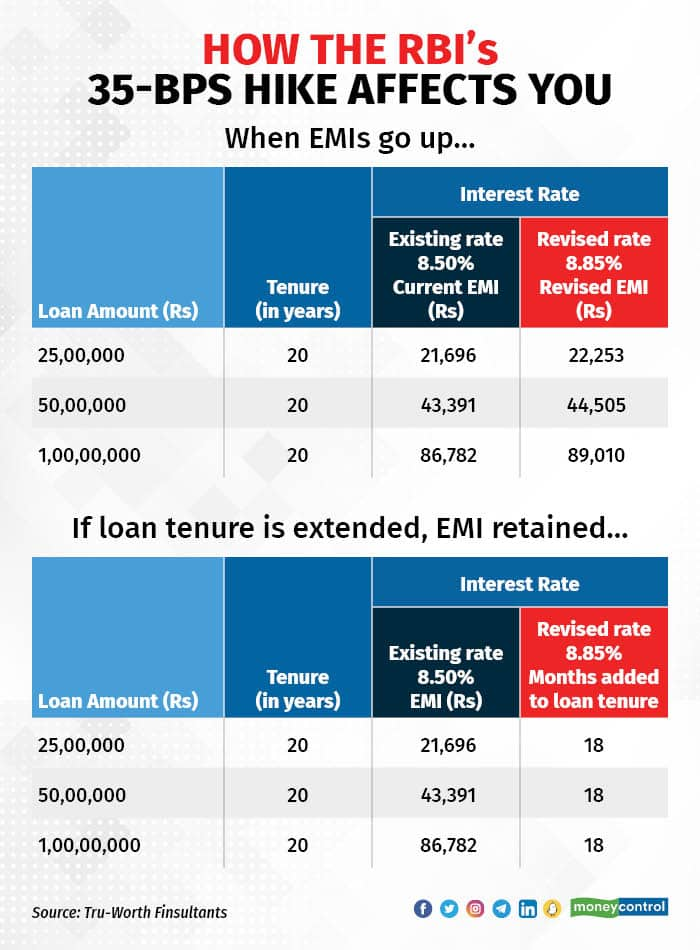

Rising EMIs are pinching

The EMI burden has shot up substantially in the past eight months.

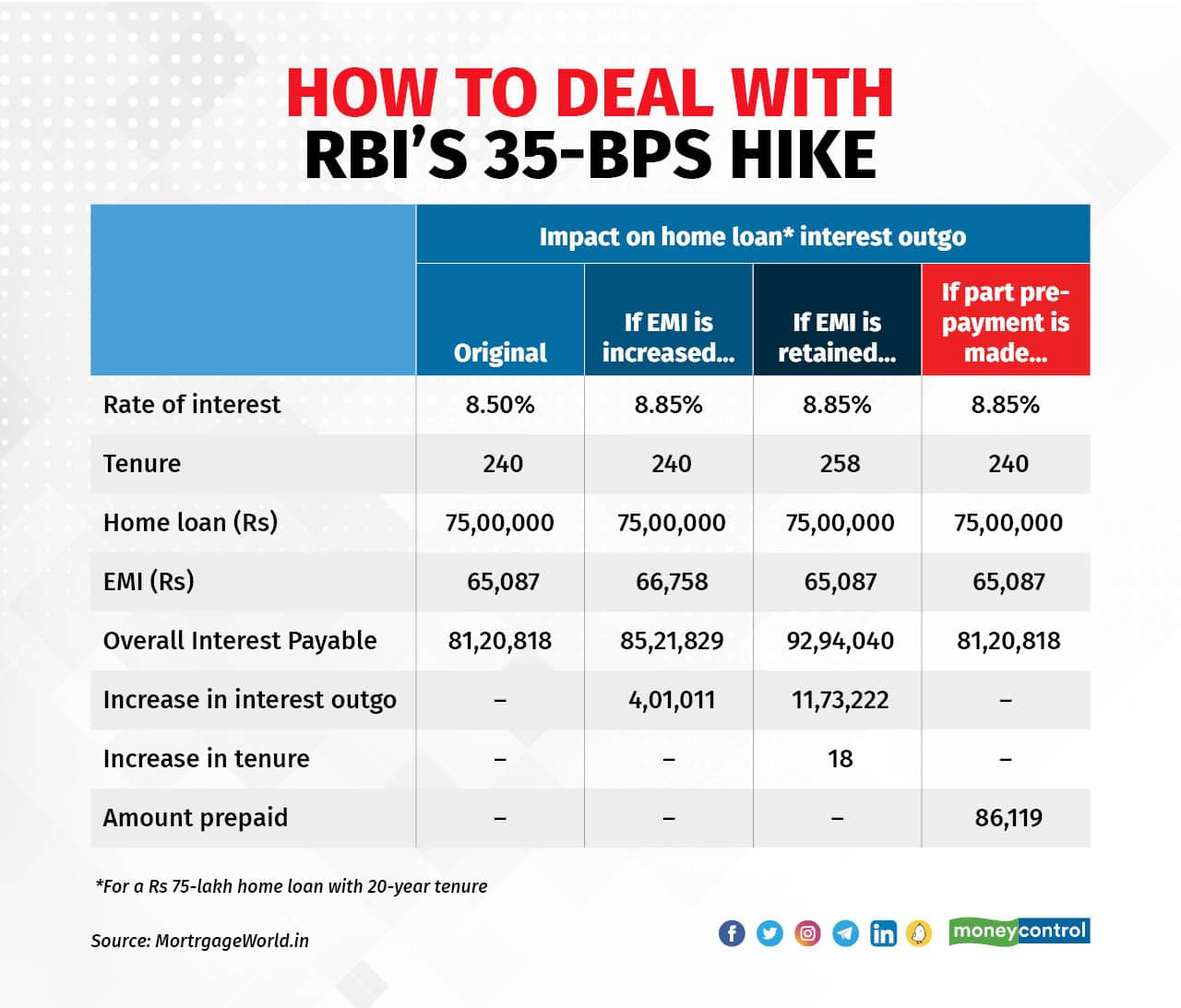

“Existing home loan borrowers should opt for the EMI increase option, with the consent of their lenders, as and when their interest rates are increased,” says Kukreja. He adds, opting for the EMI increase option would result in lower interest costs than the tenure increase option. Financially constrained home loan borrowers can opt for the tenure increase option if they want their EMIs to remain the same. But if you’re in your 50s and still paying your EMIs, then make sure that your EMIs are complete by your retirement age.

The borrower ends up paying higher interest on borrowed loan amount if EMI is retained and tenure increased. For the recent rate hike, the revised repayment period for Rs 75 lakh home loan with an interest rate of 8.5 percent and original tenure of 20 years (240 months) will be over 21.5 years (258 months). This means that the interest payout over this period will rise by close to Rs 11.7 lakh. “If you increase just the EMIs the overall additional interest burden will be Rs 4.01 lakh,” says Patel.

Existing home loan borrowers who see significant improvements in their credit profile after availing home loan can initiate a home loan balance transfer to reduce their interest cost. “Their improved credit profile may make them eligible to transfer their existing home loans to other lenders at much lower interest rates,” says Kukreja.

Use prepayment strategy to reduce the loan tenor

Long-term loans like home loans allow you to make part pre-payments. In a rising interest rate environment, rethink your home loan repayment strategy and consider making pre-payments to save on rising interest costs. Just an extra few thousand every month can reduce your interest payout over the long term.

“Prepaying your home loan as and when funds are available can do wonders and shorten your ballooning loan tenor,” says Shetty.

For example, if you pay 5 percent of the loan balance every year, you can pay off your 20-year loan in 12 years. Prepaying one additional EMI every year can close your loan in just 17 years, and if you increase your EMI by 5 percent every year, you can finish your loan in less than 13 years. A 10 per cent increase in your EMI every year can close your loan in about ten years. Lastly, you could also consider refinancing your home loan if your rate is not in sync with the market or your credit profile. A difference of 50 bps warrants a look.

A good occasion to pre-pay your home loans is when you get your annual bonus. Earmark a portion of your bonus to prepay your housing loan, every year.

Rate hike brings cheer to depositors

Apart from the changes in the policy rates, the increase or decrease in fixed deposit (FD) rates are also influenced by the gap between credit growth rates and deposit growth rates. “As long as the credit growth rates outperform the growth rates of bank deposits, banks would continue to increase FD rates to attract more deposits to meet the increasing credit demand,” says Kukreja.

As of December 2, at least 24 government, private, and foreign banks were offering FDs with interest rates of 7 percent or higher on select tenors as opposed to 17 on November 8.

“Consumers planning to park their surpluses in FDs should stick to tenures of 1 to 2 years,” says Kukreja. As FD rates are expected to further increase over the short term, depositors should avoid auto-renewal facility while booking their FDs, he adds. This might allow depositors to renew the FDs at higher interest rates, after factoring in the highest rate slabs available at the time of renewal.