The market turned volatile after a day of record run to close with moderate gains on November 25, which were still enough to see the benchmark indices close at a new high on the first day of the December series.

The broader markets looked strong, with the Nifty midcap 100 and smallcap 100 indices rising around a percent each.

The Sensex rose 21 points to 62,294, while the Nifty50 climbed 29 points to 18,513 and formed a Doji pattern on the daily charts, indicating indecisiveness among the bulls and the bears about the market direction.

The index gained more than a percent during the week and formed a Bullish Engulfing candle on the weekly scale.

The underlying trend for Nifty continues to be positive. Having surpassed the crucial upper resistance during the week, the index is expected to move to a new all-time high (above 18,606) by next week, Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

A sustainable move above 18,600 will likely pull the Nifty towards the new milestone of 18,950 in the near term (which is 0.786 percent Fibonacci extension taken from the June 22 bottom, September 22 top and September 22 higher bottom, as per the weekly chart), he added.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support, resistance levels on the Nifty

As per the pivot charts, the key support for the Nifty is at 18,463, followed by 18,442 and 18,408. If the index moves up, the key resistance levels to watch out for are 18,532, by 18,553 and then 18,587.

The Nifty Bank underperformed broader markets on November 25, falling 91 points to 42,984 and formed a bearish candlestick on the daily charts. It made higher highs, higher lows for the fourth straight session. The important pivot level, which will act as crucial support, is placed at 42,881, followed by 42,770 and 42,588. On the upside, key resistance levels are 43,244, 43,356 and 43,537.

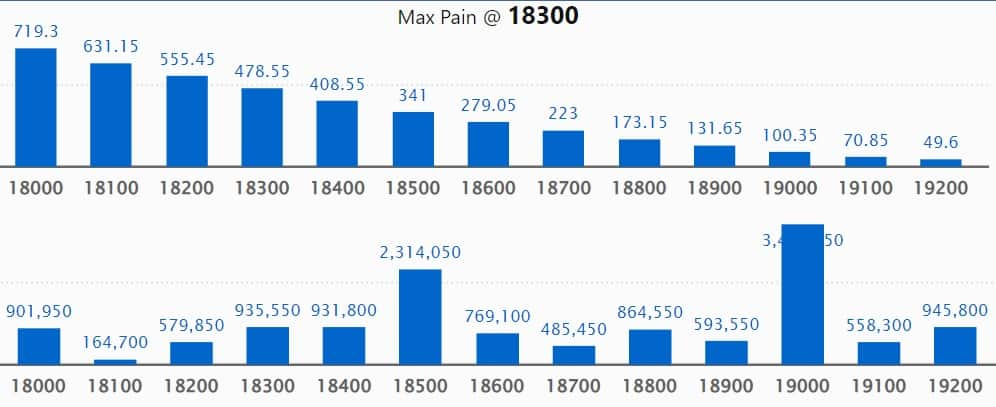

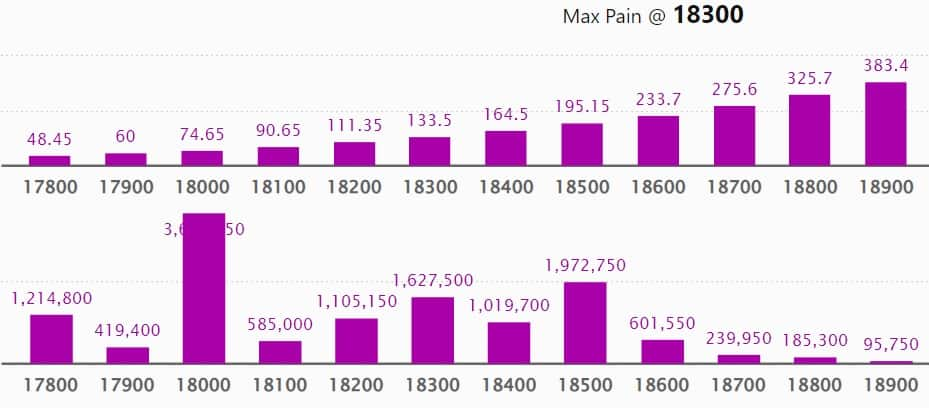

The maximum Call open interest of 34.13 lakh contracts was seen at 19,000 strike, which can act as a crucial resistance level in the December series.

It was followed by 20,000 strike, which holds 25.38 lakh contracts, and 18,500 strike, which has more than 23.14 lakh contracts.

Call writing was seen at 20,000 strike, which added 3.77 lakh contracts, followed by 19,000 strike, which added 3.39 lakh contracts, and 19,300 strike, which added 1.72 lakh contracts.

Call unwinding was seen at 18,300 strike, which shed 1.16 lakh contracts, followed by 18,000 strike, which shed 38,800 contracts, and 18,400 strike, which shed 36,150 contracts.

We have seen a maximum Put open interest of 36.46 lakh contracts at 18,000 strike, which can act as a crucial support level in the December series.

This was followed by 17,000 strike, which holds 30.28 lakh contracts, and 17,500 strike, which accumulated 24.15 lakh contracts.

Put writing was seen at 18,500 strike, which added 3.34 lakh contracts, followed by 18,200 strike, which added 2.97 lakh contracts, and 18,300 strike, which added 2.5 lakh contracts.

Put unwinding was seen at 17,200 strike, which shed 16,750 contracts, followed by 17,900 strike, which shed 13,850 contracts and 16,900 strike, which shed 13,400 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in Coromandel International, ICICI Prudential Life Insurance, ICICI Bank, Sun Pharma, and Marico among others.

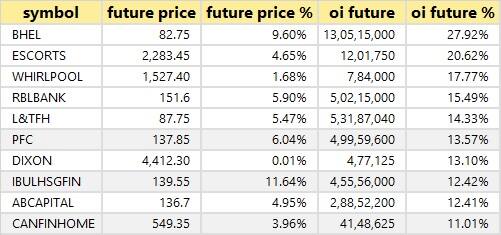

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen:

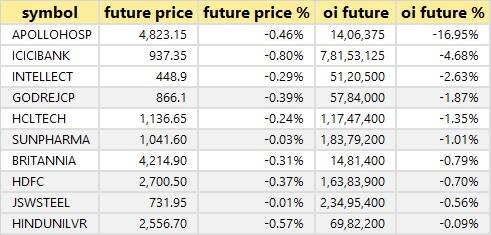

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen:

30 stocks see a short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

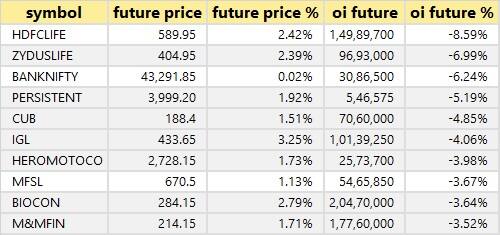

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen:

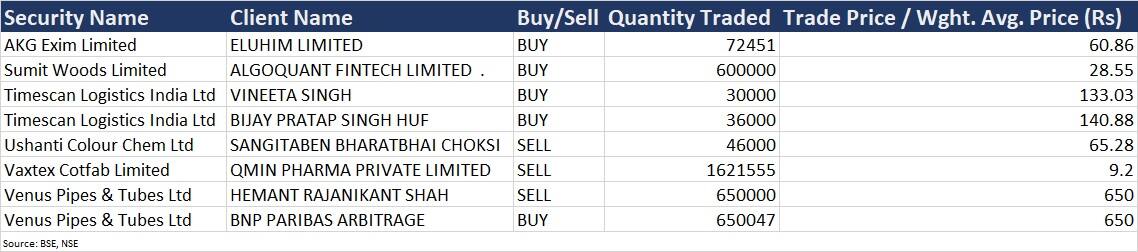

Venus Pipes & Tubes: BNP Paribas Arbitrage picked a 3.2 percent stake, or 6.5 lakh shares, in the company through open market transactions at an average price of Rs 650 a share. The stake acquired is worth Rs 42 crore. Investor Hemant Rajanikant Shah sold 6.5 lakh shares at the same price.

(For more bulk deals, click here)

Investors Meetings on November 28

Asian Paints: Officials of the company will interact with DSP Mutual Fund, Fidelity Investments, Goldman Sachs Asset Management, HDFC Mutual Fund, Mirae Mutual Fund, White Oak Capital Management, UTI Mutual Fund, and Nippon Mutual Fund.

Mahindra Holidays & Resorts India: Officials of the company will interact with Prospero Tree and Camel Foods.

EKI Energy Services: Officials of the company will interact with MIB Securities India, B&K Securities, Dron Capital and Ananta Capital.

Infibeam Avenues: Officials of the company will interact with Sunidhi Securities and Finance.

Greaves Cotton: Officials of the company will interact with Sameeksha Capital.

Thyrocare Technologies: Officials of the company will interact with Incred Capital.

Tata Motors: Officials of the company will interact with Nordea Asset Management.

Aether Industries: Officials of the company will interact with Ventura Securities.

Tega Industries: Officials of the company will interact with Bajaj Allianz Life Insurance.

Hindustan Zinc: Officials of the company will interact with prospective investors via non-deal roadshows for disinvestment of residual government's shareholding in the company.

Ajanta Pharma: Officials of the company will interact with GIC, UBS Global Asset Management, Wellington Management, M&G Investment Management, Duro Capital, and Manulife Asset Management.

Stocks in News

Hero MotoCorp: The company has decided to raise the ex-showroom prices of its motorcycles and scooters from December 1. The price increase will be up to Rs 1,500 and the quantum will vary by specific models and markets. This will help the company offset any further cost impact and drive improvement in margins, the company has said.

L&T Finance Holdings: L&T Finance Holdings has completed 100 percent stake sale in subsidiary L&T Investment Management and received Rs 3,484 crore ($425 million) as consideration from HSBC Asset Management (India). The company also realised a surplus cash balance of Rs 764 crore in L&T Investment Management.

Va Tech Wabag: The Indian water technology multinational company signed an agreement with the Asian Development Bank (ADB) towards raising Rs 200 crore through unlisted non-convertible debentures (NCD). The NCDs carrying 5 years and 3 months tenor will be subscribed by ADB over a 12-month period. This will be ADB’s first investment in a water sector company in India.

Shriram Properties: Subsidiary Shriprop Builders has acquired Suvilas Realities, a real estate company in Bengaluru. The deal value is Rs 30 crore for a 100 percent stake. Suvilas Realities is developing a high-rise residential apartment project Suvilas Palms in the city’s Jalahalli neighbourhood .

Indian Oil Corporation: The oil marketing company has raised Rs 2,500 crore by issuing 25,000, 7.44 percent NCDs of Rs 10 lakh each on a private placement basis. IOC will utilise funds for refinancing existing borrowing or funding capital expenditure.

Indian Energy Exchange: The company got the board of directors’ approval for a Rs 98-crore share buyback. The buyback price is Rs 200 a share and the maximum number of shares to be bought back would be up to 49 lakh.

Muthoot Finance: The company will raise Rs 300 crore through a public issue of secured redeemable non-convertible debentures of the face value of Rs 1,000 each. The issue is with a base issue size of Rs 75 crore with an option to retain oversubscription up to Rs 225 crore aggregating up to a tranche limit of Rs 300 crore. The issue will open on November 28 and will close on December 19.

Bajaj Finance: The company has entered into a share-purchase agreement to acquire up to a 40 percent stake in Snapwork Technologies by way of primary and secondary transactions. The company intends to strengthen the technology roadmap through this acquisition which will be completed by December 2022. The acquisition cost is Rs 93 crore.

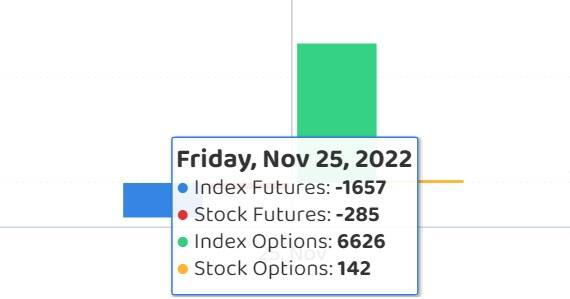

Fund Flow

Foreign institutional investors (FIIs) net bought shares worth Rs 369.08 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 295.92 crore on November 25, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are at the beginning of the December series, not a single stock is under the NSE F&O ban list for November 28.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.