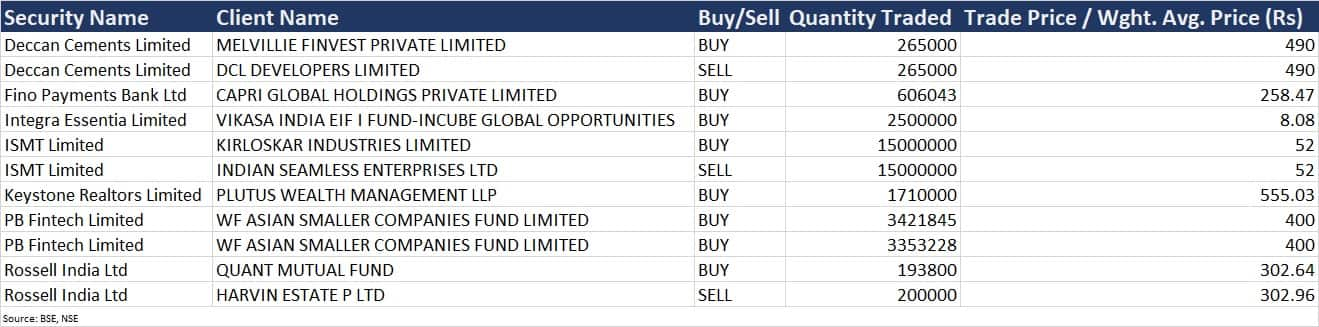

As per the bulk deals data, the fund has purchased 34.21 lakh shares on the NSE and 33.53 lakh shares on the BSE.

Hedge fund WF Asian Smaller Companies Fund picked a 1.5 percent stake worth Rs 271 crore in PB Fintech, the operator of Policybazaar and Paisabazaar, via open market transactions on November 24.

The Ward Ferry Management-operated fund, in total, has bought 67.75 lakh shares in PB Fintech, which is 1.5 percent of the total paid-up equity.

As per the bulk deals data, the fund has purchased 34.21 lakh shares on the NSE and 33.53 lakh shares on the BSE. The average buying price for these shares was Rs 400 per share and these shares are worth Rs 271 crore.

Earlier WF Asian Smaller Companies Fund bought 50 lakh shares in PB Fintech at an average price of Rs 388 per share on November 14.

This hedge fund already held 59.13 lakh shares or 1.32 percent stake in PB Fintech as of September 2022. If we add this, the total shareholding by WF Asian increased to 2.6 percent, up from 1.32 percent earlier.

The stock rallied nearly 8 percent on Thursday, to close at Rs 432.

Among other bulk deals, investor Capri Global Holdings bought additional 6.06 lakh equity shares in Fino Payments Bank. These shares were bought at an average price of Rs 258.47 per share.

In the previous session, Capri Global had purchased a 1.58 percent stake or 13.19 lakh shares in Fino Payments Bank at an average price of Rs 228.77 per share.

As a result, Fino Payments Bank shares surged 36 percent in two consecutive sessions.

Further, Plutus Wealth Management LLP has bought 17.1 lakh shares or 1.5 percent stake in Rustomjee Group company Keystone Realtors at an average price of Rs 555.03 per share. These shares were worth Rs 94.9 crore.

Keystone shares gained 3 percent to close at Rs 556.85 on Thursday, the debut day.