The BSE Sensex on November 10 dropped 420 points to 60,614, while the Nifty50 declined 129 points to 18,028 and formed a high wave kind of pattern on the daily charts.

The market extended losses for the second consecutive session on November 10, the weekly expiry day, but the Nifty50 strongly defended the psychological 18,000 mark. Thus, experts feel if the index sustains the crucial level in coming sessions then 18,350, the high of the current calendar year, can't be ruled out.

All the sectoral indices traded lower on Thursday. The BSE Sensex dropped 420 points to 60,614, while the Nifty50 declined 129 points to 18,028 and formed a high wave kind of pattern on the daily charts.

Normally, a high wave candle formations after a reasonable weakness call for an upside bounce from the lows post confirmation, Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

The positive chart pattern like higher tops and bottoms continued on the daily chart and Thursday's swing low could be considered as a new higher bottom of the sequence.

A sustainable move above 18,100 levels could confirm a higher bottom reversal and that could open another round of upside bounce, the market expert said, adding immediate support is placed at 17,950 levels.

The broader markets like Nifty Midcap 100 and Smallcap 100 indices fell more than 1 percent each, while India VIX dropped by 2.18 percent to 15.57 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,982, followed by 17,951 & 17,900. If the index moves up, the key resistance levels to watch out for are 18,085 followed by 18,116 and 18,167.

The Nifty Bank fell 179 points to 41,603 and formed a bullish candle on the daily charts on November 10 as the closing was higher than the opening levels. The important pivot level, which will act as crucial support for the index, is placed at 41,398, followed by 41,321 and 41,197 levels. On the upside, key resistance levels are placed at 41,646 followed by 41,723 & 41,847 levels.

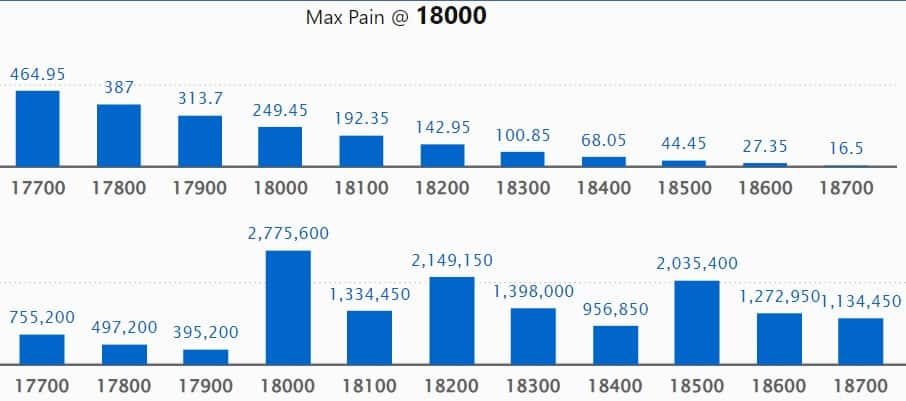

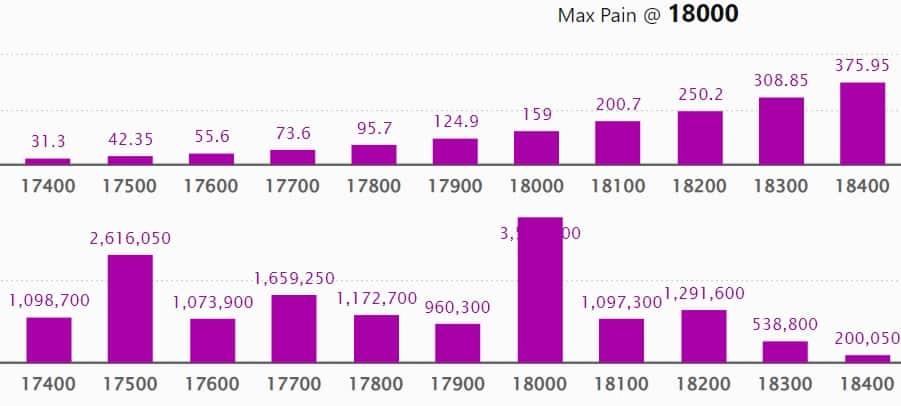

The maximum Call open interest of 27.75 lakh contracts was seen at 18,000 strike. This is followed by 19,500 strike, which holds 23.93 lakh contracts, and 19,000 strike, which have more than 22.57 lakh contracts.

Call writing was seen at 18,000 strike, which added 9.91 lakh contracts, followed by 18,100 strike which added 3.19 lakh contracts, and 18,500 strike which added 1.41 lakh contracts.

Call unwinding was seen at 18,900 strike, which shed 3.09 lakh contracts, followed by 19,000 strike which shed 2.2 lakh contracts and 18,700 strike which shed 1.67 lakh contracts.

Maximum Put open interest of 35.28 lakh contracts was seen at 18,000 strike, which can act as a crucial support level in the November series.

This is followed by 17,000 strike, which holds 32.39 lakh contracts, and 17,500 strike, which has accumulated 26.16 lakh contracts.

Put writing was seen at 18,000 strike, which added 7.87 lakh contracts, followed by 17,500 strike, which added 3.47 lakh contracts, and 17,900 strike which added 2.98 lakh contracts.

Put unwinding was seen at 17,000 strike, which shed 5.02 lakh contracts, followed by 18,200 strike which shed 4.9 lakh contracts and 17,100 strike which shed 2.99 lakh contracts.

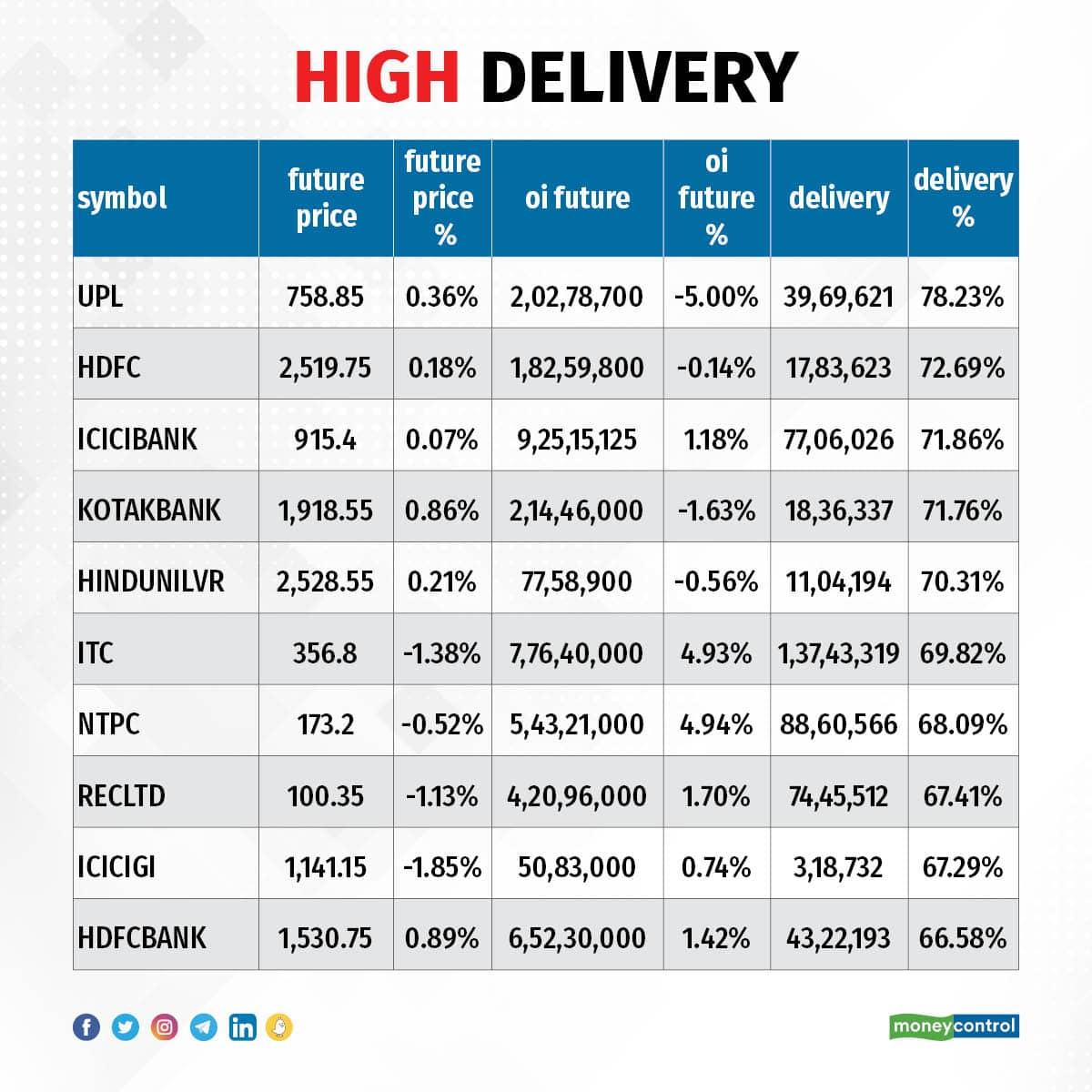

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in UPL, HDFC, ICICI Bank, Kotak Mahindra Bank, and Hindustan Unilever, among others.

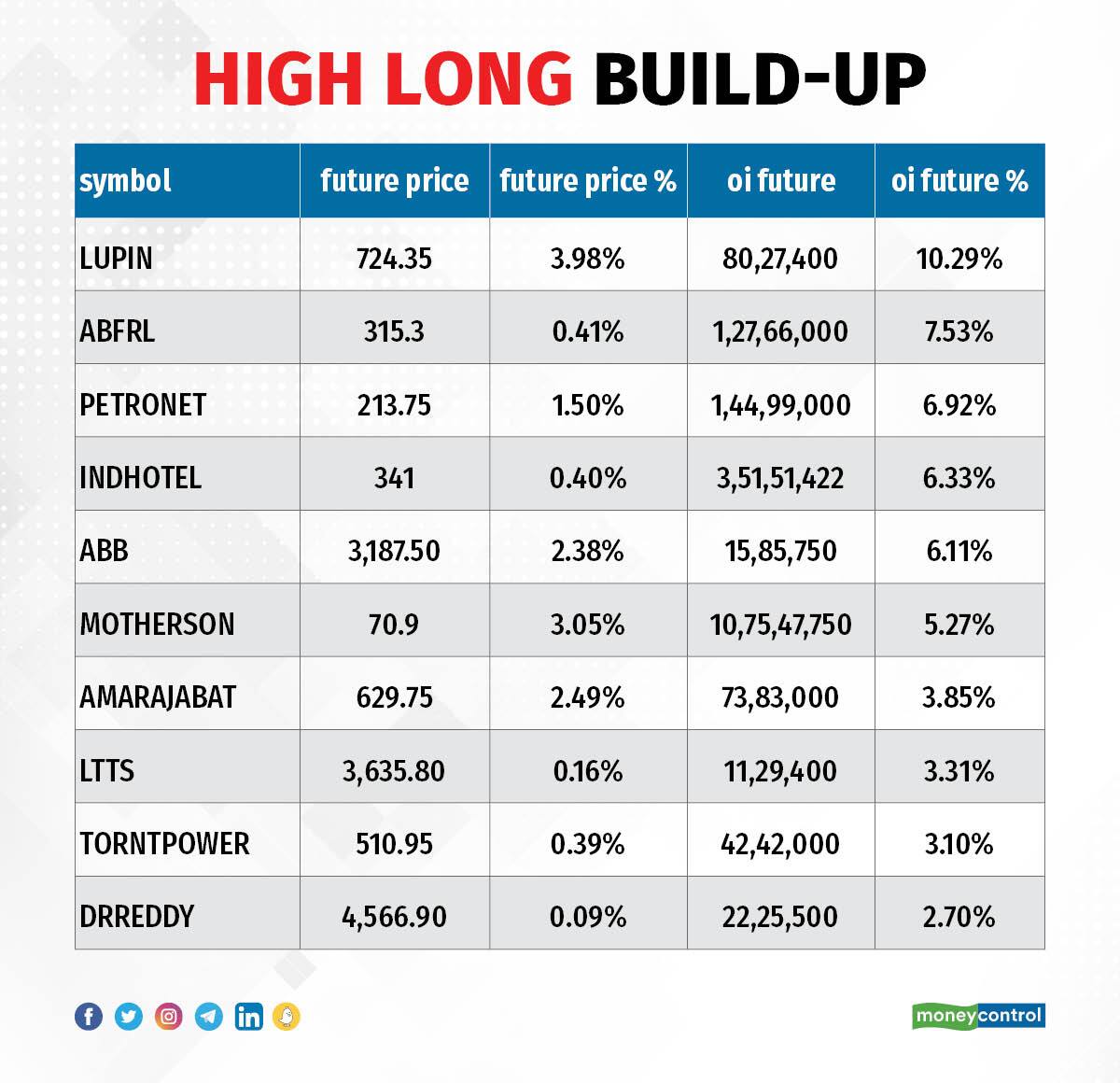

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Lupin, Aditya Birla Fashion and Retail, Petronet LNG, Indian Hotels, and ABB India, in which a long build-up was seen.

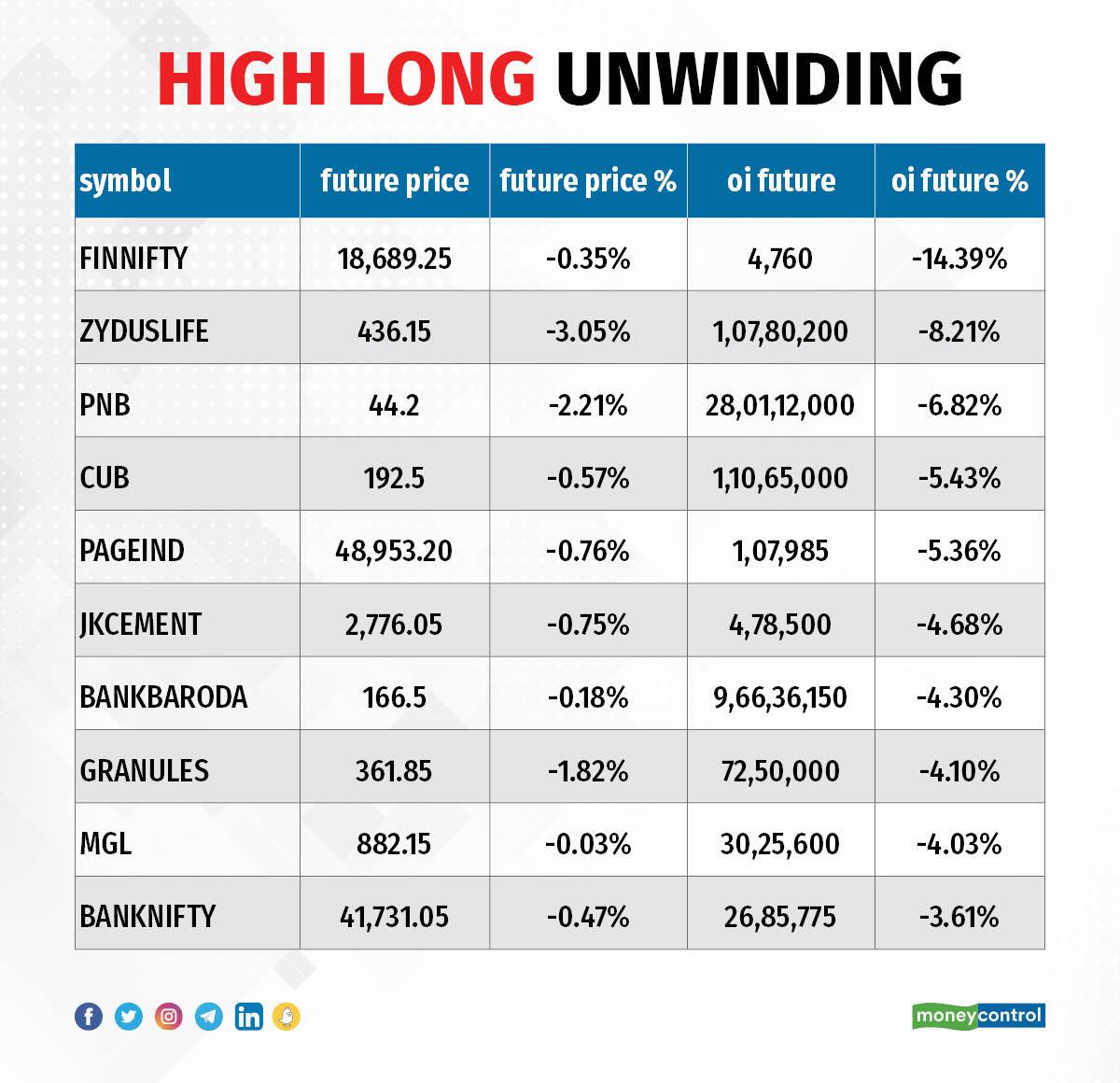

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Zydus Life Sciences, Punjab National Bank, City Union Bank, and Page Industries, in which long unwinding was seen.

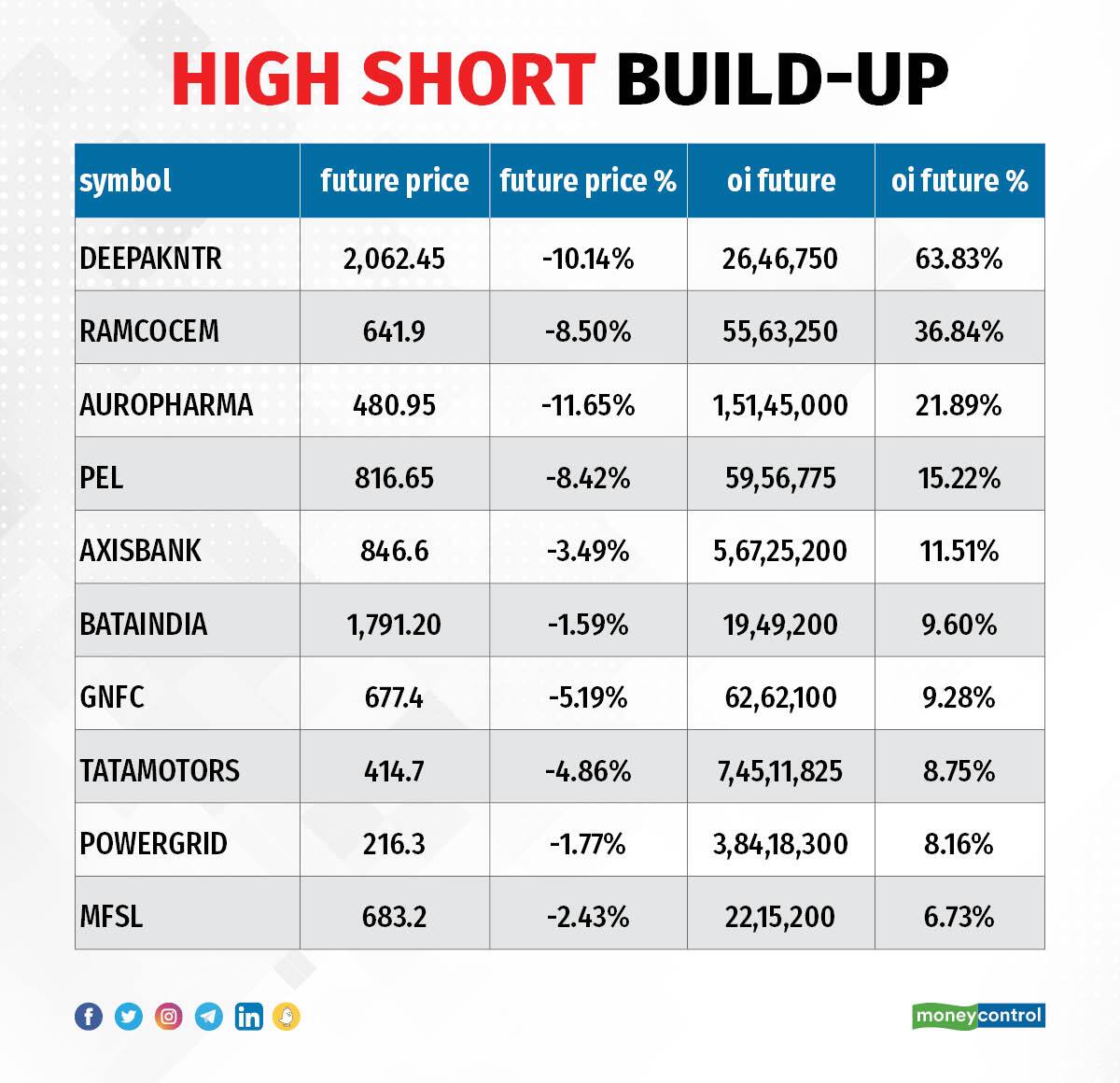

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including Deepak Nitrite, Ramco Cements, Aurobindo Pharma, Piramal Enterprises, and Axis Bank.

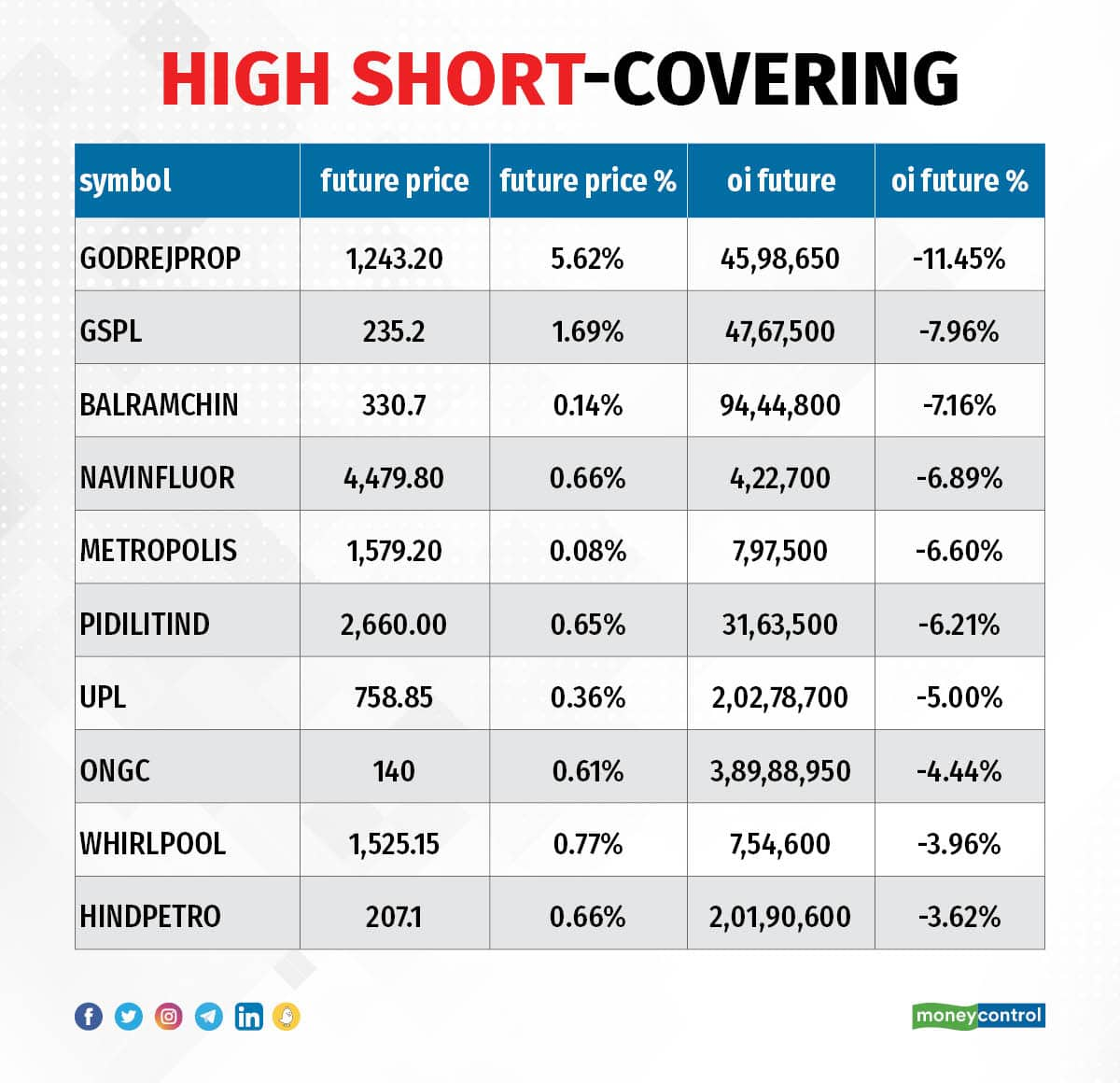

29 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks, in which short-covering was seen including Godrej Properties, Gujarat State Petronet, Balrampur Chini Mills, Navin Fluorine International, and Metropolis Healthcare.

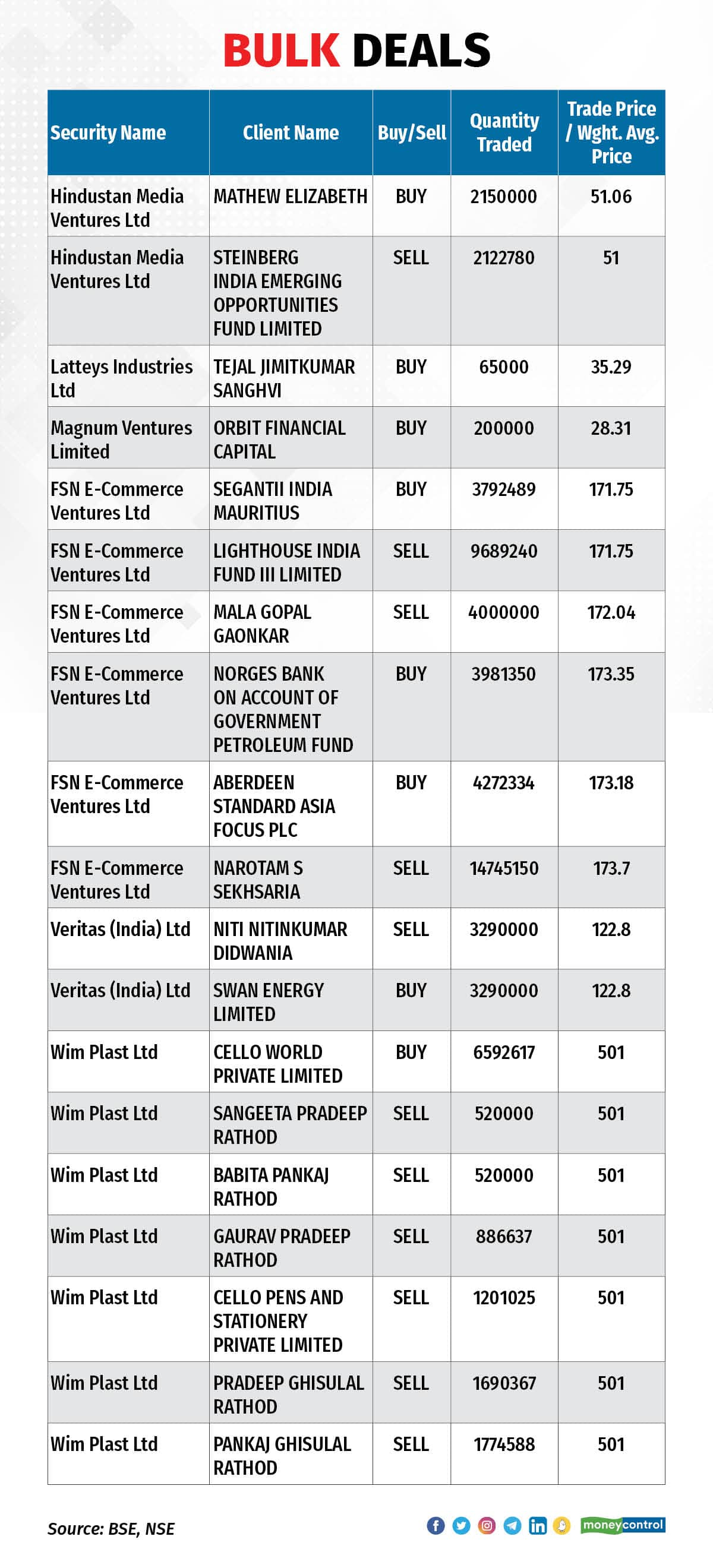

FSN E-Commerce Ventures: Foreign investors Segantii India Mauritius, Norges Bank, and Aberdeen Standard Asia Focus Plc has bought total 2.53% equity stake or 1.2 crore shares in FSN E-Commerce Ventures, the operator of multi-brand beauty retailer Nykaa, via open market transactions on Thursday, the ex-bonus day. However, high networth individual Narotam S Sekhsaria, and Lighthouse India Fund III exited the company, while Mala Gopal Gaonkar offloaded 40 lakh shares at an average price of Rs 172.04 per share.

(For more bulk deals, click here)

Results on November 11 and November 12

Hindalco Industries, Mahindra & Mahindra, Life Insurance Corporation of India, ABB India, Adani Power, Alkem Laboratories, Alembic Pharmaceuticals, Ashoka Buildcon, Astral, Astrazeneca Pharma India, Bharat Dynamics, BHEL, Delhivery, Dhani Services, Easy Trip Planners, Emami, Exide Industries, Fortis Healthcare, GSK Pharma, Glenmark Pharma, Hindustan Aeronautics, Ipca Laboratories, Lemon Tree Hotels, Pfizer, Sun TV Network, Thermax, Ujjivan Financial Services, Zee Entertainment Enterprises, and Zydus Lifesciences will be in focus ahead of September FY23 quarter earnings on November 11.

Aurobindo Pharma, Brigade Enterprises, Godfrey Phillips India, Hindustan Copper, India Pesticides, JK Cement, Jaiprakash Associates, Lumax Auto Technologies, Manappuram Finance, Paras Defence and Space Technologies, Patanjali Foods, Skipper, and Trident will be in focus ahead of September FY23 quarter earnings on November 12.

Stocks in News

DCX Systems: The company will make its grand debut on the bourses on November 11. The issue price is Rs 207 per share. Analysts largely expect the stock to list with 35-40 percent premium over issue price.

Eicher Motors: The automobile company registered highest ever quarterly revenue and profits. It recorded a massive 76 percent year-on-year growth in profit at Rs 657 crore for the quarter ended September FY23 backed by strong operating as well as top line performance. Revenue from operations at Rs 3,519 crore for the quarter grew by 56.4 percent and EBITDA increased by 75 percent to Rs 821.4 crore compared to year-ago period. Margin expanded to 23.3 percent from 20.9 percent in the same period. Topline and bottomline were largely in line with analysts' estimates, but operating performance slightly missed estimates. Royal Enfield sold 2.03 lakh motorcycles in September FY23 quarter, an increase of 64.7 percent YoY.

Zomato: The food delivery giant posted net loss at Rs 251 crore for the quarter ended September FY23, narrowing sharply from loss of Rs 430 crore in same period last year with strong top line and improving operating performance. Revenue from operations for the quarter at Rs 1,661 crore increased by 62 percent over a year-ago period, and EBITDA loss narrowed to Rs 311 crore from loss of Rs 536 crore in the same period. Hence, the quarterly earnings included ~50 days of Blinkit financials.

Apollo Hospitals Enterprises: The healthcare services provider reported a 20 percent year-on-year decline in profit at Rs 212.8 crore for the quarter ended September FY23 impacted by weak operating performance, and higher purchases of stock-in-trade. Revenue from operations grew by 14.4 percent to Rs 4,251 crore compared to year-ago period. EBITDA for the quarter at Rs 565.4 crore declined by 8 percent and margin fell by 330 bps YoY to 13.3 percent for the September FY23 quarter.

Adani Power: The company has entered into a Memorandum of Understanding to sell its 100 percent equity stake in subsidiary, Support Properties (SPPL) to AdaniConnex. The transaction value is Rs 1,556.5 crore. ACX is a 50:50 joint venture between promoter group company Adani Enterprises, and EdgeConneX.

Jindal Steel & Power: The company has recorded a 92.3 percent year-on-year decline in consolidated profit at Rs 200 crore for the quarter ended September FY23, impacted by dismal operating performance and fall in top line. Revenue from operations fell 0.7 percent YoY to Rs 13,521.4 crore in Q2FY23. EBITDA tanked 58 percent to Rs 1,931.4 crore and margin contracted by 1,950 bps to 14.3 percent compared to year-ago period. JSPL has prepaid its entire overseas long term debt.

Bata India: The footwear company has reported 37.7 percent year-on-year increase in standalone profit at Rs 51.1 crore for the quarter ended September FY23 backed by strong operating performance and top line. Revenue during the quarter at Rs 830 crore increased by 35 percent YoY, and EBITDA rose 35.1 percent to Rs 160.9 crore compared to year-ago period.

Adani Green Energy: The company recorded a massive 49 percent year-on-year increase in consolidated profit at Rs 149 crore for Q2FY23 led by lower cost of materials sold and finance cost. Revenue from operations increased by 19.5 percent to Rs 1,686 crore and EBITDA grew by 9 percent to Rs 966 crore compared to same period last year, but the margin dropped 550 bps YoY to 57.3 percent in Q2.

Alkem Laboratories: The pharma company has received Form 483 with 3 observations from US FDA for its manufacturing unit in St. Louis, USA. There is no data integrity observation. The US FDA had conducted a pre-approval inspection at the company's manufacturing facility during October 31 to November 9.

Indian Hotels: The company recorded consolidated profit at Rs 121.6 crore for quarter ended September FY23, against loss of Rs 120.6 crore in same period last year on better top line and operating performance. The low base in year-ago period also supported earnings. Revenue jumped 69.2 percent to Rs 1,232.6 crore compared to year-ago period. EBITDA at Rs 294 crore for the quarter increased by 304 percent and margin expanded by 1,390 bps to 23.9 percent compared to same period last year.

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 36.06 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 967.13 crore on November 10, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The NSE has retained Punjab National Bank under its F&O ban list for November 11. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.