Shipping containers await off-loading at the Port of Long Beach in Long Beach, California, US, on Thursday, October 13, 2022. The head of the second-biggest US port expects the pandemic-era surge in consumer demand that snarled supply chains will start to cool, with evidence of a deceleration already reflected in weaker inbound container arrivals. - Bloomberg

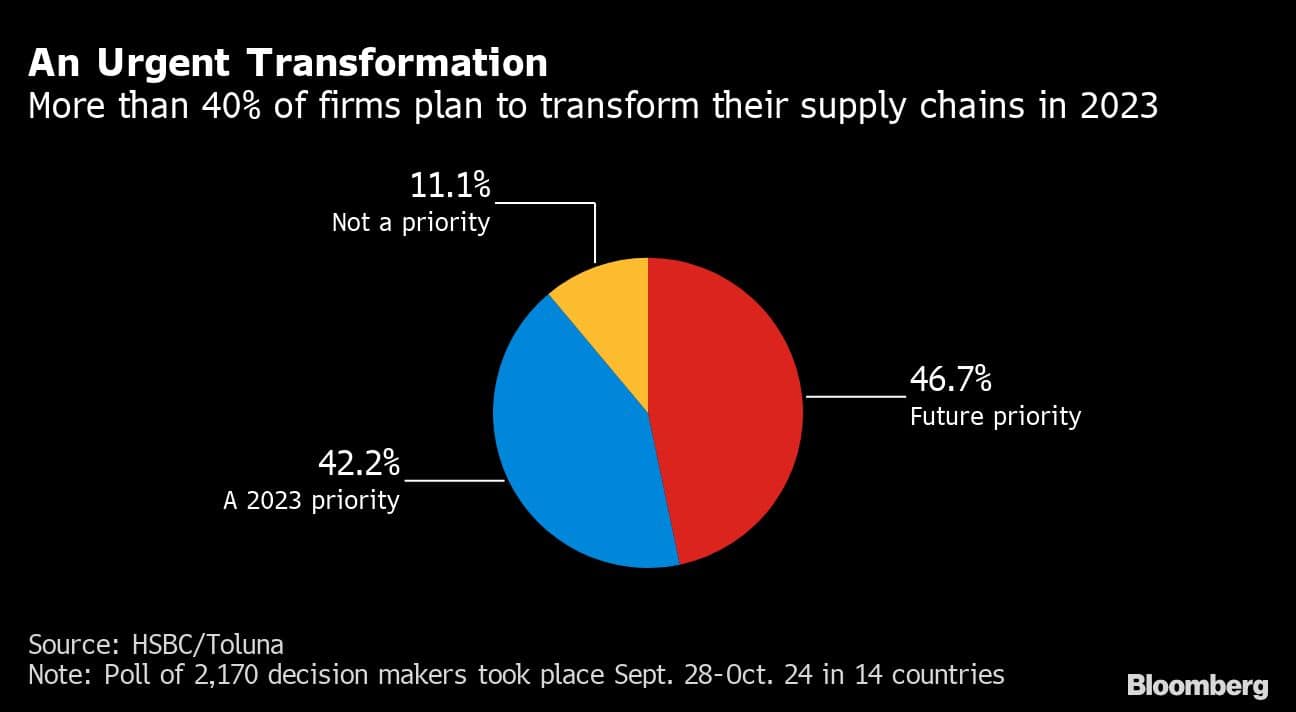

More than 40 percent of corporate decision-makers see an urgent need to overhaul their supply chains in 2023, with inflation, higher interest rates and weaker global trade acting as some of the stiffest economic headwinds, a new survey showed.

Just 11 percent of respondents in the HSBC Holdings Plc survey said transforming their supply chain wasn’t a priority next year, but 42 percent plan to do so and almost 47 percent see it as a priority at some stage in the future. Conducted by the research firm Toluna, the poll covered 2,170 executives at medium-size companies in 14 countries from September 28 to October 24, according to the London-based bank.

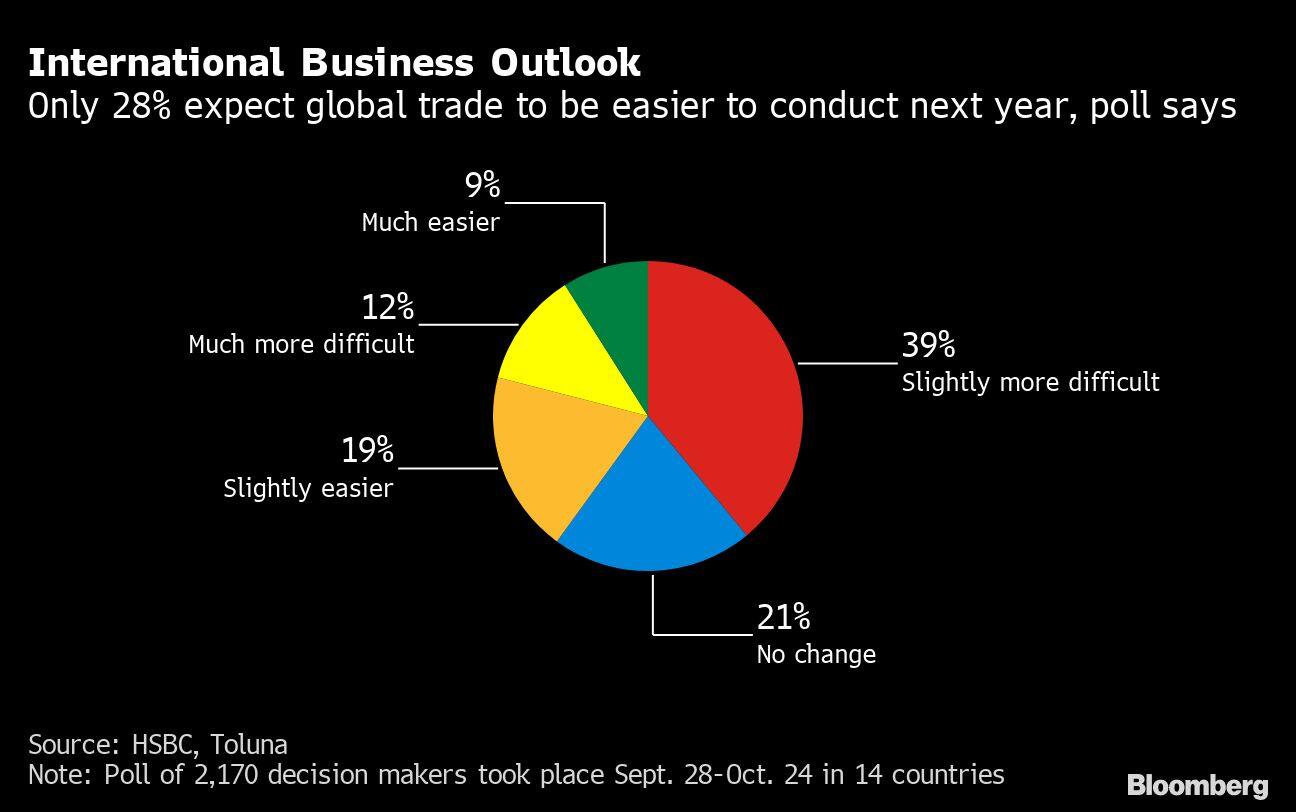

The survey also showed concerns were broader than supply chains, with 51 percent of respondents saying their expect the environment for international trade to be harder next year. That lines up with the latest forecasts from the World Trade Organization for cross-border commerce to grow just 1 percent next year, after a projected 3.5 percent increase this year.

Asked about the biggest impediments to their business next year, 38 percent cited inflation, 32 percent pointed to higher interest rates and 27 percent said an uncertain political environment, the poll showed.

Overall, though, there was plenty of optimism about revenue prospects for the year ahead, according to the survey. More than three-quarters expect sales growth to exceed 10 percent next year, with 19 percent of those respondents expecting revenue to increase by more than 20 percent.

“Businesses are operating in an increasingly complex global economic landscape, navigating a wide range of challenges,” Barry O’Byrne, chief executive of HSBC’s global commercial banking unit, said in a statement. “Despite this, there is a strong sense of global resilience and ambition amongst mid-size businesses.”

Here’s a breakdown for several countries where supply chains and global trade are especially key:

India

Indian business leaders are some of the most optimistic about international trade in 2023, with 45 percent expecting it will be easier, compared with 28 percent globally. Seven in 10 plan to enter at least one new foreign market, and 58 percent will focus on making their supply chain more secure.

Australia

Almost half will focus on making their supply chain more secure, but 18 percent are concerned there is a lack of quality suppliers and goods, according to the survey.

Malaysia

Some 65 percent say they will focus on making their supply chain more sustainable in 2023, but 29 percent were concerned about a lack of quality suppliers and goods to support a sustainable supply chain.

Indonesia

Similarly, some 80 percent of respondents will focus on making their supply chain more sustainable, but at the same time 28 percent are concerned about a lack of quality suppliers and goods.