Buying in the last 90 minutes of the session helped the Nifty recoup the day’s losses and close half a percent higher on November 7. All sectors, barring pharma, participated in the rally.

The Sensex closed 235 points higher at 61,185, while the Nifty rose 86 points to 18,203 and formed a Doji pattern on the daily charts, indicating indecisiveness among bulls and bears about the market trend.

"Normally, a formation of Doji at the highs calls for caution for long positions. But a sustainable move above the high of Doji at 18,255 levels is likely to nullify the negative impact of the pattern," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, said.

The short-term trend continues to be positive, he said.

The market is now showing signs of sustainable upmove. The next upside levels to watch over the next one or two weeks are 18,350 and 18,600, Shetti said. Immediate support is at 18,100.

The broader markets also gained momentum with the Nifty Midcap 100 and Smallcap 100 indices rising 0.8 percent each. India VIX, the volatility index, fell 0.44 percent to 15.59 levels, making the trend favourable for the bulls.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support for the Nifty is placed at 18,101, followed by 18,056 and 17,984. If the index moves up, the key resistance levels to watch out for are 18,247, 18,292 and 18,365.

The Nifty Bank rallied more than 400 points, or 1 percent, to close at 41,687 and formed small bodied bearish candle on the daily charts on November 7. The level of 41,328 will act as crucial support followed by 41,328 and 41,159. On the upside, key resistances are at 41,770 followed by 41,874 and 42,043 .

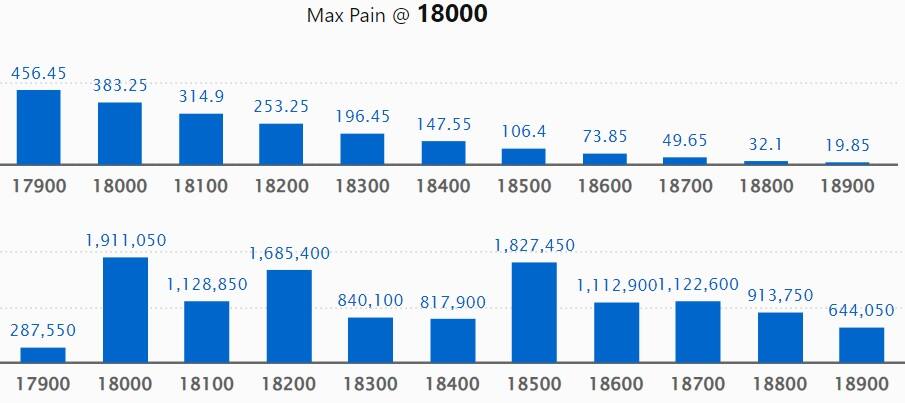

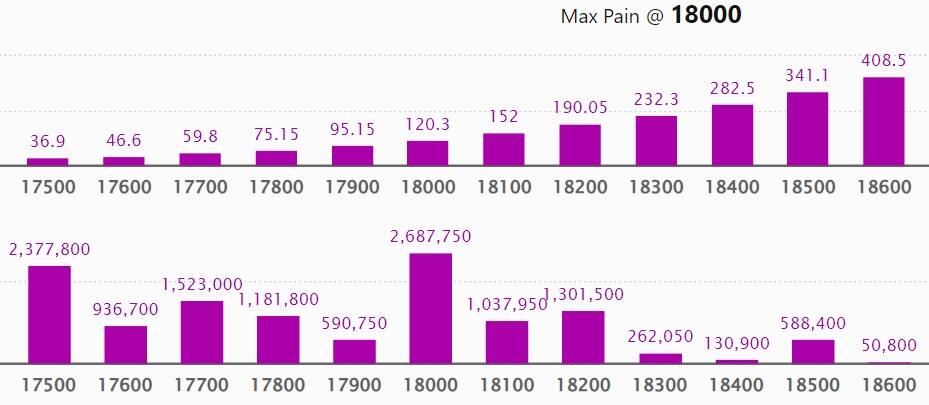

The maximum Call open interest of 23.4 lakh contracts was seen at 19,500 strike, which can act as a crucial resistance level in the November series.

This is followed by 19,000 strike, which holds 22.37 lakh contracts, and 18,000 strike, which have more than 19.11 lakh contracts.

Call writing was seen at 18,200 strike, which added 2.68 lakh contracts, followed by 19,000 strike which added 2.06 lakh contracts, and 18,400 strike which added 1.17 lakh contracts.

Call unwinding was seen at 18,000 strike, which shed 4.02 lakh contracts, followed by 18,100 strike which shed 2.44 lakh contracts and 18,500 strike which shed 1.93 lakh contracts.

The maximum Put open interest of 36.3 lakh contracts was seen at 17,000 strike, which can act as a crucial support level in the November series.

This is followed by 18,000 strike, which holds 26.87 lakh contracts, and 17,500 strike, which has accumulated 23.77 lakh contracts.

Put writing was seen at 18,200 strike, which added 3.96 lakh contracts, followed by 17,100 strike, which added 2.56 lakh contracts, and 17,600 strike which added 1.55 lakh contracts.

Put unwinding was seen at 18,000 strike, which shed 2.49 lakh contracts, followed by 17,200 strike which shed 1.36 lakh contracts and 16,900 strike which shed 1.18 lakh contracts.

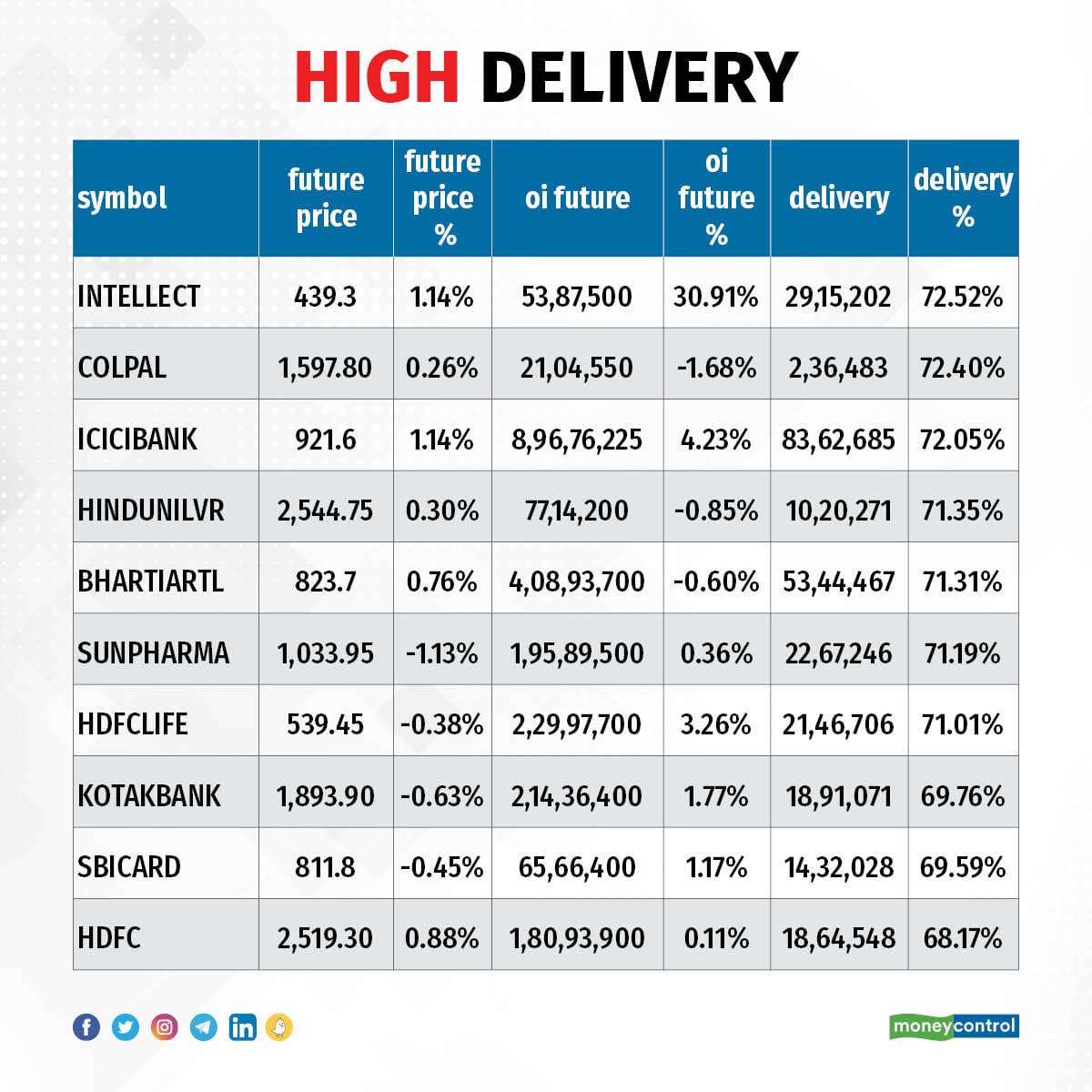

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Intellect Design Arena, Colgate Palmolive, ICICI Bank, Hindustan Unilever, and Bharti Airtel, among others.

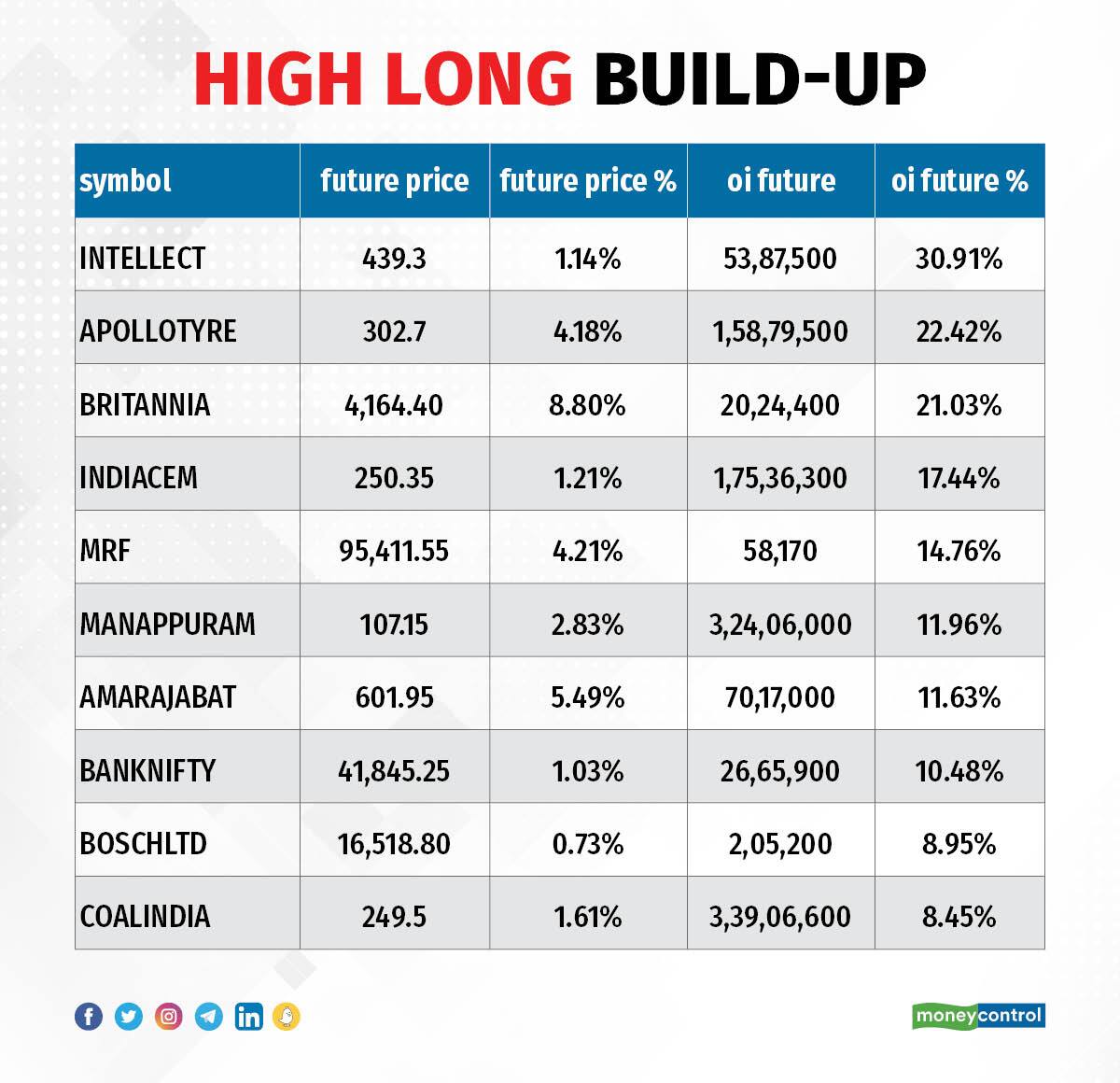

An increase in open interest, along with an increase in price, indicates a build-up of long positions. Based on the open interest future percentage, here are Top 10 stocks in which a long build-up was seen:

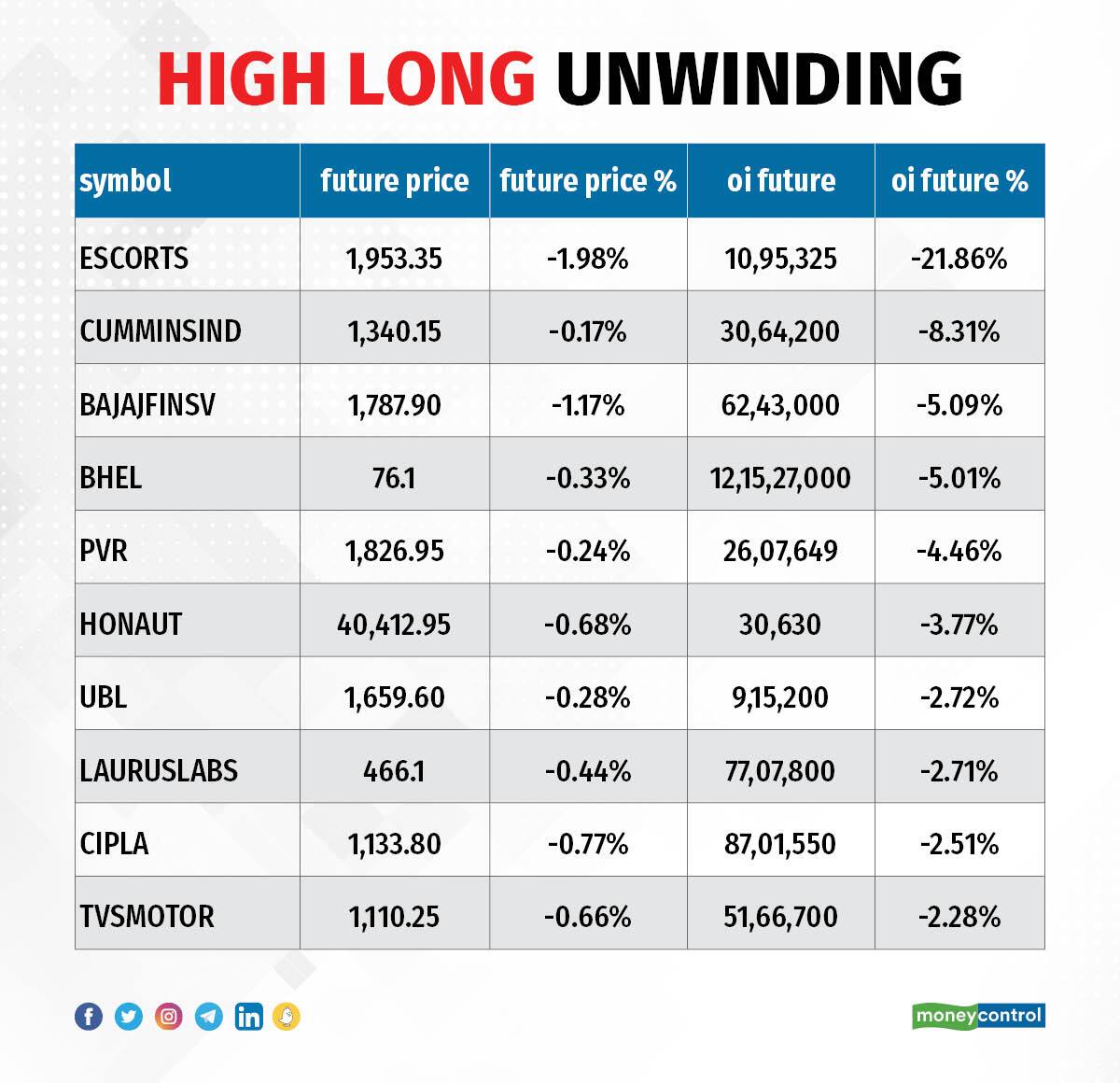

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the Top 10 stocks in which long unwinding was seen:

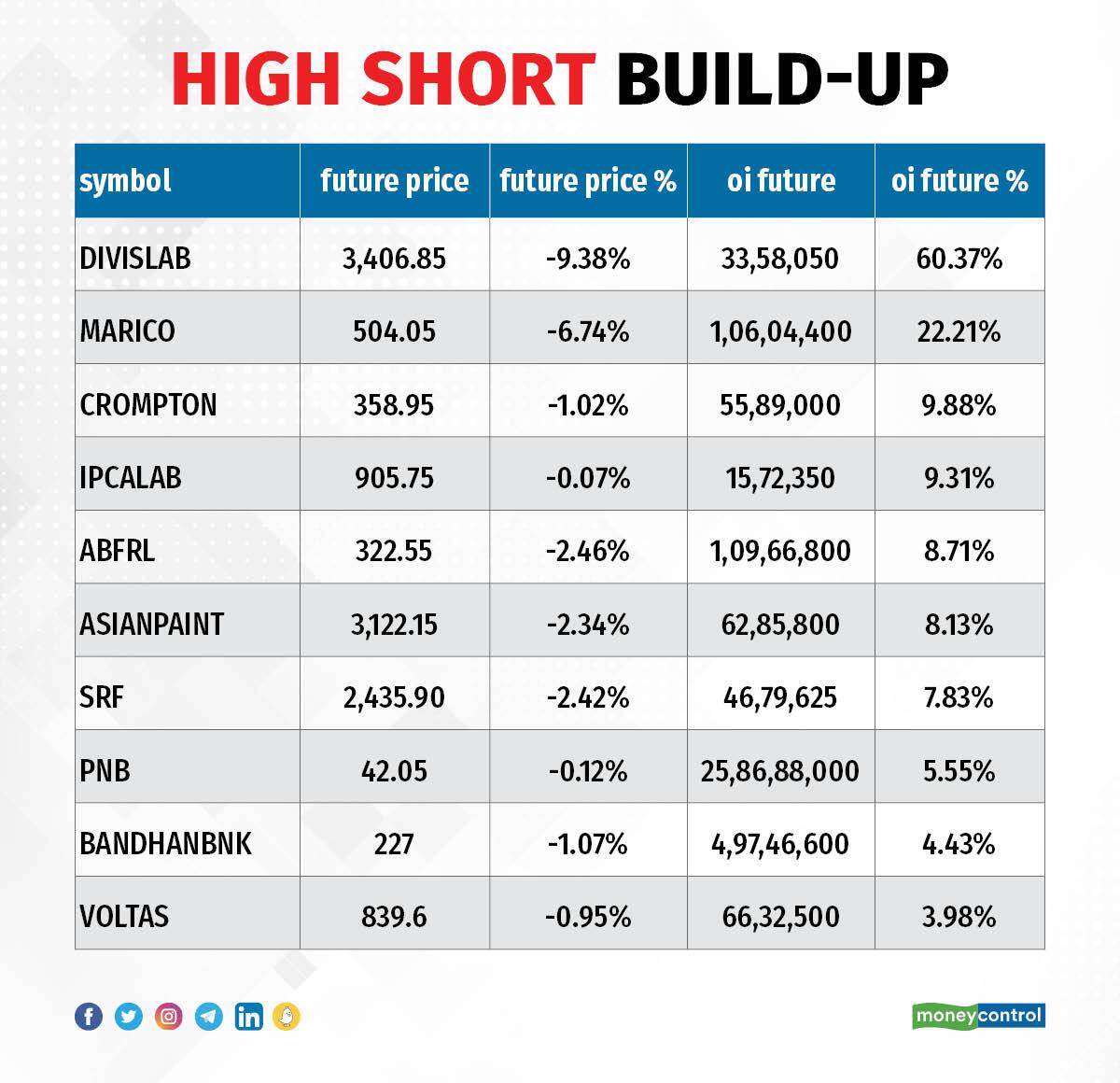

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

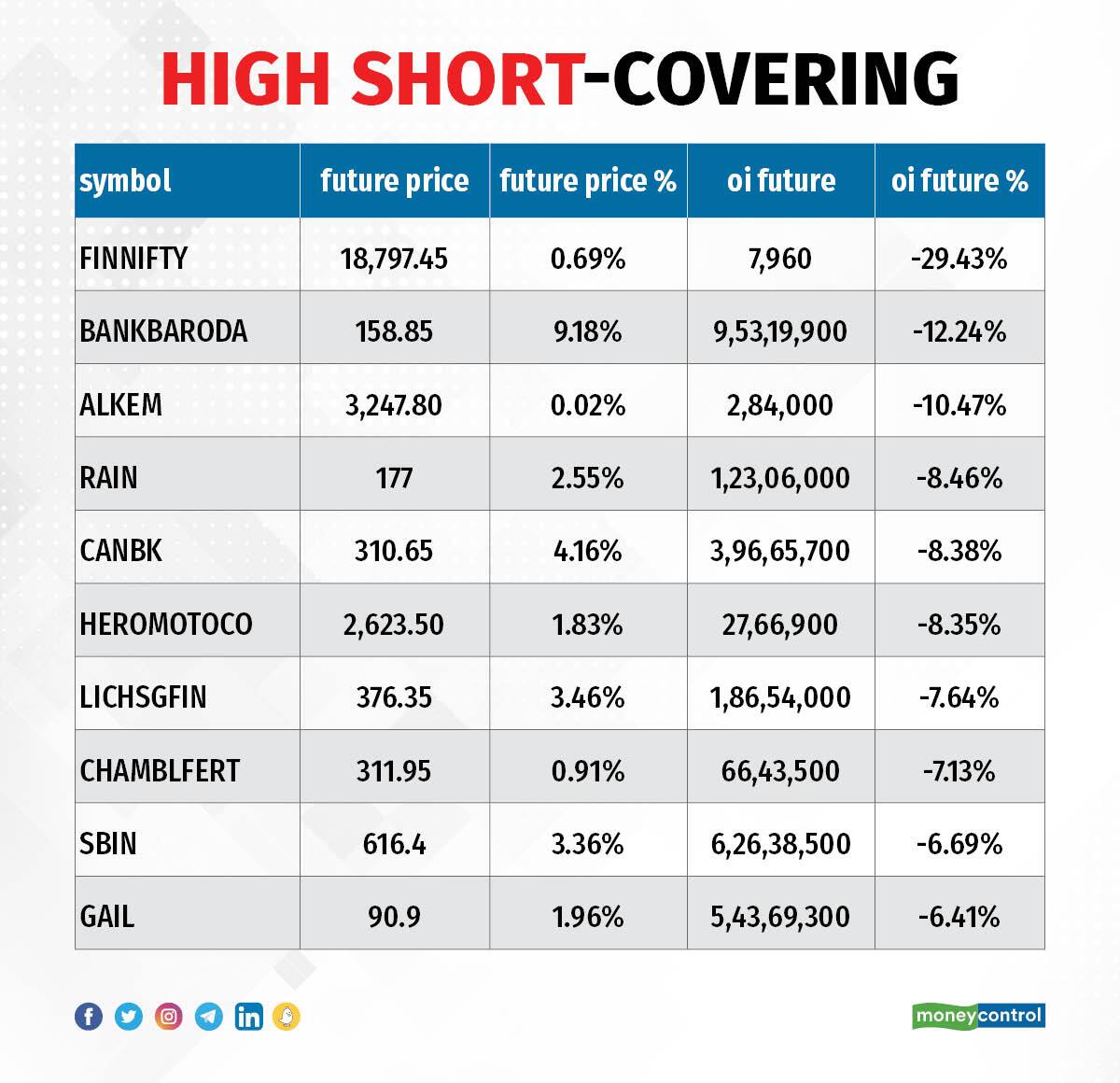

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the Top 10 stocks in which short-covering was seen:

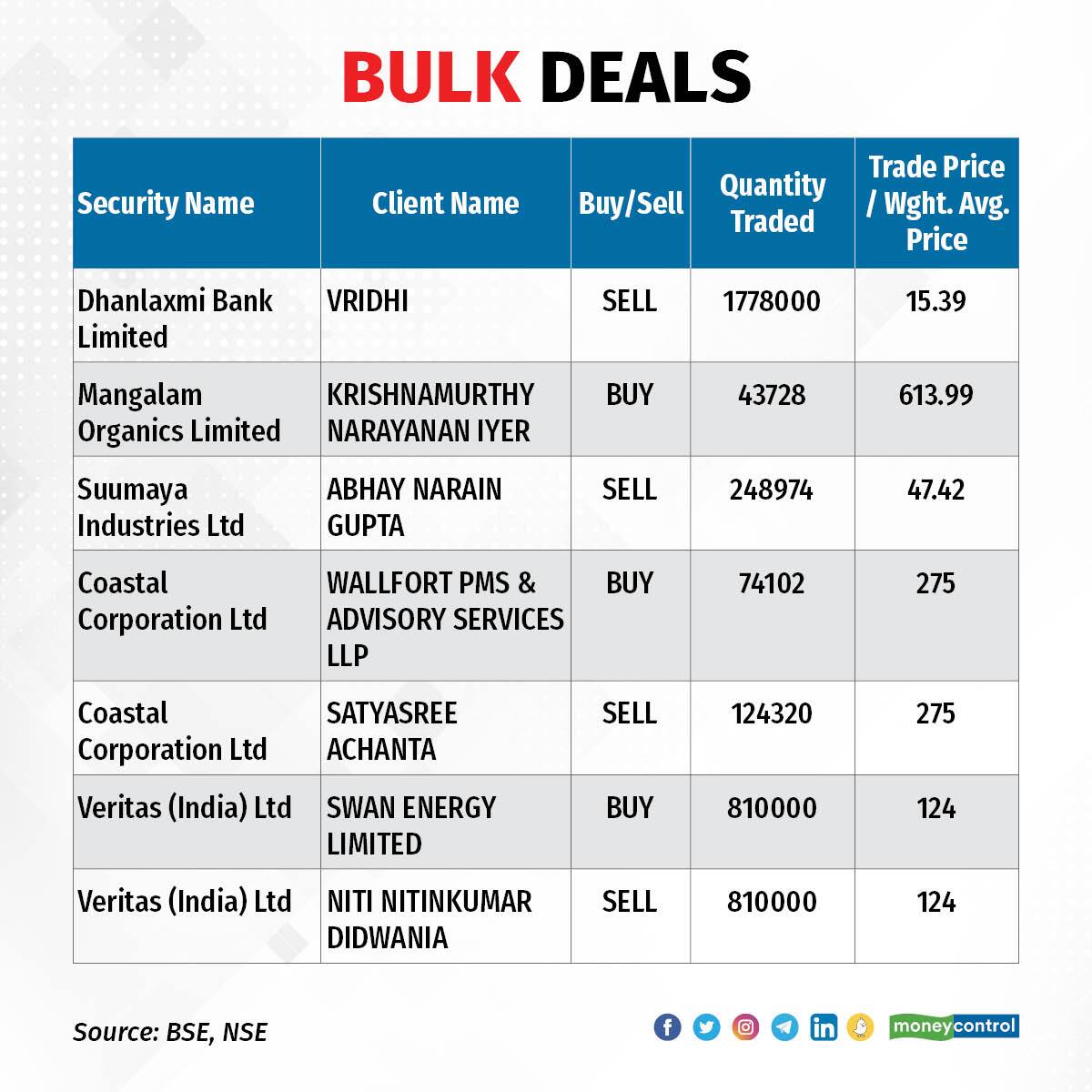

Veritas (India): Swan Energy bought additional 8.1 lakh equity shares in the company through open market transactions. These shares were acquired at an average price of Rs 124 a share. Promoter Niti Nitinkumar Didwania was the seller.

(For more bulk deals, click here)

Tata Motors, Lupin, NALCO, Bajaj Consumer Care, Balrampur Chini Mills, Barbeque-Nation Hospitality, Deepak Nitrite, Edelweiss Financial Services, Engineers India, Godrej Properties, Nuvoco Vistas Corporation, Petronet LNG, Pidilite Industries, Prestige Estates Projects, Quess Corp, Star Health, and Tracxn Technologies will be in focus ahead of the September quarter earnings on November 9.

Stocks in News

Coal India: The country's largest coal mining company clocked a 106 percent year-on-year increase in consolidated profit at Rs 6,044 crore for the quarter ended September FY23, supported by a healthy top line, higher other income, and strong operating performance. Revenue from operations jumped 28 percent YoY to Rs 29,838 crore for the quarter, with raw coal production rising 10.6 percent YoY to 139.2 million tonnes and raw coal offtake increasing 4.8 percent to 154.53 million tonnes.

PB Fintech: The Policybazaar parent posted a consolidated loss of Rs 186.63 crore for the quarter ended September 30, 2022, narrowing from a loss of Rs 204.44 crore in the corresponding quarter of the last fiscal. Revenue from operations at Rs 573.5 crore was up 105 percent YoY. The company is confident of being adjusted EBITDA positive by Q4 this year.

Bharat Electronics: The Navratna defence PSU has signed a memorandum of understanding (MoU) with Delhi Metro Rail Corporation (DMRC) for jointly developing the indigenous communication-based train control system (i-CBTC).

Redington India: The company reported a 21.3 percent YoY increase in consolidated profit at Rs 391.91 crore for the quarter ended September 30, 2022. Revenue grew by 24.6 percent to Rs 19,051 crore from the year-ago period with healthy growth in Singapore, India and South Asia as well as the Rest of World.

Affle India: The consumer intelligence driven global technology company has clocked a 39.6 percent YoY increase in profit at Rs 58.7 crore for the quarter ended September FY23 on healthy growth in topline and operating performance. Revenue at Rs 354.6 crore for the quarter increased by 29 percent YoY and EBITDA rose 39 percent YoY to Rs 72.3 crore in Q2FY23. The CPCU business noted strong momentum delivering 6.5 crore converted users in Q2FY23, an YoY increase of 32. percent.

CEAT: The RPG Group company reported a 85 percent YoY decline in consolidated profit at Rs 6.44 crore for the quarter ended September FY23, dented by an increase in input cost and expenses towards voluntary retirement scheme. Revenue from operations increased 18 percent YoY to Rs 2,894 crore, and EBITDA at Rs 203.14 crore fell 7.8 percent from the year-ago period. It received approval from the board of directors for an additional investment of Rs 396 crore to increase farm radial tyres capacity at Ambarnath plant by 55 tonnes per day over the next two years.

One 97 Communications: Paytm parent posted a consolidated loss of Rs 571.5 crore for the September quarter, widening from a loss of Rs 473.5 crore in year-ago period but falling from a loss of Rs 645.4 crore in the previous quarter. Revenue from operations increased 76 percent on-year to Rs 1,914 crore for the quarter, driven by an increase in merchant subscription revenues, growth in bill payments due to growing MTU (monthly transaction user) and growth in disbursements of loans through the platform. The sequential rise in the top line was 14 percent.

Bharat Petroleum Corporation: The oil marketing company reported standalone loss of Rs 304.2 crore for the quarter ended September FY23, against a profit of Rs 2,841 crore in the same period last year despite one-time compensation of Rs 5,582 crore from the government for under -recoveries. Revenue from operations increased 26 percent YoY to Rs 1.28 lakh crore for the quarter.

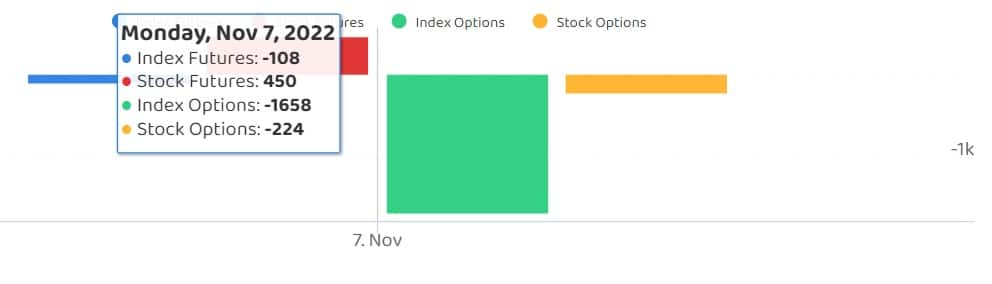

Fund Flow

Foreign institutional investors (FIIs) net bought shares worth Rs 1,948.51 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 844.20 crore on November 7, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The NSE has not added any stock under its F&O ban list for November 8.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.