Top Searches

- News

- Business News

- India Business News

- Power of digital transactions! Currency in circulation declines in Diwali week for 1st time in 20 years

Power of digital transactions! Currency in circulation declines in Diwali week for 1st time in 20 years

The Indian cash lead economy now has changed to smartphone lead payment economy!

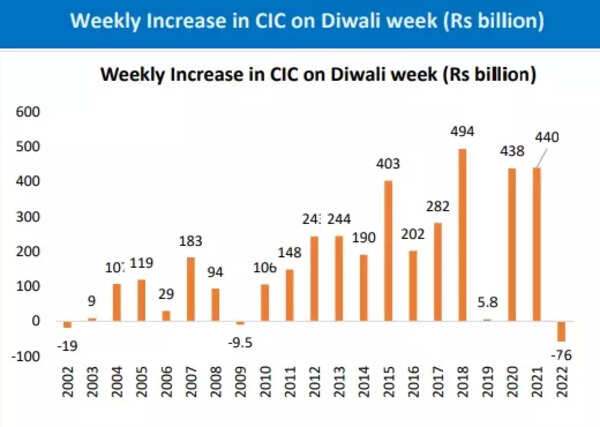

The Indian economy is undergoing a structural transformation, with currency in circulation declining during the busy Diwali week for the first time in 20 years, notes an SBI Research report. According to the report, the Indian cash lead economy now has changed to smartphone lead payment economy!

The pandemic has caused disruption with more people opting to contactless digital transactions. The report states that with increased acceptance of digital payments in the country, the over reliance on cash is slowly fading away.

Why the shift?

The success of the digital journey is primarily due to the relentless push by the government to formalize and digitalize the economy, says the report.

Also, the interoperable payments systems like UPI, wallets & Prepaid Payment Instruments (PPIs) have made it simple and cheaper to transfer money digitally. The system has expanded rapidly with new innovations like QR code, NFC etc and has also seen the swift entry of big tech firms in this industry.

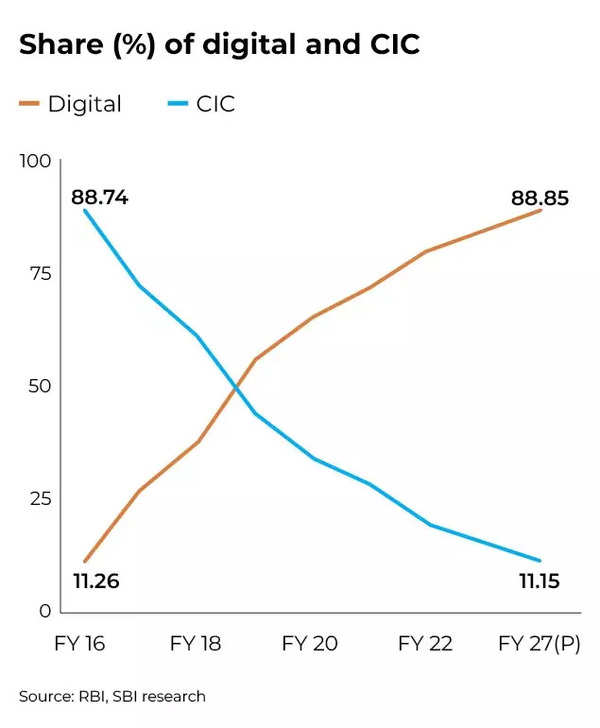

In the total payment system, SBI Research defined digital transactions as those in IMPS, UPI, and PPI; cash transactions as CIC. According to the report, the share of CIC in payment systems has been declining from 88% in FY16 to 20% in FY22! It is estimated to go down further to just 11.15% in FY27. The digital transactions share is increasing from 11.26% in FY16 to 80.4% in FY22; it is expected to touch 88% in FY27.

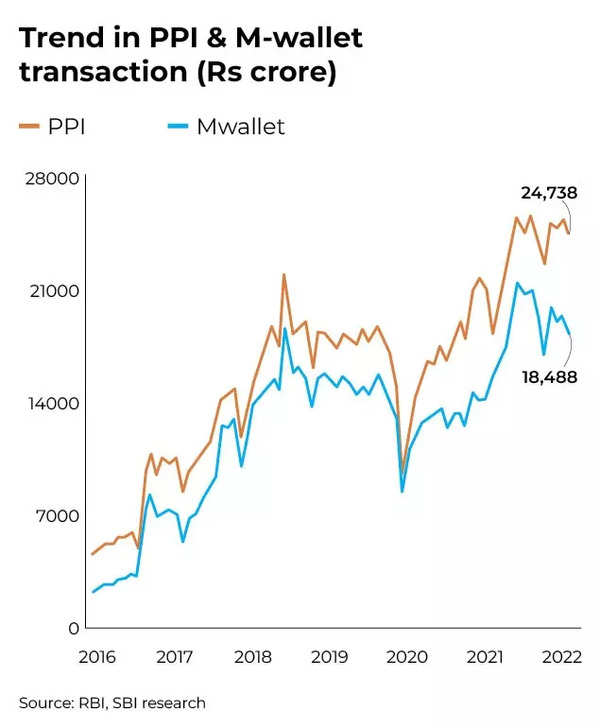

The latest retail digital transactions data reveals that NEFT holds a share of 55% in value terms. Most of the transactions are done either through internet banking or at the branch." However, if we look only at transactions done through smart phones like UPI, IMPS & e-wallet, they have a share of around 16%, 12% and 1% respectively. So, the small retail payments done through UPI/e-wallets holds around 11-12% in the payment industry," the report notes.

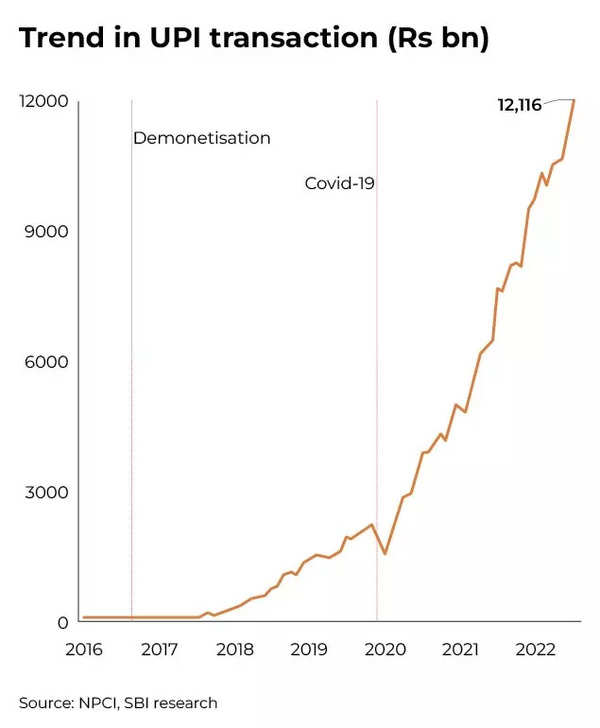

The share of credit & debit cards in transaction value has remained flat, while UPI has jumped to 16% in FY22 from 0% in FY16. Paper based instruments such as cheque etc has declined from 46% in FY16 to 12.7% in FY22. The slow pace of ‘m-wallets’ may be due to the rise in UPI payments from August 16 onwards reaching to 12 lakh crores in October 2022, capturing the market very quickly, the report adds.

The SBI Research report states that a lower currency in circulation also is akin to a CRR cut for the banking system. "it results in less leakage of deposits and it will impact monetary transmission positively," the report adds.

The pandemic has caused disruption with more people opting to contactless digital transactions. The report states that with increased acceptance of digital payments in the country, the over reliance on cash is slowly fading away.

Why the shift?

The success of the digital journey is primarily due to the relentless push by the government to formalize and digitalize the economy, says the report.

Also, the interoperable payments systems like UPI, wallets & Prepaid Payment Instruments (PPIs) have made it simple and cheaper to transfer money digitally. The system has expanded rapidly with new innovations like QR code, NFC etc and has also seen the swift entry of big tech firms in this industry.

Currency in circulation declines in Diwali week

In the total payment system, SBI Research defined digital transactions as those in IMPS, UPI, and PPI; cash transactions as CIC. According to the report, the share of CIC in payment systems has been declining from 88% in FY16 to 20% in FY22! It is estimated to go down further to just 11.15% in FY27. The digital transactions share is increasing from 11.26% in FY16 to 80.4% in FY22; it is expected to touch 88% in FY27.

Share of digital transactions and CIC

The latest retail digital transactions data reveals that NEFT holds a share of 55% in value terms. Most of the transactions are done either through internet banking or at the branch." However, if we look only at transactions done through smart phones like UPI, IMPS & e-wallet, they have a share of around 16%, 12% and 1% respectively. So, the small retail payments done through UPI/e-wallets holds around 11-12% in the payment industry," the report notes.

Trend in PPI and M-wallet transaction

The share of credit & debit cards in transaction value has remained flat, while UPI has jumped to 16% in FY22 from 0% in FY16. Paper based instruments such as cheque etc has declined from 46% in FY16 to 12.7% in FY22. The slow pace of ‘m-wallets’ may be due to the rise in UPI payments from August 16 onwards reaching to 12 lakh crores in October 2022, capturing the market very quickly, the report adds.

Trend in UPI transaction

The SBI Research report states that a lower currency in circulation also is akin to a CRR cut for the banking system. "it results in less leakage of deposits and it will impact monetary transmission positively," the report adds.

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE

Start a Conversation

end of article