The market extended the northward journey for the fourth consecutive session with the Nifty50 closing at a more than nine-month high on November 1, driven by gains in metal, pharma, technology, and select FMCG stocks.

The BSE Sensex climbed 375 points to 61,121, while the Nifty50 rose 133 points to 18,145 and formed a Doji kind of pattern on the daily charts, indicating indecisiveness among bulls and bears about the future market trends.

"On the daily timeframe, the index managed to sustain above the 18,000 mark, indicating a good start for the November month," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

The prices are quoting above the prior swing high of 18,096 on September 15, and at the same time, RSI (relative strength index) has surpassed the corresponding swing high. This confirms that the up move is accompanied by strong momentum.

As per the overall texture of trend and evidence supported by indicators, the market expert feels that the Nifty will move higher to the level of 18,350 followed by 18,604.

The broader markets also closed higher but the breadth remained muted. The Nifty Midcap 100 and Smallcap 100 indices rose 0.87 percent and 0.22 percent respectively as 1,069 shares advanced against 900 falling shares on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 18,083, followed by 18,056 & 18,011. If the index moves up, the key resistance levels to watch out for are 18,171 followed by 18,198 and 18,243.

The Nifty Bank fell 18 points to 41,290 and formed a bearish candle on the daily charts on November 1. The important pivot level, which will act as crucial support for the index, is placed at 41,198, followed by 41,083 and 40,896 levels. On the upside, key resistance levels are placed at 41,572 followed by 41,687 and 41,874 levels.

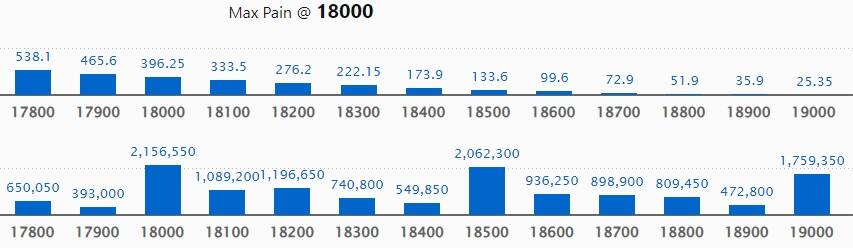

The maximum Call open interest of 21.56 lakh contracts was seen at 18,000 strike, followed by 18,500 strike, which holds 20.62 lakh contracts, and 19,000 strike, which has 17.59 lakh contracts.

Call writing was seen at 18,100 strike, which added 5.88 lakh contracts, followed by 18,200 strike which added 5.36 lakh contracts, and 18,800 strike which added 2.09 lakh contracts.

Call unwinding was seen at 18,500 strike, which shed 1.7 lakh contracts, followed by 17,800 strike which shed 1.5 lakh contracts and 17,900 strike which shed 75,250 contracts.

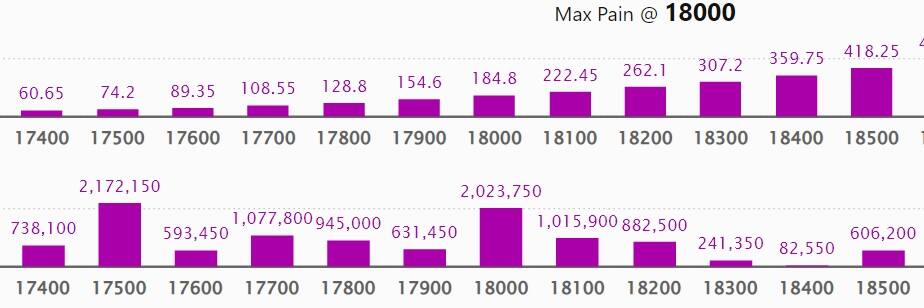

Maximum Put open interest of 29.94 lakh contracts was seen at 17,000 strike, which can act as a crucial resistance level in the November series.

This is followed by 17,500 strike, which holds 21.72 lakh contracts, and 18,000 strike, which has accumulated 20.23 lakh contracts.

Put writing was seen at 18,100 strike, which added 8.39 lakh contracts, followed by 18,000 strike, which added 6.54 lakh contracts, and 18,200 strike which added 5.35 lakh contracts.

Put unwinding was seen at 17,500 strike, which shed 1.22 lakh contracts, followed by 17,300 strike which shed 80,950 contracts and 17,100 strike which shed 29,800 contracts.

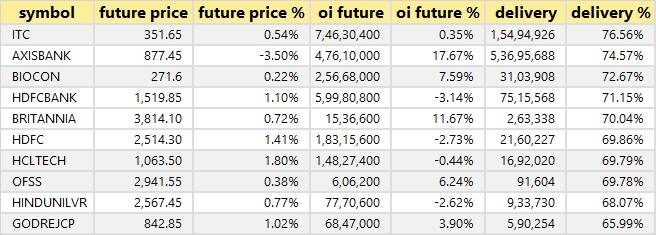

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in ITC, Axis Bank, Biocon, HDFC Bank, and Britannia Industries, among others.

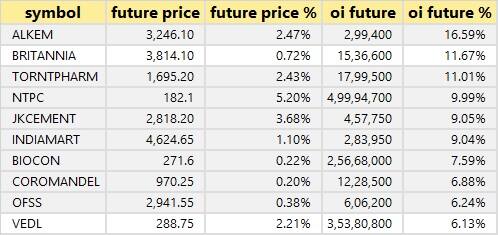

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Alkem Laboratories, Britannia Industries, Torrent Pharma, NTPC, and JK Cement, in which a long build-up was seen.

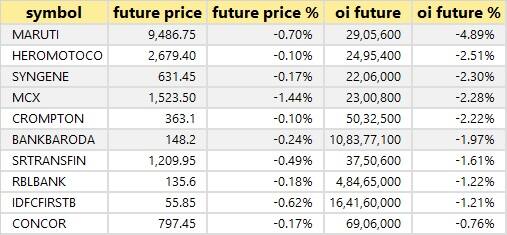

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Maruti Suzuki India, Hero MotoCorp, Syngene International, MCX India, and Crompton Greaves Consumer Electrical, in which a long unwinding was seen.

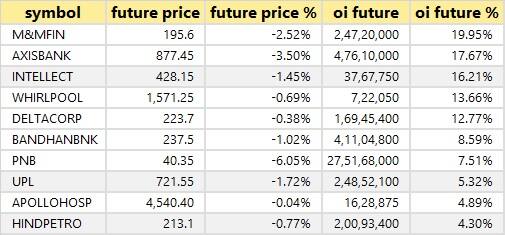

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including M&M Financial Services, Axis Bank, Intellect Design Arena, Whirlpool, and Delta Corp.

71 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks, in which a short-covering was seen, including NMDC, AU Small Finance Bank, Nifty Financial, Astral, and Abbott India.

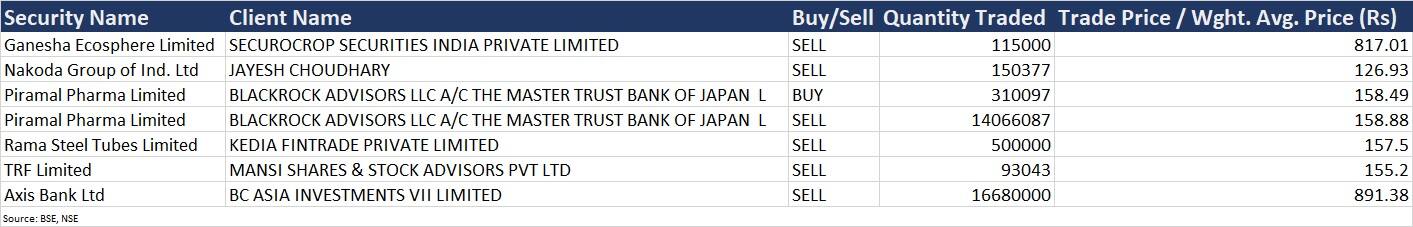

(For more bulk deals, click here)

M&M Financial Services, Adani Transmission, Dalmia Bharat, EIH, GATI, Gravita India, JK Paper, Kajaria Ceramics, KSB, Mahindra Holidays & Resorts India, MTAR Technologies, Procter & Gamble Hygiene & Health Care, Redington, SIS, and Triveni Turbine will be in focus ahead of quarterly earnings on November 2.

Stocks in News

Tech Mahindra: The IT services company has recorded a 13 percent sequential increase in consolidated profit at Rs 1,299 crore for the quarter ended September FY23. Consolidated revenue increased by 3.3 percent QoQ to Rs 13,129 crore for the quarter. Revenue in dollar terms grew by 0.3 percent QoQ to $1,638 million and it clocked 2.9 percent growth in revenue in constant currency terms. The company has declared a special dividend of Rs 18 per share.

Adani Ports and Special Economic Zone: The company's consolidated profit increased by 65.5 percent YoY to Rs 1,738 crore for the quarter ended September FY23, supported by top line, operating income and lower tax cost. Revenue surged 33 percent YoY to Rs 5,211 crore for the quarter. Cargo for the quarter stood at 86.6 MMT, a 15 percent YoY growth.

LIC Housing Finance: The housing finance company clocked a 23 percent YoY growth in standalone profit at Rs 305 crore for the quarter ended September FY23. Revenue from operations for the quarter grew by 8 percent to Rs 5,085 crore compared to the year-ago period.

Voltas: The company posted a consolidated loss of Rs 6 crore for the quarter ended September FY23, against a profit of Rs 104 crore for the same period last year, impacted by the provision made on an overseas project. Total income for the quarter at Rs 1,833 crore rose by 5.5 percent compared to the year-ago period.

Kansai Nerolac Paints: The company has recorded a 27 percent year-on-year increase in consolidated profit at Rs 111.2 crore for the quarter ended September FY23, supported by higher operating income. Revenue from operations grew by 19 percent YoY to Rs 1,931 crore for the quarter. The quarter witnessed good demand in automotive paints with the easing of the supply chain challenges, but demand in decorative paints was subdued due to extended rains.

Karnataka Bank: The bank recorded a massive 228 percent year-on-year growth in standalone profit at Rs 412 crore for the quarter ended September FY23 as there was a write-back of provisions and contingencies of Rs 14 crore in Q2FY23. Net interest income grew by 26 percent YoY to Rs 803 crore for the quarter.

Hero MotoCorp: The company sold 4.54 lakh motorcycles and scooters in October 2022, a 17 percent decline compared to 5.47 lakh units sold in the year-ago month. In the current financial year, it sold 32.72 lakh units, higher by 8.7 percent compared to 30.11 lakh units sold in the same period last year.

Veranda Learning Solutions: The company has terminated the acquisition of T.I.M.E. It had entered into a share purchase agreement (SPA) for the acquisition of 100 percent shareholding of Hyderabad-based firm T.I.M.E (Advanced Educational Activities Pvt Ltd) in April 2022. The transactions could not be consummated by the long stop date. Accordingly, the SPA has now been terminated by the parties.

Eicher Motors: The company sold 82,235 units of Royal Enfield in October 2022, up by 86 percent compared to 44,133 units sold in the same month last year. International business sold 5,707 units of Royal Enfield in October this year, up 62 percent YoY.

Fund Flow

Foreign institutional investors (FIIs) have net-bought shares worth Rs 2,609.94 crore, whereas domestic institutional investors (DIIs) net-sold shares worth Rs 730.14 crore on November 1, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The NSE has added Punjab National Bank to its F&O ban list for November 2. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.