It was a strong opening for the week as the benchmark indices rallied more than one percent, backed by buying across sectors, but the broader markets had a mixed closing with muted breadth.

The BSE Sensex closed above the psychological 60,000 mark, surging 787 points to 60,747, while the Nifty50 jumped 225 points to 18,012 and formed a bullish candle on the daily charts.

"On the daily timeframe, the index is maintaining its bullish formation and managed to close above the 18,000 mark after more than a month, which indicates a positive undertone of the index," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

The momentum indicator RSI (relative strength index) is sustaining above 65 levels which shows strong bullish momentum of the index for the short to medium term.

As per the overall chart pattern and indicator set-up, the market expert feels that the Nifty will move towards 18,115 - 18,350 levels. "Our bullish view will be negated if it breaches below 17,420 levels."

The Nifty Midcap 100 index climbed more than one percent, and the Smallcap 100 index was up 0.13 percent as about 1,084 shares advanced against 913 declining shares on the NSE.

The further cooling down of volatility also made the trend favourable for bulls. India VIX, the fear index, was down by 0.75 percent to 15.80 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,931, followed by 17,902 & 17,855. If the index moves up, the key resistance levels to watch out for are 18,025 followed by 18,054 and 18,101.

The Nifty Bank also traded higher, rising more than 300 points to 41,308 but underperformed benchmark indices on October 31, forming a small-bodied bullish candle on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 41,161, followed by 41,103 and 41,008 levels. On the upside, key resistance levels are placed at 41,350 followed by 41,409 & 41,503 levels.

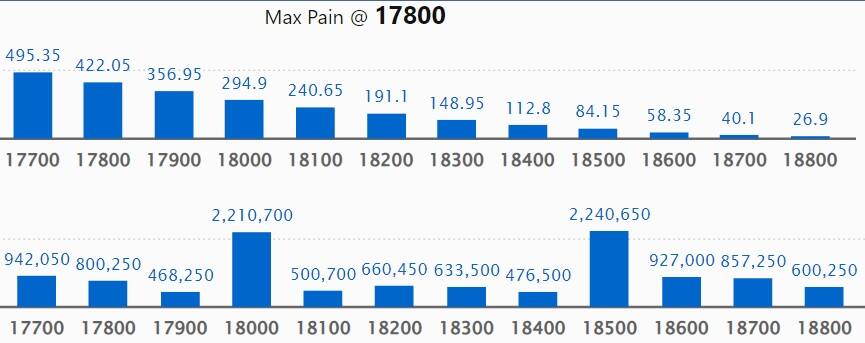

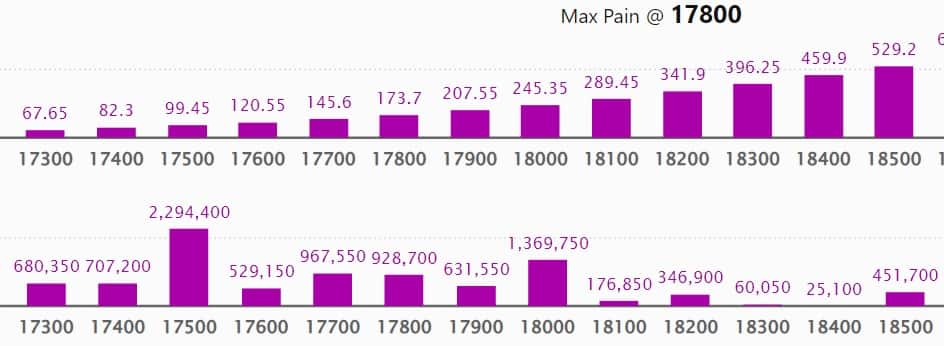

The maximum Call open interest of 22.4 lakh contracts was seen at 18,500 strike, which can act as a crucial resistance level in the November series.

This is followed by 18,000 strike, which holds 22.10 lakh contracts, and 19,000 strike, which has 15.98 lakh contracts.

Call writing was seen at 18,000 strike, which added 4.02 lakh contracts, followed by 18,700 strike which added 3.5 lakh contracts, and 18,800 strike which added 2.38 lakh contracts.

Call unwinding was seen at 18,100 strike, which shed 1.51 lakh contracts, followed by 17,800 strike which shed 1.47 lakh contracts and 17,500 strike which shed 72,700 contracts.

Maximum Put open interest of 28.06 lakh contracts was seen at 17,000 strike, which can act as a crucial support level in the November series.

This is followed by 17,500 strike, which holds 22.94 lakh contracts, and 16,500 strike, which has accumulated 19.48 lakh contracts.

Put writing was seen at 18,000 strike, which added 8.06 lakh contracts, followed by 16,800 strike, which added 4.44 lakh contracts, and 17,900 strike which added 3.35 lakh contracts.

Put unwinding was seen at 16,500 strike, which shed 1.09 lakh contracts, followed by 16,700 strike which shed 80,450 contracts and 16,600 strike which shed 76,800 contracts.

STOCKS WITH A HIGH DELIVERY PERCENTAGE

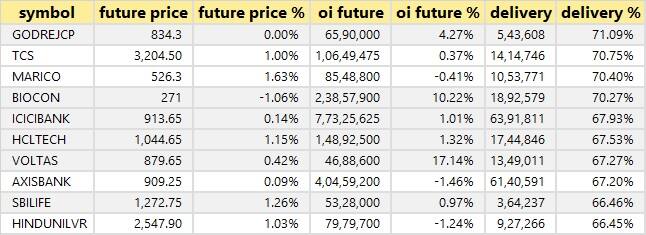

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Godrej Consumer Products, TCS, Marico, Biocon, and ICICI Bank, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Voltas, JK Cement, Dr Reddy's Laboratories, and Metropolis Healthcare, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 6 stocks including NTPC, Hindalco Industries, RBL Bank, Bajaj Auto, and LIC Housing Finance, in which a long unwinding was seen.

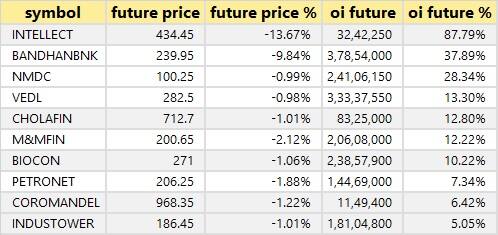

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen, including Intellect Design Arena, Bandhan Bank, NMDC, Vedanta, and Cholamandalam Investment.

63 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks, in which short-covering was seen, including SBI Cards and Payment Services, Bajaj Finserv, Tata Chemicals, Crompton Greaves Consumer Electrical, and Max Financial Services.

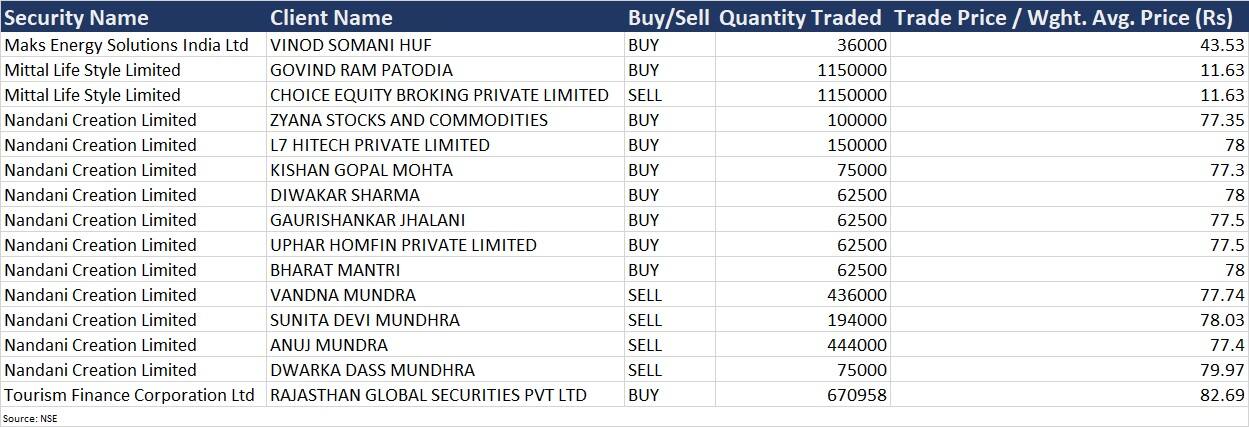

(For more bulk deals, click here)

Sun Pharmaceutical Industries, Adani Ports and Special Economic Zone, Tech Mahindra, UPL, Punjab National Bank, FSN E-Commerce Ventures (Nykaa), Karnataka Bank, LIC Housing Finance, Chambal Fertilisers & Chemicals, Cholamandalam Investment and Finance Company, CMS Info Systems, Dhanuka Agritech, JK Tyre & Industries, Kansai Nerolac Paints, Macrotech Developers, Tata Investment Corporation, Varun Beverages, Voltas, and Whirlpool of India will be in focus ahead of September FY23 quarter earnings on November 1.

Stocks in News

Larsen & Toubro: L&T consolidated PAT grows 22.5 percent to Rs 2,229 crore as consolidated revenue grows 23 percent to Rs 42,763 crore driven by execution tailwinds in the infrastructure projects segment and sustained growth momentum in the IT & TS portfolio. The company won orders worth Rs 51,914 crore at the group level during the quarter, a YoY growth of 23 percent. The consolidated order book of the group was at Rs 372,381 crore as of September-end.

Tata Steel: The company reported an 87 percent YoY decline in consolidated PAT at Rs 1,514 crore as revenue remained flat at Rs 59,878 crore. Concerns about a slowdown in key economies, persisting geopolitical issues coupled with seasonal factors led to a volatile operating environment. Sequentially, the profit declined by 80 percent. The production for the quarter was down 3 percent on-year and deliveries were down 2 percent. EBITDA per ton tanked 60 percent on year and QoQ to Rs 8,673 crore.

Castrol India: The lubricants company reported a flat growth in its PAT of Rs 187 crore while the revenues rose 4 percent to Rs 1,121 crore. The performance was impacted by forex pressures and inflationary pressures, leading to rising costs of additives and base oil.

Glenmark Pharmaceuticals: Glenmark Pharmaceuticals Inc (USA) launched Fingolimod capsules, 0.5 mg, the generic version of Gilenya1 Capsules, 0.5 mg, of Novartis Pharmaceuticals Corporation. According to IQVIA sales data for the 12-month period ending September 2022, the Gilenya Capsules, 0.5 mg market achieved annual sales of approximately $1.8 billion.

Data Patterns: Data Patterns reported a growth of 63 percent in PAT to Rs 21 crore aided by the decline in operating costs. The total revenue grew 51 percent to Rs 90 crore. The company has Rs 884 crore worth of orders in hand.

GHCL: The company announced a 212 percent on-year growth in its net profit to Rs 289 crore as compared to Rs 93 crore a year ago. The standalone revenue was up 73 percent to Rs 1,389 crore and was aided by the doubling of its inorganic chemicals business, the revenue for which grew by 98 percent on-year to Rs 1,130 crore. EBITDA was up 159 percent on-year to Rs 442 crore.

Equitas Small Finance Bank: The small finance bank recorded a profit of Rs 116 crore for the quarter ended September FY23, increasing 183 percent YoY. Net interest income for Q2FY23 at Rs 610 crore increased by 26 percent YoY. Gross advances at Rs 22,779 crore as of September FY23 grew by 20 percent YoY and disbursement at Rs 3,845 crore increased 22 percent YoY.

Fund Flow

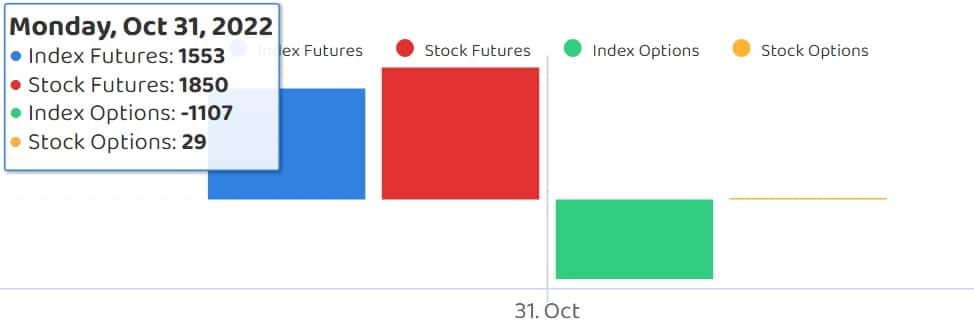

Foreign institutional investors (FIIs) have net-bought shares worth Rs 4,178.61 crore, whereas domestic institutional investors (DIIs) net-sold shares worth Rs 1,107.10 crore on October 31, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are at the beginning of the new series, the NSE has not added any stock under its F&O ban list for November 1. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.