Vedanta

Metals-to-oil conglomerate Vedanta Limited on October 28 reported a 53 percent year-on-year (YoY) decline in consolidated profit after tax (PAT) at Rs 2,690 crore in the September quarter on weaker commodity prices and higher fuel costs.

The company posted a net profit of Rs 5,812 crore in the same quarter last fiscal.

Profit attributable to owners of Vedanta Limited stood at Rs 1,808 crore, down 60.8 percent YoY from Rs 4,615 crore.

The consolidated revenue from operations for the Anil Agarwal-owned company rose 20 percent to Rs 36,237 crore from Rs 30,048 crore in the year-ago quarter.

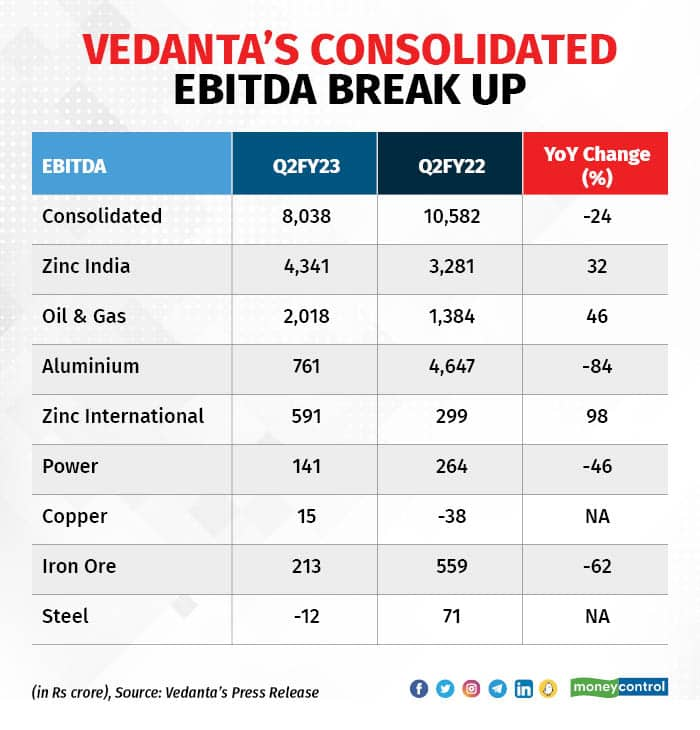

Earnings before interest, taxes, depreciation, and amortisation (EBITDA) declined 24 percent YoY to Rs 8,038 crore as against Rs 10,582 crore in Q2FY22. EBITDA margins contracted 1,500 basis points to 25 percent from 40 percent.

One basis point is one-hundredth of a percentage point.

The performance in the September quarter was affected by weaker commodity prices. The impact was particularly severe for its aluminium business due to a sharp decline in prices and also in its oil & gas division due to the windfall tax and lower crude prices.

The company said its depreciation & amortisation increased by 24 percent YoY and 6 percent QoQ to Rs 2,624 crore, mainly due to higher depletion charge in oil & gas and amortisation at Zinc India.

“I am pleased to share that we have generated strong free cash flow (pre capex) of Rs 8,369 crore underpinned by robust operational and financial performance. We remain well positioned, with a rich diversified asset portfolio, strong balance sheet, and cost optimization levers, to withstand challenging macroeconomic environment," Vedanta CEO Sunil Duggal said.

Gross debt decreased by Rs 2,543 crore QoQ to Rs 58,597 crore as on September 30, 2022. Cash and cash equivalents position came in at Rs 26,453 crore.

In its aluminium segment, production went up by 3 percent QoQ and 2 percent YoY. Cost of production decreased 8 percent sequentially, driven by improved operational and buying efficiencies.

Zinc India saw highest-ever Q2 mined metal production, up by 3 percent YoY. Integrated zinc, refined lead and silver production increased by 13 percent, 16 percent and 19 percent on YoY basis.

In oil & gas, average daily gross operated production declined 15 percent YoY to 140,471 boepd (barrels of oil equivalent per day), the company said.

Vedanta closed at Rs 285 on the National Stock Exchange, down 1.16 percent. The stock is down 6 percent over the past year but has generated returns of around 10 percent over the month.