Last week started on a sluggish note as global markets once again looked a bit tentative over the previous weekend. However, market participants at our end pounced on to this opportunity as Nifty witnessed a V-shaped recovery to reclaim the 17,300 mark.

As the week progressed, the sentiments on global front improved drastically which provided the much-needed impetus to domestic markets. As a result, Indian stocks kept marching higher in latter half to eventually conclude the pre-Diwali week convincingly above 17,500 by adding over a couple of percent gains to the bulls’ kitty in the week ended October 21.

Most of our recent hope or anticipation has turned into a reality and in the process, rock solid support zone around 17,000 – 16,800 has certainly proved its significance.

From a technical standpoint, Nifty is now placed in a safer territory and from hereon, the immediate support is visible in the vicinity of 17,400 – 17,350. Since the undertone is strongly bullish, one should continue with an optimistic bias and use intermediate declines to add bullish bets.

On the higher side, Nifty has reached to our immediate targets of 17,500 – 17,600; but now, we can safely extend these projections towards 17,800 and even retesting of 18,000 cannot be ruled out. For this to happen, we do not require flamboyant moves from global bourses, rather their stability is the need of the hour.

Sectorally, the banking counters outshined by a fair margin last week, especially on Friday after Axis Bank's stellar Q2 performance. This heavyweight space is likely to be the major charioteer and once other heavyweight too starts chipping in, markets are good to go towards the 18,000 mark.

As far as the broader market is concerned, it remained quite this week; but if we see global uncertainty completely disappearing, the midcaps will have a strong comeback soon.

Here are two buy calls for short term:

IRCTC: Buy | LTP: Rs 743.55 | Stop-Loss: Rs 718 | Target: Rs 785 | Return: 5.6 percent

This stock has been off radar for a quite some time now. Over the past couple of months, the stock prices made a smart recovery which appears to be the accumulation phase.

After this, it made valiant attempts to surpass the sturdy wall of '200-SMA' (simple moving average; but failed to do so on multiple occasions. Last week, stock prices finally managed to surpass and sustain above this key moving average, which is a sign of strength.

If we look at the daily momentum oscillators and combine it with weekly price structure, we expect the stock to find its mojo back soon. Thus, we recommend buying for a near term target of Rs 785. Traders can participate by following strict stop-loss at Rs 718.

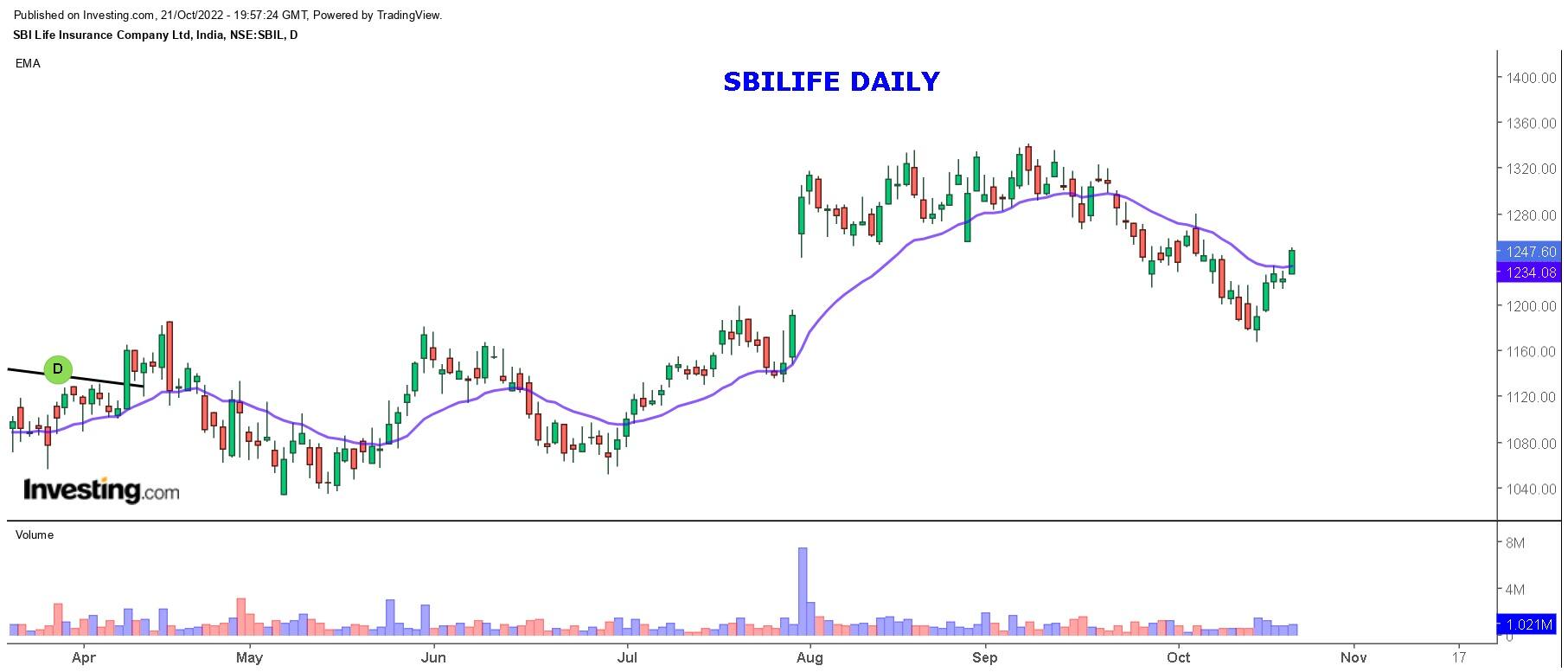

SBI Life Insurance Company: Buy | LTP: Rs 1,246.35 | Stop-Loss: Rs 1,226 | Target: Rs 1,285 | Return: 3 percent

The life insurance companies underwent a decent price correction over the past few weeks. However, we can see this stock recovering smartly last week precisely after testing the sacrosanct support around ‘200-day SMA’.

With Friday's strong move, stock prices managed to traverse the '20-day EMA' (exponential moving average), which is an indication of further strength in current week.

Additionally, the ‘RSI-smoothened’ on daily chart is positively poised. Traders are advised to buy for a near term target of Rs 1,285. The strict stop-loss needs to be placed at Rs 1,226.