The Street is expecting moderate performance from Tata Consumer Products in the second quarter of FY23. The FMCG company, set to report its numbers on October 20, will likely see its topline grow by 10 percent year-on-year, according to experts.

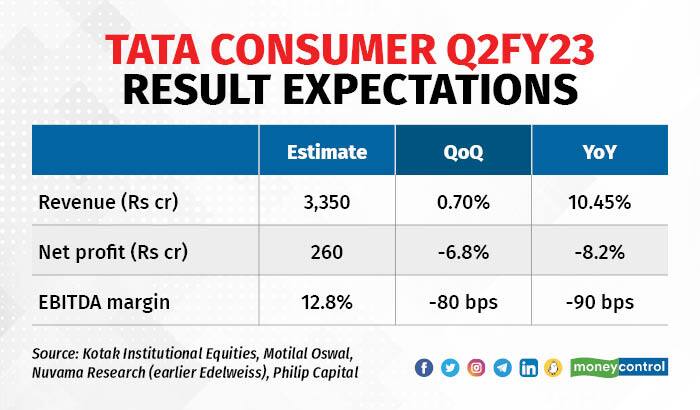

An average of estimates of brokerages polled by Moneycontrol suggests revenue will rise to Rs 3,350 crore. Net profit is expected to decline 8.2 percent from corresponding quarter of last fiscal to Rs 260 crore. Sequentially, net profit will likely drop by 6.8 percent.

Analysts at Motilal Oswal Financial Services expect revenue for the India foods business to grow by 22 percent YoY, entirely on the back of price hikes. Volume growth will remain subdued in beverages and foods businesses owing to high base impact and reduced in-home consumption, notes Philip Capital.

Other businesses such as Sampann, NourishCo and Soulfull are expected to do well. Analysts at Kotak Institutional Equities estimate Rs 140 crore in revenue for NourishCo, which indicates 65 percent YoY growth aided by geographical expansion.

EBITDA margin for aggregate of subsidiaries, largely overseas business, is likely to contract by 460 basis points quarter-on-quarter. Analysts at KIE list multiple headwinds behind this.

“UK Tea: Depreciation of British Pound versus US Dollar would erode gross margin (tea procured from Kenya in US$ terms). US Coffee: Renewal of purchase contracts of coffee at spot price (coffee inflation would impact profitability)” they note.

Overall EBITDA margin for the company is expected to come in at 12.8 percent, which is lower both sequentially and year-on-year due to high cost inventory and inflationary pressures.

MOFSL expects 1 percent volume growth in the India branded tea business, while Nuvama Research expects salt volume growth to be flattish due to high base, with strong pricing growth. Tea prices and update on new product launches will be key monitorables, added analysts.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.