Asian Paints is expected to clock anywhere between 80-90 percent year-on-year growth in consolidated post-tax profit and 16-32 percent YoY growth in consolidated revenue for the quarter ended September 2022, aided by continued market share gains and price hikes.

The company will report its Q2FY23 results on October 20.

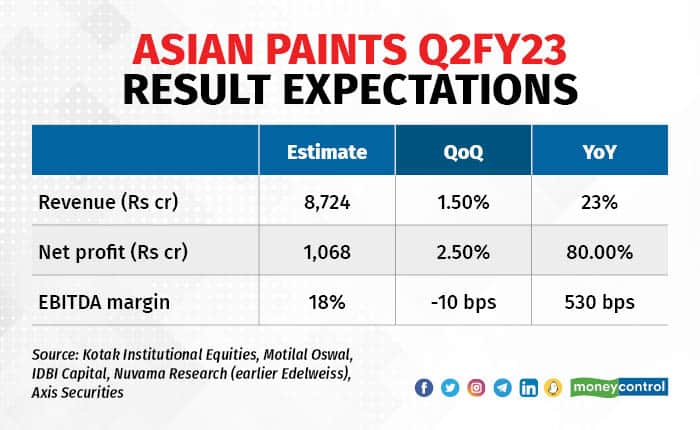

According to an average of estimates of brokerages polled by Moneycontrol, revenue will rise by 23 percent year-on-year to Rs 8,724 crore. Net profit is expected to grow 80 percent from corresponding quarter of last fiscal to Rs 1,068 crore. Sequentially, net profit will likely grow 2.5 percent.

As per analysts at Kotak Institutional Equities, Asian Paints’ growth outperformance versus peers should continue even as the gap may narrow. “We expect 15 percent YoY growth (+12 percent on 3-year CAGR basis) in subsidiary revenues,” they noted.

The company’s volume growth might come in at 12 percent YoY, estimates by Motilal Oswal Financial Services and Nuvama Research suggest. Combination of 12-13 percent volume growth, price hikes and strong traction from decorative and B2B business will help the topline, according to Axis Securities. “Exterior paints' demand in July-Aug was impacted by heavy rainfalls but saw robust comeback in September, with onset of festive season,” Nuvama Research added.

ICICI Securities, on the other hand, has moderate expectations from volume growth. It has modelled 7 percent rise YoY, owing to high base and softer demand in the rural regions.

EBITDA margins have been pegged at 18 percent, which indicates an expansion of 530 basis points year-on-year. This will be on the back of softening raw material prices, strong operating leverage benefits and cost efficiency programs. Prices of titanium dioxide, a key input material for paint manufacturing, has declined 10.3 percent quarter-on-quarter, notes Motilal Oswal.- Investors will be watching out for:

- Management commentary on demand outlook in metro cities, Tier-2 and Tier-3

- Raw material pricing trends

- Dealer network