The market rebounded sharply to recoup all its previous day's losses and closed with a percent gain on October 14. Still, it was off the day's closing high due to profit booking at higher levels, hence forming a bearish candle on the daily charts.

Banking & financial services, technology, and select FMCG & pharma stocks supported the market, but the selling in auto, metal and oil&gas stocks cut down gains.

The BSE Sensex on Friday rallied 685 points to settle at 57,920 while the Nifty50 rose 171 points to 17,186. Broader markets, on the other hand, closed flat.

"On the daily timeframe, the Nifty formed a bearish candle while protecting the 20-day SMA (simple moving average - 17,240.70 Level) on the upside for the 16th consecutive day, this points towards the bearish undertone of the prices while having high underlying volatility," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

The momentum indicator RSI (relative strength index) is sustaining below the 50 mark and at the same time showing a range shift on the downside, reflecting the weak momentum of the index.

As per the overall chart pattern and indicator set-up, the market expert feels that the Nifty will move in a broader range of 16,740 - 17,430 levels for short to medium term.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,121, followed by 17,056. If the index moves up, the key resistance levels to watch out for are 17,300 and 17,413.

The Nifty Bank jumped 682 points or 1.8 percent to 39,306 on October 14 and formed a small-bodied bearish candle on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 39,144, followed by 38,983. On the upside, key resistance levels are placed at 39,519 and 39,732 levels.

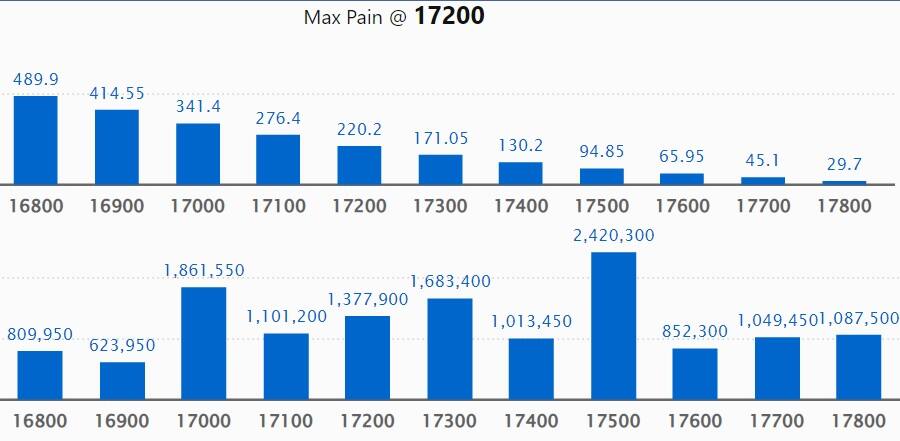

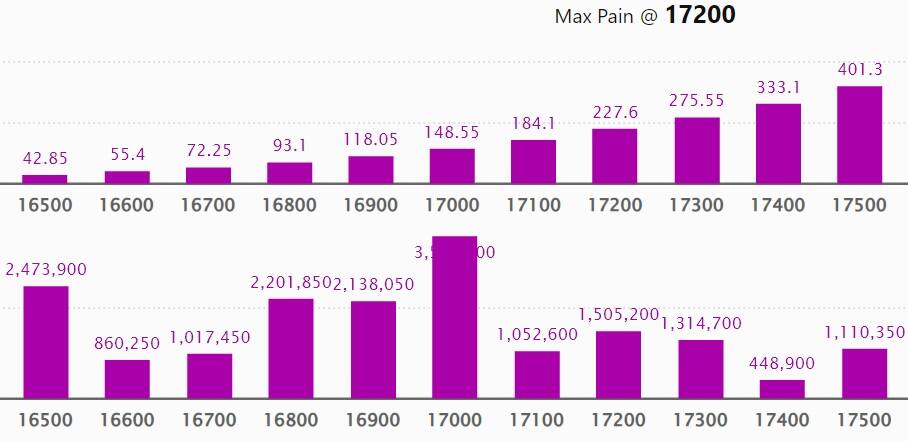

Maximum Call open interest of 42.35 lakh contracts was seen at 18,000 strike, which can act as a crucial resistance level in the October series.

This is followed by 17,500 strike, which holds 24.2 lakh contracts, and 17,000 strike, which has 18.61 lakh contracts.

Call writing was seen at 17,300 strike, which added 5.75 lakh contracts, followed by 18,100 strike which added 3.43 lakh contracts, and 18,000 strike which added 2.95 lakh contracts.

Call unwinding was seen at 17,100 strike, which shed 16.53 lakh contracts, followed by 17,000 strike which shed 15.71 lakh contracts and 17,200 strike which shed 1.73 lakh contracts.

Maximum Put open interest of 35.57 lakh contracts was seen at 17,000 strike, which can act as a crucial support level in the October series.

This is followed by 16,000 strike, which holds 34.54 lakh contracts, and 16,500 strike, which has accumulated 24.73 lakh contracts.

Put writing was seen at 17,300 strike, which added 6.71 lakh contracts, followed by 17,200 strike, which added 5.64 lakh contracts, and 16,900 strike which added 3.61 lakh contracts.

Put unwinding was seen at 17,100 strike, which shed 13.46 lakh contracts, followed by 17,000 strike which shed 13.29 lakh contracts and 16,200 strike which shed 3.23 lakh contracts.

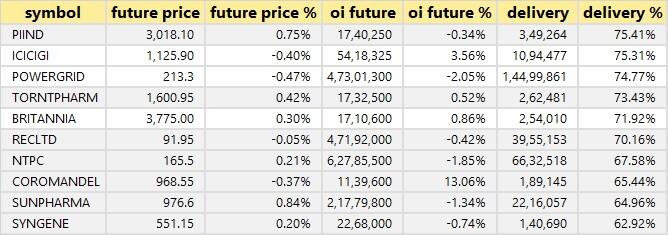

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in PI Industries, ICICI Lombard General Insurance, Power Grid Corporation of India, Torrent Pharma, and Britannia Industries, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including City Union Bank, Coforge, Mahanagar Gas, Navin Fluorine International, and Federal Bank, in which a long build-up was seen.

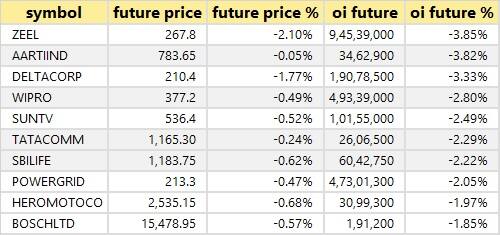

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Zee Entertainment Enterprises, Aarti Industries, Delta Corp, Wipro, and Sun TV Network, in which long unwinding was seen.

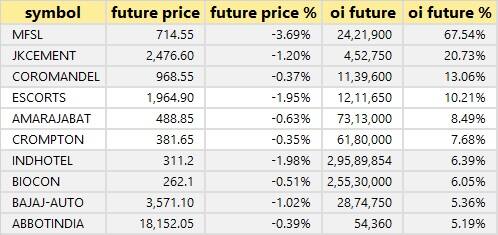

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen. The list includes Max Financial Services, JK Cement, Coromandel International, Escorts, and Amara Raja Batteries, among others.

55 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks, in which short-covering was seen. The list includes names such as Nifty Financial, L&T Technology Services, Infosys, Nifty, and AU Small Finance Bank.

BLS International Services: Ace investor Shankar Sharma acquired 11.5 lakh equity shares in the company at an average price of Rs 275 per share.

Suzlon Energy: Mukul Agrawal bought 1,83,42,924 equity shares in the company at an average price of Rs 1.19 per share, and ITI Holdings and Investment purchased 1,76,71,493 equity shares at an average price of Rs 1.24 per share. However, Vanguard Emerging Markets Stock Index Fund A Series of VIEIF sold 2,51,27,794 shares and Vanguard Total International Stock Index Fund offloaded 2,47,74,663 shares at an average price of Rs 1.23 per share.

Veritas (India): Swan Energy bought additional 8.25 lakh shares in the company at an average price of Rs 123 per share, however, promoter Niti Nitinkumar Didwania was the seller.

(For more bulk deals, click here)

ACC, Can Fin Homes, Craftsman Automation, Heidelbergcement India, PVR, Tata Coffee, Tata Metaliks, RPG Life Sciences, Spandana Sphoorty Financial, Indowind Energy, Bank of Maharashtra, Star Housing Finance, and Thangamayil Jewellery will be in focus ahead of quarterly earnings on October 17.

Stocks in News

Electronics Mart India: The company will make its debut on the bourses on October 17. The offer price has been fixed at Rs 59 per share.

HDFC Bank: The leading private sector lender has reported a 20% YoY growth in standalone profit at Rs 10,606 crore for the quarter ended September FY23. Net interest income grew by 18.9% to Rs 21,021.2 crore with loan book growing 19% compared to year-ago period. Asset quality improved further with gross non-performing assets as a percentage of gross advances falling 5 bps QoQ to 1.23% and net NPA fell 2 bps to 0.33% in Q2FY23.

Avenue Supermarts: The D-Mart retail chain operator clocked a 64.1% year-on-year growth in profit at Rs 685.8 crore for the quarter ended September FY23, with revenue rising 36.6% to Rs 10,638.3 crore and EBITDA climbing 33.4% to Rs 892 crore compared to year-ago period, but margin fell 20 bps to 8.4 percent in Q2FY23 YoY.

L&T Infotech: The IT services company recorded consolidated profit at Rs 679.8 crore for the quarter ended September FY23, up 7.2%% sequentially, with revenue rising 6.9% to Rs 4,836.7 crore and EBIT climbing 7.8% to Rs 780.9 crore. Revenue in dollar terms grew by 3.6% QoQ to $601 million and constant currency revenue growth stood at 4.6% QoQ.

Dilip Buildcon: The road construction company has received project worth Rs 702 crore from Gujarat Metro Rail Corporation. The completion period for the said project is 26 months.

Shree Cement: The cement company has reported a 67.2% year-on-year decline in standalone net profit at Rs 189.6 crore for the quarter ended September FY23, dented by weak operating performance and higher fuel cost. Revenue from operations grew by 17.9% YoY to Rs 3,780.9 crore in Q2FY23. At the operating level, EBITDA plunged 41.7% to Rs 523.3 crore hit by higher power & fuel cost, and freight & forwarding expenses. Margin tanked 1,420 bps to 13.8% compared to year-ago period. Numbers missed analysts' estimates.

Bajaj Auto: The company has reported a 15.7% year-on-year decline in consolidated profit at Rs 1,719.4 crore for the quarter ended September FY23 as the profit in Q2FY22 was boosted by exceptional income. Revenue grew by 16.4% to Rs 10,202.7 crore, while EBITDA jumped 25% to Rs 1,749.6 crore and margin expanded by 120 bps YoY to 17.2% in Q2FY23.

Tata Elxsi: The company has recorded a 39.3% year-on-year growth in profit at Rs 174.2 crore for the quarter ended September FY23, supported by topline. Revenue grew by 28.2% YoY to Rs 763.2 crore in Q2FY23.

ZEE Entertainment Enterprises: Equity shareholders of the company have given a approval to the proposed merger of ZEE and BangIa Entertainment with and into Culver Max Entertainment, formerly Sony Pictures Networks India. ZEE already had received an approval from the Competition Commission of India (CCI) for the merger on October 4, and also received approvals from the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) in July 2022.

Oberoi Realty: The real estate company recorded a 19.5% year-on-year growth in consolidated profit at Rs 318.62 crore for the quarter ended September FY23, led by increase in income from joint ventures against significantly low income in year-ago period. Revenue declined 8.7% YoY to Rs 688.6 crore in the quarter ended September FY23.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 1,011.23 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 1,624.13 crore on October 14, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Delta Corp, Indiabulls Housing Finance, and India Cements - are under the NSE F&O ban list for October 17. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.