Shree Cement

Shree Cement Ltd is likely to report a drop in net profit in the second quarter of this fiscal despite a rise in revenues due to a huge surge in operating costs led by petroleum coke and coal prices.

Volumes and realisations are expected to be higher on a year-on-year basis, resulting in a growth in revenues in the July-September quarter, which is usually weak as construction activities slow down due to the monsoon.

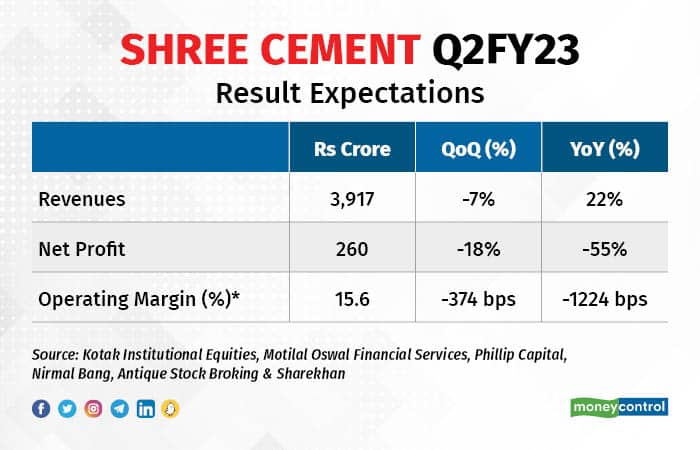

The cement major is likely to post a 55 per cent year-on-year drop in profit after tax (PAT) even as the revenues are seen rising 22 percent when it announces earnings for July-September 2022 on October 14.

Profitability down

According to a poll of brokerages conducted by Moneycontrol, the company is expected to report a standalone PAT of Rs 260 crore while clocking standalone revenues of Rs 3,917 crore in Q2.

The company had posted a PAT of Rs 578 crore during the corresponding period of last year when its standalone revenues stood at Rs 3,206 crore.

The net profit during the previous quarter of the current fiscal stood at Rs 316 crore on revenues of Rs 4,203 crore.

Volumes and realisations

Analysts expect Shree’s cement volumes to grow 18 percent on year to 7.5 million tonne (MT) while on a sequential basis they are seen declining marginally by 1 percent.

“We estimate volume of 7.4 MT (+18.5 percent YoY, -0.7 percent QoQ) during the quarter, factoring seasonality and backended recovery in demand during the quarter,” said analysts at Kotak Institutional Equities.

The blended realisations are likely to improve 6-7 percent on year but compared to the previous quarter they are forecast to dip 4 percent due to lower exit prices and rollback of price hikes.

Operating costs rise

Earlier Shree Cement was most efficient in managing operating costs, which gave it an edge over the competition. However, now the competition has caught up and the company seems to have lost that edge.

The rise in petroleum coke and coal prices and use of high-cost inventory will severely impact the prospects of cement players in the country and consequently, for Shree Cement, the variable costs are likely to surge about 80 percent as compared to the previous year period. This would expand the operating costs per tonne by close to 24-28 percent.

“We expect the variable cost per tonne to increase by 82 percent YoY, resulting in a 28 percent rise in operating expenses per tonne,” said a report from Motilal Oswal Financial Services.

Margins hit

As a result, cement earnings before interest, tax, depreciation and amortisation (EBITDA) per tonne are estimated to decline to Rs 780-850 per tonne, a decline of more than 40 percent YoY and a decline of more than 20 percent on a sequential basis.

EBITDA margins are estimated to tank 1,200 basis points (bps) to 16 percent from the margin of 28 percent achieved during the same period last year. On a sequential basis, the EBITDA margins are down 350 bps from 19.5 percent recorded during the previous quarter.

At 11.35 am, Shree Cement was trading at Rs 20,850, down Rs 162 on the National Stock Exchange. The stock is down 25 percent over the past one year and has lost 13 percent in the past one month.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.