Catherine Wood, chief executive officer of ARK Investment Management LLC, participates in a panel discussion during the Milken Institute Global Conference in Beverly Hills, California, U.S., on Monday, May 2, 2022. Photographer: Lauren Justice/Bloomberg

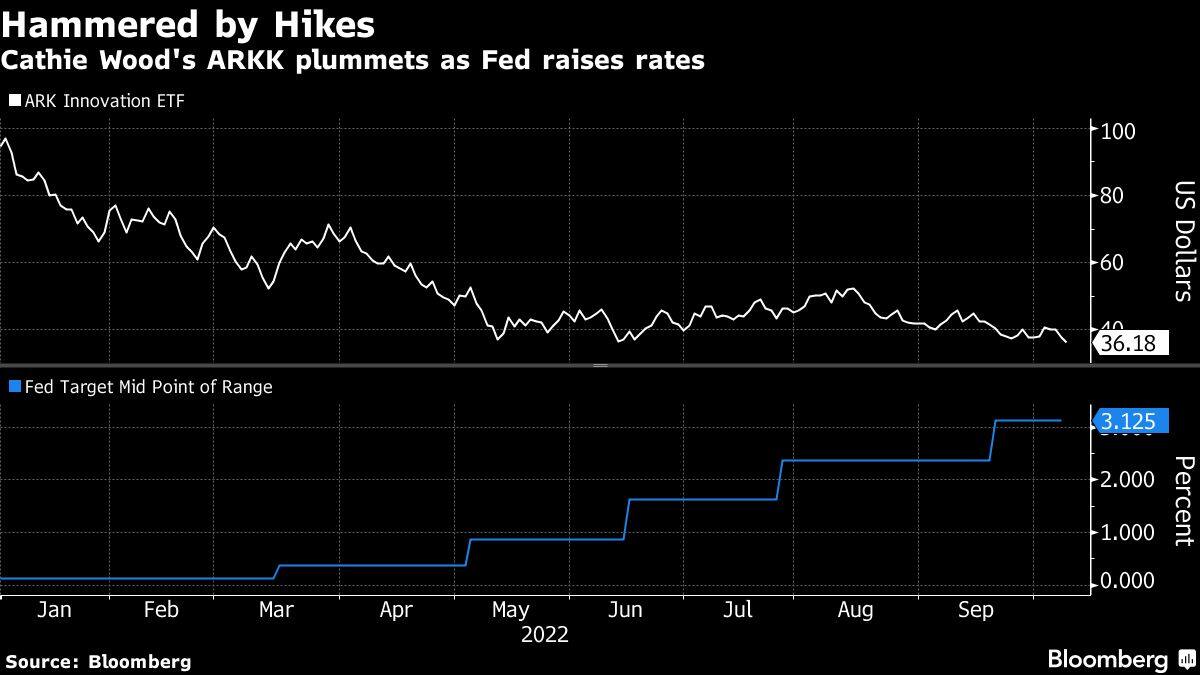

Cathie Wood, whose innovation-themed ETFs have plummeted in this era of rising interest rates, is taking the Federal Reserve to task for its aggressive tightening campaign.

In the latest market commentary from her firm ARK Investment Management, Wood pens an open letter to the Fed expressing concern that the central bank is making a policy error with its rapid rate hikes.

She warns that the central bank could be raising the risks of a deflationary bust, pointing to a slew of falling commodity prices and retailers’ growing inventories as key indicators. The money manager argues that, in targeting price growth and jobs numbers, the central bank is focusing on the wrong barometers.

“The Fed seems focused on two variables that, in our view, are lagging indicators -- downstream inflation and employment -- both of which have been sending conflicting signals and should be calling into question the Fed’s unanimous call for higher interest rates,” Wood wrote.