Top Searches

- News

- Business News

- India Business News

- Govt upbeat on tax mop-up despite growth moderation

Govt upbeat on tax mop-up despite growth moderation

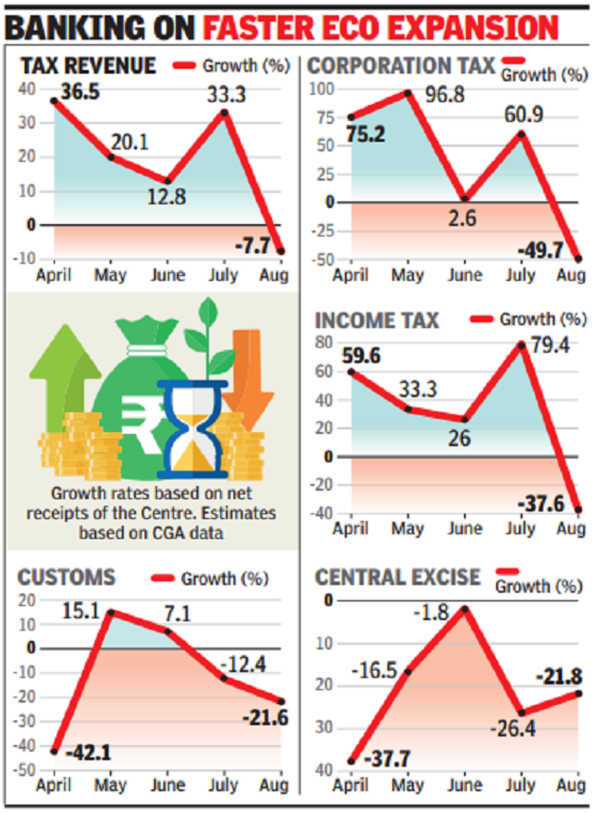

NEW DELHI: The government remains hopeful of tax collections remaining robust despite a moderation in growth rates in recent weeks, which is partly due to full data not being captured as well as some impact of the base effect.

Latest direct taxes data released by the finance ministry indicated that the growth rate in gross collections had slowed from nearly 40% in June to 23.8% during the fiscal year up to October 8, when the mop-up rose to just under Rs 9 lakh crore. Net of refunds, collections were 16.3% higher at around Rs 7.5 lakh crore.

Between April and September 8, the Central Board of Direct Taxes (CBDT) had estimated the growth in gross collections at over 35%, which moderates to 30% in the fiscal year up to September 17.

Officials said the growth rate will pick up in the coming days as the numbers on tax deducted at source are added. Besides, the net direct tax collections too will pick up as the Centre is pushing refunds to taxpayers. CBDT said between April and October 8, refunds shot up 81% to over Rs 1.5 lakh crore.

“Processing of refunds is a priority area and the speed has improved. Once the refund payout gets over, the growth rates for gross and net collections will converge,” an officer told TOI.

While the latest data released by the Controller General of Accounts points to a 7.7% decline in the overall revenue of the Centre during April-August, officials said that not too much should be read into the numbers.

To begin with, excise collections dropped by over 20% due to a reduction in levies on auto fuel.

Customs revenue was too pegged to be 22% lower at Rs 14,315 crore in August. Officials said that the data only captured the cash payment and scrips too were used by businesses to pay the duty. In any case, the impact of lower commodity prices is seen to be playing out in several sectors, which has resulted in a moderation of imports at the macro level.

The Centre is hopeful of mopping up more revenue than it had budgeted for at the start of the year and the optimism has resulted in the overall market borrowings being Rs 10,000 crore lower than the original estimate. This is despite the higher spending on account of food and fertiliser subsidies.

Latest direct taxes data released by the finance ministry indicated that the growth rate in gross collections had slowed from nearly 40% in June to 23.8% during the fiscal year up to October 8, when the mop-up rose to just under Rs 9 lakh crore. Net of refunds, collections were 16.3% higher at around Rs 7.5 lakh crore.

Between April and September 8, the Central Board of Direct Taxes (CBDT) had estimated the growth in gross collections at over 35%, which moderates to 30% in the fiscal year up to September 17.

Officials said the growth rate will pick up in the coming days as the numbers on tax deducted at source are added. Besides, the net direct tax collections too will pick up as the Centre is pushing refunds to taxpayers. CBDT said between April and October 8, refunds shot up 81% to over Rs 1.5 lakh crore.

“Processing of refunds is a priority area and the speed has improved. Once the refund payout gets over, the growth rates for gross and net collections will converge,” an officer told TOI.

While the latest data released by the Controller General of Accounts points to a 7.7% decline in the overall revenue of the Centre during April-August, officials said that not too much should be read into the numbers.

To begin with, excise collections dropped by over 20% due to a reduction in levies on auto fuel.

Customs revenue was too pegged to be 22% lower at Rs 14,315 crore in August. Officials said that the data only captured the cash payment and scrips too were used by businesses to pay the duty. In any case, the impact of lower commodity prices is seen to be playing out in several sectors, which has resulted in a moderation of imports at the macro level.

The Centre is hopeful of mopping up more revenue than it had budgeted for at the start of the year and the optimism has resulted in the overall market borrowings being Rs 10,000 crore lower than the original estimate. This is despite the higher spending on account of food and fertiliser subsidies.

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE

Start a Conversation

end of article