The equity market on October 10 had a kneejerk reaction to the global cues amid fears that Federal Reserve may continue with aggressive policy tightening in upcoming policy meetings but managed to recoup significant losses in the afternoon to end off the day's low on October 10. All sectors, barring IT, were caught in the bear trap.

The BSE Sensex declined 200 points to 57,991, while the Nifty50 fell 74 points to 17,241 and formed a bullish candle on the daily charts as the closing was higher than the opening levels.

"The short-term trend of Nifty is weak with high volatility. The emergence of sharp buying interest from near the lows could be a cheering factor for the bulls to make a comeback. Hence, one may expect Nifty to retest the hurdle of 17,400 levels in the near term," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Immediate support is placed at 17,050-17,100 levels, Shetti added.

The broader markets also reeled under selling pressure as the Nifty Midcap 100 index was down nearly 1 percent and Smallcap 100 index declined half a percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,110, followed by 16,980. If the index moves up, the key resistance levels to watch out for are 17,326 and 17,411.

The Nifty Bank remained under pressure, falling 85 points to end at 39,093 and formed a bullish candlestick pattern on the daily scale on October 10. The important pivot level, which will act as crucial support for the index, is placed at 38,636, followed by 38,178. On the upside, key resistance levels are placed at 39,433 and 39,773 levels.

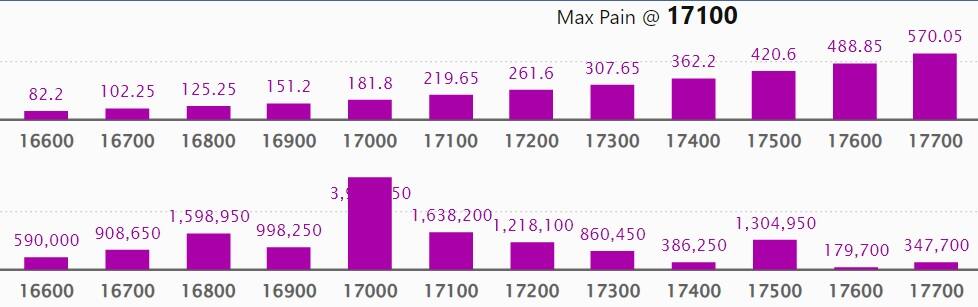

Maximum Call open interest of 35.01 lakh contracts was seen at 18,000 strike, which can act as a crucial resistance level in the October series.

This is followed by 17,000 strike, which holds 21.74 lakh contracts, and 18,500 strike, which has 18.13 lakh contracts.

Call writing was seen at 17,100 strike, which added 11.63 lakh contracts, followed by 17,000 strike which added 6.76 lakh contracts, and 18,000 strike which added 4.3 lakh contracts.

Call unwinding was seen at 17,400 strike, which shed 34,500 contracts, followed by 17,300 strike which shed 32,050 contracts and 16,000 strike which shed 9,750 contracts.

Maximum Put open interest of 39.59 lakh contracts was seen at 17,000 strike, which can act as a crucial support level in the October series.

This is followed by 16,000 strike, which holds 30.45 lakh contracts, and 16,500 strike, which has accumulated 23.84 lakh contracts.

Put writing was seen at 17,100 strike, which added 10.7 lakh contracts, followed by 17,000 strike, which added 7.02 lakh contracts, and 17,200 strike which added 2.04 lakh contracts.

Put unwinding was seen at 17,500 strike, which shed 1.07 lakh contracts, followed by 17,400 strike which shed 1.04 lakh contracts and 16,900 strike which shed 1.01 lakh contracts.

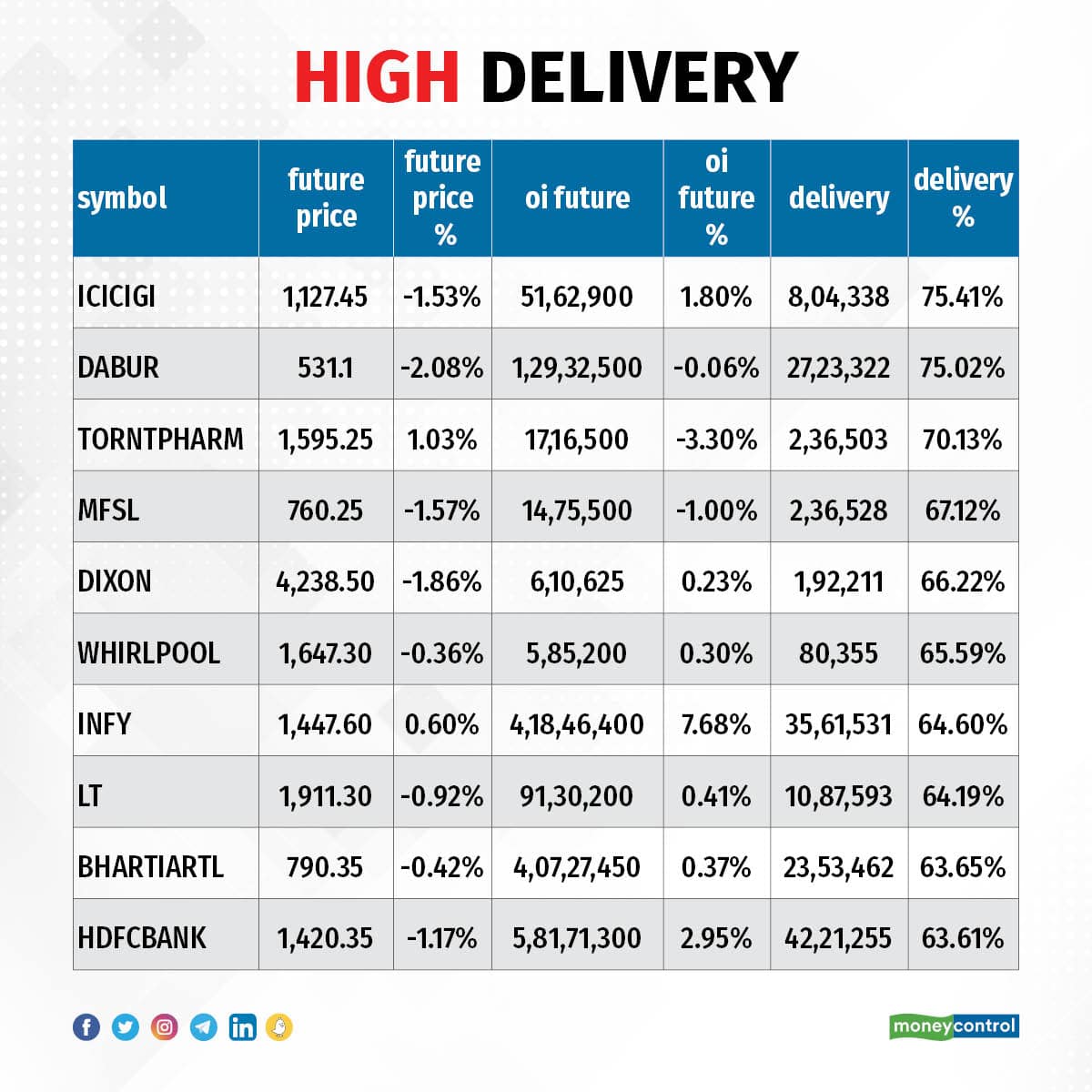

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in ICICI Lombard General Insurance, Dabur India, Torrent Pharma, Max Financial Services, and Dixon Technologies, among others.

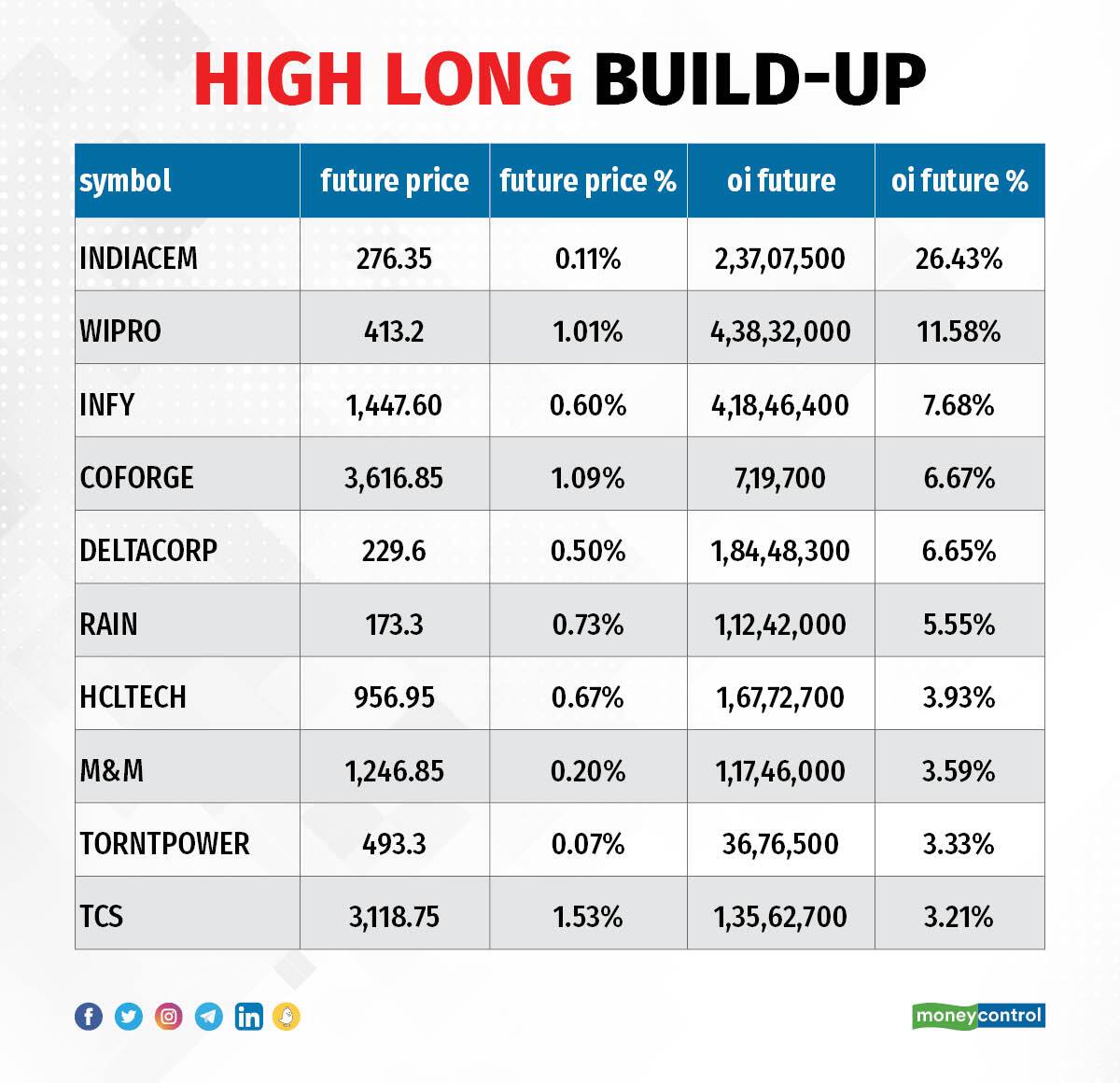

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen. The list includes names such as India Cements, Wipro, Infosys, Coforge, and Delta Corp.

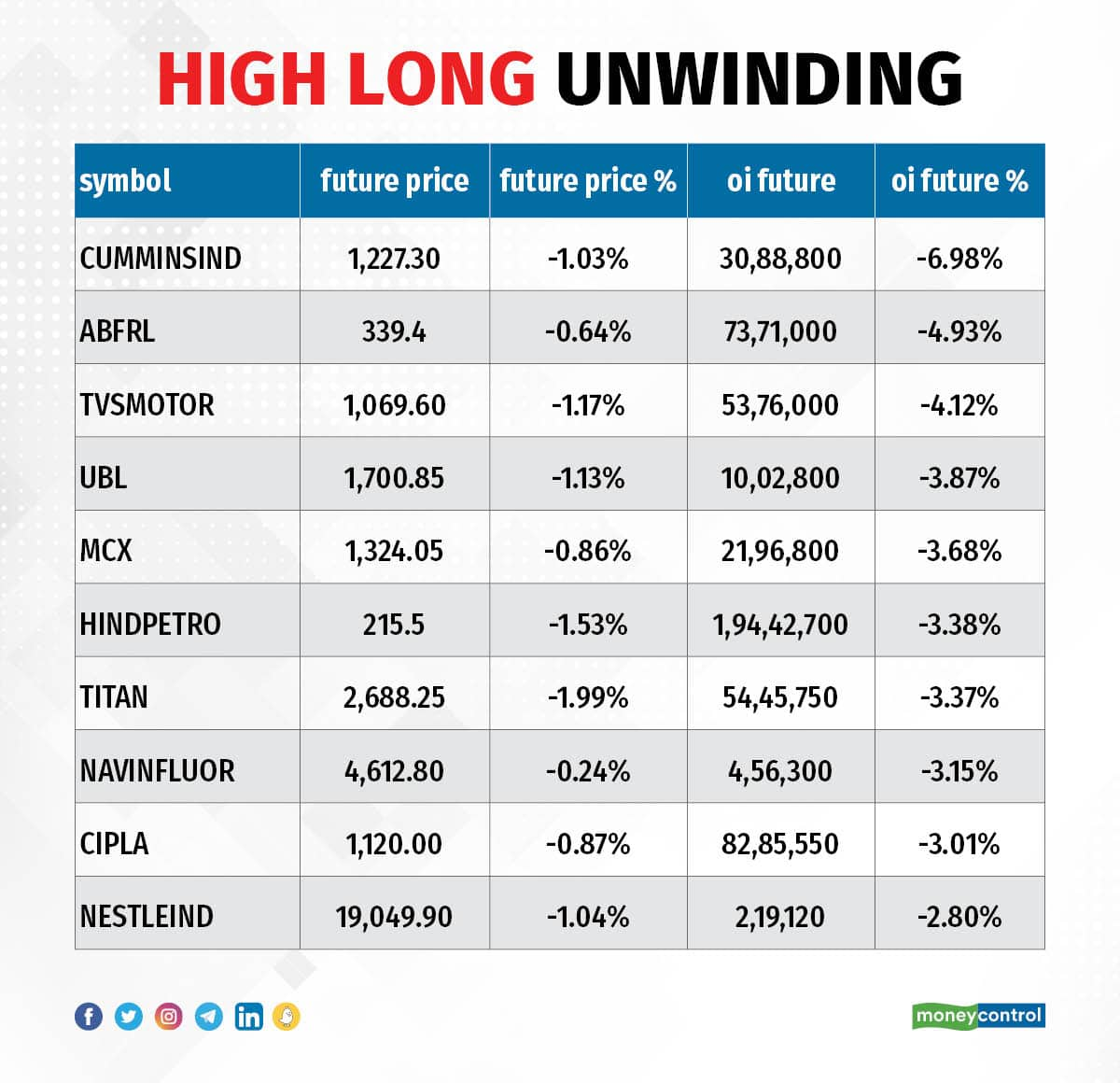

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Cummins India, Aditya Birla Fashion & Retail, TVS Motor Company, United Breweries, and MCX India, in which long unwinding was seen.

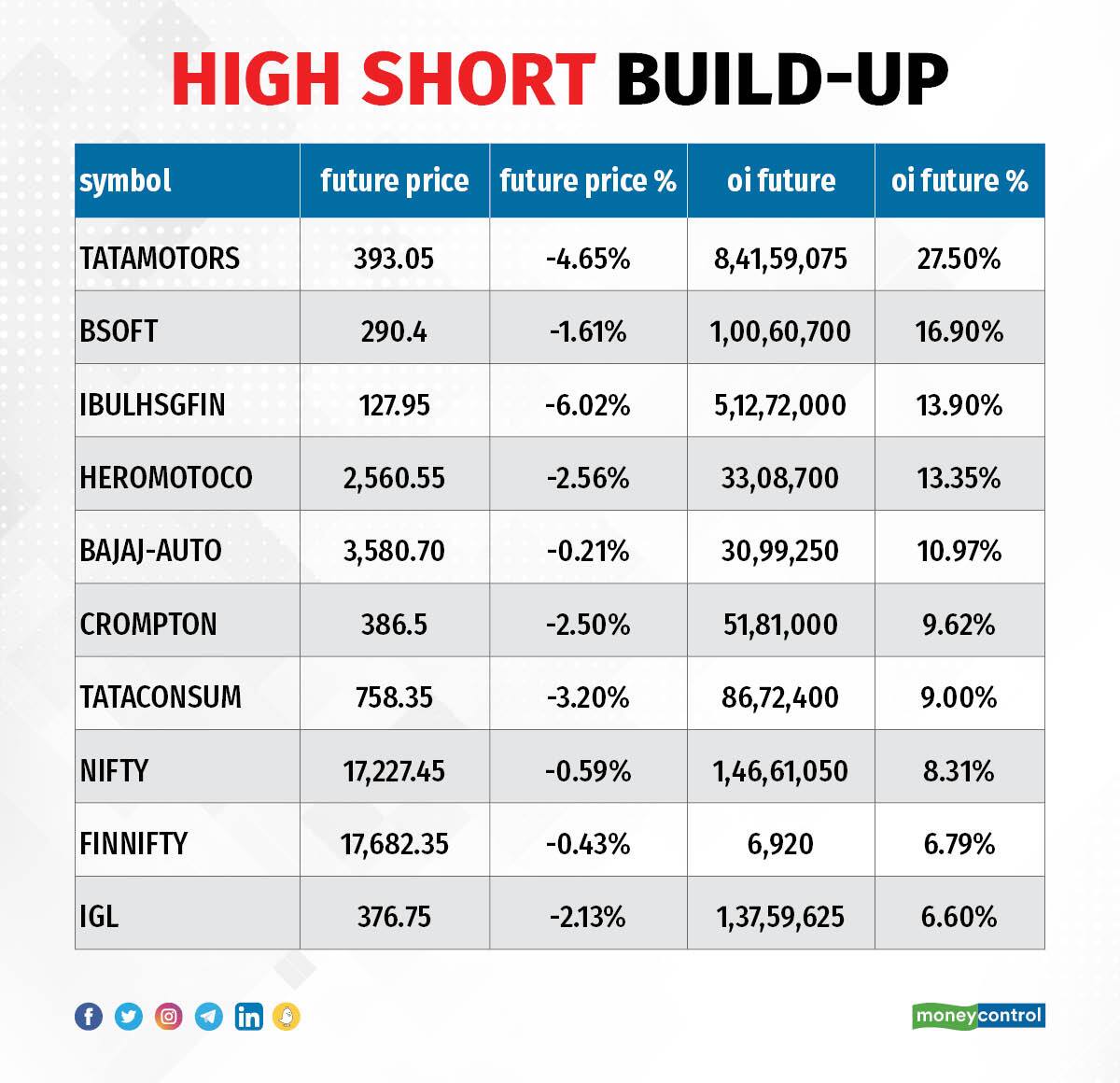

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including Tata Motors, Birlasoft, Indiabulls Housing Finance, Hero MotoCorp, and Bajaj Auto.

17 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks, in which short-covering was seen. The list includes GAIL India, NMDC, Torrent Pharma, Axis Bank, and Tata Chemicals.

(For more bulk deals, click here)

Delta Corp, GM Breweries, Gujarat Hotels, Supreme Infrastructure India, and Trident Texofab will be in focus ahead of quarterly earnings on October 11.

Stocks in News

Tata Consultancy Services: The IT services company reported a 10% sequential growth in consolidated profit at Rs Rs 10,431 crore for Q2FY23, with profitable growth across all industry verticals and in all major markets. Consolidated revenue grew by 4.8% sequentially (up 18 percent YoY) to Rs 55,309 crore, driven by strong execution, with dollar revenue rising 1.4% and constant currency revenue growth at 4% for the quarter. The orderbook remained quite strong at $8.1 billion for Q2FY23, though slightly down compared to $8.2 billion in previous quarter.

JTL Infra: The stock will be in focus as the company clocked a 56.5% growth year-on-year in consolidated profit at Rs 20.27 crore for the September FY23 quarter, backed by strong operating performance. Consolidated revenue for the quarter grew by 14% YoY to Rs 299.9 crore.

Rategain Travel Technologies: Investor Wagner exited the company by selling entire 57.04 lakh equity shares or 5.28% shareholding in the company via open market transactions on October 6. However, Nippon Life India Trustee acquired additional 4.89% equity in Rategain during December 9, 2021 and October 6, 2022, taking total shareholding to 8.75%.

Panacea Biotec: The company has received long-term supply orders worth $127.30 million (around Rs 1,040 crore) from UNICEF and Pan American Health Organization (PAHO). The company will supply WHO pre-qualified fully liquid Pentavalent vaccine, Easyfive-TT (DTwP-HepB-Hib). UNICEF order is worth $98.755 million (Rs 813 crore) for supply of 99.70 million doses during calendar years 2023-2027 and PAHO award is worth $28.55 million (Rs 235 crore) for supply 24.83 million doses during calendar years 2023-2025.

India Cements: The cement company has sold its entire shareholding in Springway Mining to JSW Cement. It has entered into a Share Purchase Agreement with JSW Cement and divested the entire shareholdings for Rs 476.87 crore. With this, Springway Mining is ceased to be the wholly owned subsidiary of the company.

Triveni Turbine: Nippon Life India Trustee sold 2.92 lakh equity shares or 0.09% stake in the company via open market transactions. With this, its shareholding in the company reduced to 2.98%, from 3.07% earlier.

Inox Wind: The company said its subsidiary Inox Green Energy Services sold entire equity shareholding held in Wind One Renergy, Wind Three Renergy and Wind Five Renergy, to Adani Green Energy. All three special purpose vehicles successfully commissioned 50 MW each of SECI Tranche 1 in 2019. Inox Wind had won 250 MW under the Tranche 1 of Solar Energy Corporation of India's (SECI -1) bids for wind power projects at Dayapar, Gujarat connected on the central grid, at a fixed tariff of Rs 3.46 per unit for 25 years for sale to PTC India.

Fund Flow

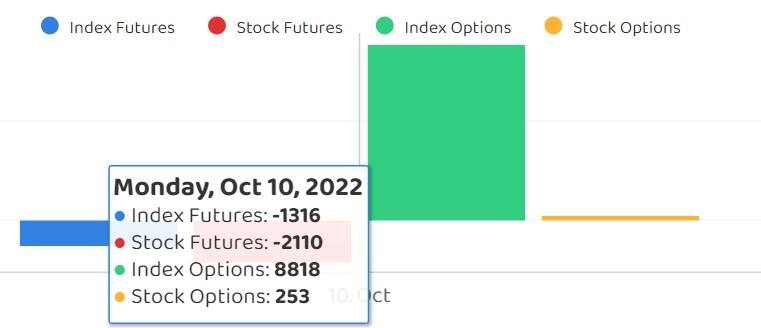

Foreign institutional investors (FIIs) turned net sellers to the tune of Rs 2,139.02 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 2,137.46 crore on October 10, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added Indiabulls Housing Finance, and India Cements under its F&O ban list for October 11. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.