Top Searches

- News

- Business News

- India Business News

- Rupee closes at lifetime low of 82.33/$

Rupee closes at lifetime low of 82.33/$

MUMBAI: The Rupee closed at a new low of 82.33 in the interbank foreign exchange market on Friday. While the Rupee had closed at 81.89 on Thursday, it later weakened to 82.30 in post-market trade following large-scale dollar purchases by state-owned banks ostensibly for defence requirements.

The Rupee weakened even as the RBI reported that the country’s foreign exchange reserves dropped by $4.85 billion to $532 billion as of September 30 – the lowest level since July 2020. This was the ninth consecutive week of decline. Foreign exchange reserves had touched a high of $645 billion in October 2021.

Dealers said it was unusual for currency to slip so much without an external factor. “This was a very rare occasion where there was a big gap between over-the-counter v/s Futures closing, and normally it’s around 5 to 10 paisa. The Rupee is still in negative mode with further depreciation cannot be ruled out,” said KN Dey of United Financial Consultants.

The Rupee opened weak on Friday and hit a low of 82.41. There was mild intervention by the RBI, which supported the Rupee marginally but could not prevent its closing at a lifetime low of 82.33.

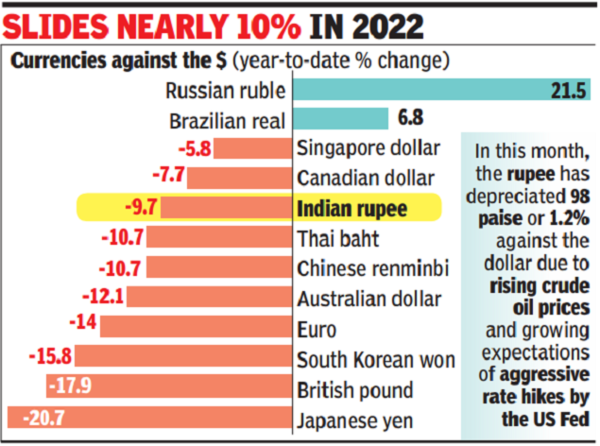

Although the dollar has not appreciated against major currencies, the sentiment in respect of the Rupee continues to be weak. “Markets will continue to be guided by the overall dollar strength and the macro events playing out. The dollar has not gained much recently, but the Rupee has depreciated. The decision of oil exporters to cut production is a negative for the Rupee,” said Ashhish Vaidya, head of treasury DBS Bank. He added that while crude oil prices will play a major role in determining India’s macroeconomic fundamentals, they are not the only factor for the Rupee which would be influenced whenever there is a risk-on or risk-off sentiment in global markets.

“Fed’s hawkish-than-expected guidance drove global currencies sharply lower in Sep ‘22. Rupee too depreciated to a record low. Other factors contributing to the rupee weakness include: elevated trade deficit, slowdown in foreign portfolio flows and high domestic inflation… The adverse global environment entails that Rupee is likely to remain under pressure in the near-term,” said an economic report from the Bank of Baroda.

The Rupee weakened even as the RBI reported that the country’s foreign exchange reserves dropped by $4.85 billion to $532 billion as of September 30 – the lowest level since July 2020. This was the ninth consecutive week of decline. Foreign exchange reserves had touched a high of $645 billion in October 2021.

Dealers said it was unusual for currency to slip so much without an external factor. “This was a very rare occasion where there was a big gap between over-the-counter v/s Futures closing, and normally it’s around 5 to 10 paisa. The Rupee is still in negative mode with further depreciation cannot be ruled out,” said KN Dey of United Financial Consultants.

The Rupee opened weak on Friday and hit a low of 82.41. There was mild intervention by the RBI, which supported the Rupee marginally but could not prevent its closing at a lifetime low of 82.33.

Although the dollar has not appreciated against major currencies, the sentiment in respect of the Rupee continues to be weak. “Markets will continue to be guided by the overall dollar strength and the macro events playing out. The dollar has not gained much recently, but the Rupee has depreciated. The decision of oil exporters to cut production is a negative for the Rupee,” said Ashhish Vaidya, head of treasury DBS Bank. He added that while crude oil prices will play a major role in determining India’s macroeconomic fundamentals, they are not the only factor for the Rupee which would be influenced whenever there is a risk-on or risk-off sentiment in global markets.

“Fed’s hawkish-than-expected guidance drove global currencies sharply lower in Sep ‘22. Rupee too depreciated to a record low. Other factors contributing to the rupee weakness include: elevated trade deficit, slowdown in foreign portfolio flows and high domestic inflation… The adverse global environment entails that Rupee is likely to remain under pressure in the near-term,” said an economic report from the Bank of Baroda.

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE

Start a Conversation

end of article