Representative Image

Shares of Jewellery and watchmaker Titan Company zoomed in the early trade on October 7, after the firm reported strong growth in sales for September quarter, springing a positive surprise for investors.

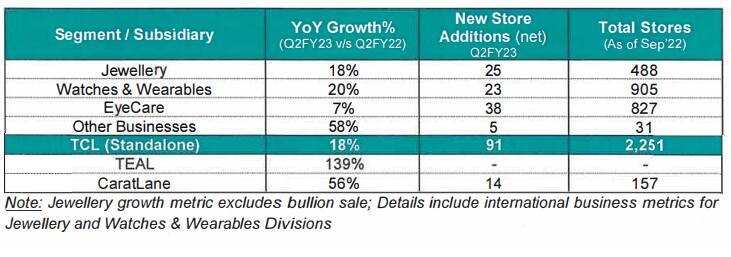

“The Company witnessed healthy double-digit growth across most businesses with overall sales growing 18 percent YoY (year-on-year),” Titan said in a regulatory filing.

At 9:56am, the stock was trading 5.18 percent higher at Rs 2728 apiece on the BSE, while the benchmark Sensex was at 58,132.09, down 90.01 points or 0.15 percent.

The jewellery division of the company grew 18 percent YoY on a high base of Q2FY22 that had elements of pent-up demand and spillover purchases of a Covid disrupted Q1FY22. Gold jewellery clocked low double digit growth whereas studded sales were higher than the overall division driven by good activations and better contribution from high value purchases, the company said.

The watch business grew 20 percent YoY, clocking its highest quarterly revenue. Titan said the strong tailwind demand led by a desire to own more premium watches helped the brand grow fastest in the watches category, assisted by higher volume and average selling prices YoY.

The company’s eyecare business grew 7 percent and other businesses that includes sarees and perfumes grew 58 percent compared to the last year.

In its outlook for festive season, Titan said it continues to be optimistic and positivity is visible in consumer sentiment across categories.

Source: Titan Company

Source: Titan Company

Morgan Stanley maintained its ‘overweight’ rating on the stock with a target of Rs 2,902. It said initial Q2 trends are “strong”. Improving studded mix, positive sentiments and good festive season outlook are key positives.

Follow our live blog for more market updates

Titan said its store addition pace was strong as well. Retail network continued the pace of expansion adding 105 stores for the quarter. Maximum addition - at 35 stores - was for its eyecare business while jewellery and watch business followed with 25 and 23 stores, respectively.

Motilal Oswal said earnings growth visibility for Titan remains strong. It has compounded earnings by about 20 percent for an elongated period of time, the broker underlined, adding the structural investment case for the stock is intact.

“In the Jewelry industry, which is organizing at a rapid space, it is clearly at the vanguard in terms of growth among organized players,” Motilal Oswal said. “Its runway for growth is long, with a market share of ~6 percent. Unlike other high-growth categories, the competitive intensity from organized and unorganized peers in Jewelry is considerably weaker.”

The broker maintained a ‘buy’ rating with a target of Rs 2,970.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.