The market gained for the second consecutive session, rising a third of a percent supported by technology, metal, select banks and auto stocks, on October 6, but there was a bit of volatility in the last couple of hours of trade.

The BSE Sensex climbed 157 points to 58,222, while the Nifty50 rose 58 points to 17,332 and formed a bearish candle on the daily charts as the closing was lower than the opening levels.

"A small negative candle was formed on the daily chart with an upper shadow. Technically, this pattern indicates a breather type formation post sharp upside bounce from the lower supports of 16,800 levels recently," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Shetti feels the short-term uptrend of Nifty remains intact and there is a possibility of minor consolidation in the next 1-2 sessions around the hurdle of 17,400-17,500 levels before showing a decisive upside breakout of the said resistance. Immediate support is placed at 17,220 levels, the analyst said.

The broader markets also extended gains and performed much better than benchmark indices. The Nifty Midcap 100 and Smallcap 100 indices rose more than 1.2 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,289, followed by 17,246. If the index moves up, the key resistance levels to watch out for are 17,402 and 17,472.

The Nifty Bank gained 173 points to close at 39,283 and formed Doji kind of pattern on daily scale on October 6. The important pivot level, which will act as crucial support for the index, is placed at 39,141, followed by 38,999. On the upside, key resistance levels are placed at 39,517 and 39,750 levels.

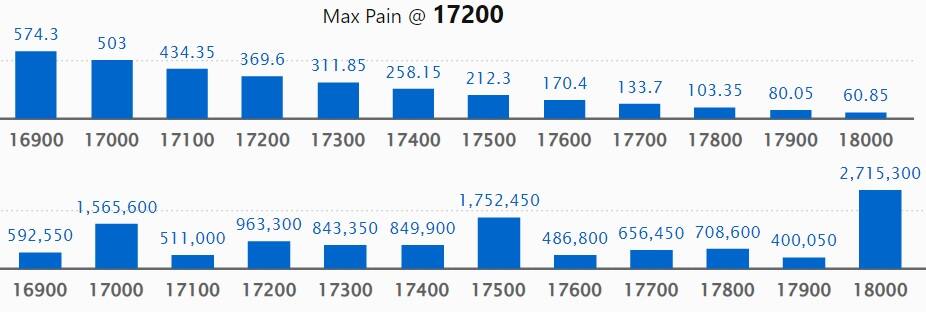

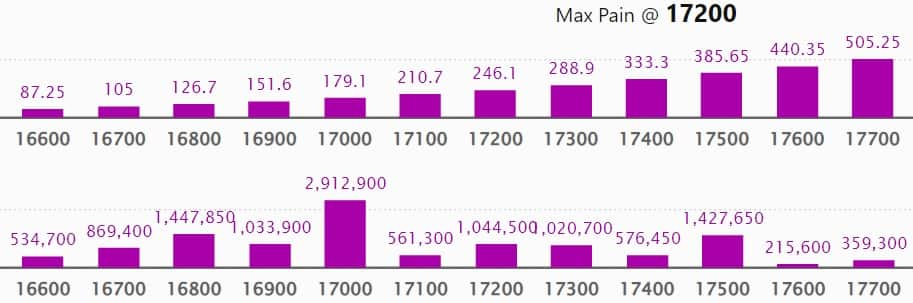

Maximum Call open interest of 27.15 lakh contracts was seen at 18,000 strike, which can act as a crucial resistance level in the October series.

This is followed by 17,500 strike, which holds 17.52 lakh contracts, and 18,000 strike, which has 16.56 lakh contracts.

Call writing was seen at 17,400 strike, which added 4.32 lakh contracts, followed by 18,400 strike which added 2.68 lakh contracts, and 17,500 strike which added 1.25 lakh contracts.

Call unwinding was seen at 18,000 strike, which shed 1.04 lakh contracts, followed by 17,000 strike which shed 75,050 contracts and 17,200 strike which shed 56,050 contracts.

Maximum Put open interest of 29.96 lakh contracts was seen at 16,000 strike, which can act as a crucial support level in the October series.

This is followed by 17,000 strike, which holds 29.12 lakh contracts, and 16,500 strike, which has accumulated 26.11 lakh contracts.

Put writing was seen at 17,300 strike, which added 3.74 lakh contracts, followed by 17,000 strike, which added 3.66 lakh contracts, and 17,400 strike which added 3.63 lakh contracts.

Put unwinding was seen at 16,100 strike, which shed 41,600 contracts, followed by 16,200 strike which shed 39,950 contracts and 17,100 strike which shed 34,000 contracts.

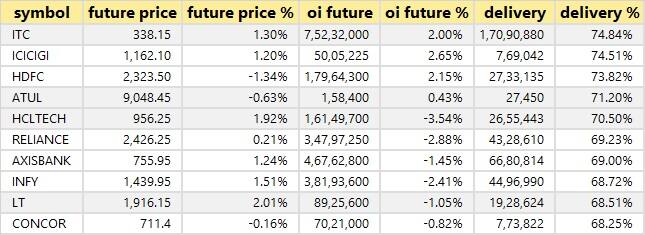

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in ITC, ICICI Lombard General Insurance, HDFC, Atul, and HCL Technologies, among others.

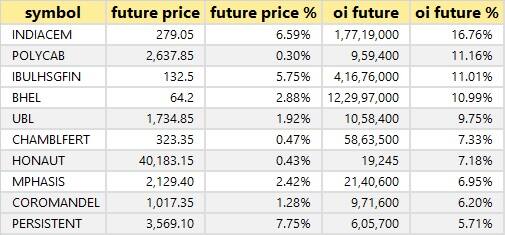

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including India Cements, Polycab India, Indiabulls Housing Finance, BHEL, and United Breweries.

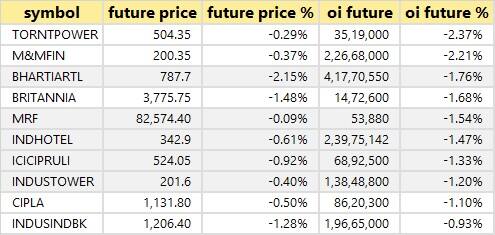

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Torrent Power, M&M Financial Services, Bharti Airtel, Britannia Industries, and MRF, in which long unwinding was seen.

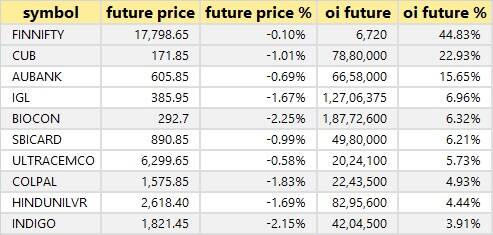

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including Nifty Financial, City Union Bank, AU Small Finance Bank, Indraprastha Gas, and Biocon.

60 stocks witnessed short-covering

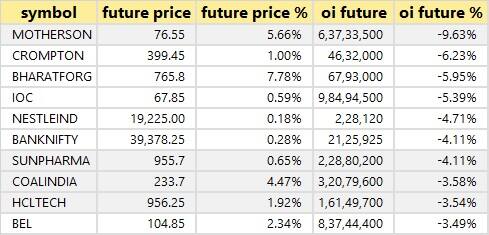

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks, in which short-covering was seen including Motherson Sumi, Crompton Greaves Consumer Electrical, Bharat Forge, Indian Oil Corporation, and Nestle India.

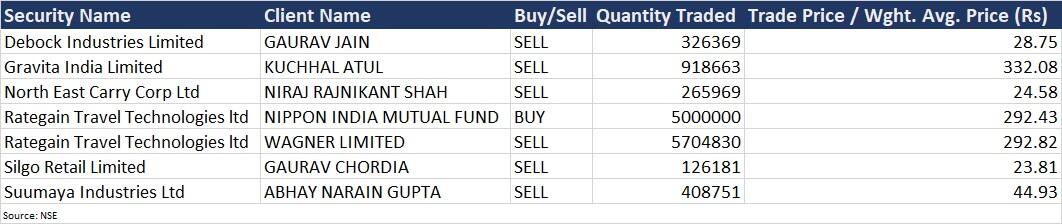

Gravita India: Investor Kuchhal Atul sold 9,18,663 equity shares in the company via open market transactions. These shares were sold at an average price of Rs 332.08 per share.

Rategain Travel Technologies: Nippon India Mutual Fund acquired 50 lakh shares in the company at an average price of Rs 292.43 per share, however, Wagner sold 57,04,830 shares at an average price of Rs 292.82 per share.

(For more bulk deals, click here)

Investors Meetings on October 7

Tata Motors: Officials of the company will interact with Millennium, and Ashmore UK.

Tips Industries: Officials of the company will interact with analysts and investors.

Jindal Steel & Power: Officials of the company will meet ICICI Prudential Life Insurance, Kotak Mutual Fund, DSP Mutual Fund, Mirae Asset Management, Goldman Sachs Asset Management, IDFC Mutual Fund, and SBI Mutual Fund.

Stocks in News

Equitas Small Finance Bank: The small finance bank clocked 20% year-on-year growth in provisional gross advances at Rs 22,802 crore for the quarter ended September FY23. Deposits also grew by 20% YoY to Rs 21,726 crore during the same quarter, while CASA ratio improved to 48.13% in Q2FY23, up from 45.31% in year-ago period, while cost of funds declined to 6.25%, from 6.81% in corresponding period last fiscal.

NTPC: The country's largest power generation company has collaborated with GE Gas Power to reduce carbon intensity at its Kawas gas power plant in Gujarat. Both companies signed a Memorandum of Understanding (MoU) for feasibility to demonstrate of hydrogen (H2) co-firing blended with natural gas in GE’s 9E gas turbines installed at NTPC’s Kawas combined-cycle gas power plant in Gujarat. NTPC's Kawas gas power plant is powered by four GE 9E gas turbines operating in a combined-cycle mode and has an installed capacity of 645 megawatt (MW).

Indian Hume Pipe Company: The company has received Letter of Acceptance for the work of Rs 194.03 crore from Maharashtra Jeevan Pradhikaran Division, Buldhana, Maharashtra, under Jal Jeevan Mission Project for Jalgaon Jamod 150 Villages Regional Rural Water Supply Scheme. The project is to be completed within 24 months with a trail run for 12 months after completion of project.

Quess Corp: The company has entered into definitive agreements to divest its 53% stake in subsidiary Simpliance Technologies, to Aparajitha Corporate Services, a HR compliance services company. The deal is valued at an enterprise value of Rs 120 crore, on a cash and debt free basis.

Dabur India: The company said India business had a steady performance & is expected to report revenue growth in mid-single digits, while international business is expected to post double-digit revenue growth in constant currency. Hence, consolidated revenue is expected to grow at mid-single digit. Its food & beverages vertical continued with robust double-digit growth on a high base of 43% growth in Q2FY22, while home & personal care portfolio is expected to record mid-single digit growth on a high base of 16.7% growth in Q2FY22. During the quarter ended September FY23, inflation was at peak levels which impacted gross margins, and operating margin in Q2FY23 is expected to be lower by around 150-200 bps versus Q2FY22.

FSN E-Commerce Ventures: Beauty and lifestyle retailer Nykaa has signed strategic partnership with Middle East-based retailer Apparel Group. The company with Apparel Group will recreate omnichannel beauty retail platform in the Gulf Cooperation Council (GCC). Apparel Group has more than 75 brands with over 2,000 stores across 14 countries.

Titan Company: The company witnessed healthy double-digit growth across most businesses with overall sales growing 18% YoY. The company has continued its retail network expansion with addition of 105 stores (net) for the quarter ended September FY23. Its jewellery division grew by 18% YoY on a high base of Q2FY22, while watches & wearables segment clocked 20% growth YoY. Subsidiary Titan Engineering & Automation registered 139% YoY growth with automation solutions division reporting 240% YoY growth, and aerospace and defence division clocking 66% growth. Another subsidiary Caratlane reported 56% YoY growth in busines driven by promotions around Raksha Bandhan and hero launches during the quarter.

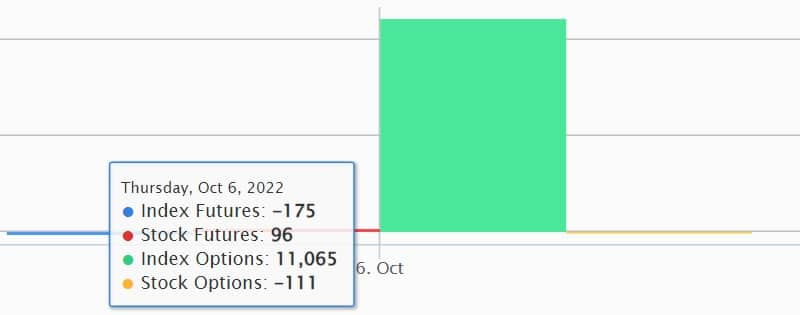

Fund Flow

Foreign institutional investors (FIIs) remained net buyers to the tune of Rs 279.01 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 43.92 crore on October 6, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock under its F&O ban list for October 7 as well. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.