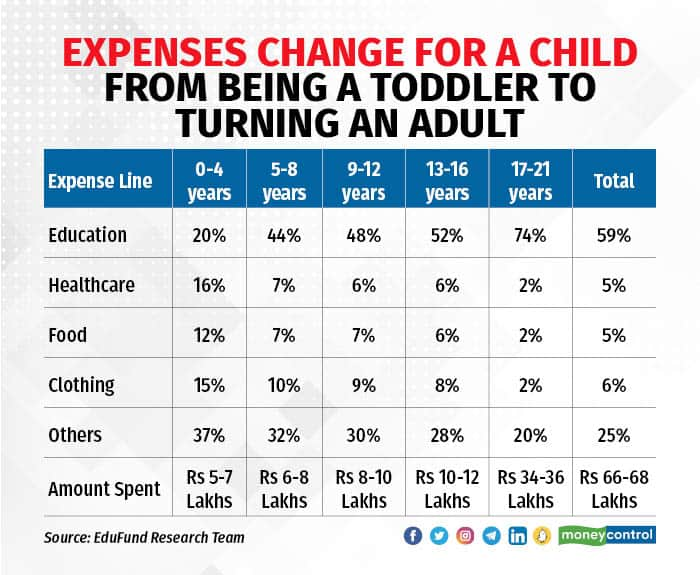

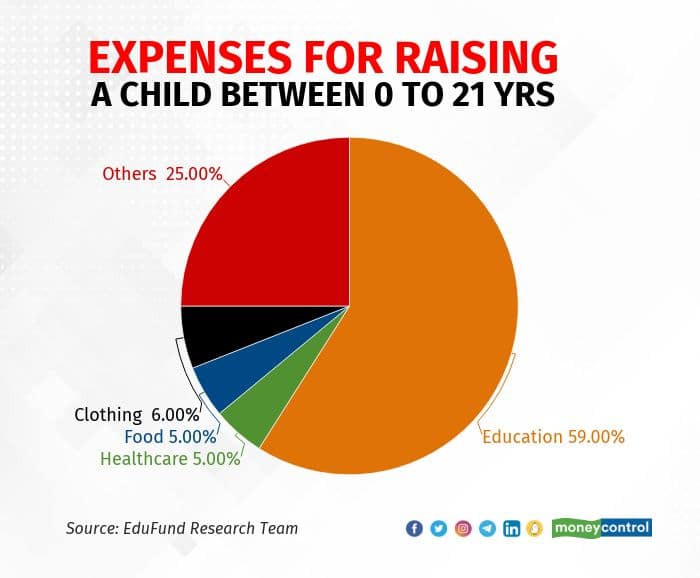

According to EduFund Research, the average person ends up spending as much as Rs 36-38 lakh raising a child from birth to 21 years of age due to multiple expenses that a parent needs to meet. The cost of these expenses – be it food, clothing, gadgets, or education — has been on the rise, with inflation at about 7 to 10 percent across categories.

As a child grows, so do expenses.

- In the initial years, the child needs special attention, hence food and healthcare expenses are on the higher side.

- When a child grows rapidly, clothing expenses are higher due to the frequent purchase of new sets of clothing.

- Education expenses increase as a child goes from school to college. Nearing adulthood, education is the biggest expense for a child. This includes all expenses related to education – tuition fees, living, books, stationery, coaching, etc.

While the expenses are alarming, the lack of awareness about how to prepare for them is even more so.

The only way to prepare is by investing in an asset class that grows faster than the inflation in education expenses. You can do this with the help of short- and long-term goals.- Short-term goals are ones that can be achieved in less than a year. These could be your child’s immediate school or tuition fees.

- Long-term goals are those where time is on your side, and you have a few years to accumulate the required corpus. It could be your child’s college fees, or any other education-related expense that is likely to come up in due course of time.Achieving short-term goals

When a child starts going to school or college, there are many expenses besides school fees. For example, fees for additional courses, the cost of a laptop, etc. All these expenses are essential and need to be fulfilled. But often, these are overlooked. If we plan for these properly and save effectively, our goals can be achieved per our means.

Let us assume you plan to save for your child’s school fees. It is a short-term goal where you accumulate the corpus in a year’s time to be used during the next academic year.

Say you are looking to save Rs 1.25 lakh for your child’s school fees, and you have one year for the same. You need to find out the right investment vehicle to invest your savings to achieve your target.

To achieve this, you need to invest in a mutual fund with high liquidity and safety, along with capital appreciation. Debt funds are the best option for such short-term goals as they are significantly less volatile. You can start a mutual fund SIP of Rs 10,000 a month for a year. That way, you will invest Rs 1.2 lakh over 12 months and get Rs 1.25 lakh by the time your goal matures.

Achieving long-term goals

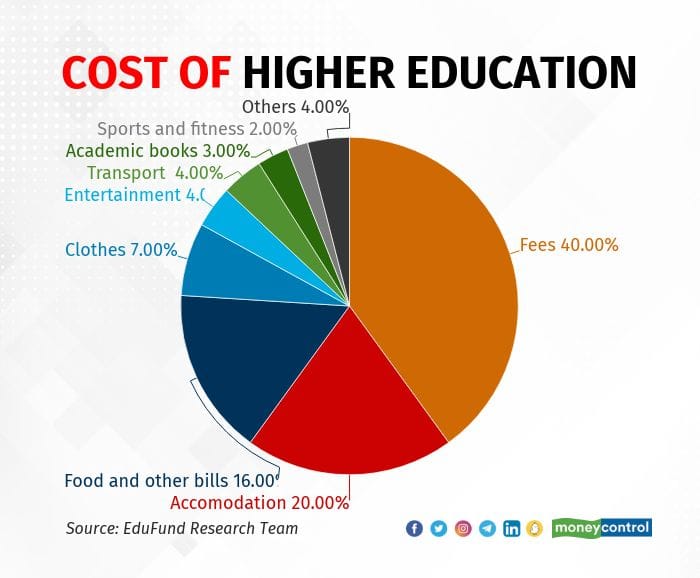

Higher education expenses can be very high. Apart from fees, there are expenses like accommodation, utility bills, clothes, books, food, groceries, transport, etc. Fees account for only 40 percent of the expenses.

Education accounts for 74 percent of the Rs 36-38 lakhs spent on average raising a child. The cost of education is rising at 10 percent per annum.

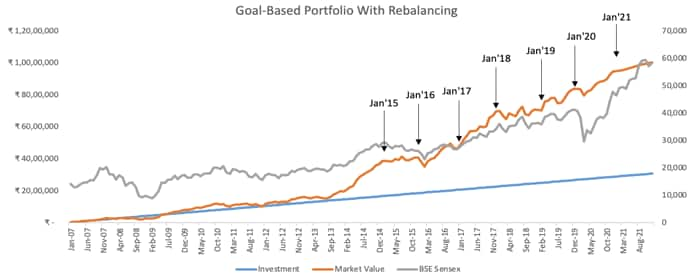

Let’s assume you need to accumulate Rs 1 crore after 15 years for your child’s education. To achieve this goal, you need to start a SIP of Rs. 15,000 per month. If it grows by 15 percent accordingly annually, that will help you achieve your corpus amount.

You should start your investment journey as early as possible so that you have time by your side. Compounding benefits will help you accumulate your corpus even with a smaller monthly contribution.

For longer horizon expenses such as higher education costs, the ideal way to invest is to start with high-risk funds and accumulate wealth as long as possible, and then move to capital protection as you reach closer to the goal.

Stages to long-term goal-based investing

1. Accumulation Phase: at this stage, an investor's risk appetite is high. This is the stage where capital grows at a much higher rate. Here, the investment faces high volatility, and the gains are also good. Higher reward, higher risk.

2. Capital protection phase: in this phase, the capital / wealth shifts from aggressive allocation to safer funds like a balanced advantage, conservative hybrid, etc. Debt funds are included to reduce the volatility of the portfolio.

The aim is to preserve the gains, maintain liquidity, and beat inflation.

Stages to short-term goal-based investing

In these goals, you would not have an accumulation phase as risk tends to be low owing to a lower duration of less than one year.

Conclusion

Define your short-term and long-term goals, and start saving and investing as early as possible. The investment strategy for both types of goals will be different. But goal-based investing will make your life easier.