Poonawalla Fincorp is a Cyrus Poonawalla group-promoted non-deposit-taking systemically important non-banking finance company. (Representative image)

There’s a new investment opportunity in town.

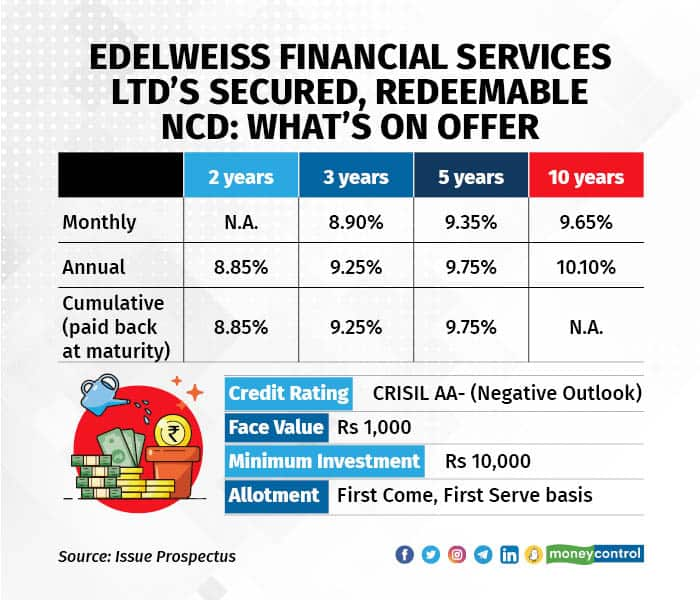

Edelweiss Financial Services Ltd has launched a new non-convertible debenture (NCD) issue. The company plans to raise Rs 400 crore via debentures of the face value of Rs 1,000 each.

Investors will have 10 options to choose from in this NCD issue, depending on the tenure and coupon rates on offer, and on how frequently they want to receive interest payments.

The NCD offers investment tenures of 24 to 120 months. Coupon rates start from 8.85% a year and go all the way up to 10.10% a year.

What’s hot

Edelweiss Financial Services Limited is part of the Edelweiss Group. The Group has a presence in several financial services businesses, from lending and asset management to wealth management and insurance. Some of its businesses are in industries such as capital markets and broking, which have persevered and come out better off since the pandemic began easing.

The company has a pan-India presence and a good brand to rely on for future growth. On a standalone basis, the financial health of this subsidiary seems decent, with both revenue and the balance sheet expanding many times over from FY20 to FY 22.

Edelweiss Financial Services, through its 29 subsidiaries, offers lending, asset management, asset reconstruction, insurance, and wealth management services.

For investors looking to add on some regular income through debt allocation, this issue offers a good interest rate at a time when bank fixed deposit rates are yet to rise in line with repo rate hikes.

The spread-out maturities mean that you can choose a tenure that suits you. The bonds will be listed, which means you have the option of exiting early if you choose to or need to.

What’s not

A large chunk of the company’s total income in FY21 and FY22 came through the sale of subsidiaries. While revenue from operations did grow 30% in FY22 over the previous year, gains from reformatting of financial information after the sale of subsidiaries, and income from those sales distorts the profitability in both years.

According to the rating agency Acuite, Edelweiss Group’s credit profile remains under pressure due to the decline in its asset quality and profitability. Hence, the group-level financial performance requires careful monitoring over the short to medium term.

The issue has been rated AA- with a negative outlook by rating agencies CRISIL and Acuite. The AA rating reflects the well-capitalized Edelweiss Group, while the negative outlook reflects concerns around its deteriorating asset quality and stressed profitability. This could lead to concerns about its ability to service the high-cost debt being raised now.

What should you do?

Long-term returns offered by this issue are attractive for investors. However, since the company is not AAA rated, the risks are a concern and cannot be ignored in the current domestic interest rate and regulatory environment. Moreover, with the threat of a global economic slowdown looming large, the financial services sector may not see the growth momentum it hopes for over the medium-term horizon.

“Investors should be mindful about the issue’s rating. In this context, despite the track record of the borrower, it’s tough to recommend the 10-year option even at a high yield. If investors want to take advantage of the higher coupon, they must be willing to accept the risk, and are better off with the 24- or 36-month bond,” says Deepak Chabbria, chief executive officer and director, Axiom Financial Services Pvt Ltd.

Returns from NCDs are fixed but not guaranteed. A lot depends on the issuing company and its financial health, as well as its ability to discharge future financial obligations. Keep in mind that this company has an investment-grade credit rating, and given the risks in its outlook, the 2-3 year option looks worth investing in. But carefully weigh the risk versus the return before committing to an investment.

These are secured NCDs. The issue opens on October 3 and closes on October 17. Allotment, however, is on a first-come, first serve basis.