Stock Market News

It was a happy Friday for the Indian market as the BSE Sensex gained more than 1,000 points on September 30 after the Reserve Bank of India, as expected, raised the repo rate by 50 basis points in its fight against inflation.

Buying was seen in most of the sectors, with banking & financial services, metal, auto and realty stocks gaining the most, helping the benchmark indices snap a seven-day losing streak.

The 30-pack Sensex rallied 1,017 points, or 1.8 percent, to 57,427, while the Nifty climbed 276 points, or 1.6 percent, to 17,094, much above its 200-day simple moving average (16,982) and formed a bullish engulfing pattern on the daily chart.

The broader market mirrored the benchmark. The Nifty midcap 100 and smallcap 100 indices gained 1.6 percent each.

"The candlestick pattern is formed while taking support of 200 days SMA. The 200 days SMA has acted as point of inflection in the past for the index which makes its very crucial for the prices," Vidnyan Sawant, AVP- Technical Research, GEPL Capital, said.

The momentum indicator relative strength index (RSI) was below 50 levels, indicating overall bearish momentum in the short to medium term.

The chart pattern and indicator setup signal that the Nifty will continue its corrective move and if it slips below 16,747, then it will move down towards 16,653 in the coming future.

"Our corrective view would be negated if we see prices sustaining above the level of 17,291 levels," Sawant said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is 16,832, followed by 16,570. If the index moves up, the key resistance levels to watch out for are 17,272 and 17,449.

The Nifty Bank rallied 984 points, or 2.6 percent, to 38,632 and formed a bullish engulfing candlestick pattern on the daily scale on September 30. The important pivot level that will act as crucial support is 37,742, followed by 36,852. On the upside, key resistance levels are 39,166 and 39,701.

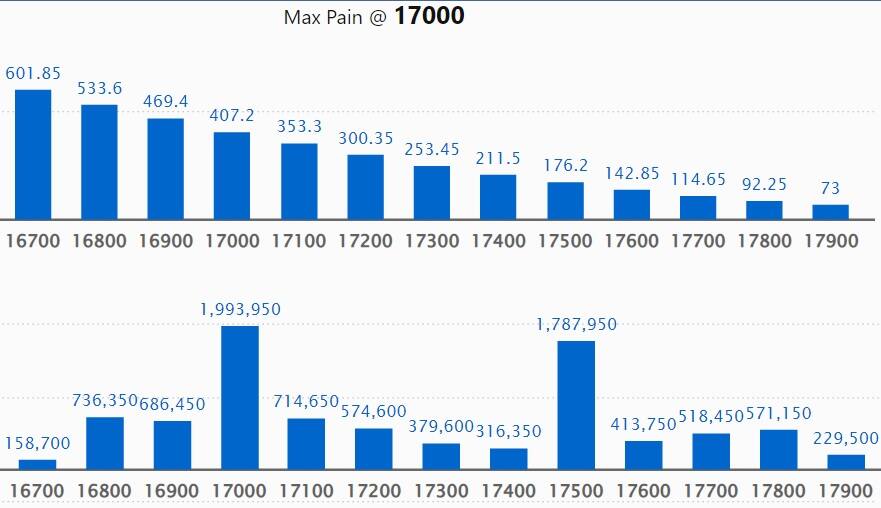

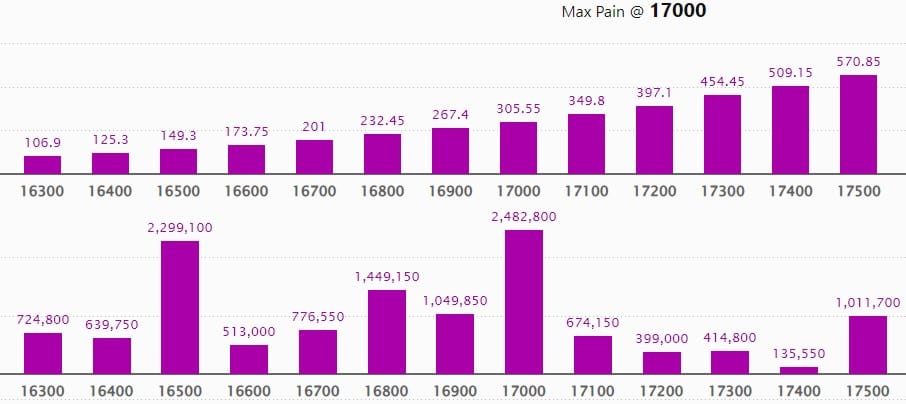

Maximum Call open interest of 24.52 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the October series.

This is followed by 17,500 strike, which holds 17.87 lakh contracts, and 17,000 strike, which has 19.93 lakh contracts.

Call writing was seen at 17,100 strike, which added 2.91 lakh contracts, followed by 17,500 strike that added 2.35 lakh contracts and 17,200 strike ,which added 1.5 lakh contracts.

Call unwinding was seen at 16,900 strike, which shed 80,100 contracts, followed by 16,500 strike that shed 19,550 contracts and 17,600 strike that shed 12,900 contracts.

Maximum Put open interest of 26.1 lakh contracts was seen at 16,000 strike, which will act as crucial support in the October series.

This is followed by 17,000 strike, which holds 24.82 lakh contracts, and 16,500 strike that has accumulated 22.99 lakh contracts.

Put writing was seen at 17,100 strike, which added 2.92 lakh contracts, followed by 16,800 strike that added 2.72 lakh contracts and 16,700 strike, which accumulated 1.52 lakh contracts.

Put unwinding was seen at 17,400 strike, which shed 17,200 contracts, followed by 17,500 strike that shed 16,250 contracts and 18,000 strike that shed 13,050 contracts.

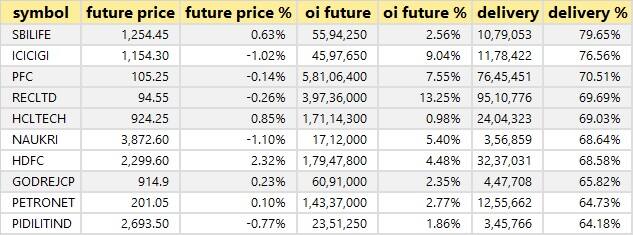

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in a stock. The highest delivery was seen in SBI Life Insurance, ICICI Lombard General Insurance, PFC, REC, and HCL Technologies among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen:

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, Mahanagar Gas, Max Financial Services and Abbott India saw long unwinding.

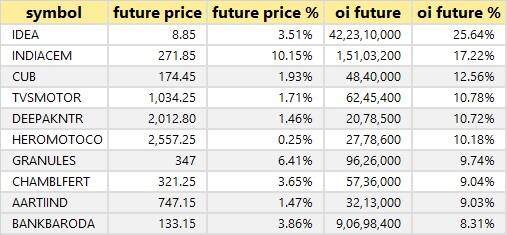

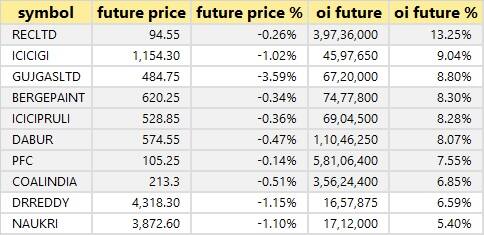

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

50 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen:

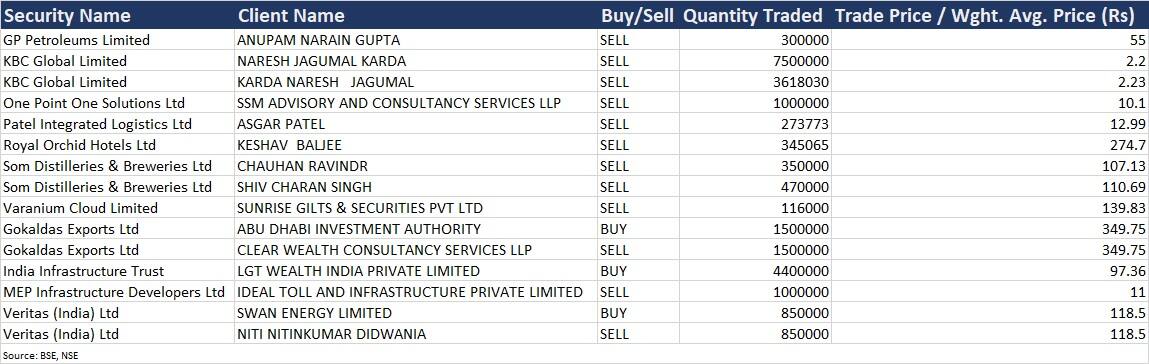

Royal Orchid Hotels: Promoter Keshav Baljee sold 3,45,065 equity shares, or 1.25 percent, stake in the company via open market transactions at an average price of Rs 274.7 per share.

Gokaldas Exports: Abu Dhabi Investment Authority acquired 15 lakh equity shares in the company at an average price of Rs 349.75 a share. Clear Wealth Consultancy Services LLP sold 15 lakh shares at the same price.

Veritas (India): Promoter Niti Nitinkumar Didwania offloaded 8.5 lakh shares, or 3.17 percent stake, in the company through open market transactions at an average price of Rs 118.5 a share. Swan Energy was the buyer of those shares. In September, Niti Nitinkumar Didwania sold a 9.73 percent stake against his 57.49 percent stake as of June 2022, and Swan Energy acquired those shares.

(For more bulk deals, click here)

Investors Meetings on October 3

Raymond: The management will meet certain institutional investors in London.

Stocks in News

APL Apollo Tubes: The steel tube maker registered the highest quarterly sales volume of 6.02 lakh tonnes in Q2FY23, up 41 percent YoY and growing 42 percent sequentially. The sales volume for the first half of FY23 was 10.25 lakh tonnes compared to 8 lakh tonnes in the same period last year. In the second half of FY23, the sales volume would get further boost from the commissioning and ramp-up of the new Raipur plant, the company said.

Eicher Motors: VE Commercial Vehicles, an unlisted material subsidiary of the company, sold 6,631 vehicles in September 2022, up 9.2 percent from 6,070 units sold in the year-ago period. In the first half of FY23, it registered a 67.6 percent YoY growth in sales at 35,085 vehicles.

Escorts Kubota: Escorts Kubota said its agri machinery segment sold 12,232 tractors in September 2022, registering a growth of 38.7 percent as against 8,816 tractors sold in the same month last year. Domestic tractor sales increased 42.7 percent percent to 11,384 units and export sales grew 0.8 percent to 848 tractors compared to the year-ago period.

Zydus Lifesciences: Zydus Lifesciences has received approval from the United States Food and Drug Administration to market Sildenafil, a high blood pressure drug. It works by relaxing and widening the blood vessels in lungs, which allows the blood to flow more easily. The drug will be manufactured at the group’s facility at Baddi, Himachal Pradesh. The drug had annual sales of $65 million in the United States, according to IQVIA data of August 2022.

Poonawalla Fincorp: Care Ratings has upgraded the long-term rating of Poonawalla Fincorp and its subsidiary, Poonawalla Housing Finance (PHFL) to 'AAA' with a stable outlook. This rating is applicable for bank loan facilities, non-convertible debentures, market-linked debentures and subordinated debt.

Spandana Sphoorty Financial: Crisil has removed the company from "watch with developing implications" and reaffirmed rating as 'A' with a stable outlook for bank loan facilities worth Rs 3,500 crore.

Likhitha Infrastructure: The company has received orders worth Rs 177 crore from various oil & gas distribution companies during the quarter ended September 30, 2022. The total outstanding order book of the company as on September 2022 is Rs 1,125 crore.

Dilip Buildcon: The company received a provisional completion certificate for rehabilitation and up-gradation from two to four lane for Varanasi - Dagamagpur section of the National Highway-7 on EPC mode in Uttar Pradesh. With this, the authority declared the project fit for entry into commercial operation on September 29.

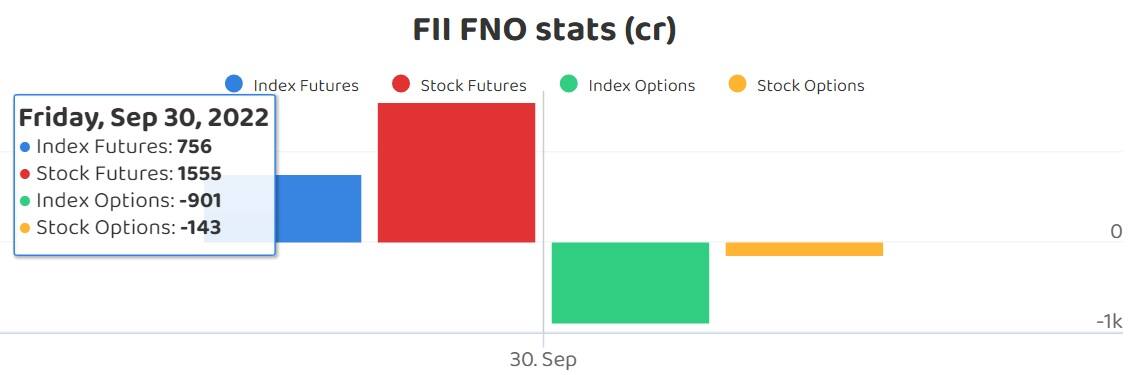

Fund Flow

Foreign institutional investors (FIIs) net sold shares worth Rs 1,565.31 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 3,245.45 crore on September 30, as per provisional NSE data.

Stocks under F&O ban on NSE

The National Stock Exchange has not added a single stock under its F&O ban list for October 3.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.