- News

- City News

- rajkot News

- Ban, recession push Gujarat fish exports down by 35%

Ban, recession push Gujarat fish exports down by 35%

Reduced purchasing powers of consumers in European countries is a major reason for declining exports, says sea food exporters

RAJKOT: While the nets are cast for fresh catch, sea food export from Gujarat is in doldrums — down by 30 to 35% in the beginning of the fish season itself — thanks to inflation, recession in Europe and the US and a weak euro against the dollar.

Reduced purchasing powers of consumers in European countries is a major reason for declining exports, says sea food exporters. Factors like devaluation of euro, high energy price, average electricity bill per household going by five to seven times besides various other economical reasons have had an adverse impact on the Indian exporters as well.

High-end varieties like cuttlefish, pomfrets, lobsters and jumbo shrimps go to the European market. But fish has now become an exotic item in the European market thus diverting the fish eaters to find alternative source of protein owing to the rocketing prices of sea food.

High-end varieties like cuttlefish, pomfrets, lobsters and jumbo shrimps go to the European market. But fish has now become an exotic item in the European market thus diverting the fish eaters to find alternative source of protein owing to the rocketing prices of sea food.

The average cost of fish in Europe is 12 euro per kilo.

Gujarat’s sea food export market depends on China, Europe and USA. China accounts for 40% export while Europe accounts for 30% export. And therefore, Gujarat’s exporters are still far away from pre-Covid levels in export figures to China.

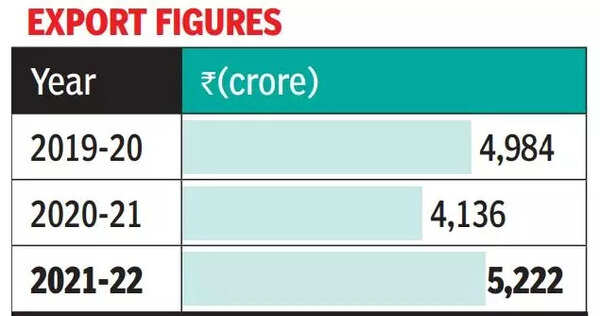

Veraval town in Gir Somnath district, which has over 100 fish processing units, commands yearly export to the tune of Rs 5,000 crore.

President of Seafood Exporters Association of India (SEAI), Jagdish Fofandi told TOI, “The impact of world recession has started from Europe. High fuel cost and energy cost because of war between Russia and Ukraine resulted in high inflation. We fear that it will wipe out our growth in exports in the last several years.”

The US to has declined import owing to inflation, unemployment and several other trade-related problems.

Again, Ecuador and Vietnam get preferential tariff in USA because of trade agreements and also the shipping charge is lower compared to India due to its proximity.

Kenny Thomas, a leading exporter who exports exclusively in the European market, said, “I have been in this business for the past 35 years but found this year to be one of the slowest. My inventory is 20% higher than last year. I believe that if the demand doesn’t pick up in Europe and China, exporters’ inventory will be 50% higher compared to last year by the end of December.”

The export to China has yet not picked up.

Chinese authorities had banned several Indian fish exporters companies including 40 from Veraval after they reported dead nucleic acid material on the outer side of packing when Covid was at peak. The ban is yet to be lifted.

“The situation in China improved and shipment has become smooth but the ban on Indian companies imposed during Covid has not been lifted. Fifty percent of units of Gujarat exporting only to China are facing the heat,” Fofandi added.

Reduced purchasing powers of consumers in European countries is a major reason for declining exports, says sea food exporters. Factors like devaluation of euro, high energy price, average electricity bill per household going by five to seven times besides various other economical reasons have had an adverse impact on the Indian exporters as well.

The average cost of fish in Europe is 12 euro per kilo.

Gujarat’s sea food export market depends on China, Europe and USA. China accounts for 40% export while Europe accounts for 30% export. And therefore, Gujarat’s exporters are still far away from pre-Covid levels in export figures to China.

Veraval town in Gir Somnath district, which has over 100 fish processing units, commands yearly export to the tune of Rs 5,000 crore.

President of Seafood Exporters Association of India (SEAI), Jagdish Fofandi told TOI, “The impact of world recession has started from Europe. High fuel cost and energy cost because of war between Russia and Ukraine resulted in high inflation. We fear that it will wipe out our growth in exports in the last several years.”

The US to has declined import owing to inflation, unemployment and several other trade-related problems.

Again, Ecuador and Vietnam get preferential tariff in USA because of trade agreements and also the shipping charge is lower compared to India due to its proximity.

Kenny Thomas, a leading exporter who exports exclusively in the European market, said, “I have been in this business for the past 35 years but found this year to be one of the slowest. My inventory is 20% higher than last year. I believe that if the demand doesn’t pick up in Europe and China, exporters’ inventory will be 50% higher compared to last year by the end of December.”

The export to China has yet not picked up.

Chinese authorities had banned several Indian fish exporters companies including 40 from Veraval after they reported dead nucleic acid material on the outer side of packing when Covid was at peak. The ban is yet to be lifted.

“The situation in China improved and shipment has become smooth but the ban on Indian companies imposed during Covid has not been lifted. Fifty percent of units of Gujarat exporting only to China are facing the heat,” Fofandi added.

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE

Start a Conversation

end of article