Fixed income strategists were all ears when Reserve Bank of India governor Shaktikanta Das announced the outcome of the Monetary Policy Committee meeting.

The MPC decided to hike the repo rate by 50 basis points and fixed income investors breathed easy. There were no surprises and, more importantly, no hawkish tone as seen in statements by the US Federal Reserve. Does it mean it is time to revisit investments in debt funds?

What changed today?

The hike lifts the repo rate to 5.9 percent and the standing deposit facility rate – at which the RBI pays interest to commercial banks – gets adjusted to 5.65 percent. In anticipation of the repo rate hike following the US Fed rate hike of 75 basis points, yields on treasury bills and government bonds climbed up a couple of days ago. Short-term rates are expected to continue following the direction given by the MPC.

The MPC reiterated that the 5 percent inflation projected for the first quarter of FY24 is well within the tolerance band of 2 percent below and above the target of 4 percent.

Signs of recession in developed nations have brought down crude oil prices on expectations of lower demand. Crude oil prices, a key variable for imported inflation in India, trades at $88 per barrel compared to $139 in March.

Market participants took a cue from the governor’s commentary and the 10-year benchmark bond yield traded almost flat at about 7.38 percent.Simply put, the RBI may be less keen on hiking interest rates aggressively as inflation cools.

The short and long of debt funds

Yield movements tend to impact the net asset values of debt funds. Long-duration bond prices see the adverse impact of rising bond yields.

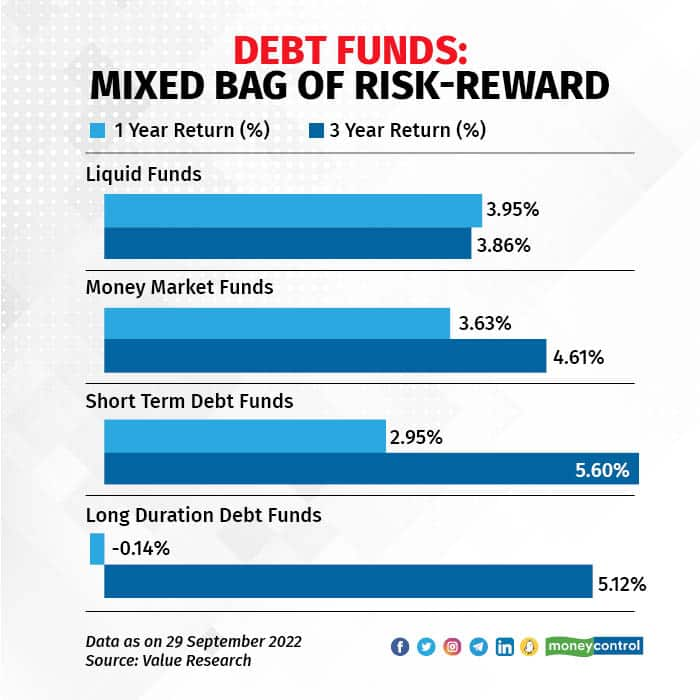

In the current calendar year, among open-ended debt schemes, liquid funds emerged as the best-performing category with 3.08 percent returns. Since these schemes invest in money market instruments maturing in up to 91 days, they tend to benefit from rising short-term rates with minimum adverse impact of rising interest rates.

Marzban Irani, chief investment officer for debt at LIC Mutual Fund, says, “We expect RBI to raise the repo rate by 25 to 50 basis points in the near term to protect the currency as the US Fed is aggressively hiking rates and inflation is yet to come down meaningfully.”

If repo rates are hiked further, then it would be supportive of liquid and other very short-term rate focused debt funds. Liquid funds and ultra-short debt funds remain better placed as short-term parking space for money, given the relatively lower interest rates on offer for bank fixed deposits of similar tenures.

Though liquid funds have done well so far, long-duration products are at the other extreme. In the current financial year, debt funds investing in gilt with 10-year constant maturity have lost the most: 1.04 percent.

Though investors have remained cautious of long-duration products, fearing steep interest rate hikes, things could change soon. Market participants have factored in the possibility of the interest rate hiking cycle ending soon. Experts indicated the time is ripe for a serious look at long-duration schemes.

Vikram Dalal, founder of Synergee Capital Services, recommends investments in long-duration debt funds in a staggered manner.

“There is a possibility of a maximum couple of more rate hikes of 25 basis points each and the RBI has indicated inflation at 5 percent in FY24, which will be within its tolerance limit. If the RBI pauses the rate hike cycle next year and decides to cut rates subsequently, then there could be very good risk-adjusted returns for investors in long-duration schemes,” he explained.

Though the case for investments in long-term bonds is getting built slowly, experts are keen on taking calculated risks.

“Aggressive monetary tightening in advanced economies will continue to weigh on domestic monetary policy. It would be difficult for the RBI to soften its stance in such a hostile global environment,” said Pankaj Pathak, fund manager-fixed income, at Quantum AMC. “The RBI guided to keep banking system liquidity near neutral through variable rate repos and reverse repos. This should support short-term bonds, though longer-tenure bonds may face some pressure in the absence of OMO purchases by the RBI.”

Pathak expects the 10-year benchmark bond yield to continue to trade in a range of 7.2 percent-7.6 percent and recommends that long-term fixed income investors put their money in dynamic bond funds in this volatile market environment for a 2-3 year investment horizon.

Target maturity funds (TMF) too can be considered by investors keen on investing for a long duration with some visibility on returns.

“Investors in TMF tend to benefit from rolldown maturity portfolios when interest rates are high as they are now,” said Deepak Panjwani, head-debt of markets at GEPL Capital. “These schemes potentially give higher returns than the fixed deposit along with the indexation benefit if held for more than three years.”

What should you do?

The best thing to do is to take advantage of the high rates available in both short-term and long-term debt funds compared to bank fixed deposits. However, do not take decisions based purely on the potential of returns.

The holding period should ideally match the duration of the debt fund. For a three-month timeframe, a liquid fund makes sense. For one year, a money market fund can be considered.

“It is a good time to invest in long-duration schemes provided you are willing to hold on to them for a minimum of three years,” Irani said.It’s the ideal tenure not just for investing – debt funds also have a tax advantage if held for at least three years as they carry a lower capital gains tax and offer indexation benefits.

While short-term debt funds may not be too risky at this moment and a couple of more rate hikes are expected, investors have to be extra careful with their investments in long-duration schemes.

“Do not invest all your money at one go now in long-duration funds. The risks around foreign factors such as rate actions by policymakers in the US, increased volatility in the financial markets in developed nations, and rising geo-political tensions pushing up crude oil prices, along with domestic factors such as the depreciating rupee, sticky inflation, and current account deficit can invite volatility in the bond market,” Dalal said.