The market put up a major disappointing performance for yet another session on September 26 as the benchmark indices plunged more than 1.6 percent tracking a correction in global peers amid mounting recession fears. The significant selling by FIIs and depreciation in currencies against the US dollar also weighed on sentiment.

The BSE Sensex tanked 954 points to 57,145, while the Nifty50 plunged 311 points to 17,016 and formed a bearish candlestick pattern on the daily charts.

"A long bear candle was formed on the daily chart with an opening downside gap. Technically, this market action indicates a sharp down-trended movement in the market. Though Nifty declined sharply by around 1,000 points from the high of 18,000 levels, still there is no confirmation of any buying emerging from the lows," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He feels the short-term trend of the Nifty is sharply down, and the weakness is expected to continue for the next 1-2 sessions. The lower support area of 16,800 is expected to offer a base for the market in the short term, the market expert said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,931, followed by 16,845. If the index moves up, the key resistance levels to watch out for are 17,149 and 17,282.

The Nifty Bank also witnessed major selling pressure, falling 930 points to 38,616 and formed a bearish candle on the daily charts with lower low lower high formation for a fourth consecutive session on September 26. The important pivot level, which will act as crucial support for the index, is placed at 38,329, followed by 38,042. On the upside, key resistance levels are placed at 39,066 and 39,516 levels.

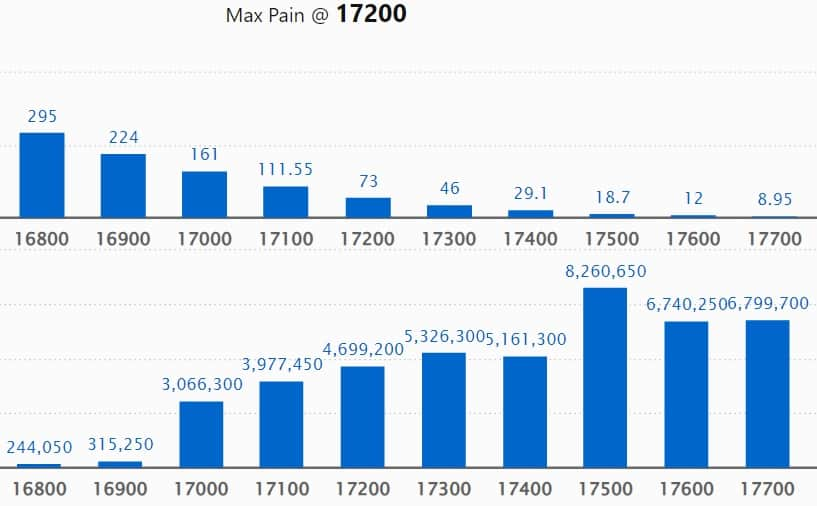

Maximum Call open interest of 1.03 crore contracts was seen at 18,000 strike, which will act as a crucial resistance level in the September series.

This is followed by 17,500 strike, which holds 82.6 lakh contracts, and 19,000 strike, which has 70.89 lakh contracts.

Call writing was seen at 17,200 strike, which added 43.54 lakh contracts, followed by 17,100 strike which added 37.74 lakh contracts, and 17,300 strike which added 37.68 lakh contracts.

Call unwinding was seen at 18,200 strike, which shed 15.79 lakh contracts, followed by 18,300 strike which shed 14.78 lakh contracts, and 18,400 strike which shed 12.65 lakh contracts.

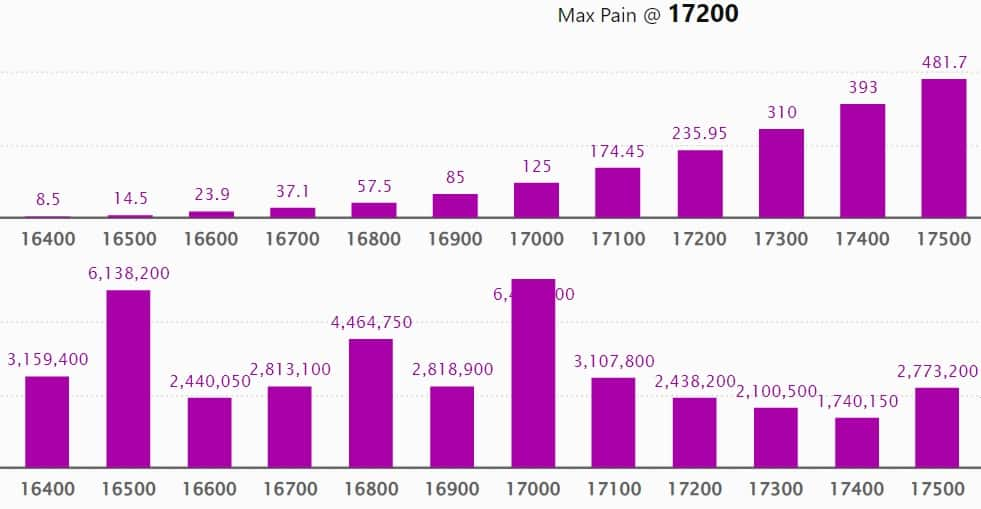

Maximum Put open interest of 72.44 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the September series.

This is followed by 17,000 strike, which holds 64.97 lakh contracts, and 16,500 strike, which has accumulated 61.38 lakh contracts.

Put writing was seen at 16,500 strike, which added 16.85 lakh contracts, followed by 16,000 strike, which added 14.27 lakh contracts, and 17,000 strike which added 13.37 lakh contracts.

Put unwinding was seen at 17,300 strike, which shed 16.1 lakh contracts, followed by 17,400 strike which shed 12.86 lakh contracts and 17,500 strike which shed 11.89 lakh contracts.

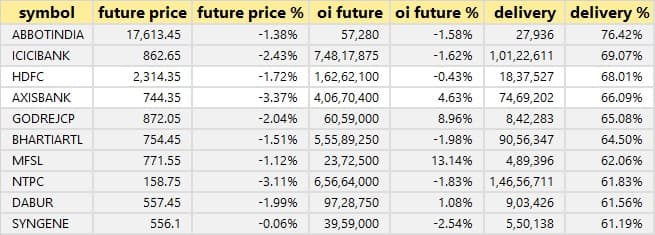

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Abbott India, ICICI Bank, HDFC, Axis Bank, and Godrej Consumer Products, among others.

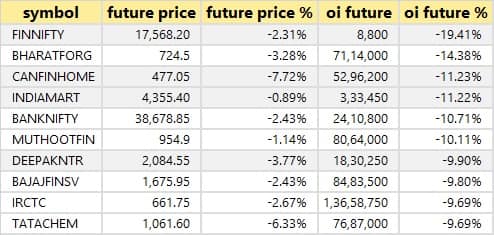

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Bharat Forge, Can Fin Homes, IndiaMART InterMESH, and Bank Nifty, in which long unwinding was seen.

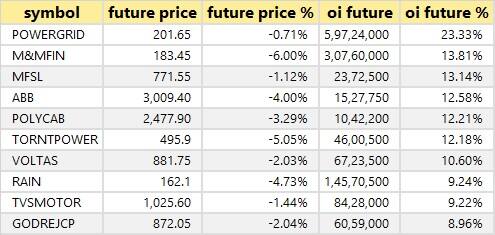

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, the top 10 stocks in which a short build-up was seen include Power Grid Corporation of India, M&M Financial Services, Max Financial Services, ABB India, and Polycab India.

17 stocks witnessed short-covering

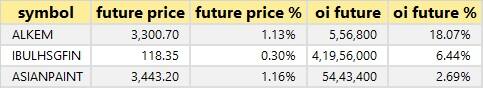

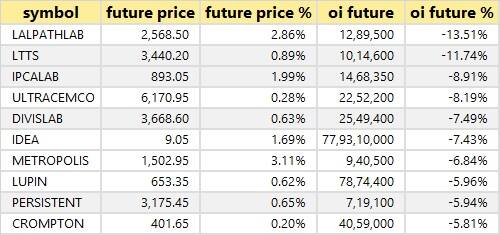

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks, in which short-covering was seen including Dr Lal PathLabs, L&T Technology Services, Ipca Laboratories, UltraTech Cement, and Divis Laboratories.

Mastek: Smallcap World Fund Inc acquired 5,49,676 equity shares in the company via open market transactions. These shares were bought at an average price of Rs 1,759.97 per share. However, Hornbill Orchid India Fund sold 4,29,086 shares in the company at an average price of Rs 1,760.01 per share.

(For more bulk deals, click here)

Investors Meetings on September 27

PI Industries, Blue Star: Officials of companies will meet Phillip Capital.

Shoppers Stop: Officials of the company will be meeting with representatives of HDFC Mutual Fund.

AXISCADES Technologies: Officials of the company will be interacting with several analysts and investors.

Syngene International: Officials of the company will be interacting with Alliance Bernstein LP, Creaegis Advisors LLP, Fidelity Investments, OrbiMed Advisors India, Wellington Management, and Goldman Sachs.

One 97 Communications (Paytm): Officials of the company will be interacting with institutional investors and analysts in Abu Dhabi & Dubai.

Safari Industries (India): Officials of the company will interact with Tantallon Capital.

Metro Brands: Officials of the company will interact with Kotak Securities and Enam AMC.

Remsons Industries: Officials of the company will interact with Augmenta Research, and iWealth Management.

Punjab National Bank: Officials of the company will interact with Moon Capital Management.

ISGEC Heavy Engineering: Officials of the company will interact with UTI Mutual Fund.

Royal Orchid Hotels: Officials of the company will meet Svan Investments.

Stocks in News

Embassy Office Parks REIT: Blackstone Inc is slated to sell 7.7 crore units of Embassy REIT worth Rs 2,650 crore via block deals on September 27, CNBC Awaaz reported citing sources. The offer price of the block deal stands at Rs 345 per unit.

Mahindra Logistics: The company has entered into a Business Transfer Agreement with Rivigo Services and its promoter for acquisition of its B2B express business, as a going concern, on slump sale basis. The transaction cost is Rs 225 crore and the acquisition will be completed by November 1, 2022.

Jyoti Structures: The company has secured a contract from Sterlite Power Transmission for turnkey supply and construction of 400 KV & 220 kV double circuit transmission line in Goa & Karnataka. The contract is valued at Rs 237 crore and it will be commissioned in phased manner by December 2023 and July 2024.

Dev Information Technology: The company has received order worth Rs 4.97 crore for delivering of database management system software along with data centre class operating system software.

Amara Raja Batteries: The company said the board has given approval for demerger of plastic component for battery business with the name of Mangal Industries. The turnover of the said business as of March 2022 was Rs 569.4 crore.

Filatex India: The company has commissioned its project for debottlenecking melt capacity of 50 MT per day and manufacturing lines of 120 MT per day at Dahej Plant.

Orient Bell: The company announced completion of expansion at its Hoskote plant in Bengaluru district. This expansion involved capex of around Rs 34 crore well ahead of schedule. With this the total capacity of the company has increased from 32 MSM per annum to 33.8 MSM per annum including 10 MSM per annum of the associated entities.

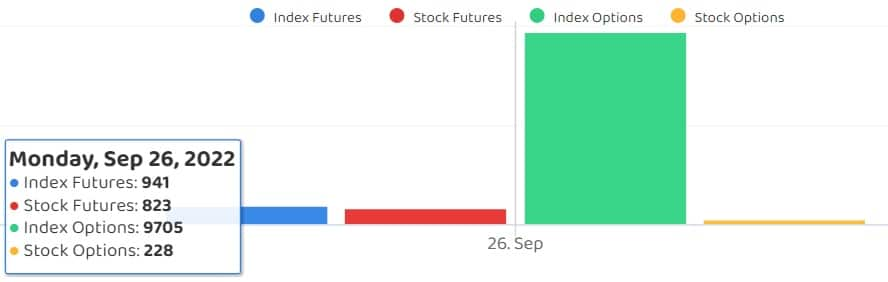

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 5,101.30 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 3,532.18 crore on September 26, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Vodafone Idea, Zee Entertainment Enterprises, and Punjab National Bank - are under NSE F&O ban list for September 27. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.