Stock Market News

Volatile markets closed lower the week ended September 23 following weak global cues, as rising fears of a recession due to aggressive policy tightening by the US Federal Reserve (the Fed), along with fresh escalation of tensions between Russia and Ukraine, dented sentiment.

Benchmark indices remained under pressure for the second consecutive session, with the BSE Sensex falling 742 points, or 1.26 percent, to 58,099, and the Nifty 50 declining more than 200 points, or 1.16 percent, to 17,327, dragged down by most sectors barring auto and FMCG.

The broader markets also traded in the negative terrain as the Nifty Midcap 100 index dropped 1.32 percent and the Smallcap 100 index dipped 2.3 percent.

Volatile and range bound trade is expected to continue this week too, with focus on RBI policy, monthly futures and options (F&O) expiry, and global cues — including the US GDP, experts said.

"We expect volatility to remain high as we have important events like the Reserve Bank of India (RBI) Monetary Policy Committee's (MPC) policy review meeting, and monthly derivatives expiry, scheduled during the week. Besides, prevailing pressure in global indices will continue to weigh on the sentiment," Ajit Mishra, VP – Research, at Religare Broking, said.

It seems the markets are finally giving in to the pressure of global indices, especially the US indices, and are likely to inch lower yet. Hence, participants should align their positions accordingly and maintain positions on both sides, Mishra said.

Here are 10 key factors that will keep traders busy this week:

1) RBI policy

The MPC’s decision on the interest rate is due on Friday, and the street will be closely watching this. With elevated inflation worries, the MPC is likely to hike the repo rate by 25-35 bps (basis points) . With the current scenario in forex markets, a 50 bps hike can't be ruled out, with no change in inflation and growth forecast for the full year, experts said, adding that the focus will also be on the Rupee which hit record lows last week.

"Inflation remains high at around 7 percent and is unlikely to come down any time soon. This means that a rate hike is given. The quantum is what the market is interested in,’’ Madan Sabnavis, Chief Economist at Bank of Baroda, said.

While a hike of 25-35 bps would have signalled that the RBI is confident that the worst of inflation is over, recent developments in the forex market could prompt a 50 bps hike to stay on track with other markets so as to retain investor interest, he added.

2) Rupee at record low

The Indian rupee weakened for the eighth consecutive session on Friday, losing 184 paisa in the period to end at a record closing low of Rs. 80.99 to the USD, while the weekly loss was 124 paisa, weighed down by a strong US currency, escalation of Ukraine-Russia tensions, and aggressive policy tightening by several central banks globally — including the Fed and the Bank of England (BoE) to control inflation. Weakness in equity markets also weighed on the currency.

The rupee registered a fresh all time low, at 81.23 to the dollar. The panic was created by the dollar index (DXY) which witnessed strong buying as a hedge against interest rate hikes and the inflation cycle, Jateen Trivedi, VP - Research, at LKP Securities, said.

He thinks the rupee downtrend will continue as long as positive triggers are not witnessed from the inflation front. The next trigger for the rupee is the MPC policy meet next week, which should provide some respite to the fall of the rupee. Prior to the meet, the rupee could range between Rs. 80.50-81.55.

3) Dollar at multi-year high

Another key factor to focus on would be the US dollar index, which measures the US dollar value against a basket of the world's six leading currencies. The US dollar index has increased more than 7 percent in the last one-and-half-months, to hit a record high of 113 last Friday, the highest since May 2002. This has come in the wake of consistent interest rate hikes by the Fed and expectations of further aggressive tightening to bring inflation down to the target of 2 percent, even at the cost of some economic pain.

Several experts expect the reversal in interest rates to take place in 2024 now, instead of 2023 earlier, especially after the hawkish commentary by the Fed.

"We still believe that post the recent Fed dot plots (4.6 percent terminal rate through early 2023), the inflation print will likely disappoint (vis-à-vis other economies). We believe the Fed's commentary is aimed at keeping financial conditions tight, which therefore emphasises controlling inflation at the cost of growth. The Fed has thus guided the markets to stop reacting to any softer economic numbers," Emkay Global said in a note.

The brokerage added that while the DXY will need very bad inflation prints to move higher, a meaningful pull back is unlikely till inflation prints (or proxies) come in below expectations.

The speeches by several Fed officials as well as others like the European Central Bank (ECB) and the Bank of Japan (BoJ), will be closely watched by market participants to get a sense of further action plans.

4) FII Selling

Foreign institutional investors (FII) remained net sellers for yet another week, to the tune of Rs 4,362 crore, following strong dollar and US bond yields post the Fed’s aggressive policy tightening. As a result, they are net sellers on a monthly basis as well, to the tune of Rs 2,445 crore so far in September, against purchases worth more than Rs 22,000 crore the previous month.

If the US dollar index and US 10-year treasury yield remain strong, then experts feel that Foreign Portfolio Investors (FPI) are unlikely to buy aggressively going forward. Hence, the movement of both these factors will be crucial for FII flows in the coming weeks.

On the other hand, Domestic Institutional Investors (DII) were net buyers the past week, to the tune of more than Rs 1,100 crore, but they are net sellers (nearly Rs 1,900 crore) so far in September.

5) Global economic data cues

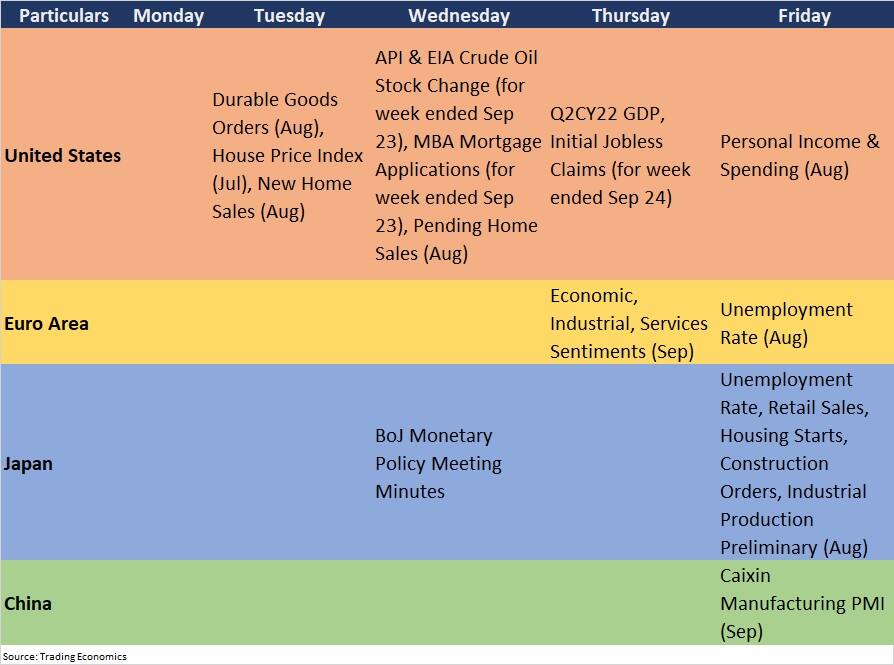

US GDP numbers for the quarter ended June (Q2-CY22) will be keenly watched by global investors, given the Fed's aggressive approach towards controlling inflation.

US GDP has contracted by 1.6 percent in Q1-CY22, while for Q2-CY22, the fall in growth was revised to 0.6 percent against 0.9 percent contraction in advance estimates in July.

"The direction of the Fed's rate hikes in the future may be influenced by this figure, therefore international markets will be closely monitoring it," Apurva Sheth, Head of Market Perspectives at Samco Securities, said.

Here are key global data points to watch out for next week:

6) Oil prices

Oil prices remained volatile and corrected further last week as the USD hit more than 20-year highs, and recession fears mounted due to aggressive policy tightening by central banks globally, raising concerns about the outlook on oil demand.

International Brent crude futures ended at $86.15 per barrel, the lowest since January 2022, down 5.7 percent for the week. The prices have dropped 30 percent in the last three-and-half months.

Further fall in oil prices is expected to support the RBI commentary as we are among the largest oil importers, experts said. Hence, market participants will be closely watching this space.

7) Technical view

The Nifty 50 has seen the formation of a bearish candlestick pattern on the daily (on Friday) as well as weekly charts, after breaking down strong support at 17,400-17,500 levels.

There was also a breakdown of the gap-up area of August 30, and of the 50-day exponential moving average (17,358). Hence, given the weak environment, the index may break its August lows at around 17,150 levels, followed by the 17,000 mark, in the coming days. The upside hurdle is expected to remain at 17,700-17,800 levels if there is a recovery, experts said.

"On the weekly chart, the Nifty formed a reasonable bear candle with a long upper shadow, which signals a sell-on-rise opportunity in the market. The downside momentum seems to have picked up as per the daily and weekly time frame charts," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, said.

Hence, the present sharp weakness is likely to drag the Nifty down to 17,000-16,900 levels in the near term. Any pullback rally up to 17,500 levels could be a sell-on-rise opportunity for the next week, he said.

After a recent fall of more than 4 percent from around 18,100 levels, Options data indicated that there had been a downward shift in the broader trading range for the Nifty 50 to 16,800-17,800, while in the immediate term, the index could trade in a range of 17,000-17,600, experts said. The added that volatility was going to be high given the expiry week for September F&O contracts.

On the Options front, we have seen maximum Call open interest at 18,000 strike, followed by 19,000 and 18,500 strike, with the maximum Call writing at 17,500 strike, followed by 17,400, and 17,600 strikes.

The maximum Put open interest was seen at 16,000 strike, followed by 17,000 and 16,500 strikes, with the maximum Put writing at 16,800 strike, followed by 17,300 and 17,100 strikes.

"If we look at the F&O data, the short exposure of FIIs in index futures has jumped to 80 percent, which means sentiments are weak but the market is hedged. We are heading into the expiry week on a weaker note as the Nifty slipped below the Put base of 17,500, where 17,000 is the next base," Santosh Meena, Head of Research at Swastika Investmart, said.

9) IPO

Harsha Engineers International is going to make a debut on the bourses on Monday, following a healthy response to its initial public offering (IPO) that was oversubscribed 74.70 times the previous week. The final issue price has been fixed at Rs 330 per share.

A grey market premium of more than 50 percent and a healthy investor response, along with strong financials and robust growth outlook, indicates the listing may bring a big smile on the investor’s face come Monday, experts said.

10) Corporate action and economic data points

On the economic data front, fiscal deficit and infrastructure output for the month of August, foreign exchange (forex) reserves for the week ended September 23, and current account numbers for Q2CY22 will be released on the coming Friday.

Apart from that, auto stocks may be in focus ahead of September sales data due over the next weekend.

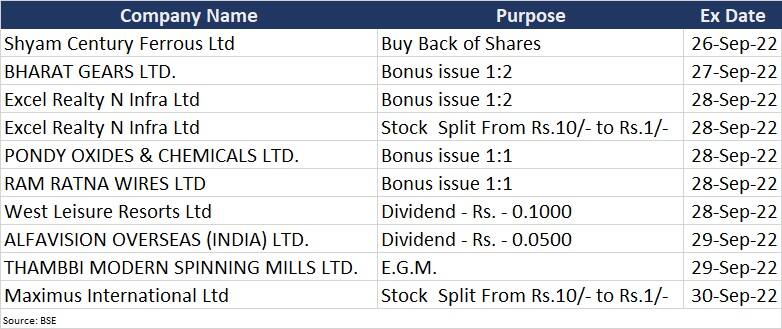

In corporate action, Bharat Gears, Pondy Oxides & Chemicals, and Ram Ratna Wires will start trading ex-bonus, while Excel Realty N Infra will be quoting ex-bonus as well as ex-split next week.

Here are key corporate actions taking place in the coming week: