Top Searches

- News

- Business News

- India Business News

- Advance tax payments up 17%

Advance tax payments up 17%

NEW DELHI: Both direct tax and indirect taxes, especially GST, have grown faster so far in the year, providing comfort to policymakers in the wake of higher-than-budgeted subsidy bill. The non-tax revenue too has got a fillip due to record receipts from spectrum sale, a part of which has been committed to a fresh Rs 1. 6 lakh crore bailout for BSNL.

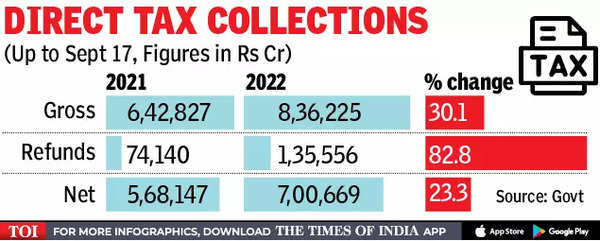

“Direct tax collections continue to grow at a robust pace, a clear indicator of the revival of economic activity post pandemic, as also the result of the stable policies of the government, focusing on simplification and streamlining of processes and plugging of tax leakage through effective use of technology,” the finance ministry said. After refunds, net collection was estimated to have grown 23% to Rs 7 lakh crore.

Advance tax payments were 17% higher at Rs 2. 95 lakh crore, the tax department said. The government said that there has been a remarkable increase in the speed of processing of ITRs filed in the current fiscal, with almost 93% of the verified ITRs processed till September 17. “This has resulted in faster issue of refunds with almost a 468% increase in the number of refunds issued in the current financial year. ”

“Direct tax collections continue to grow at a robust pace, a clear indicator of the revival of economic activity post pandemic, as also the result of the stable policies of the government, focusing on simplification and streamlining of processes and plugging of tax leakage through effective use of technology,” the finance ministry said. After refunds, net collection was estimated to have grown 23% to Rs 7 lakh crore.

Advance tax payments were 17% higher at Rs 2. 95 lakh crore, the tax department said. The government said that there has been a remarkable increase in the speed of processing of ITRs filed in the current fiscal, with almost 93% of the verified ITRs processed till September 17. “This has resulted in faster issue of refunds with almost a 468% increase in the number of refunds issued in the current financial year. ”

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE

Start a Conversation

end of article