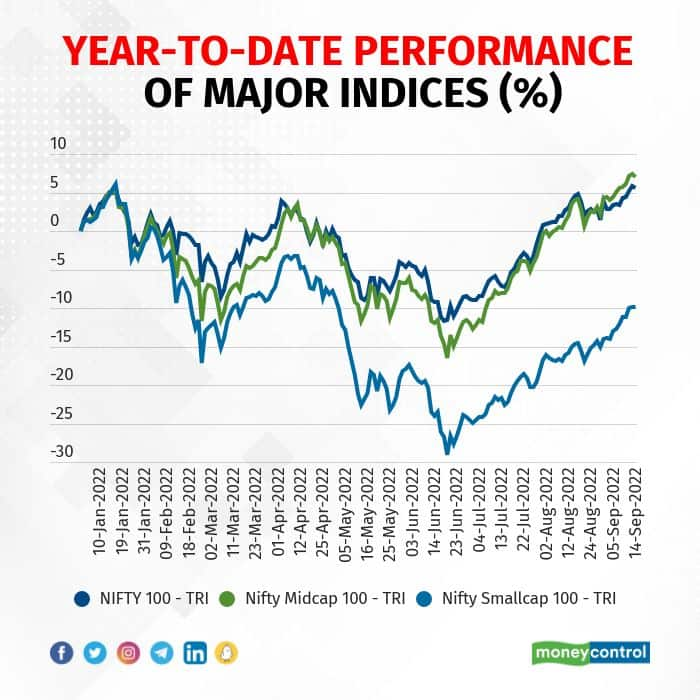

Markets are down 10-16 percent from their peaks, thanks to the global geopolitical situation, supply squeeze, spiralling inflation and consequent rate hikes and foreign fund outflow.

Within the broader market, large cap and midcap indices gained 5-7 percent year-to-date with the easing of inflationary pressures and fall in crude oil prices. However, the smallcap index is down 10 percent YTD.

Market conditions like these expose the vulnerability of small-cap and mid-cap stocks, but they also provide an opportunity to make big gains.

While some investors with a high risk appetite have found a fascination for small-cap stocks, should you invest?

The economy

Apparently, the market is taking cues from the economy. With consumer price-based inflation hitting an eight-year high of 7.79 per cent in April, the Reserve Bank of India hiked has policy rate by a total of 140 basis points this year to 5.40 per cent.

According to experts, India’s inflation is likely to remain around 6 per cent, the upper limit of the RBI’s tolerance band, in FY23. With inflation staying high, more rate hikes are on the cards this year.

The economic growth has also slowed down this year. This doesn’t bode well for the markets, which may stay low for a few more months.

So how would it affect small-cap stocks?

In a stagflation economy (low demand, high inflation), small-cap companies find it comparatively difficult to exercise their pricing power and pass on costs. As a result, their business might sometimes go off-track. When the market tumbles, small-cap companies go through the worst sell-off.

On the other hand, large caps with good fundamentals and strong business moats are better positioned to weather the economic downturn and make a comeback.

Small caps aren’t that bad

This is not to say that small caps should be avoided. On the other hand, if you ignore the short term and zoom out to the long-term curve, the volatility factor of some small caps reduces and the return profile improves drastically.

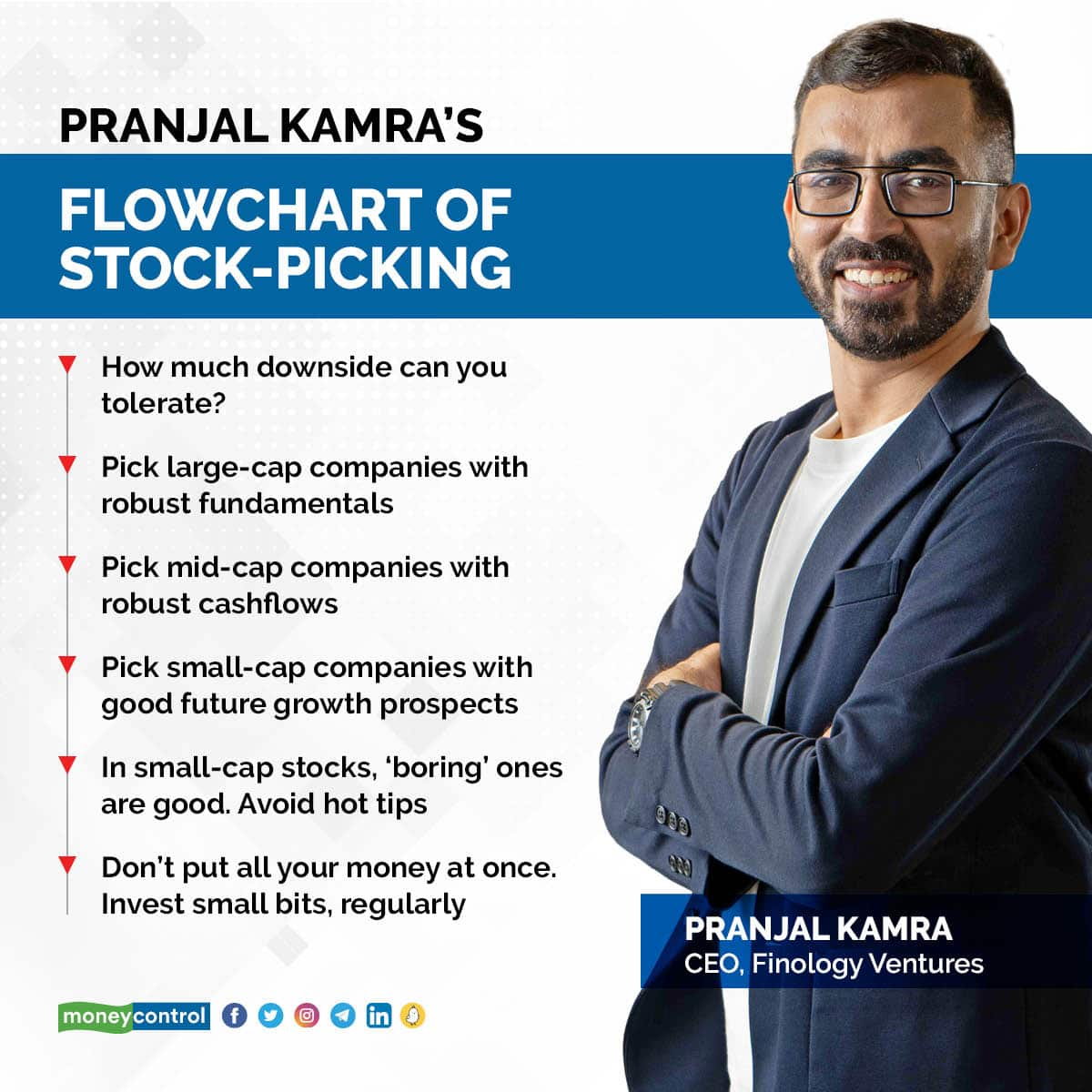

But the question is, can you afford to watch your money go down every day for a while and still hold on to the stock? If not, small caps aren’t your thing. No matter how much the expected growth rate of the stock, your risk appetite is far more important.

Allocating your money across companies

Though small-cap stocks are down, the attractiveness (and more importantly, justification) of their risk-reward ratio would largely depend on how much risk you can afford and are willing to take.

A better strategy would be to filter out companies across market capitalisation based on business metrics. Maybe start with large-cap companies with robust fundamentals, followed by mid-cap companies with good returns and cash flows. No matter what the short-term performance is, in the long run, stock prices tend to move in tandem with the fundamentals of the business.

Lastly, a small portion of your portfolio can consist of small-cap companies that have good growth prospects in the future. Don’t just go for hot sectors like speciality chemicals. There are a number of small companies in seemingly boring sectors like building materials that can prove to be good bets in the long run.

Every investor should target risk-weighted returns. By risk, I mean the risk you can afford and are willing to take. Subsequently, look for robust business metrics. That can help you narrow down your portfolio to a list of attractive as well as safe investments.

As the clouds of uncertainty still hover on the markets, it is wise to stay cash-rich. Invest in a staggering manner and average your investments on dips.