Top Searches

- News

- Business News

- International Business News

- US Fed looks at fourth-straight 75bps increase

US Fed looks at fourth-straight 75bps increase

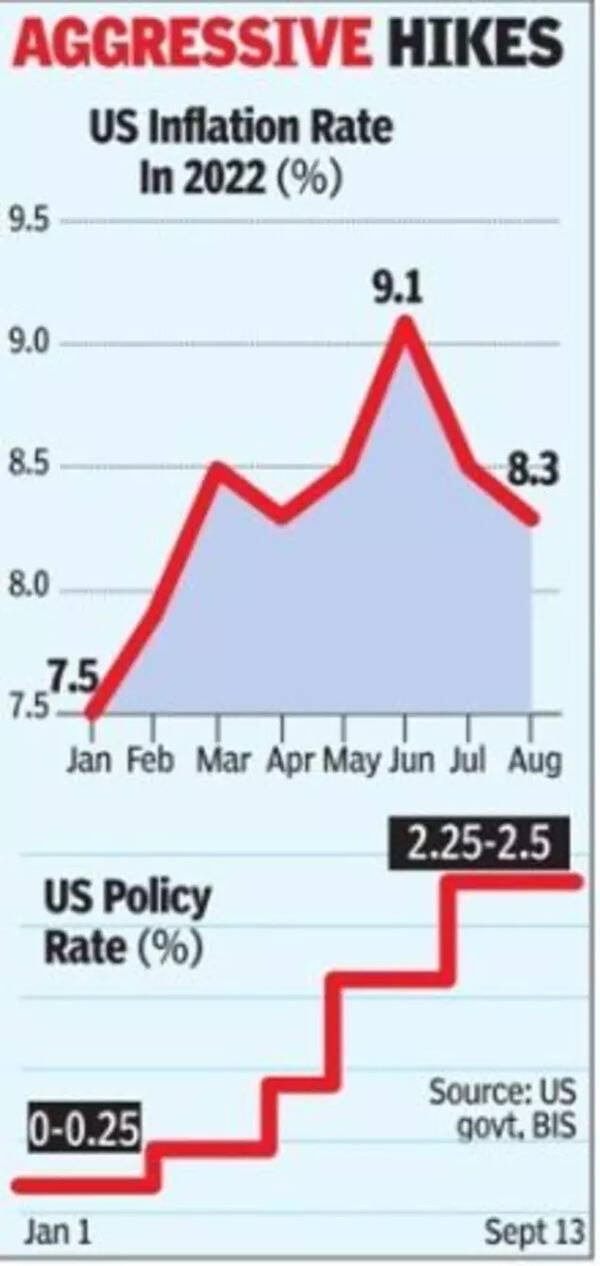

Federal Reserve officials are under fresh pressure to extend rather than slow down their aggressive interest rate increases after US inflation came in hotter than forecast for August. This has potentially put a fourth-straight 75-basis-point (100bps = 1 percentage point) increase on the table - a third within this month and another similar sized hike in November.

While cheaper gasoline held US headline consumer inflation to a 0.1% advance in August from the prior month, the core measure that excludes volatile food and energy prices jumped 0.6% - double economists' expectations, Labor department data showed on Tuesday. That suggests inflation is stubbornly high and broad-based, increasing the odds the Fed will stick with its aggressive tightening campaign for longer than anticipated.

US stocks sold off sharply after August's inflation report came in higher than expected. Intraday, the Dow Jones index was down over 1,300 points, or 4%, while the S& was down 4.5% and the Nasdaq Composite 5.3%.

Gold fell the most in almost a month after the high US inflation data.

Investors now fully expect the Fed will lift its benchmark interest rate by 75bps for the third consecutive time when it meets September 20-21. Bets increased that it will deliver the same size move again in November, and investors now project the tightening cycle peaking around 4.28% in April.

Fed officials are working to quickly move rates into restrictive territory, a level at which policy is slowing economic activity and not stimulating demand. The consumer price index, which landed during the central bank's pre-meeting blackout period, is one of the last major economic reports officials will receive before they gather next week.

Fed Chair Jerome Powell and his colleagues have said their rate decision will be based on the "totality" of the economic data.

While cheaper gasoline held US headline consumer inflation to a 0.1% advance in August from the prior month, the core measure that excludes volatile food and energy prices jumped 0.6% - double economists' expectations, Labor department data showed on Tuesday. That suggests inflation is stubbornly high and broad-based, increasing the odds the Fed will stick with its aggressive tightening campaign for longer than anticipated.

US stocks sold off sharply after August's inflation report came in higher than expected. Intraday, the Dow Jones index was down over 1,300 points, or 4%, while the S& was down 4.5% and the Nasdaq Composite 5.3%.

Gold fell the most in almost a month after the high US inflation data.

Investors now fully expect the Fed will lift its benchmark interest rate by 75bps for the third consecutive time when it meets September 20-21. Bets increased that it will deliver the same size move again in November, and investors now project the tightening cycle peaking around 4.28% in April.

Fed officials are working to quickly move rates into restrictive territory, a level at which policy is slowing economic activity and not stimulating demand. The consumer price index, which landed during the central bank's pre-meeting blackout period, is one of the last major economic reports officials will receive before they gather next week.

Fed Chair Jerome Powell and his colleagues have said their rate decision will be based on the "totality" of the economic data.

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE

Start a Conversation

end of article