personal-finance

How do Business Cycle funds work?

Sep 12, 07:09

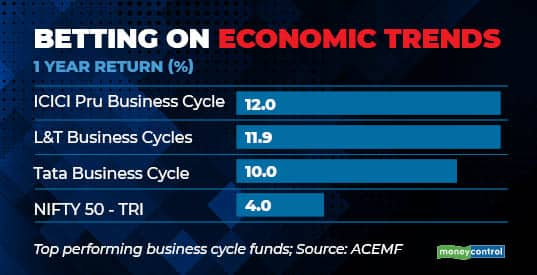

Fund managers of the business cycle funds try to identify fluctuations in the economic activities, and invest in sectors and stocks that are likely to outperform from the changing trends. Such business cycle is defined in terms of periods of expansion and contraction. For instance, during the early expansion phase, cyclical stocks tend to outperform while in contraction period, the defensive sectors will do well. Fund managers follow a top-down approach and manage dynamically by considering economic parameters, investment indicators, business and consumer sentiment indicators to identify the cycles. Six such schemes are available in the market currently.