It has been a highly volatile year for the stock market. After touching 60,000-point levels earlier in the year, the benchmark S&P BSE Sensex hit a one-year low in June, and then again made a strong recovery towards 60,000.

The ongoing Russia-Ukraine war, elevated crude oil prices, fears of a recession, all have been weighing on the markets. While stock markets do course correct between short rallies and falls, the debt market seems to be moving in one direction so far. Yields on the 10-year G-sec bond have moved 72 basis points higher in this period.

Mahindra Manulife Mutual Fund is among the new entrants in the Rs 37 trillion mutual fund industry, and was set up with the idea of making deeper penetration in the smaller cities and towns, called B-30 locations in industry parlance.

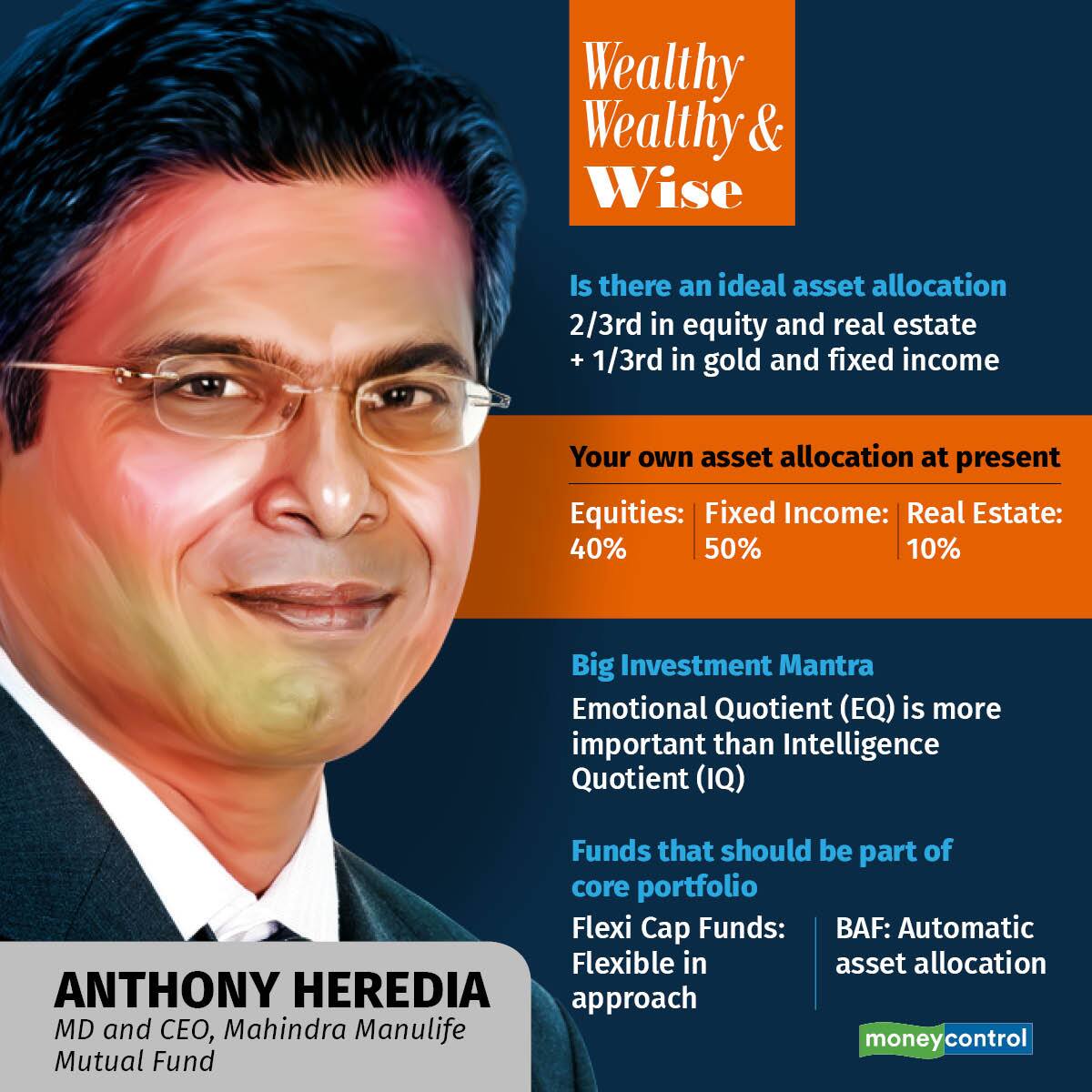

Anthony Heredia, managing director and chief executive officer of Mahindra Manulife Mutual Fund, is an industry veteran. He was the managing director of Morgan Stanley Investment Management (2008-2014), India’s first foreign fund house that was launched back in 1994. Towards end of 2013, HDFC Asset Management Co Ltd acquired Morgan Stanley Mutual Fund. Later, Heredia also headed Baroda Pioneer Mutual Fund and BOI AXA Mutual Fund.

In the current environment where equity markets are volatile and debt instruments are offering higher yields, Heredia tells us how investors should invest their Rs 10 lakh today.

Is this a good time to invest in equity fund for an investor waiting on the sidelines? Should one look at active or passive funds?

There is never a right time because timing rarely works in equity markets.

But what is important is the right time frame in terms of your investment horizon. However, in the current market environment where we are seeing heightened volatility, it is advisable to invest in stages rather than in one go. Investors can either opt for SIPs (systematic investment plans) or STPs (systematic transfer plans) to stagger their investments. The other option is to invest on market declines.

Between active and passive, we think investors should go for actively managed funds. Especially in the current environment where everything is evolving, it is not easy to predict which segment of the market will perform, blue-chips or large-caps, mid-caps or small-caps. Instead, opt for a flexicap fund where the fund manager has the flexibility to rotate between different market caps and sectors and respond to the evolving situation on the ground.

The other option is a balanced advantage fund (BAF). Investors can even put money in one go in a BAF, as the fund dynamically reduces equity exposure and increases debt exposure when markets are expensive and vice versa.

Are equity markets overheated? Should an investor sell and sit on cash?

The stock markets are slightly more expensive than before.

While investors with long-term goals should continue with their systematic plans, there are some risks to watch out for. For investors with a short investment horizon of just a year or two, high allocation to equities can be avoided at this juncture.

Name two or three risks that can derail equity markets.

Crude oil prices can negatively impact markets if they remain at elevated levels. If crude oil prices normalise within this year, then the market valuations capture that, but if prices remain high beyond this year, then market valuations will need to adjust to factor that in. Oil price always has a telling impact on corporate earnings and the economy.

Apart from this, if global inflation continues to remain an issue, it will eventually impact global demand. We have a significant number of companies where a sizeable part of revenues come from global demand. While the expectation is that inflation will be brought under control as central banks raise interest rates, if that doesn’t happen there are chances of a recession.

China is another risk. The Chinese regime is not predictable in terms of actions. Some of it can have a contagion impact on markets, because it can impact commodity demand at one level and financial stability if the real estate problem is not solved. So I think how China deals with an economic slowdown and its tough stance on Covid-19 can have an impact on markets and we need to be watchful for it.

Banks have been raising interest rates in fixed deposits. There are many banks that are offering upwards of 7 percent for deposits of less than three years. Are fixed deposits (FDs) good alternatives, especially for seniors and those nearing their retirement?

Fixed instruments should always be a reasonable proportion of investment for senior citizens and those nearing their retirement, at least 50 percent of their overall allocation.

One should always try to lock into longer-tenure fixed deposits, when rates are higher. Yes, we are in that environment, but I think there is still some room for bank FD rates to go up. The broader rates in the debt markets have gone up. For example, there is quite a bit of differential between corporate deposit rates and FD rates.

If the credit offtake continues to pick up like we saw in the last quarter, I think by the end of this year FD rates will climb even further and that will be an even better time to lock in FD rates for longer periods.

For other investors, tax efficiency is also an important factor as they may want to withdraw funds after reaching their goals. In that case, mutual funds are a good alternative. A savvy investor can look at a gilt fund at some stage when the rates appear to have peaked out, while others can consider target maturity funds (TMFs) to lock in money at high rates.

What is your biggest investment mantra?

EQ (emotional quotient) is more important than IQ (intelligence quotient). Controlling emotions can help you make far more money in the long term in equities than your intellect’s ability to foresee the future.

How do you manage your own investments? Do you have an advisor?

Bit of both. Some of it is on my own, especially when it comes to assets like real estate and direct equity. When it comes to other mutual funds, I take the help of an advisor because they are doing this full-time.

I have a couple of mutual fund distributors that I rely on for advice. Selecting the fund category is still my decision, but then within that category, what I should do, which fund I should select, for that I rely on them.

Should investors put money in initial public offerings (IPOs) and what should they watch out for when investing directly in the stock market?

Investors need to be very selective with IPOs. One can consider companies that are in niche businesses, which are not well-represented in stock markets already.

When it comes to investing directly in stock markets, even I don’t do it beyond a point. Even though I have spent around 25 years in the asset management industry, this requires time and expertise which is not everybody’s cup of tea. It can be part of someone’s equity exposure, but there are very few people for whom it can become virtually the only way of investing.