The market corrected for the second consecutive session amid rangebound and volatile trade, weighed by weakness in global counterparts, on September 7.

The BSE Sensex fell 168 points to 59,029, while the Nifty50 declined 31 points to 17,624 and formed a bullish candle on the daily charts as the closing was higher than opening levels.

In the broader space, the Nifty Midcap 100 and Smallcap 100 indices gained half a percent and eight-tenth of a percent respectively.

"A long bull candle was formed on the Nifty50 on the daily chart after opening lower. Technically, this pattern indicates sideways movement in the market around 17,750-17,400 levels. Wednesday's upside recovery after a weak opening signals an emergence of buying interest from the lows. This is a positive indication for the market ahead," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He says the short-term trend of the Nifty continues to be rangebound at 17,750-17,400 levels. Having moved up from near the lower range on Wednesday, there is a possibility of Nifty making an attempt towards the upper range and also crucial trend line resistance around 17,800 levels in the coming sessions, the market expert said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,522, followed by 17,420. If the index moves up, the key resistance levels to watch out for are 17,689 and 17,753.

The Nifty Bank declined 211 points to 39,456 and formed small bodied bullish candlestick pattern on the daily scale on Wednesday. The important pivot level, which will act as crucial support for the index, is placed at 39,285, followed by 39,115. On the upside, key resistance levels are placed at 39,599 and 39,743 levels.

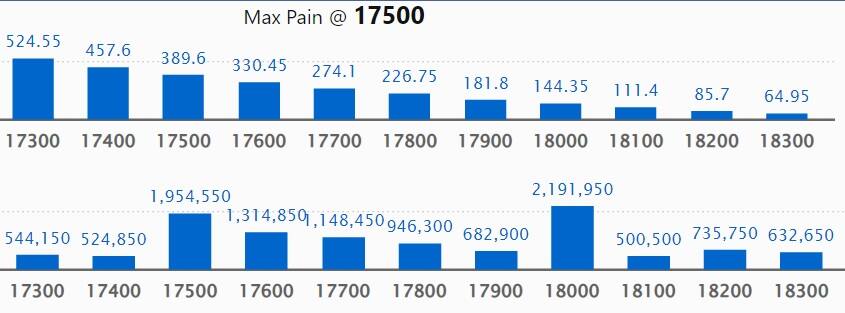

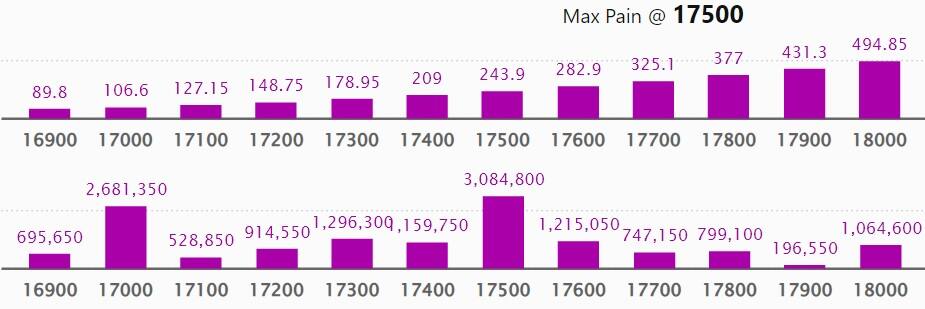

Maximum Call open interest of 21.91 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the September series.

This is followed by 18,500 strike, which holds 18.27 lakh contracts, and 19,000 strike, which has accumulated 17.89 lakh contracts.

Call writing was seen at 17,500 strike, which added 2.48 lakh contracts, followed by 17,600 strike which added 2.38 lakh contracts and 18,700 strike which added 98,200 contracts.

Call unwinding was seen at 19,000 strike, which shed 66,500 contracts, followed by 17,700 strike which shed 55,400 contracts and 18,200 strike which shed 12,850 contracts.

Maximum Put open interest of 42.64 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the September series.

This is followed by 16,500 strike, which holds 33.75 lakh contracts, and 17,500 strike, which has accumulated 30.84 lakh contracts.

Put writing was seen at 17,500 strike, which added 1.55 lakh contracts, followed by 17,200 strike, which added 1.49 lakh contracts and 17,400 strike which added 65,850 contracts.

Put unwinding was seen at 18,000 strike, which shed 85,050 contracts, followed by 17,700 strike which shed 74,000 contracts, and 17,000 strike, which shed 42,500 contracts.

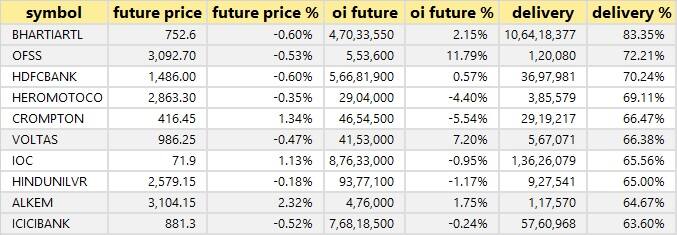

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Bharti Airtel, Oracle Financial, HDFC Bank, Hero MotoCorp, and Crompton Greaves Consumer Electrical, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Container Corporation, JK Cement, Ramco Cements, ACC, and Firstsource Solutions, in which a long build-up was seen.

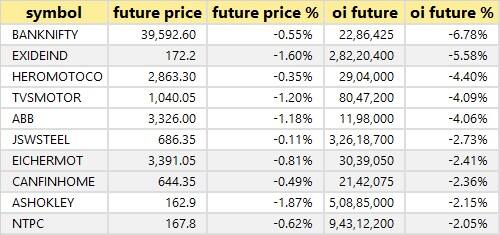

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Bank Nifty, Exide Industries, Hero MotoCorp, TVS Motor Company, and ABB India, in which long unwinding was seen.

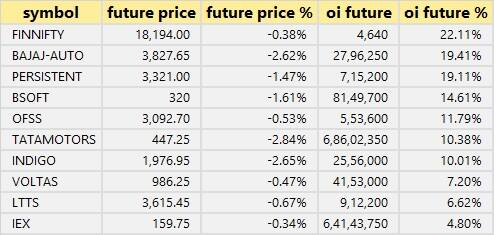

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Bajaj Auto, Persistent Systems, Birlasoft, and Oracle Financial in which a short build-up was seen.

52 stocks witnessed short-covering

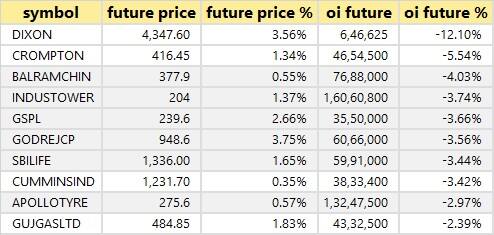

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Dixon Technologies, Crompton Greaves Consumer Electricals, Balrampur Chini Mills, Indus Towers, and GSPL in which a short-covering was seen.

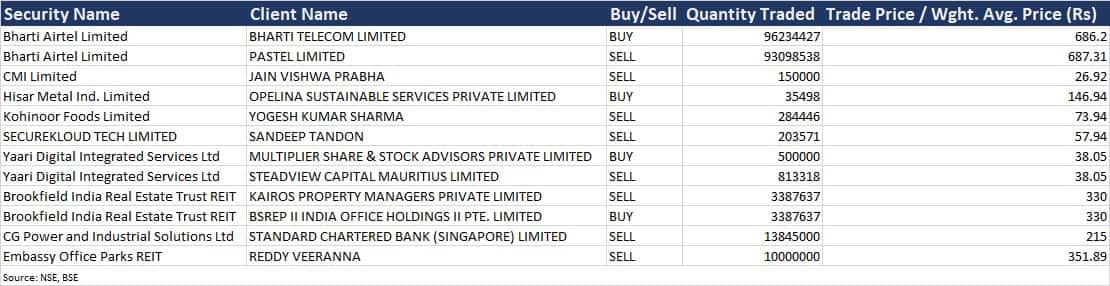

CG Power and Industrial Solutions: Standard Chartered Bank (Singapore) sold 1,38,45,000 equity shares in the company via open market transactions. These shares were sold at an average price of Rs 215 per share.

Yaari Digital Integrated Services: Steadview Capital Mauritius has offloaded 8,13,318 equity shares (0.8 percent) in the company via open market transactions. These shares were sold at an average price of Rs 38.05 per share. However, Multiplier Share & Stock Advisors acquired 5 lakh shares at the same price.

(For more bulk deals, click here)

Investors Meetings on September 8

UltraTech Cement: Officials of the company will meet American Century, Alliance Bernstein, Graticule Asia Macro Advisors, and Lord Abbett & Co.

Syngene International: Officials of the company will meet C Worldwide Asset Management.

One 97 Communications: Officials of the company will attend Citi's 2022 Global Tech Conference and Citi's GEMS Conference 2022.

Glenmark Pharma, Aster DM Healthcare, Max Healthcare Institute, Sun Pharma, Aurobindo Pharma: Officials of these companies will attend Kotak Healthcare Forum 2022.

Escorts Kubota, Sheela Foam, Apollo Tyres, CESC, KEI Industries: Officials of these companies will attend Ashwamedh - Elara India Dialogue 2022.

Greaves Cotton: Officials of the company will meet Grandeur Peak Global, and Quaero Capital LLP.

Sapphire Foods India: Officials of the company will meet Ontario Teachers' Pension Plan.

CRISIL: Officials of the company will meet Edelweiss Mutual Fund.

Varun Beverages: Officials of the company will meet investors at Jefferies Asia Forum.

Indian Energy Exchange: Officials of the company will meet Fidelity Management Research.

Vedanta: Officials of the company will meet PhillipCapital.

Stocks in News

InterGlobe Aviation: Rakesh Gangwal, co-founder of IndiGo, and his family are looking to sell a 2.8 percent stake in InterGlobe Aviation, the holding company which runs IndiGo airlines, through a block deal. As part of the block deal, as many as 10.8 million shares belonging to the Gangwal family have been listed for sale for Rs 1,996 crore.

Concord Drugs: The company said its board of directors has given approval for the acquisition of up to 100 percent stake in Proton Remedies Private Limited at Rs 283 per share on cash basis, and issue of up to 12,56,250 convertible warrants to the promoters on preferential basis at an issue price of Rs 33 per warrant.

SBC Exports: The company has received a contract from the Institute of Company Secretaries of India. The order cost of the said tender is Rs 3.17 crore, and the period of contract will be initially for a period of two years which will be renewed after the expiry of the same. The company has previously participated in a tender for providing various types of manpower services on outsource basis at various offices of the Institute of Company Secretaries of India (ICSI) at different places in India.

Schneider Electric Infrastructure: The company has received approval from its Board of Directors for enhancing the production capacity of vacuum interrupters and vacuum circuit breakers by setting up a manufacturing unit in Kolkata.

Capacite Infraprojects: NewQuest Asia Investments II Ltd has sold a 2.36 percent stake or 16 lakh equity shares in the company via open market transactions during August 16-September 2. With this, its stake in the company reduced to 7.39 percent, down from 9.75 percent earlier.

Duroply Industries: Ace investors Porinju Veliyath and Litty Thomas picked an additional 2.12 percent stake or 1.58 lakh shares in the company via preferential allotment. With this, their shareholding in the company increased to 7.01 percent, up from 4.89 percent earlier.

Safari Industries (India): Investcorp Private Equity Fund II held a 5.55 percent stake in the company after the conversion of 13.15 lakh compulsory convertible debentures into a similar number of equity shares. The conversion of debentures into equity took place on August 30.

Zydus Lifesciences: Zydus has achieved positive proof-of-concept in its Phase 2 clinical study of NLRP3 inhibitor, ZYIL1 in patients with cryopyrin-associated periodic syndrome (CAPS). CAPS is a rare, life-long, auto-inflammatory condition, caused by NLRP3 activating mutations and is classified as an orphan disease. The Phase 2 trial was conducted in Australia.

Fund Flow

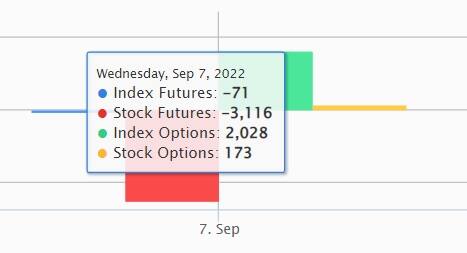

Foreign institutional investors (FIIs) have net-bought shares worth Rs 758.37 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 138.67 crore on September 7, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Delta Corp remained on the NSE F&O ban list for September 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.