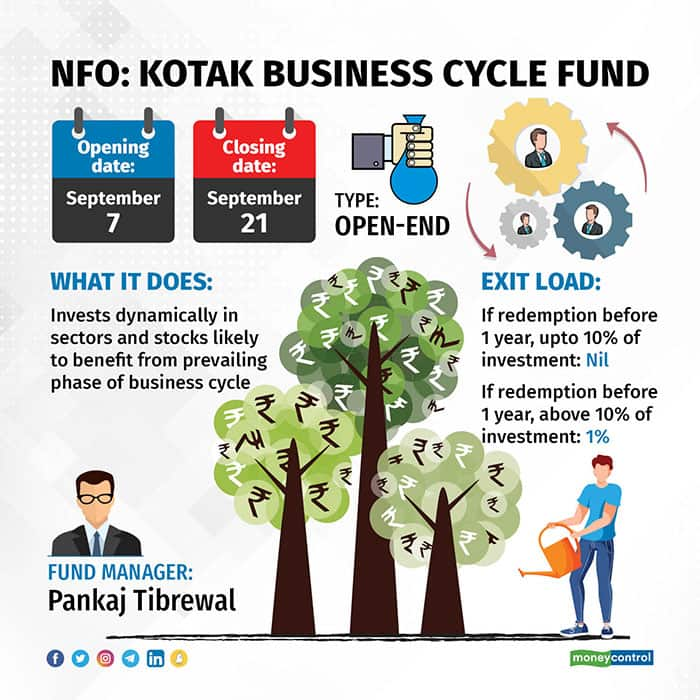

Kotak Mutual Fund (MF) has launched Kotak Business Cycle Fund (KBCF), which will dynamically rotate its portfolio in different sectors that can benefit from the prevailing business cycle of the economy. The new fund offer (NFO) opened for subscription on September 7.

The scheme

The fund will invest 80 percent of its corpus as per its theme—in sectors that the fund manager expects to do well in the prevailing business cycle.

It will use a combination of indicators across the domestic and global economy to identify the current phase of the business cycle.

What works?

During business cycles, different sectors tend to do well. KBCF will invest in stocks and sectors that are likely to benefit from the business cycle the economy is going through.

For example, in the expansion stage of the economy, rate-sensitive and cyclical companies tend to outperform. These include metals, power, infrastructure and capital goods. In the mid-stage, growth generally moderates but sectors such as energy, banking and industrials can continue to do well. Kotak MF sees the economy in this cycle right now.

In the late cycle of the economy, or in the contraction phase, sectors which typically generate high free cash flow and cash-rich companies such as FMCG, IT and pharmaceuticals tend to outperform.

“The fund will follow a combination of top-down and bottom-up approaches. We will try and identify sectors that are favourably placed in that particular phase of the business cycle. Then identify strong companies within that sector,” says Pankaj Tibrewal, senior executive vice-president and fund manager-equity, Kotak MF.

The stock selection and sector rotation will depend upon phases of the business cycle.

“Often these phases of a business cycle can overlap, which is why the portfolio may have investments in various sectors,” Tibrewal adds.

What doesn’t

Changes in business cycles can be sharp and sometimes short-lived, so the fund manager should be able to navigate through short-term volatility while also staying focused on the overall business cycle view.

Tibrewal says to protect against sector-linked volatility, the fund will use the remaining 20 percent of the corpus for risk management.

For example, if the fund has a more cyclical tilt, the balance corpus can be in defensive stocks.

Amol Joshi, the founder of Plan Rupee Investment Services, says if the fund manager is able to match the entry and exit of his investments in line with the changes in the business cycle the fund could do well, if not, it could impact the fund’s performance.

Moneycontrol’s take

Tibrewal has built a credible track record over the years. However, the business cycle theme-based funds are relatively new in the mutual fund industry, with only a few funds in this category.

The success of a business cycle fund depends on how well the fund manager times the entry and exit in sectors, to take advantage of the changes in the business cycle.

Theme-based funds can go through periods of high volatility if conditions turn unfavourable.

Let KBCF build some track record before considering it for your portfolio. The NFO closes on September 21.