The market made an attempt to extend the northward journey but failed in the morning trade itself and remained rangebound for the rest of the session on September 6.

The benchmark indices moved within the trading range of August 30 for the fourth consecutive session. The BSE Sensex fell 49 points to 59,197, while the Nifty50 declined 10 points to 17,656 and formed a small-bodied bearish candle on the daily charts.

"The momentum indicator RSI (relative strength index) moving flattish between 55 - 60 range which shows that the Nifty has sluggish momentum for the short to medium term," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

The Nifty has immediate resistance levels placed at 17,777 (5 days high) followed by 18,000 (swing high) and on the other side, it has a strong support level placed at 17,476 (3 days low), followed by 17,380 (gap support).

As per the overall chart pattern and indicator set-up, the market expert feels that the Nifty will move in a broader range of 17,380 – 18,000 levels for the short to medium term.

The broader markets' performance was better than benchmarks, as the Nifty Midcap 100 and Smallcap 100 indices gained 0.6 percent and 0.3 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,574, followed by 17,492. If the index moves up, the key resistance levels to watch out for are 17,751 and 17,846.

The Nifty Bank dropped 139 points to 39,666 and formed a bearish candlestick pattern on the daily scale on Tuesday. The important pivot level, which will act as crucial support for the index, is placed at 39,463, followed by 39,259. On the upside, key resistance levels are placed at 39,972 and 40,278 levels.

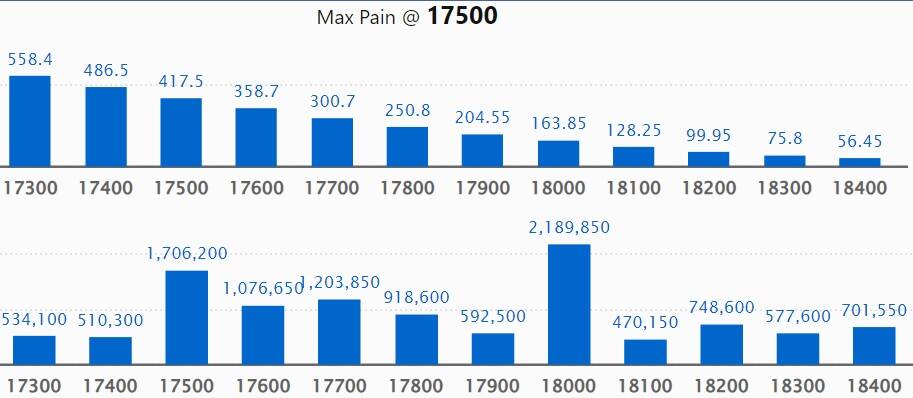

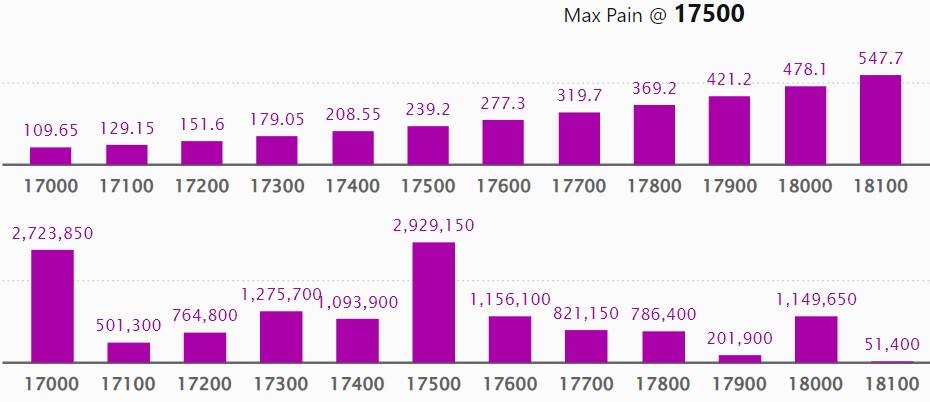

Maximum Call open interest of 21.89 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the September series.

This is followed by 19,000 strike, which holds 18.55 lakh contracts, and 18,500 strike, which has accumulated 18.09 lakh contracts.

Call writing was seen at 17,700 strike, which added 1.59 lakh contracts, followed by 19,000 strike which added 1.06 lakh contracts and 18,000 strike which added 83,050 contracts.

Call unwinding was seen at 17,600 strike, which shed 2.04 lakh contracts, followed by 17,500 strike which shed 1.1 lakh contracts and 18,300 strike which shed 42,400 contracts.

Maximum Put open interest of 33.7 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the September series.

This is followed by 17,500 strike, which holds 29.29 lakh contracts, and 17,000 strike, which has accumulated 27.23 lakh contracts.

Put writing was seen at 17,300 strike, which added 1.16 lakh contracts, followed by 17,800 strike, which added 99,900 contracts and 17,700 strike which added 89,300 contracts.

Put unwinding was seen at 17,600 strike, which shed 1.55 lakh contracts, followed by 17,500 strike which shed 97,350 contracts, and 17,000 strike, which shed 37,050 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Syngene International, Navin Fluorine International, SBI Life Insurance Company, Voltas, and Marico, among others.

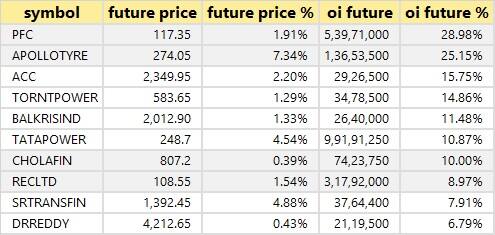

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including PFC, Apollo Tyres, ACC, Torrent Power, and Balkrishna Industries, in which a long build-up was seen.

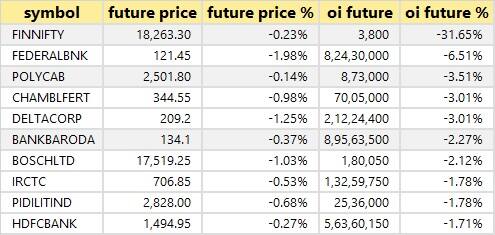

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Federal Bank, Polycab India, Chambal Fertilisers, and Delta Corp, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Syngene International, HDFC AMC, Oracle Financial, Bharat Electronics, and Torrent Pharma, in which a short build-up was seen.

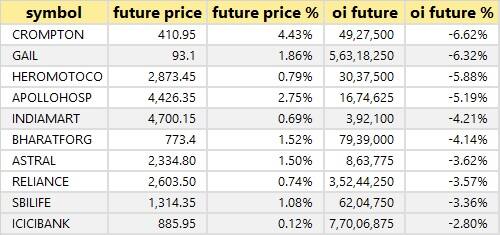

42 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Crompton Greaves Consumer Electrical, GAIL India, Hero MotoCorp, Apollo Hospital Enterprises, and IndiaMART InterMESH, in which short-covering was seen.

Dreamfolks Services: Mirae Asset India Small-Midcap Focus Equity Master Investment Trust acquired 3,03,446 equity shares in the company via open market transactions. These shares were bought at an average price of Rs 471.51 per share.

Hatsun Agro Product: Promoter Raja Ganesan Chandramogan sold 27.20 lakh equity shares or 1.26% stake in the company via open market transactions at an average price of Rs 987.8 per share.

Syngene International: Promoter Biocon sold 2,17,89,164 equity shares (or 5.4 percent stake) in the company at an average price of Rs 560.04 per share. However, ICICI Prudential Mutual Fund bought 28,28,510 equity shares at an average price of Rs 560 per share.

(For more bulk deals, click here)

Investors Meetings on September 7

UltraTech Cement: Officials of the company will meet Fidelity Management & Research, Allspring Global, Putnam Management, and Delaware Macquarie Investment.

Tata Motors: Officials of the company will meet Ontario Teachers’ Pension Plan Board.

Tata Consultancy Services: Officials of the company will attend 3rd Annual Jefferies Asia Forum Fidelity Management Research.

GAIL India, Ashoka Buildcon, Manappuram Finance, Greaves Cotton, Fortis Healthcare, Zee Entertainment Enterprises, KNR Constructions, Arvind, Indo Count Industries, Venus Pipes & Tubes: Officials of the companies will attend Ashwamedh - Elara India Dialogue 2022.

Max Healthcare Institute, Polycab India, Anupam Rasayan India, KNR Constructions, Kewal Kiran Clothing, Sapphire Foods India, Apollo Tyres, Nuvoco Vistas Corporation: Officials of the companies will attend Spark Capital Investor Conference.

KEI Industries: Officials of the company will meet Motilal Oswal Financial Services.

One 97 Communications: Officials of the company will attend Citi's 2022 Global Tech Conference and Citi's GEMS Conference 2022.

Mahindra & Mahindra: Officials of the company will attend Citi Virtual Investor Conference.

Ajanta Pharma: Officials of the company will attend Kotak Institutional Equities Healthcare Forum.

Stocks in News

Wipro: The IT services company has entered an expanded collaboration with Palo Alto Networks to deliver managed security and network transformation solutions like SASE (secure access service edge), cloud security and next-generation SOC (security operations center) solutions based on Zero Trust principles for global enterprises.

Astral: The company has received order from NCLT sanctioning Scheme of Amalgamation of subsidiaries Resinova Chemie Limited and Astral Biochem Private Limited with itself. Accordingly, the Scheme of Amalgamation has become effective from September 6.

Paras Defence and Space Technologies: The company has entered into an exclusive teaming agreement with 'ELDIS Pardubice' s.r.o., Czech Republic. They are intended to provide turnkey anti-drone systems for civilian airports in India.

InterGlobe Aviation: Petrus Johannes Theodorus Elbers has joined as Chief Executive Officer of the company with effect from September 6.

Salasar Techno Engineering: The stock will be in focus as the company said its Fund Raising Committee of the Board has approved the allotment of 3 crore equity shares to QIBs at a price of Rs 27.30 per share. The company raised Rs 81.9 crore through its issue.

Zuari Industries: The company has executed Memorandum of Understanding (MOU) with Envien International, Malta and Zuari Envien Bioenergy, to build and operate a biofuel distillery. The company will explore the organic and inorganic business opportunities in the biofuel space in India.

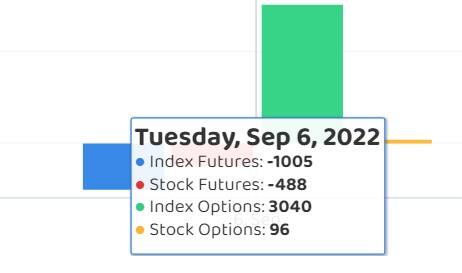

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 1,144.53 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 632.97 crore on September 6, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Delta Corp remained in the NSE F&O ban list for September 7. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.