On September 2, Axis Mutual Fund (MF), India’s seventh largest fund house, launched a silver exchange-traded fund (ETF) called Axis Silver ETF.

Axis MF joined the growing list of fund houses that have launched silver ETFs this year. In November 2021the capital market regulator Securities and Exchange Board of India (SEBI) had laid down new guidelines for silver ETFs, but a ban on new fund offers (NFO) delayed the launches.

According to mutual fund researcher ACE MF, silver ETFs launched so far manage Rs 900 crore worth of investor assets.

Those that have launched silver ETFs include HDFC MF, Aditya Birla Sun Life MF, ICICI Prudential MF, Nippon India MF, DSP MF and Edelweiss MF, aside from Axis MF’s new scheme that was just launched.

Edelweiss has taken a slightly different approach, launching a gold and silver ETF (more on that later).

Here is how a silver investment can help you diversify your portfolio.

How do silver prices move?

Compared to gold, silver prices can be a lot more volatile, as gold is held in large amounts by institutional investors such as central banks, governments, pension funds, etc. While both are precious metals and are also used in several industries, silver is used more extensively, serving as an input in several electronic components. It is also used in photovoltaic cells (for solar energy), medicine, nuclear reactors, electronic gadgets, electric vehicle batteries, etc.

Due to its price volatility, silver is preferred by traders for their short-term strategies. So, silver can also be a tactical bet on global economic recovery and growth.

Silver prices also get influenced by gold prices, as the former is seen as an alternative to gold.

“Silver tends to follow gold prices. Both generate investment interest when there is economic uncertainty. Silver is seen as a less costly alternative to gold,” points out Ravi Gehani, manager, ETFs and passive investments, DSP MF.

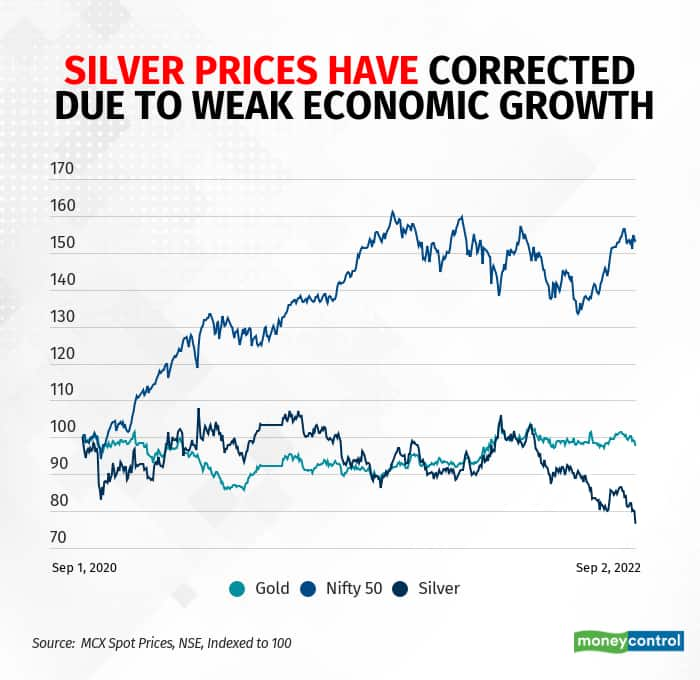

But given that silver has several industrial uses as well, in a scenario when economic growth is weak, this relationship between gold and silver prices may not hold true.

Gold and silver fund

Instead of launching a silver ETF, Edelweiss MF has launched a gold and silver ETF fund of funds. This FoF will invest in a combination of a gold and silver ETFs, with the corpus being equally divided between the two commodities.

Radhika Gupta, managing director and chief executive officer, Edelweiss MF, says the reason for launching a combination of gold and silver fund is to give investors an asset allocation solution.

“Gold will give stability to the investment portfolio, while silver tends to outperform during precious metal rallies,” Gupta points out.

Investors have the option of tapping the separate gold and silver investment offerings of other fund houses, but the Edelweiss fund allows it within the same fund.

What should investors do?

The price of silver has corrected sharply in recent months, falling to a two-year low.

Gehani says this can be attributed to several macroeconomic factors at play, and presents a good opportunity to start building silver exposure.

He adds that the gold-silver ratio indicates that silver is currently undervalued.

As mentioned earlier, silver comes with much higher volatility than gold and may not suit all investors’ risk appetite. Savvy investors who understand how economic cycles move can add silver exposure to their portfolio as a tactical allocation.