An unusually high number of stalled real estate projects across cities are becoming a cause of worry to lenders. A clutch of banks Moneycontrol spoke with said that their exposure to stalled real estate projects could compound issues of bad debt in the long run.

“Right now, the exposure towards real estate is gradually increasing because post-pandemic, demand for commercial and residential real estate spaces have grown,” said a banker with a state-run bank who did not want to be named.

“However, the key concern is the growing number of stalled projects. If these loans turn bad, this will be an additional headache for banks in terms of recovery,” he added.

The banker added that currently there is a strict underwriting process among lenders where parameters like sales velocity, pricing, and quality of the underlying collateral is considered. However, the situation could deteriorate if the number of stalled projects increases from here, the banker added.

Nearly 500,000 homes worth Rs 4.48 lakh crore are stuck across seven metro markets in the country as on May-end, says an analysis by real estate consultancy ANAROCK.

The National Capital Region (NCR) and Mumbai Metropolitan Region (MMR) together account for 77 percent of such projects. Pune had a nine percent share of delayed projects, and Kolkata five percent. The southern metros of Bengaluru, Chennai, and Hyderabad together accounted for the remaining nine percent.

Also read: India's Most Delayed Residential Projects

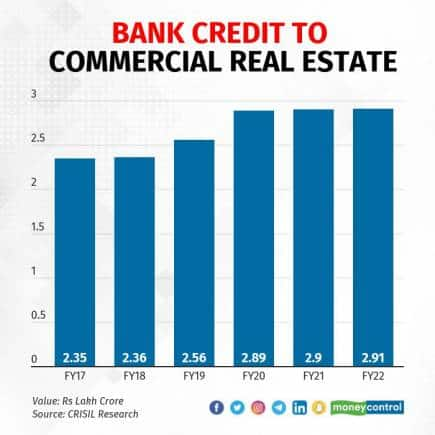

Banks have steadily increased credit exposure to the commercial real estate segment over the years. For instance, banks’ credit exposure to commercial real estate stood at Rs 2.91 lakh crore in FY22, up from Rs 2.56 lakh crore in FY19 and Rs 2.35 lakh crore in FY17, according to data compiled by CRISIL Research.

What is driving banks' exposure to real estate?

According to experts, banks have increased exposure to the real estate sector largely due to the sanguine demand for both commercial and residential spaces, and market share gain from shadow lenders or non-banking finance companies.

Interestingly, the growing work-from-home trend and historically low-interest rates have increased demand for real estate.

“Banks usually lend to grade A developers that have gained significant market share due to consolidation in the real estate sector post the RERA [Real Estate (Regulation and Development) Act] and GST implementation,” said Punit Patni, an analyst at Swastika Investmart.

“Even though some of the developers are posting losses and have stalled projects, the underlying collateral value remains robust, providing safety to the lender,” said Patni.

“Further, a majority of projects are stuck due to lack of funding. Thus, providing top-up or working capital loans will ensure the completion of projects, and a completed project is always preferred by consumers. Banks’ low cost of funds and efficient risk management has enticed them to increase exposure to such developers,” Patni added.

Moreover, there are a few real estate players whose financial strength and sales have shown an uptick, and hence there is an increased propensity of banks to fund these projects, said analysts.

“Real estate-focussed private equity (PE) funds have evinced a lot of interest in commercial and retail real estate,” said Rajesh Kothari, founder and managing director of AlfAccurate Advisors. “Uptrend in the business cycle, improved compliance, and the REIT (Real Estate Investment Trust) structure are key reasons why banks are looking at this asset class for lending,” he explained.

Not a rosy picture

However, the picture is not as rosy on the ground. Some builders and realty firms continue to be financially strained, along with labour challenges and other constraints, which is reflected in their balance sheets.

For example, Omaxe, one of the leading real estate developers in north India, reported a consolidated net loss of Rs 49.69 crore in the April-June quarter. The firm had reported a net loss of Rs 44.94 crore in the year-ago period.

According to Aniket Dani, a director at CRISIL Research, for a bank to take an exposure, profitability may not be the only parameter considered for credit appraisal.

Profitability, Dani explained, is subject to the revenue recognition method, revenue mix of existing projects versus new projects and the portion of rentals or annuity based assets.

“The key parameters banks look at for credit appraisal of any developer are largely cash flow from operations, the overall cash position of the developer, increase in the inventory ratio, etc,” Dani said.

“While as many as 10-15 listed developers are reported to have net losses in FY21 or FY22, many of them have comfortable net cash flow generation from operations as per audited figures of FY21,” Dani added.

Another banker in the stressed assets vertical of a leading state-run bank corroborated Dani’s view.

“We (banks) have to consider a whole host of issues before granting loans to realty firms. Although profitability is a crucial factor, it is not the only one,” said the banker.

“If the financial metrics of the firm deteriorate and the loan is not repaid by virtue of the project being stalled, banks have no option but to categorise the loan as a non-performing asset (NPA) and ultimately take the insolvency route,” he added.

The insolvency and bankruptcy code (IBC) is not the only route available to recover loans. However, it has become the preferred route of late.

“For recovery of loans, the banks can file civil suits or go for arbitration, initiate proceedings under the SARFAESI Act, the Recovery of Debts and Bankruptcy Act, 1993, and under the IBC,” said Sandeep Bajaj, managing partner at PSL Advocates & Solicitors, a law firm.

Key risks

According to experts, banks may be in for a tough phase if a slowdown in global growth, recession in developed countrie, and rising interest rates complicate matters for realty firms. This might derail the recovery in the real estate sector and increase stress for the lenders, they added.

“Additionally, balance sheet risks, developer risks, collateral risks, etc, are some of the key sectoral risks for banks,” said Patni.

“The asset quality outlook in the short to medium term remains positive as there is significant growth in pre-sales numbers, unsold inventory levels are low, affordability has increased significantly, and despite the current hike in interest rates, they are still below the pandemic levels,” Patni added.

In such a scenario, banks must ensure that their credit exposure is company and project specific, in order to ensure that asset quality remains strong, added Kothari.