personal-finance

How do MFs pick lower-rated bonds?

Sep 02, 05:09

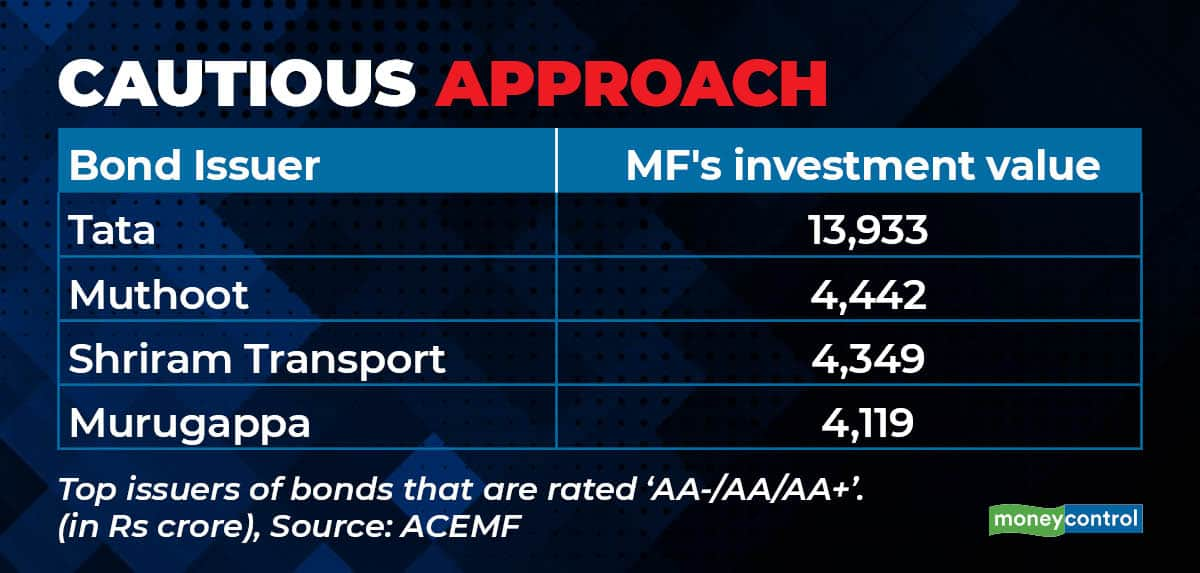

Investing in the lower-rated debt securities can fetch you higher returns but they are associated to relatively higher credit risk. Mutual funds too have sizeable exposure to non-AAA rated debt securities such as ‘AA-/AA/AA and below. MF apply many metrics while selecting those instruments from private corporate issuers. They prefer lower rated bonds that have issuers with strong parentage, healthy balance sheets, low leverage and positive long-term business prospects. Few examples are Tata Motors Finance, Aditya Birla Fashion, Retail and Manappuram Finance and TVS Credit Services.