After a day of the significant run-up, the market lost more than 1 percent on September 1 despite a sharp fall in oil prices, tracking negative sentiment in the global counterparts. Private banking, financial services, IT, metal, pharma, FMGC and oil & gas stocks were under pressure.

The market traded within the range of the previous day. The BSE Sensex fell 770 points or 1.29 percent to 58,767, while the Nifty50 plunged 216 points or 1.2 percent to 17,543, but formed a small-bodied bullish candle on the daily charts as the closing was higher than opening levels.

"A small positive candle was formed on the daily chart with a long upper shadow. Thursday's small candle pattern was formed beside the long bull candle of Tuesday. Technically, the market is placed at the broader high low range of 17,350-17,750 levels and consolidation movement with volatility is likely in the coming sessions," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

There is a possibility of an upside bounce from near the lower support of 17,350-17,300 levels in the short term. Immediate resistance is placed at 17,650 levels, Shetti added.

The outperformance in broader space continued for yet another session as the Nifty Midcap 100 and Smallcap 100 indices gained 0.1 percent each, whereas India VIX, the fear index increased by 6.3 percent to 19.87 levels, favouring the bear party.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,442, followed by 17,342. If the index moves up, the key resistance levels to watch out for are 17,669 and 17,796.

The Nifty Bank fell 235 points to close at 39,301 and formed a bullish candlestick pattern on the daily charts on Thursday. The important pivot level, which will act as crucial support for the index, is placed at 38,847, followed by 38,393. On the upside, key resistance levels are placed at 39,711 and 40,122 levels.

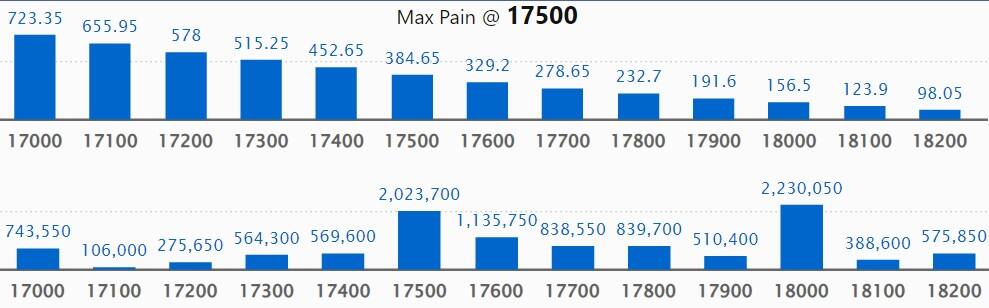

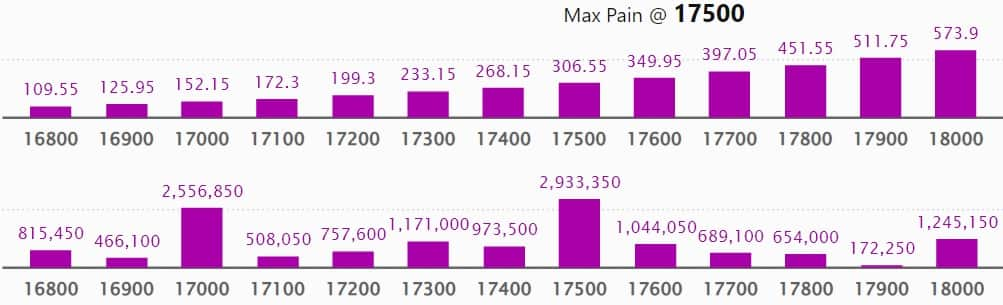

Maximum Call open interest of 22.30 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the September series.

This is followed by 17,500 strike, which holds 20.23 lakh contracts, and 19,000 strike, which has accumulated 17.09 lakh contracts.

Call writing was seen at 17,500 strike, which added 7.67 lakh contracts, followed by 17,600 strike which added 5.03 lakh contracts and 18,500 strike which added 3.06 lakh contracts.

Call unwinding was seen at 17,300 strike, which shed 2.48 lakh contracts, followed by 17,400 strike which shed 1.85 lakh contracts and 16,000 strike which shed 26,800 contracts.

Maximum Put open interest of 39.29 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the September series.

This is followed by 16,500 strike, which holds 33.74 lakh contracts, and 17,500 strike, which has accumulated 29.33 lakh contracts.

Put writing was seen at 17,500 strike, which added 4.88 lakh contracts, followed by 17,600 strike, which added 3.98 lakh contracts and 16,000 strike which added 2.84 lakh contracts.

Put unwinding was seen at 17,400 strike, which shed 3.1 lakh contracts, followed by 17,300 strike which shed 1.5 lakh contracts, and 18,000 strike, which shed 85,800 contracts.

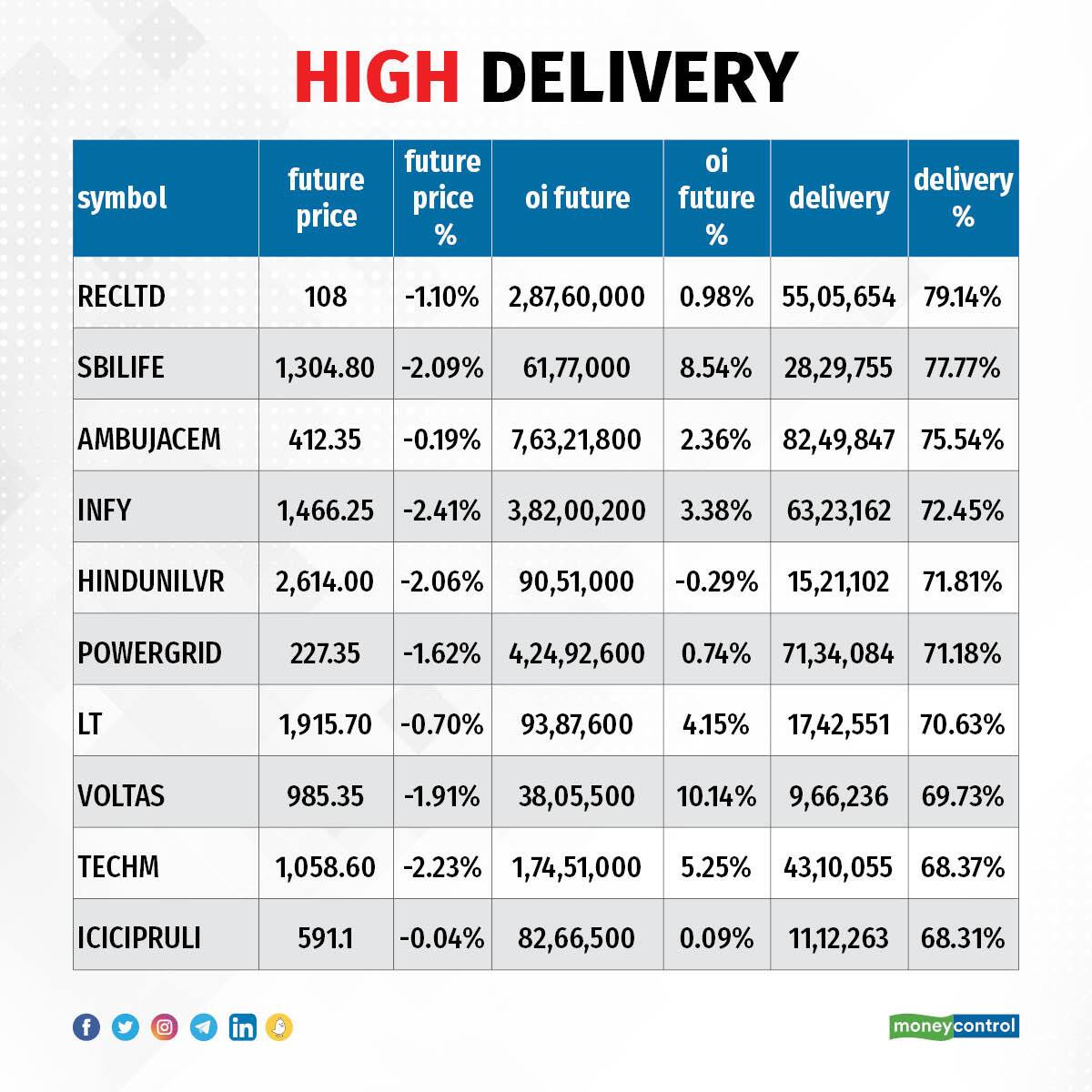

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in REC, SBI Life Insurance, Ambuja Cements, Infosys, and Hindustan Unilever, among others.

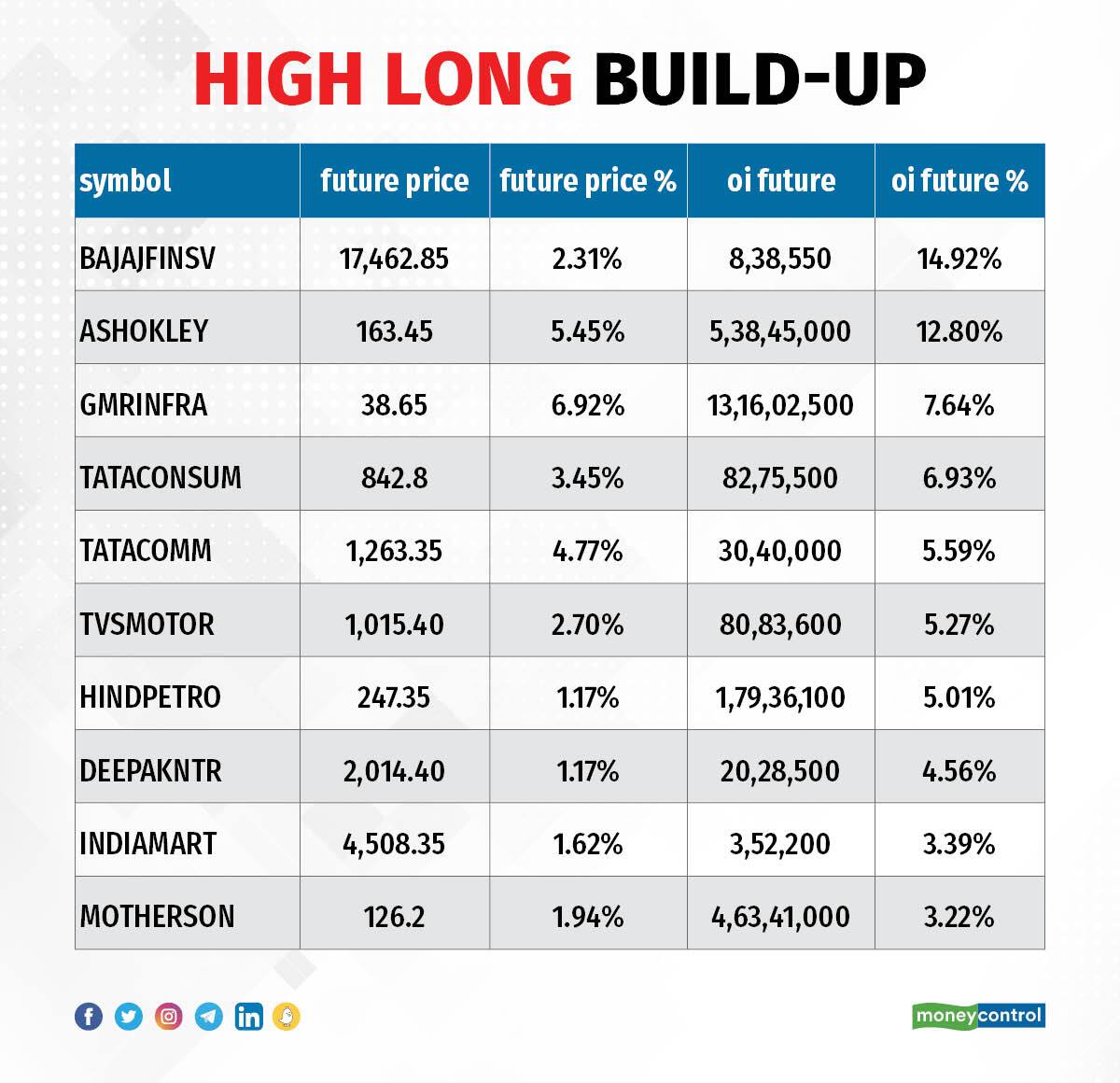

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Bajaj Finserv, Ashok Leyland, GMR Infrastructure, Tata Consumer Products, and Tata Communications, in which a long build-up was seen.

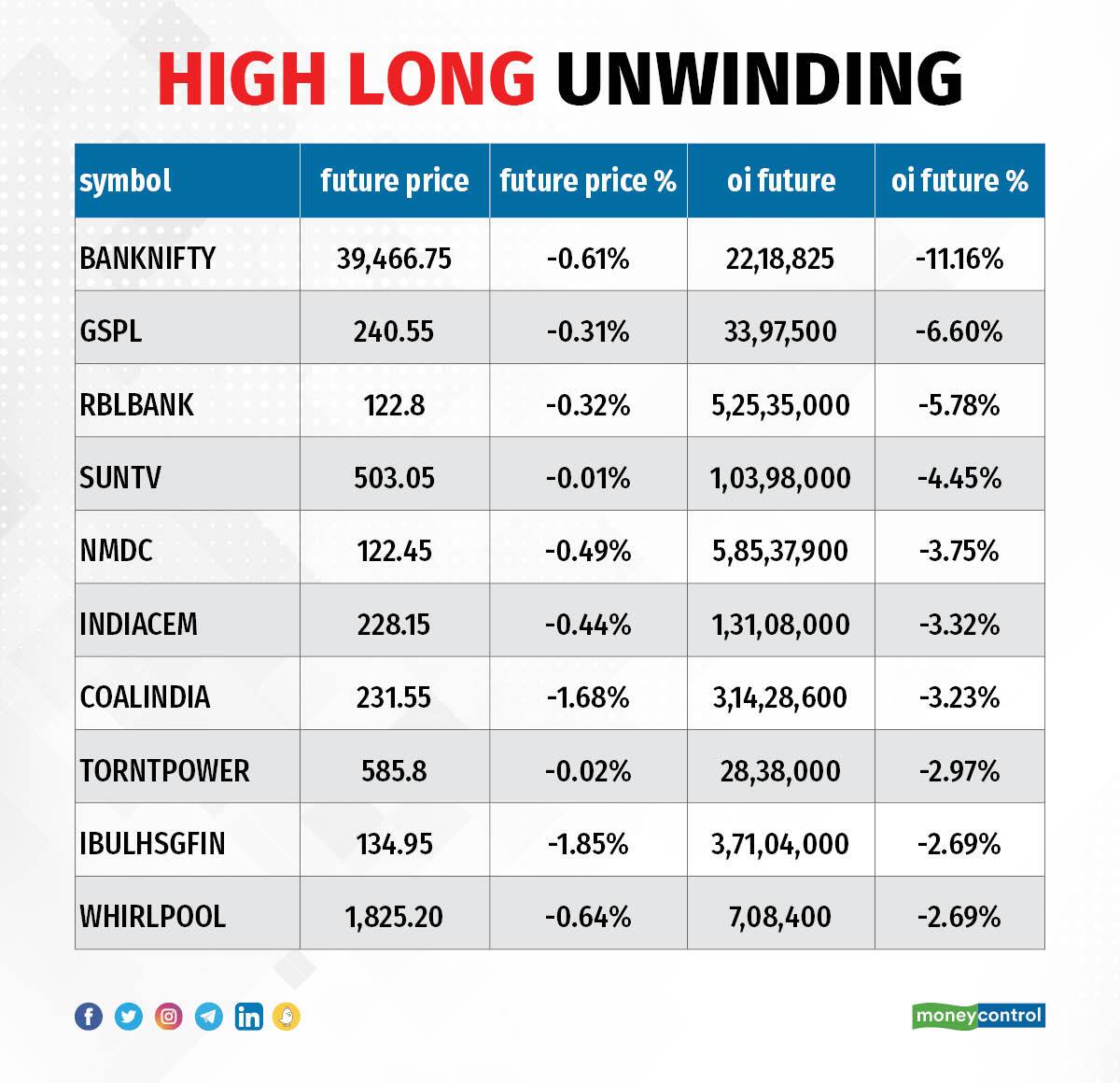

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Bank Nifty, Gujarat State Petronet, RBL Bank, Sun TV Network, and NMDC, in which long unwinding was seen.

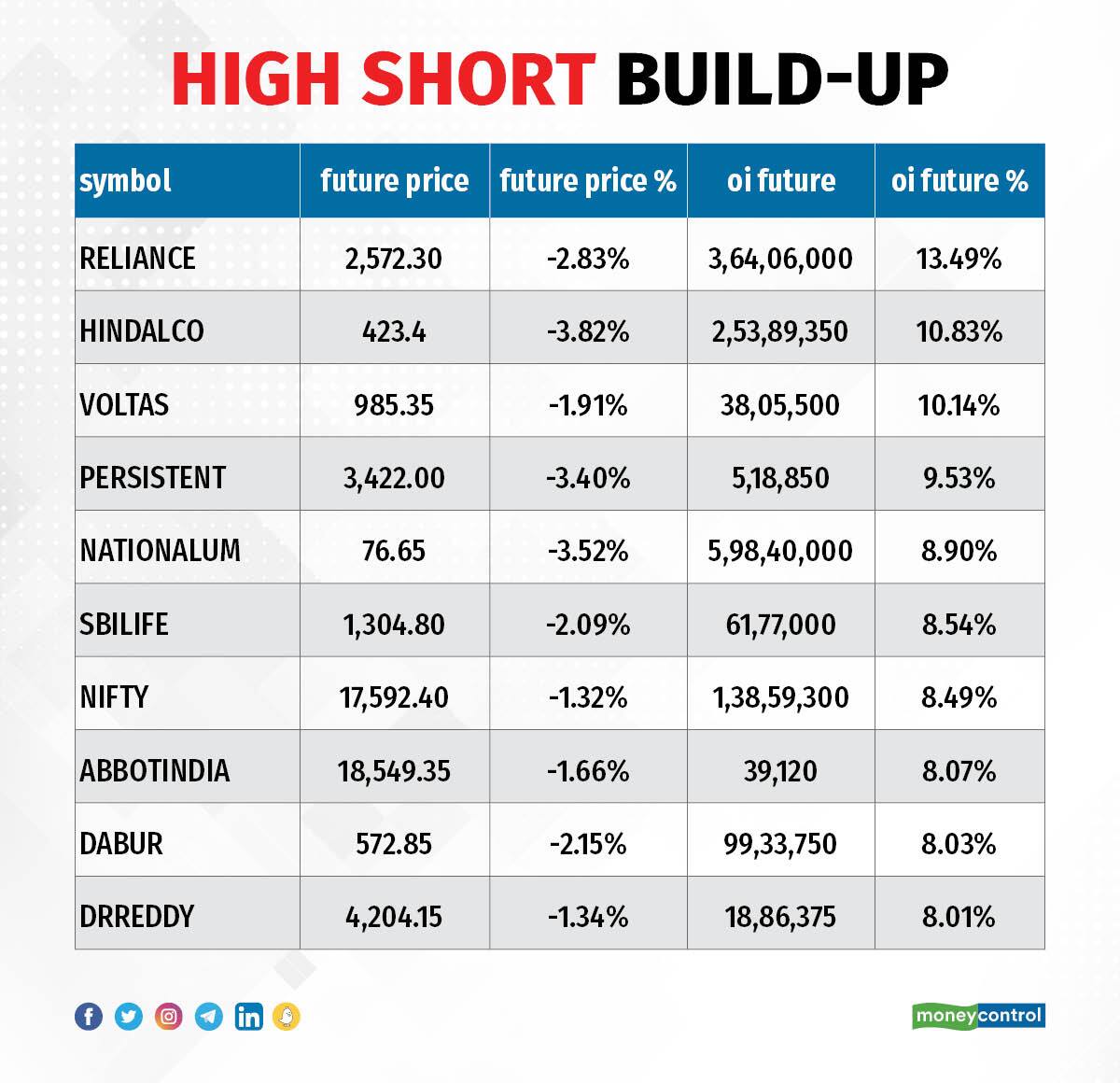

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Reliance Industries, Hindalco Industries, Voltas, Persistent Systems, and NALCO, in which a short build-up was seen.

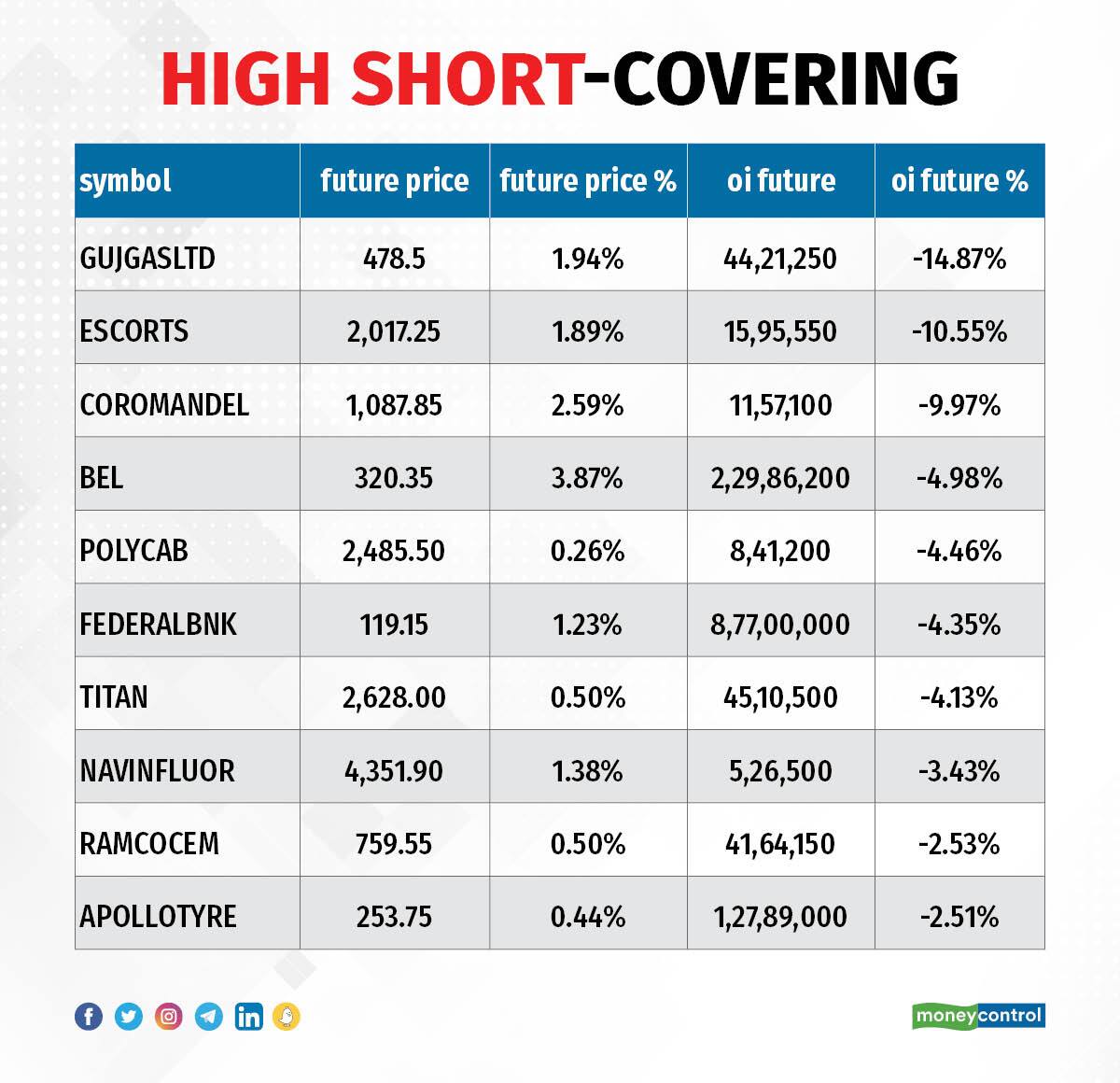

33 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Gujarat Gas, Escorts, Coromandel International, Bharat Electronics, and Polycab India, in which short-covering was seen.

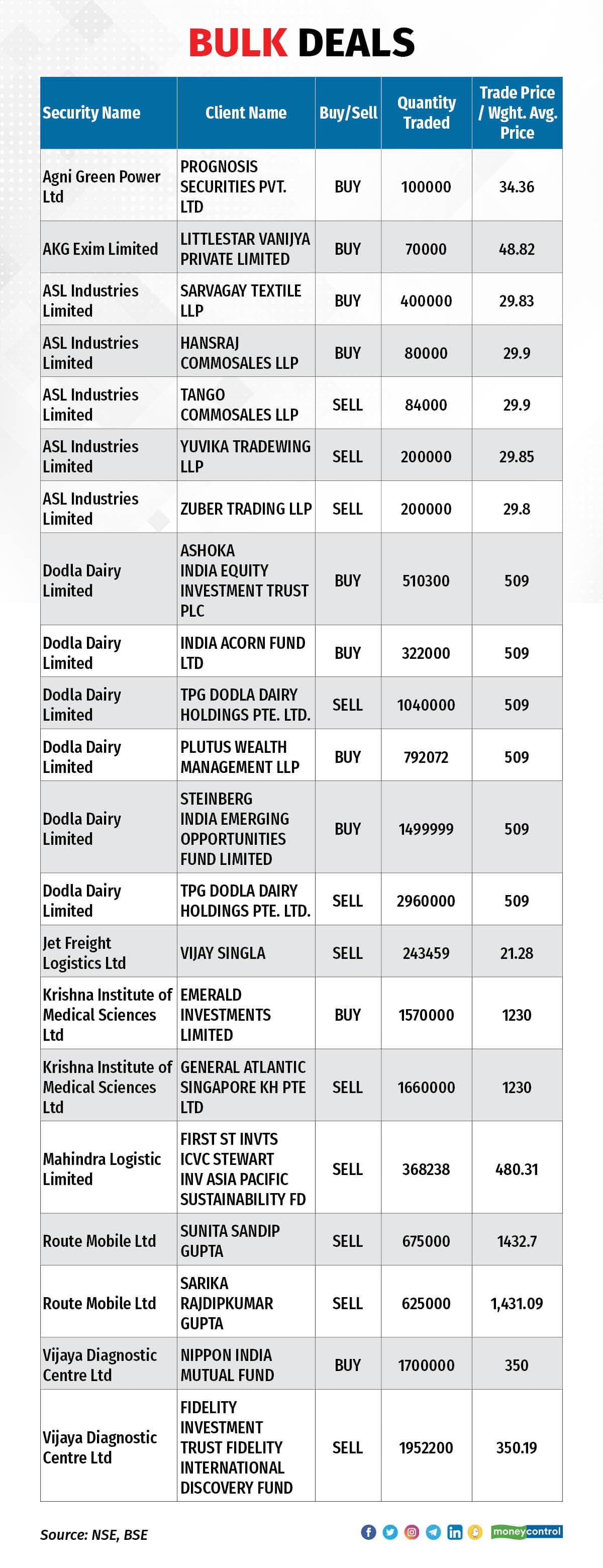

Dodla Dairy: On the NSE, Ashoka India Equity Investment Trust Plc acquired 5,10,300 equity shares in the company via open market transactions at an average price of Rs 509 per share. India Acorn Fund also bought 3.22 lakh equity shares at same price. On the BSE, Plutus Wealth Management LLP bought 7,92,072 shares, and Steinberg India Emerging Opportunities Fund purchased 14,99,999 shares at an average price of Rs 509 per share. However investor TPG Dodla Dairy Holdings Pte. Ltd sold 40 lakh equity shares at same price.

Route Mobile: Promoter Sunita Sandip Gupta has offloaded 6.75 lakh shares in the company at an average price of Rs 1,432.7 per share on the NSE, and 6.25 lakh shares at an average price of Rs 1,431.09 per share on the BSE.

Krishna Institute of Medical Sciences: Emerald Investments bought 15.7 lakh shares in the company at an average price of Rs 1,230 per share, whereas General Atlantic Singapore KH Pte Ltd sold 16.6 lakh shares at same price.

Mahindra Logistics: First Sentier Investors ICVC Stewart Investors Asia Pacific Sustainability Fund sold 3,68,238 shares in the company at an average price of Rs 480.31 per share.

Vijaya Diagnostic Centre: Nippon India Mutual Fund purchased 17 lakh shares in the company at an average price of Rs 350 per share, however, Fidelity Investment Trust Fidelity International Discovery Fund offloaded 19,52,200 shares at an average price of Rs 350.19 per share.

(For more bulk deals, click here)

Investors Meetings on September 2

Stocks in News

Adani Enterprises: Adani Enterprises will replace Shree Cement in the Nifty50 index with effect from September 30. In Nifty Next 50, Adani Total Gas, Bharat Electronics, Hindustan Aeronautics, IRCTC, Mphasis, Samvardhana Motherson, and Shree Cement will replace Adani Enterprises, Jubilant Foodworks, Lupin, Mindtree, PNB, SAIL, and Zydus Life.

Infosys: The IT services company has completed the acquisition of Europe-based life sciences consulting and technology firm BASE life science. BASE further expands Infosys' footprint in the Nordics region and will bring domain experts with commercial, medical, digital marketing, clinical, regulatory, and quality knowhow.

RattanIndia Power: The company said the board of directors appointed Rajiv Rattan as an Executive Chairman of the company for a period of five years with effect from October 1, 2022. Rajiv, a part of the promoter group, is currently a non-executive Chairman.

Aurobindo Pharma: Its subsidiary CuraTeQ Biologics has decided to expand its operations by establishing another mammalian cell culture manufacturing facility of higher capacity to cater to the future requirements. The capital expenditure for ramping up capacities is estimated to be around Rs 300 crore. The facility is likely to be fully operational by FY26. The company plans to enter into contract manufacturing operations (CMO) for biologicals for effective utilization of capacities and augmenting the business prospects in this area as the global biologics contract manufacturing demand is growing at 8 to 10 percent rate.

Ramco Systems: Enterprise aviation software provider Ramco Systems Corporation, USA announced that its US subsidiary Ramco Systems Defense and Security Incorporated (RSDSI) has received contract from General Atomics Aeronautical Systems, Inc. (GA-ASI). Ramco will implement its Aviation M&E MRO Suite V5.9 for GA-ASI’s SkyGuardian Global Support Solutions (SGSS) program.

SIS: SIS Australia Group Pty Limited, a subsidiary of the company, has signed Share Purchase Agreement for acquisition of 85% shareholding in Safety Direct Solutions Pty Ltd which provides critical risk management, medical and training services. The company will complete transaction by September 30 and the transaction cost is AUD 5 million.

Eicher Motors: Royal Enfield sold 70,112 units in August, registering 53% growth compared to 45,860 units sold in year-ago month. In financial year-to-date, Eicher sold 3.12 lakh units, up 47% over 2.13 lakh units sold in same period last year.

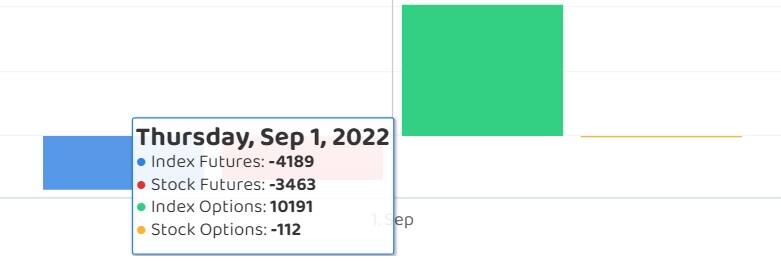

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 2,290.31 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 951.13 crore on September 1, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock in F&O ban list for September 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.