The market declined 2.5 percent in the opening trade but the recovery in the initial hour, which was followed by rangebound trade, helped the benchmark indices settle with a 1.5 percent loss on August 29. Global markets were also under pressure after Federal Reserve Chair Jerome Powell in his speech at Jackson Hole reiterated that the rate hikes to bring inflation to 2 percent target are going to continue at the cost of pain to consumers and businesses. The rising oil prices also weighed on sentiment.

The BSE Sensex tanked 861 points to 57,973, while the Nifty50 fell 246 points to 17,313 but formed a bullish candle on the daily charts as the closing was higher than opening levels.

"Technically, this market action signals a sharp downside momentum. The unfilled opening downside gap of Monday could be considered as a bearish breakaway gap and if this gap remains unfilled for the next few sessions then that could mean the market is in the middle of a downtrend, signalling more weakness ahead," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He further said the recent support of 17,340, the 23.6 percent Fibonacci retracement, has been broken on the downside and the next lower target for the Nifty as per Fibonacci retracement comes around 16,920, which is 32.8 percent retracement.

The negative sequence of lower tops and bottoms is confirmed and the present weakness could be in line with the formation of the new lower bottom (lower bottom reversal needs to be confirmed). Immediate resistance is at 17,400 levels, the market expert said.

The broader markets also came under pressure, but the correction compared to benchmarks was less. The Nifty Midcap 100 and Smallcap 100 indices declined 0.8 percent and 1 percent respectively. The volatility also increased significantly with India VIX climbing by 8.82 percent to 19.82 levels, making the trend favourable for bears.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,193, followed by 17,072. If the index moves up, the key resistance levels to watch out for are 17,407 and 17,500.

The Nifty Bank lost more than 700 points to 38,277, but formed a bullish candlestick pattern on the daily charts on Monday. The important pivot level, which will act as crucial support for the index, is placed at 38,015, followed by 37,753. On the upside, key resistance levels are placed at 38,468 and 38,659 levels.

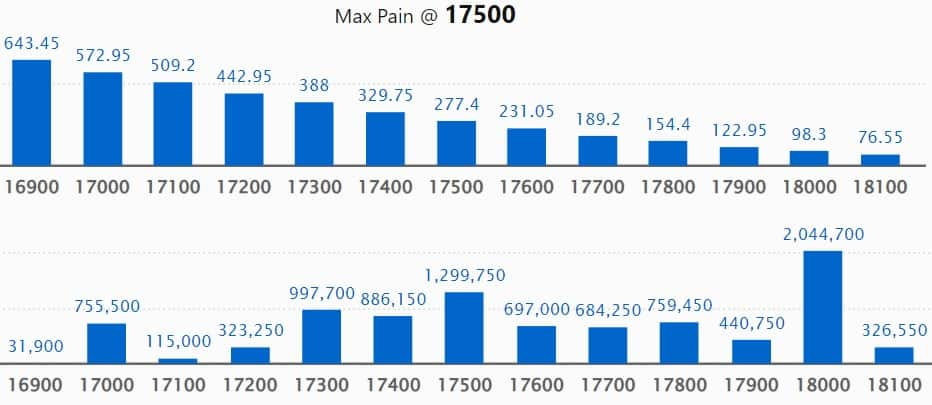

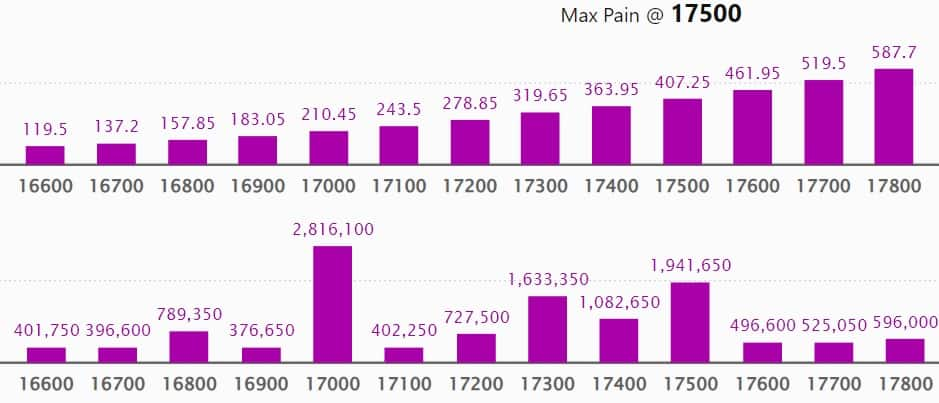

Maximum Call open interest of 20.44 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the September series.

This is followed by 18,500 strike, which holds 13.31 lakh contracts, and 17,500 strike, which has accumulated 12.99 lakh contracts.

Call writing was seen at 17,300 strike, which added 8.32 lakh contracts, followed by 17,400 strike which added 7.06 lakh contracts and 17,500 strike which added 2.45 lakh contracts.

Call unwinding was seen at 17,700 strike, which shed 1.73 lakh contracts, followed by 18,700 strike which shed 1.58 lakh contracts and 18,500 strike which shed 61,300 contracts.

Maximum Put open interest of 36.32 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the September series.

This is followed by 16,500 strike, which holds 32.95 lakh contracts, and 17,000 strike, which has accumulated 28.16 lakh contracts.

Put writing was seen at 17,300 strike, which added 9.48 lakh contracts, followed by 17,400 strike, which added 5.09 lakh contracts and 16,500 strike which added 3.1 lakh contracts.

Put unwinding was seen at 17,500 strike, which shed 5.02 lakh contracts, followed by 17,800 strike which shed 2.9 lakh contracts, and 17,700 strike, which shed 1.95 lakh contracts.

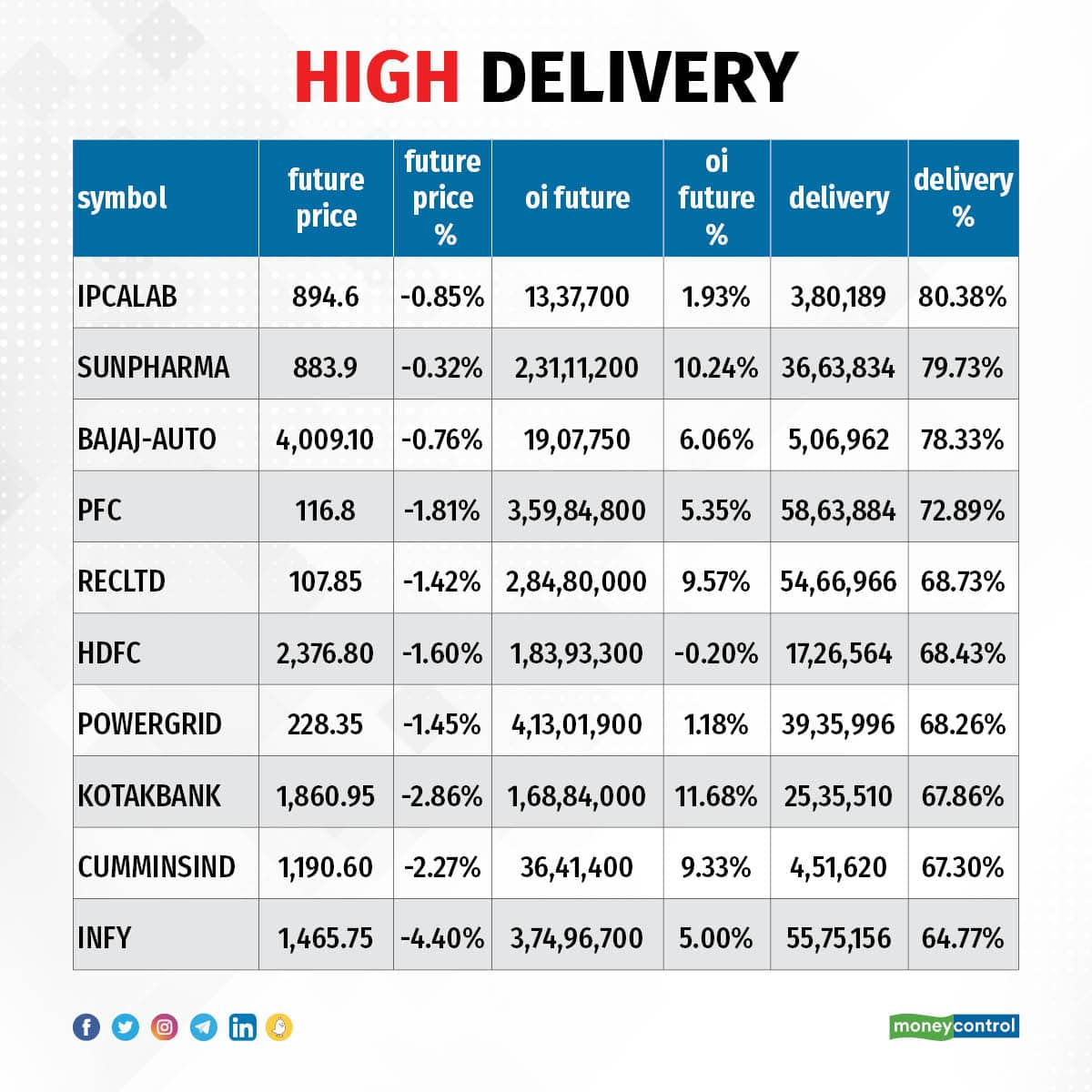

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Ipca Laboratories, Sun Pharma, Bajaj Auto, Power Finance Corporation, and REC, among others.

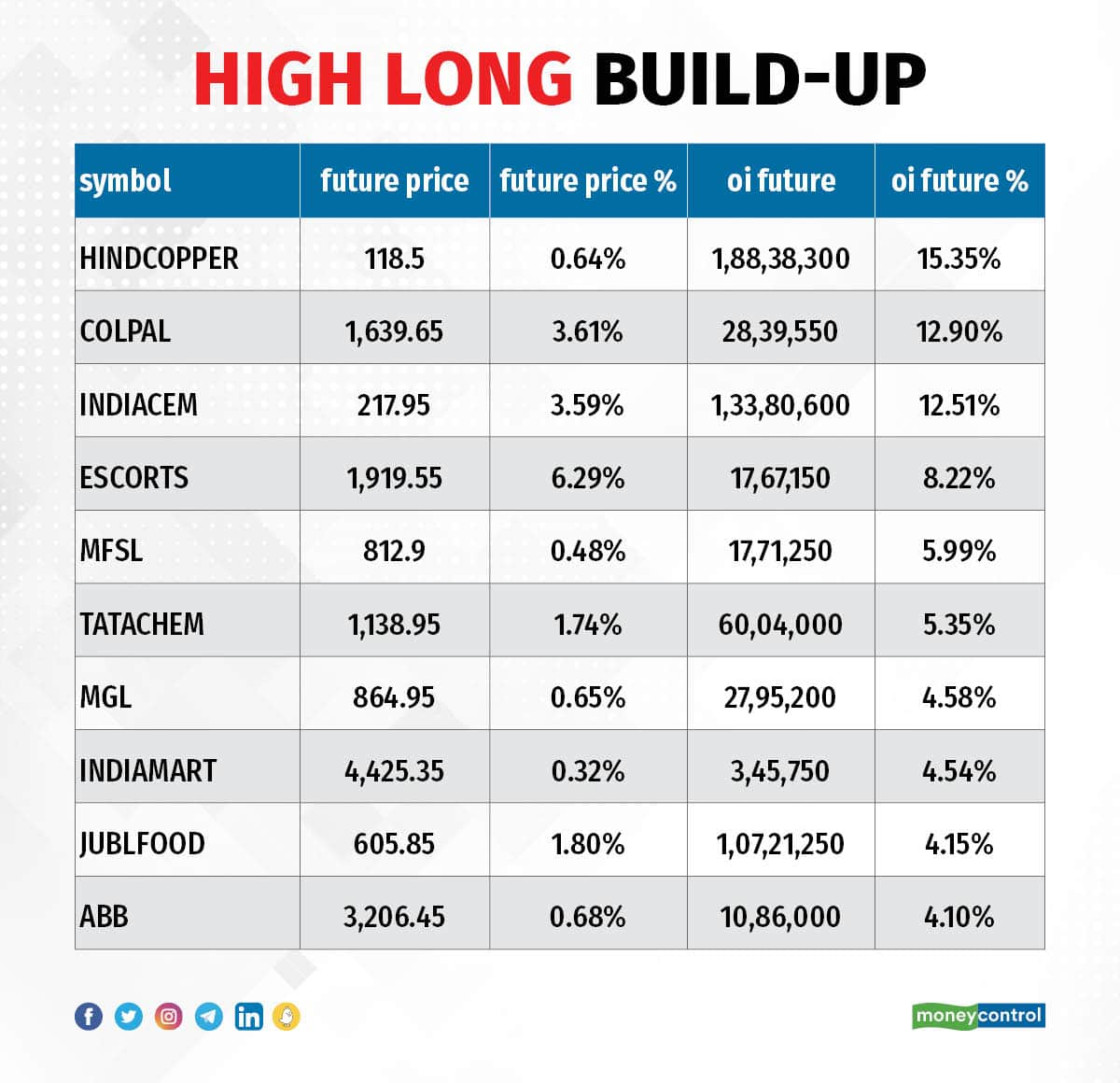

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Hindustan Copper, Colgate Palmolive, India Cements, Escorts, and Max Financial Services, in which a long build-up was seen.

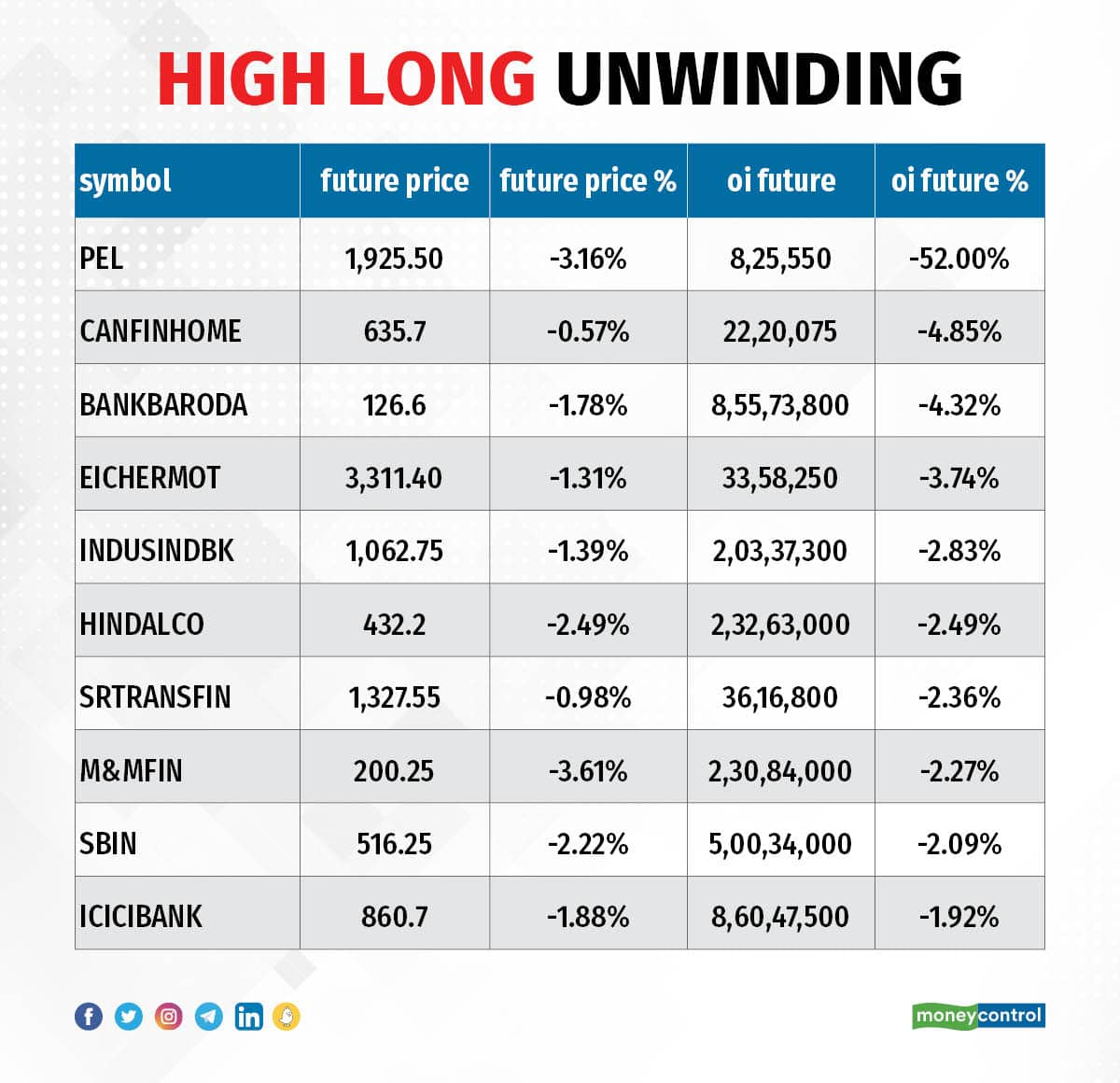

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Piramal Enterprises, Can Fin Homes, Bank of Baroda, Eicher Motors, and IndusInd Bank, in which a long unwinding was seen.

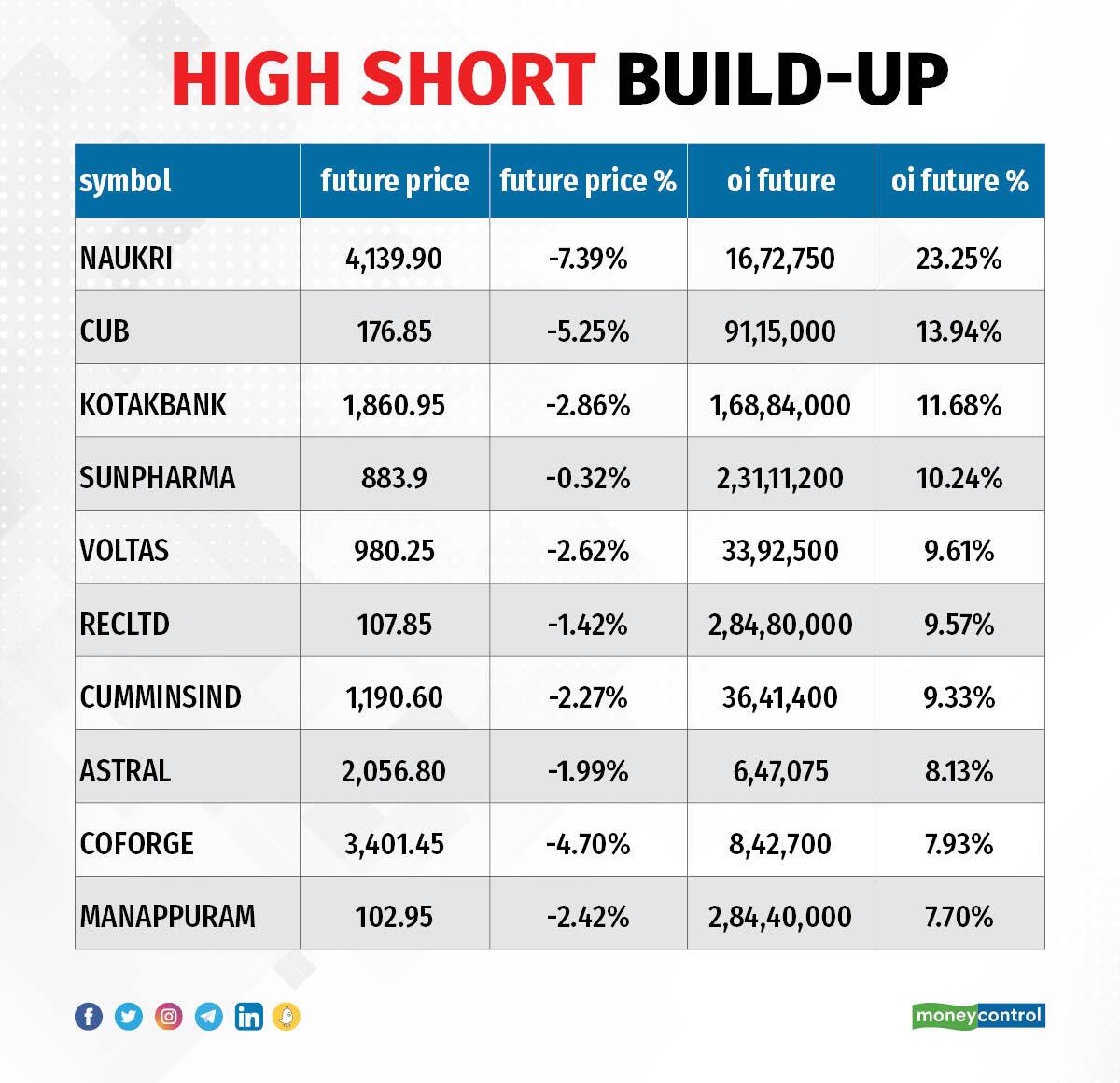

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Info Edge India, City Union Bank, Kotak Mahindra Bank, Sun Pharma, and Voltas, in which a short build-up was seen.

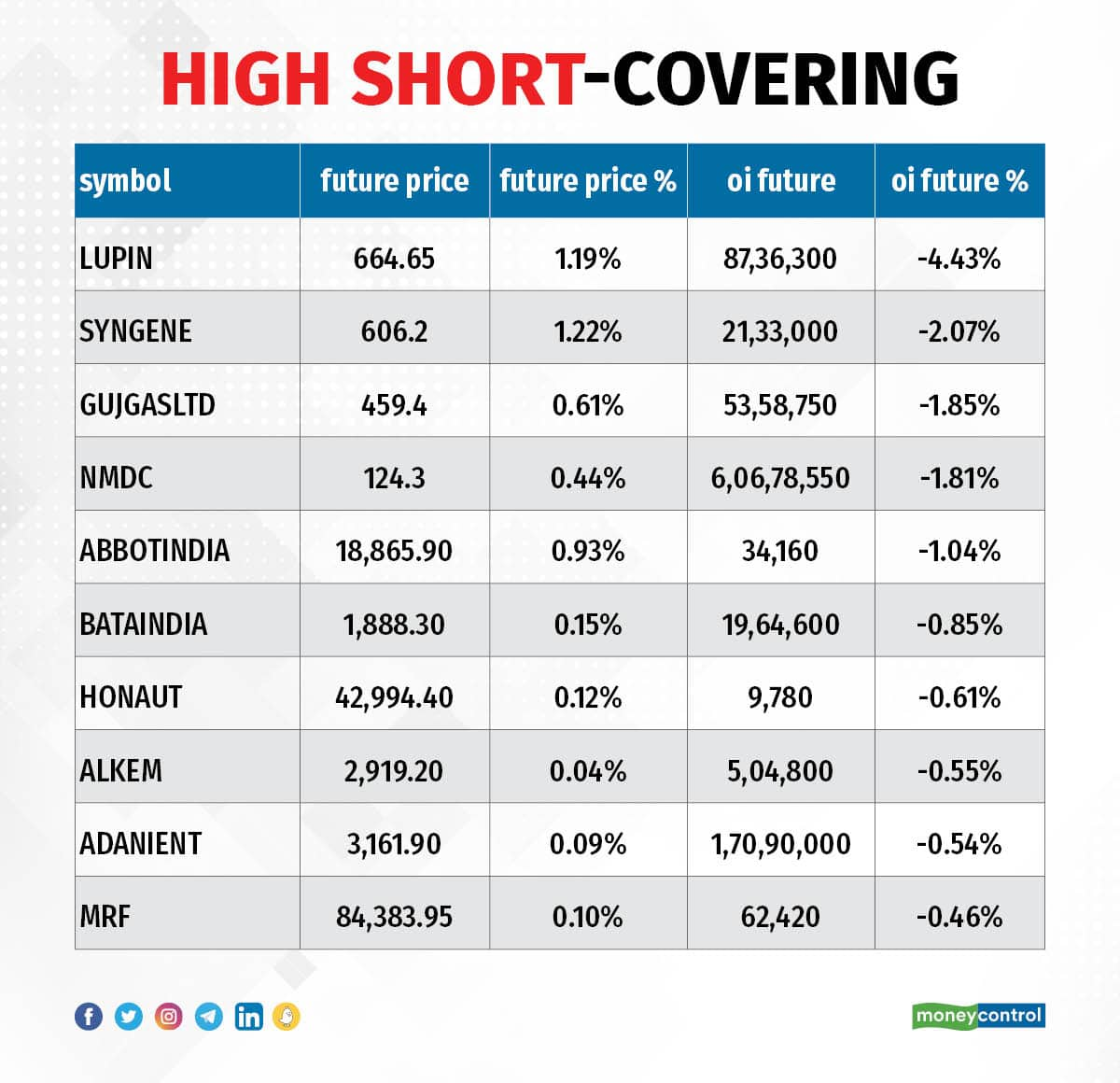

12 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Lupin, Syngene International, Gujarat Gas, NMDC, and Abbott India, in which a short-covering was seen.

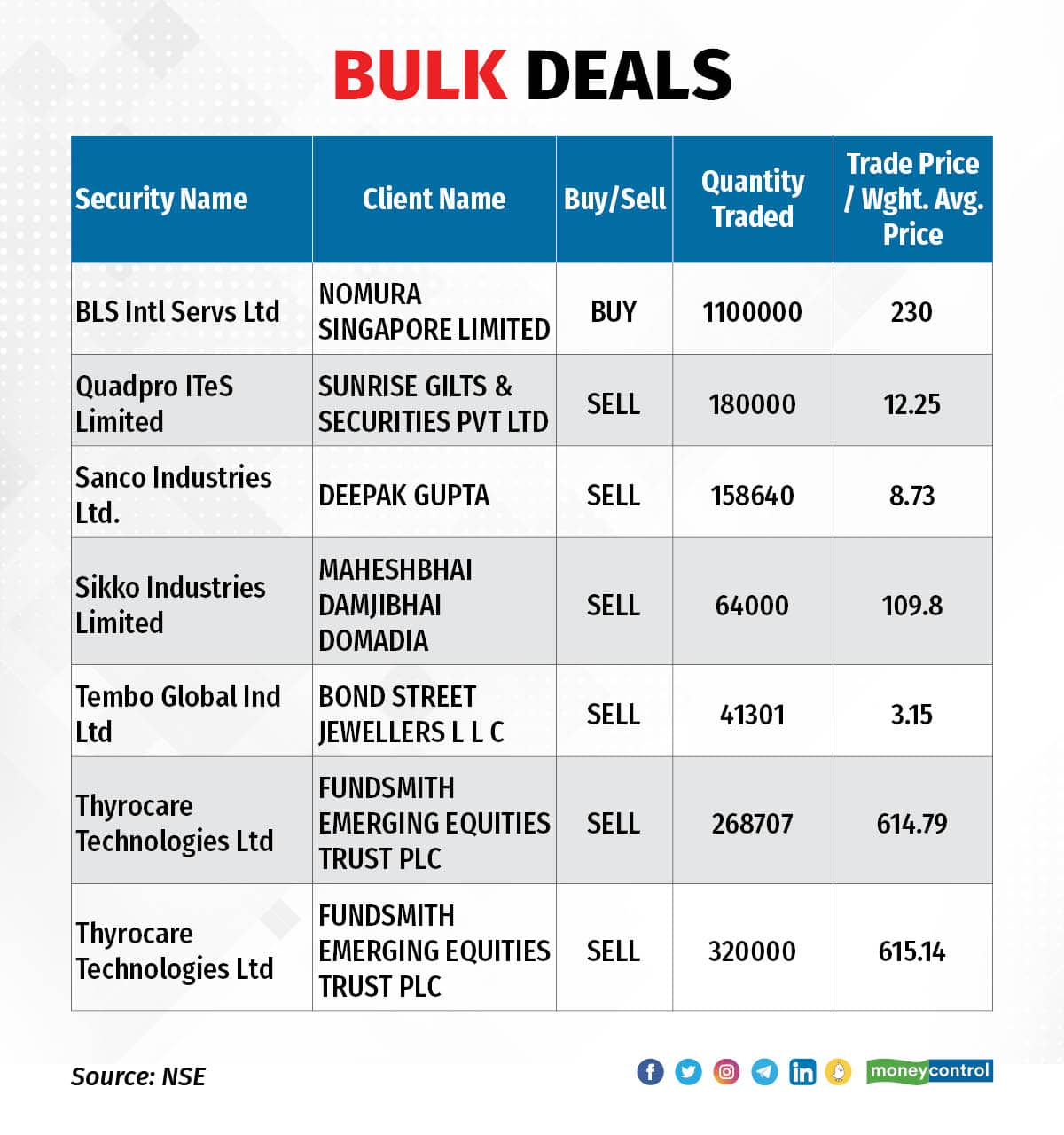

BLS International Services: Nomura Singapore acquired 11 lakh equity shares in the company via open market transactions at an average price of Rs 230 per share.

Thyrocare Technologies: Fundsmith Emerging Equities Trust Plc sold 2,68,707 equity shares in the company at an average price of Rs 614.79 per share, and 3.2 lakh shares at an average price of Rs 615.14 per share.

(For more bulk deals, click here)

Investors Meetings on August 30

SRF: Management will be interacting with certain institutional investors and analysts.

Ujjivan Small Finance Bank: Officials of the company will meet Value Quest, Birla Sun Life Insurance, Shubkam Ventures, Enam Holding, and Alchemy Capital.

Blue Star: Officials of the company will meet Ashmore Investments Management.

KEI Industries: Officials of the company will meet CLSA India.

One 97 Communications: Officials of the company will meet institutional investors and analysts.

Ashiana Housing: Officials of the company will meet PNB Metlife Insurance, Goldman Sachs Asset Management, Motilal Oswal Asset Management Company.

G R Infraprojects: Officials of the company will meet IDFC Mutual Fund, Max Life Insurance Company, Invesco Mutual Fund, Kotak Mutual Fund, Kotak Life Insurance Company, and SBI Mutual Fund.

Nuvoco Vistas Corporation: Officials of the company will meet Spark Capital.

3i Infotech: Officials of the company will meet Capital Portfolio Advisors, Roha Asset Managers, SVIP Capital, Tusk Invest, Param Capital, Finvest Advisors, and Gomukhi IndusCapital.

Patanjali Foods: Officials of the company will interact with investors.

India Pesticides: Officials of the company will meet Grandeur Peak.

Polycab India: Officials of the company will attend CLSA: India Consumer Durables Access Day.

Stocks in News

Ugro Capital: The company said the Board of Directors has made an allotment of 50,000 non-convertible debentures having a face value of Rs 10,000 each, through private placement. The tenure of instrument is 24 months from the date of allotment and the coupon rate is 10.35 percent per annum.

ICRA: The company received board approval for the appointment of Venkatesh Viswanathan as a Group Chief Financial Officer and key managerial personnel. His appointment is effective from August 30, 2022, and the company also designated him as Chief Investor Relations Officer. However, Amit Kumar Gupta has stepped down as Chief Financial Officer.

BC Power Controls: The company has received board approval for the issuance of 1.1 crore equity shares, on a preferential basis, to the promoter group category at a price of Rs 5.65 per share. The total fundraising was Rs 6.21 crore.

Krishna Institute of Medical Sciences: The company has entered into a definitive agreement to acquire a majority stake (51 percent) in SPANV Medisearch Lifesciences, Nagpur. SPANV is running a multi-speciality hospital - Kingsway Hospitals, having over 300+ beds. Existing promoters and shareholders will continue to hold the balance 49 percent stake. Post-acquisition, the hospital will be renamed 'KIMS Kingsway Hospitals'.

Orient Cement: Franklin Templeton Mutual Fund sold 1.52 lakh equity shares or 0.07 percent stake in the cement company on August 26. With this, it reduced its stake in the said company to 3.12 percent, down from 3.2 percent earlier.

Star Housing Finance: The Coronation Castles Pvt Ltd has offloaded a 0.07 percent stake in the company via open market transactions on August 26. With this, its stake reduced to 0.06 percent, from 0.13 percent earlier.

Fund Flow

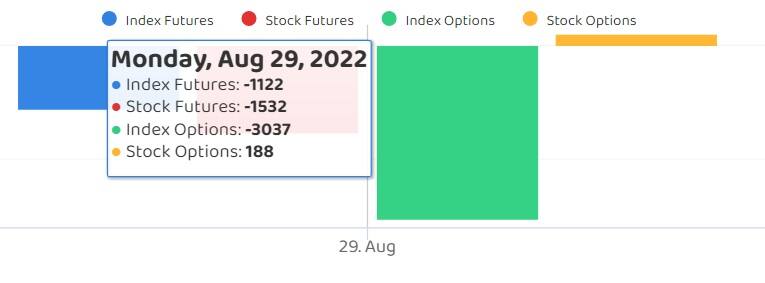

Foreign institutional investors (FIIs) have net sold shares worth Rs 561.22 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 144.08 crore on August 29, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are in the beginning of September series, there is not a single stock getting added in F&O ban list for August 30 as well. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.