The market closed lower on August 25 for the first time in last three consecutive sessions, due to selling pressure in late trade on the day of expiry of August derivative contracts. Most of key sectors pulled the benchmark indices down despite positive global cues.

The BSE Sensex fell 311 points to 58,775, while the Nifty50 declined 83 points to 17,522 and formed bearish candle which resembles Bearish Engulfing kind of pattern on the daily charts.

"A long bear candle was formed on the daily chart and the market reacted down from the hurdle of 17,700 levels. Though, Nifty declined from the highs on Thursday, the overall market breadth was positive and the broad market indices like midcap and small cap were showing resilience," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

The Nifty Midcap 100 index ended flat and the Nifty Smallcap 100 index rose half a percent.

The sharp intraday weakness of Thursday could be a worrying factor for the bulls to sustain the highs. As long as Nifty sustains above the supports of 17,300-17,200 levels, there is a possibility of an upside bounce from the lower levels, the market expert said.

One may expect broader range movement for the Nifty around 17,700-17,800 on the upside and 17,300-17,200 levels on the downside for the near term, Nagaraj said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,431, followed by 17,340. If the index moves up, the key resistance levels to watch out for are 17,670 and 17,818.

The Nifty Bank also wiped out gains in late trade, falling 88 points to 38,951 and formed bearish candle on the daily charts on Thursday. The important pivot level, which will act as crucial support for the index, is placed at 38,679, followed by 38,407. On the upside, key resistance levels are placed at 39,347 and 39,743 levels.

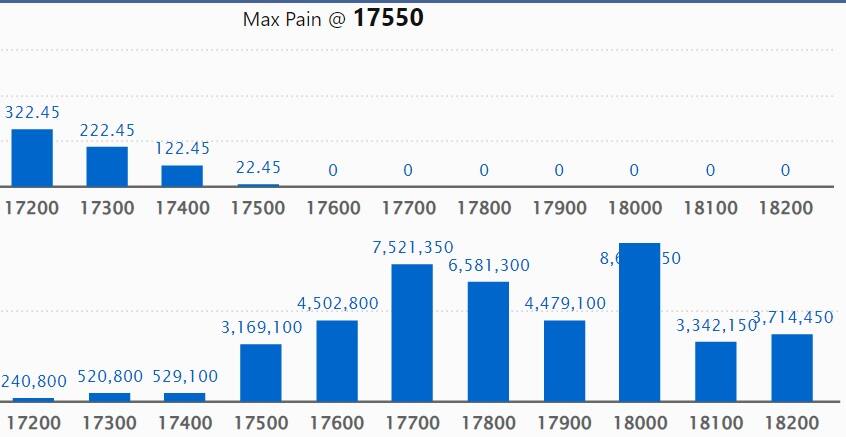

Maximum Call open interest of 86.97 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the September series.

This is followed by 17,700 strike, which holds 75.21 lakh contracts, and 17,800 strike, which has accumulated 65.81 lakh contracts.

Call writing was seen at 17,500 strike, which added 2.72 lakh contracts, followed by 17,700 strike which added 67,900 contracts.

Call unwinding was seen at 17,600 strike, which shed 35.46 lakh contracts, followed by 18,000 strike which shed 27.99 lakh contracts and 18,500 strike which shed 24.68 lakh contracts.

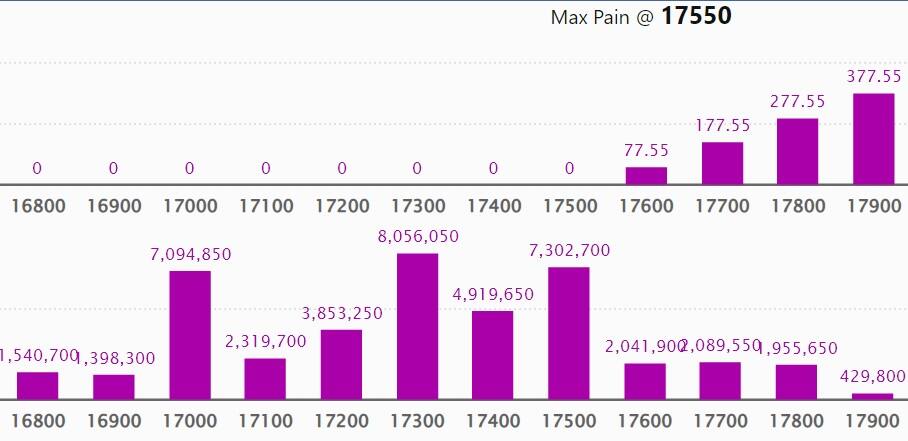

Maximum Put open interest of 80.56 lakh contracts was seen at 17,300 strike, which will act as a crucial support level in the September series.

This is followed by 17,500 strike, which holds 73.02 lakh contracts, and 17,000 strike, which has accumulated 70.94 lakh contracts.

Put writing was seen at 17,300 strike, which added 30.85 lakh contracts, followed by 17,800 strike, which added 8.47 lakh contracts and 17,700 strike which added 4.83 lakh contracts.

Put unwinding was seen at 17,000 strike, which shed 44.67 lakh contracts, followed by 17,600 strike which shed 44.46 lakh contracts, and 16,500 strike, which shed 25.45 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Sun Pharmaceutical Industries, PVR, United Breweries, UltraTech Cement, and Bajaj Auto, among others.

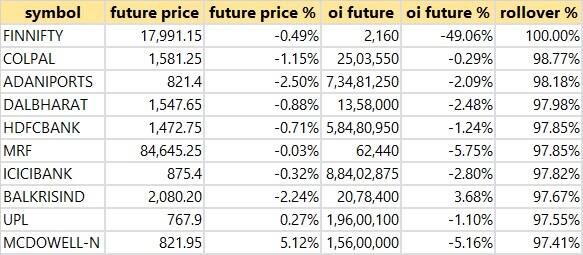

Here are the top 10 stocks which saw the highest rollovers on expiry day including Nifty Financial that witnessed 100 percent rollover, followed by Colgate Palmolive, Adani Ports, Dalmia Bharat, HDFC Bank, MRF and ICICI Bank with 98-99 percent rollovers.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the four stocks - BHEL, Aditya Birla Capital, IndiaMART InterMESH, and Indiabulls Housing Finance, in which a long build-up was seen.

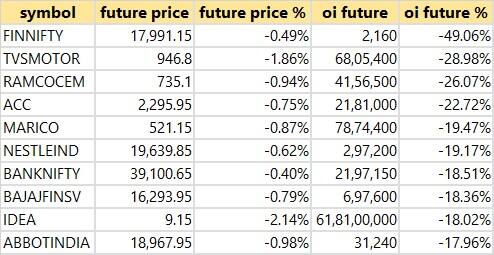

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, TVS Motor Company, Ramco Cements, ACC, and Marico, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the four stocks - Sun Pharmaceutical Industries, Balkrishna Industries, Ambuja Cements, and Bajaj Finance, in which a short build-up was seen.

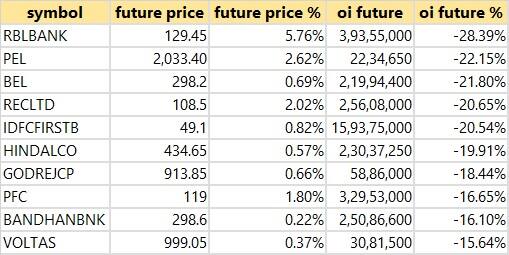

76 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including RBL Bank, Piramal Enterprises, Bharat Electronics, REC, and IDFC First Bank, in which short-covering was seen.

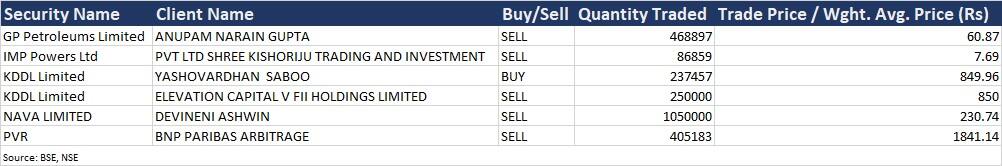

PVR: BNP Paribas Arbitrage sold 4,05,183 equity shares in the multiplex chain operator via open market transactions. These shares were sold at an average price of Rs 1,841.14 per share.

(For more bulk deals, click here)

Investors Meetings on August 26

Anand Rathi Wealth: Officials of the company will be meeting investors and analysts.

CG Power and Industrial Solutions: Officials of the company will meet HDFC Life Insurance.

Supreme Industries: Officials of the company will meet Mathews International Capital Management LLC.

PI Industries: Officials of the company will meet Taiyo Pacific Partners.

Tech Mahindra: Officials of the company will attend HDFC Securities Conference.

Alkem Laboratories: Officials of the company will meet DSP Mutual Fund, and Ashmore Asset Management.

Crompton Greaves Consumer Electrical: Officials of the company will meet Fullerton Fund Management.

Stocks in News

Syrms SGS Technology: The company will make its debut on the bourses on August 26. The issue price has been fixed at Rs 220 per share.

Dr Reddy's Laboratories: The company has received Establishment Inspection Report (EIR) for its Srikakulam facility. In July, the company informed about the inspection conducted by the United States Food & Drug Administration (USFDA) at the formulations manufacturing facility (FTO 11) in Srikakulam, Andhra Pradesh. Now the agency has concluded that the inspection is "closed".

Nelco: Intelsat, the leading provider of inflight connectivity (IFC), announced the beginning of Intelsat's inflight connectivity services in Indian skies through an agreement with Nelco, India's leading satellite communication service provider. Nelco has been offering the Aero IFC services for more than two years with plans to introduce these services to more airlines in collaboration with its global partners.

Eicher Motors: Kaleeswaran Arunachalam has tendered his resignation from the Chief Financial Officer and Key Managerial Personnel position. His resignation will take effect after working hours on September 2.

HDFC Bank: HDFC Bank has entered into non-binding term sheet with Go Digit Life Insurance. The bank will make an investment in the company between Rs 49.9 crore to Rs 69.9 crore, in two tranches, for an equity stake of up to 9.944 percent.

Inox Wind Energy: The company said its board of directors on August 30 will consider fund raising. The fund raising will be through preferential issue or on private placement basis.

Max Financial Services: Max Life Insurance Company has announced the receipt of the Commencement of Business (COB) certificate for its wholly owned subsidiary, Max Life Pension Fund Management (Pension Fund) on August 23, from Pension Fund Regulatory and Development Authority (PFRDA). This subsidiary will manage the pension assets with investment choices under the National Pension Scheme.

Infibeam Avenues: The company has received board approval for fund raising of Rs 161.50 crore via issue of warrants on preferential basis. The funds will be deployed for domestic and international fintech and software business expansion as well as for other business purposes. The company has made strategic investment and will own 50 percent stake in Gurgaon-based software startup Vishko22.

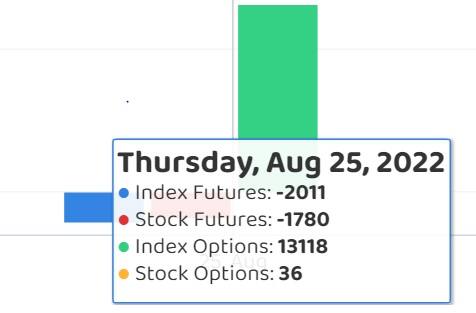

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 369.06 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 334.31 crore on August 25, as per provisional data available on the NSE.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.