The market has seen decent recovery from day's low and closed higher after two-day losses on August 23 despite weakness in global counterparts and euro touched 20-year low against US dollar. Most of sectors participated in Tuesday's recovery, barring IT that lost 1.77 percent amid rising fear of slowdown in developed markets.

The BSE Sensex recovered more than 850 points from day's low and closed with 257 points higher at 59,031, while the Nifty50 rose 87 points to 17,577. The broader markets also rebounded with the Nifty Midcap 100 and Smallcap 100 indices climbing more than 1 percent each.

But the volatility index India VIX continued to be elevated, rising by 0.06 percent to 19.05 levels, making a bit of uncertainty over the market stability.

Stocks that were in action included RBL Bank which was the biggest gainer in the futures & options segment, rising 6 percent to Rs 104.10, the highest closing level since June 10. The stock has seen formation of Morning Star kind of pattern on the daily charts, which is generally known as bullish reversal pattern.

IDFC First Bank was the third largest gainer in the F&O segment, climbing 5.5 percent to Rs 46.05, the highest closing level since February 11. The stocks has seen a Bullish Engulfing candlestick pattern formation on the daily charts with above average volumes as the big bullish candle engulfed all three previous red candles, which generally indicates a bullish bias.

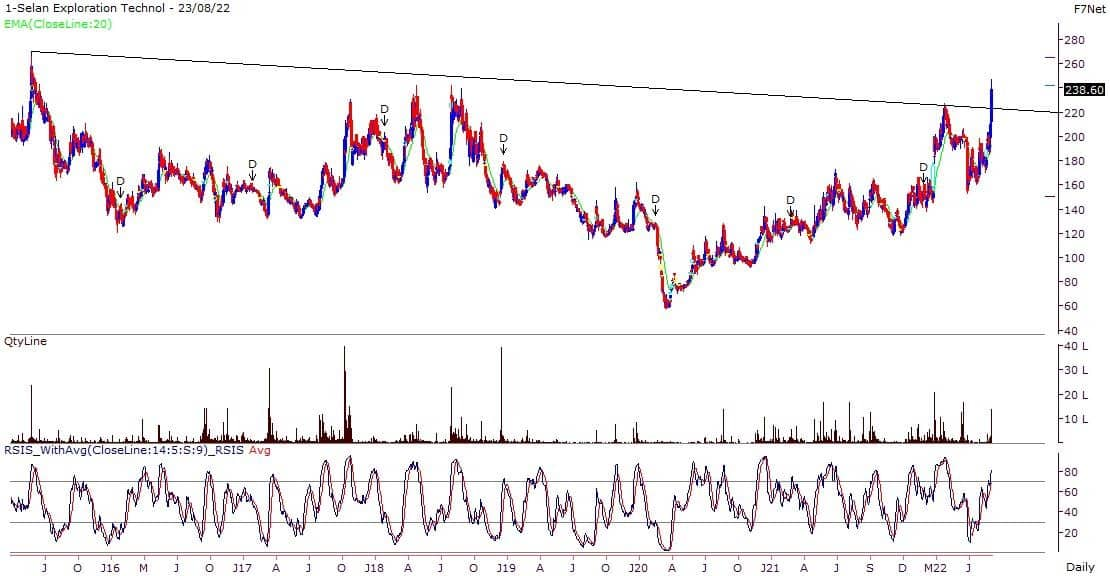

Selan Exploration Technology has seen a gap up opening on Tuesday, and rallied nearly 14 percent to Rs 238.6, the highest closing level since September 19, 2018. The stock has formed robust bullish candle with large volumes on the daily charts and has given a strong break out by closing above the upward sloping long resistance trend line adjoining January 2, 2020 and April 19, 2022.

Here's what Ruchit Jain of 5paisa.com recommends investors should do with these stocks when the market resumes trading today:

The banking space has seen a good outperformance in last couple of months and stocks within the sector have seen a decent upmove. After the corrective phase in RBL Bank, the prices have seen a pullback move in last couple of months and have recovered some of its previous losses.

However, prices have now entered the gap resistance zone which is placed in the broad range of Rs 102-111. So the risk reward ratio for fresh buying is not favourable and trades can look to lighten up longs as prices approach the higher end of the range.

The support for the stock is placed around Rs 97.

The stock has reversed significantly from the low in last couple of months and has recently given a breakout from a falling trendline resistance. The price upmove has seen good volumes indicating buying interest in the counter.

The immediate support for the stock is seen around Rs 42 and the trend remains positive till the stock trades above the same.

The immediate resistances for the stock will be seen around Rs 49 followed by Rs 54. Traders are advised to ride the trend with a trailing stop-loss method.

The stock has recently formed a ‘Higher Top Higher Bottom’ structure and has now given a breakout from its previous swing high resistance. The volumes along with the price up move are good and the ‘RSI’ (relative strength index) oscillator is hinting at a positive momentum.

Hence, traders are advised to trade with a positive bias and look for buying opportunities on declines. The immediate support for the stock is now placed in the range of Rs 215-210 while the immediate levels on the higher side to watch will be around Rs 255 followed by Rs 275.